Global services in 2025 are about strategic optionality, staying agile, staying invested in high potential areas like artificial intelligence (AI) and Global Capability Centers (GCC), and navigating uncertainty with a steady hand rather than a hopeful sprint.

Reach out to discuss this topic in depth.

The global services sector in 2025 is navigating a delicate but discernible shift. While macroeconomic and geopolitical uncertainties persist, especially around trade policies and regional tensions, providers and enterprises are showing signs of adapting with strategic caution.

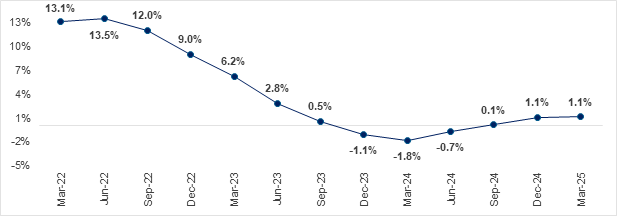

The upward trajectory of services growth has faced a halt with sideways movement in March 2025 quarter, as seen below (exhibit 1).

Exhibit 1 – Global services growth (representative) trend chart until March 2025 quarter

(in Year on Year (YoY) organic CC terms)

Recent trade announcements, including the 90-day U.S.–China tariff truce, the US-UK trade agreement, the UK–India Free Trade Agreement, and the U.S.–Saudi Arabia economic partnership, offers marginal tactical breathing room.

- The U.S.–China agreement lowers tariffs until August 2025, but its temporary nature and lack of end-state clarity means enterprises are still hesitant to commit to long-term programs

- The UK–India Free Trade Agreement (FTA), introduces structural enablers that could improve the operational ease of cross-border services delivery, especially for Indian providers with major UK clients. Provisions like easier professional mobility and social security exemptions also reduce the friction and cost of staffing, and signals for a more stable UK engagement environment

- The U.S.– Saudi Arabia agreement includes investments in digital infrastructure like DataVolt’s $20 billion commitment to build AI-focused data centers in the U.S. This initiative, along with partnerships with U.S. tech firms, could drive some demand for infrastructure support, data engineering, and operational services, areas where service providers already operate at scale

- For the US-UK agreement, there is little delta to support any major demand for global services as of now, as most of the agreed terms might not move the needle for end industries to create a notable change in services demand

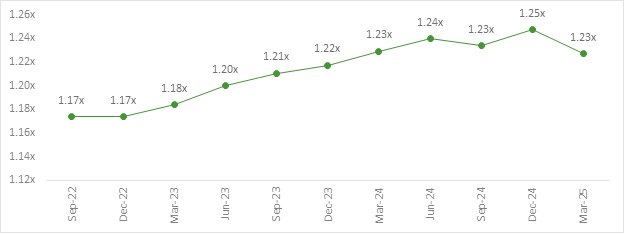

Despite these external shifts, it is this internal enterprise behavior that is mostly shaping the service’s outlook. For example, following a blockbuster 2024 in bookings, deal activity is now stabilizing (exhibit 2).

Exhibit 2 – The last-twelve-months (LTM) book-to-bill ratio of a representative set of service providers

This is not a sign of softening demand either, but rather a function of ongoing ramp-ups from large prior signings, compounded by cautious pauses in new discretionary spending. Many new deals in 2025 are rooted in cost mandates, automation, and business resilience, not transformative ambition.

The average deal size is trending smaller, with clients preferring modular, scalable engagement models. This cautious external posture is mirrored by service providers. After a brief period of heightened alert due to the India–Pakistan situation, which has now de-escalated, added a dimension of delivery caution creating the need for flexible, risk-adjusted delivery planning.

Having endured five years of overlapping global disruptions, providers are structurally more agile and better positioned to absorb shocks without overreacting.

What differentiates the current phase from prior slowdowns, however, is the concurrent momentum in strategic growth areas. For example, enterprise AI adoption is accelerating, and providers are proactively aligning to enterprise-wide AI strategies. In parallel, GCCs are gaining secular traction and service providers are now making GCC closer to their corporate strategy. These moves suggest that providers are not merely defensive, they are selectively going on the offensive in areas with durable client demand.

Taken together, these dynamics point to a sector that is neither stalling nor surging but adapting and gearing up for long-term success.

Trade shifts have created operating space, but not conviction. Client demand is evolving, not evaporating. Providers are cautious, but far from passive. Instead, the industry is resetting its rhythm: responding to external flux with internal clarity and shifting focus from scale-driven growth to value-driven resilience.

For more information regarding the US administration’s tariffs and to see what the US tariffs mean for the global services market, please visit US Administration’s Tariffs – Everest Group.

For more insights, supporting data, and trends on IT services growth, please read our report, Forces & ForesightTM Q1 2025 via Everest Group Reports – Home.

If you have any questions on the latest global trade shifts discussed in this blog, please contact Prashant Shukla to learn more at [email protected].