Blog

Is It Open Season for RPA Acquisitions? | Blog

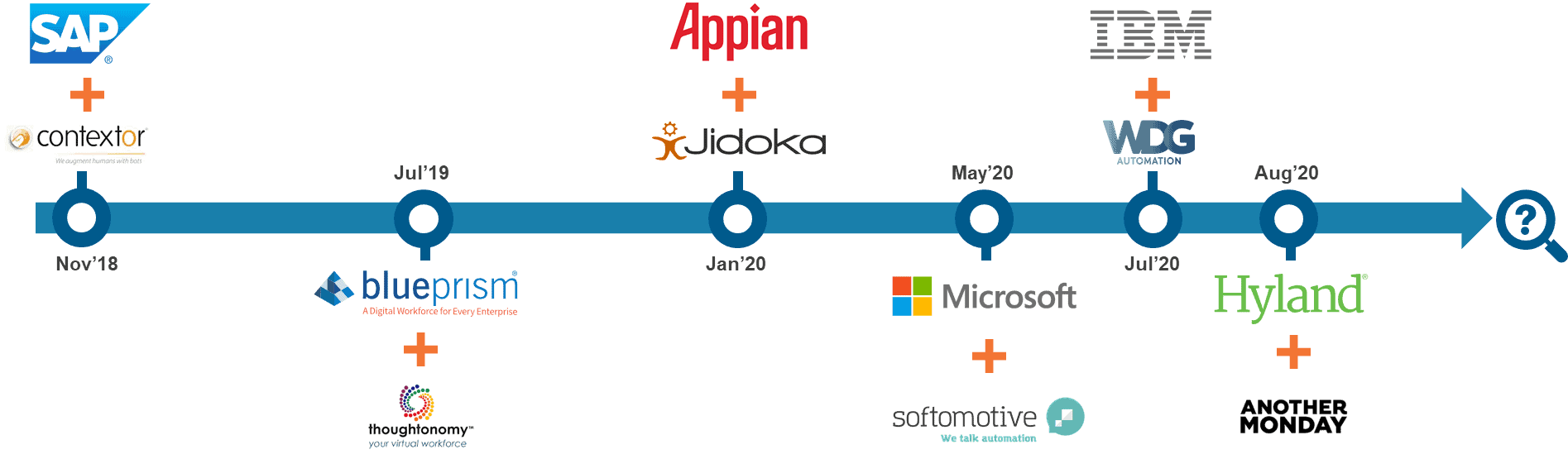

Robotic Process Automation (RPA) is a key component of the automation ecosystem and has been a rapidly growing software product category, making it an interesting space for potential acquisitions for a while now. While acquisitions in the RPA market have been happening over the last several years, three major RPA acquisitions have taken place in quick succession over the past few months: Microsoft’s acquisition of Softomotive in May, IBM’s acquisition of WDG Automation in July, and Hyland’s acquisition of Another Monday in August.

These acquisitions highlight a broader trend in which smaller RPA vendors are being acquired by different categories of larger technology market players:

- Big enterprise tech product vendors like Microsoft and SAP

- Service providers such as IBM

- Larger automation vendors like Appian, Blue Prism, and Hyland.

Recent RPA acquisitions timeline:

Why is this happening?

The RPA product market has grown rapidly over the past few years, rising to about US$ 1.2 billion in software license revenues in 2019. The market seems to be consolidating, with some of the larger players continuing to gain market share. As in any such maturing market, mergers and acquisitions are a natural outcome. However, we see multiple factors in the current environment leading to this frenetic uptick in RPA acquisitions:

Acquirers’ perspective – In addition to RPA being a fast-growing market, new category acquirers – meaning big tech product vendors, service providers, and larger automation vendors – see potential in merging RPA capabilities with their own core products to provide more unified automation solutions. These new entrants will be able to build pre-packaged solutions combining RPA with other existing capabilities at lower cost. COVID-19 has created an urgency for broader automation in enterprises, and the ability to offer packaged solutions that provide a quick ROI can be a game-changer in this scenario. Additionally, the adverse impact of the pandemic on the RPA vendors’ revenues, which may have dropped their valuations down to more realistic levels, is making them more attractive for the acquiring parties.

Sellers’ perspective – There is now a general realization in the market that RPA alone is not going to cut it. RPA is the connective tissue, but you still need the larger services, big tech/Systems-of-Record and/or intelligent automation ecosystem to complete the picture. RPA vendors that don’t have the ability to invest in building this ecosystem will be looking to be acquired by larger players that offer some of these complementary capabilities. In addition, investor money may no longer be flowing as freely in the current environment, meaning that some RPA vendors will be looking for an exit.

What can we expect going forward?

The RPA and broader intelligent automation space will continue to evolve quickly, accelerated by the predictable rise in demand for automation and the changes brought on by the new entrants in the space. We expect to see the following trends in the short term:

- More acquisitions – With the ongoing market consolidation, we expect more acquisitions of smaller automation players – including RPA, Intelligent Document Processing (IDP), process orchestration, Intelligent Virtual Agents (IVA), and process mining players – by the above-mentioned bigger categories as they seek to build more complete transformational solutions.

- Services imperative – Scaling up automation initiatives is an ongoing challenge for enterprises, with questions lingering around bot license utilization and the ability to fill an automation pipeline. Services that can help overcome these challenges will become more critical and possibly even differentiating in the RPA space, whether the product vendors themselves or their partners provide them.

- Evolution of the competitive landscape – We expect the market landscape to undergo considerable transformation:

- In the attended RPA space, while there will be co-opetition among RPA vendors and the bigger tech players, the balance may end up being slightly tilted in favor of the big tech players. Consider, for instance, the potential impact if Microsoft were to provide attended RPA capabilities embedded with its Office products suite. Pure-play RPA vendors, however, will continue to encourage citizen development, as this can unearth low-hanging fruit that can serve as an entry point into the wider enterprise organization.

- In the unattended RPA space, pure-play RPA vendors will likely have an advantage as they do not compete directly with big tech players and so can invest in solutions across different systems of record. Pure-play RPA vendors might focus their efforts here and form an ecosystem to link in missing components of intelligent automation to provide integrated offerings.

There are several open questions on how some of these dynamics will play out over time. You can expect a battle for the soul (and control) of automation, with implications for all stakeholders in the automation ecosystem. Questions remain:

- How will enterprises approach automation evolution, by building internal expertise or utilizing external services?

- How will the different approaches automation vendors are currently following play out – system of record-led versus platform versus best of breed versus packaged solutions?

- Where will the balance between citizen-led versus centralized automation lie?

Only time will tell how this all plays out.

But in the meantime, we’d love to hear your thoughts. Please share them with us at [email protected], [email protected], and [email protected].