Blog

Health Insurers Grappling with the New Dawn | Sherpas in Blue Shirts

If you’re a stakeholder – any stakeholder – in the United States’ healthcare system, the data in the following charts is troubling and flummoxing.

The U.S. Healthcare System Paradox

Although the country’s outlay on healthcare (as a share of GDP and per capita) substantially exceeds that of other developed countries, it ranks behind most nations on many measures of health outcomes, quality, and efficiency. In fact, a June 2014 study by the Commonwealth Fund ranked the U.S. dead last on most performance dimensions – e.g., access, efficiency, and quality – when compared against 10 other developed countries (Australia, Canada, France, Germany, Netherlands, New Zealand, Norway, Sweden, Switzerland, and the United Kingdom).

Winds of Change

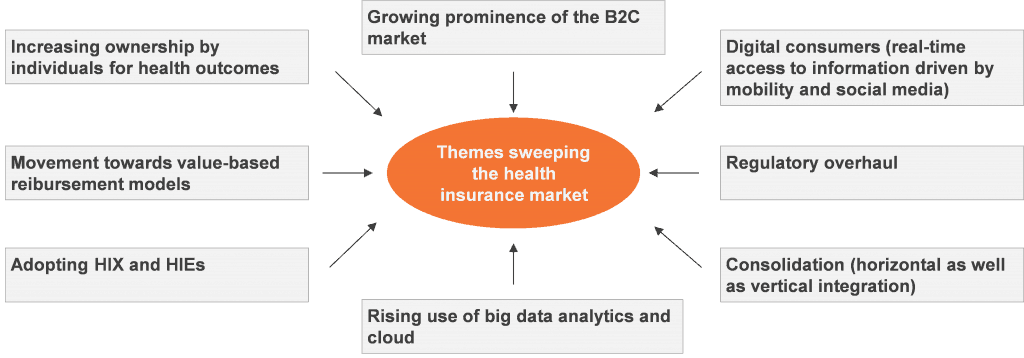

The health insurance space in the U.S. is undergoing a radical transformation driven by regulatory changes and consumerization of demand. So it is not surprising that the current focus of the massive reform underway in the country focuses on cost rationalization and efficiency enhancement.

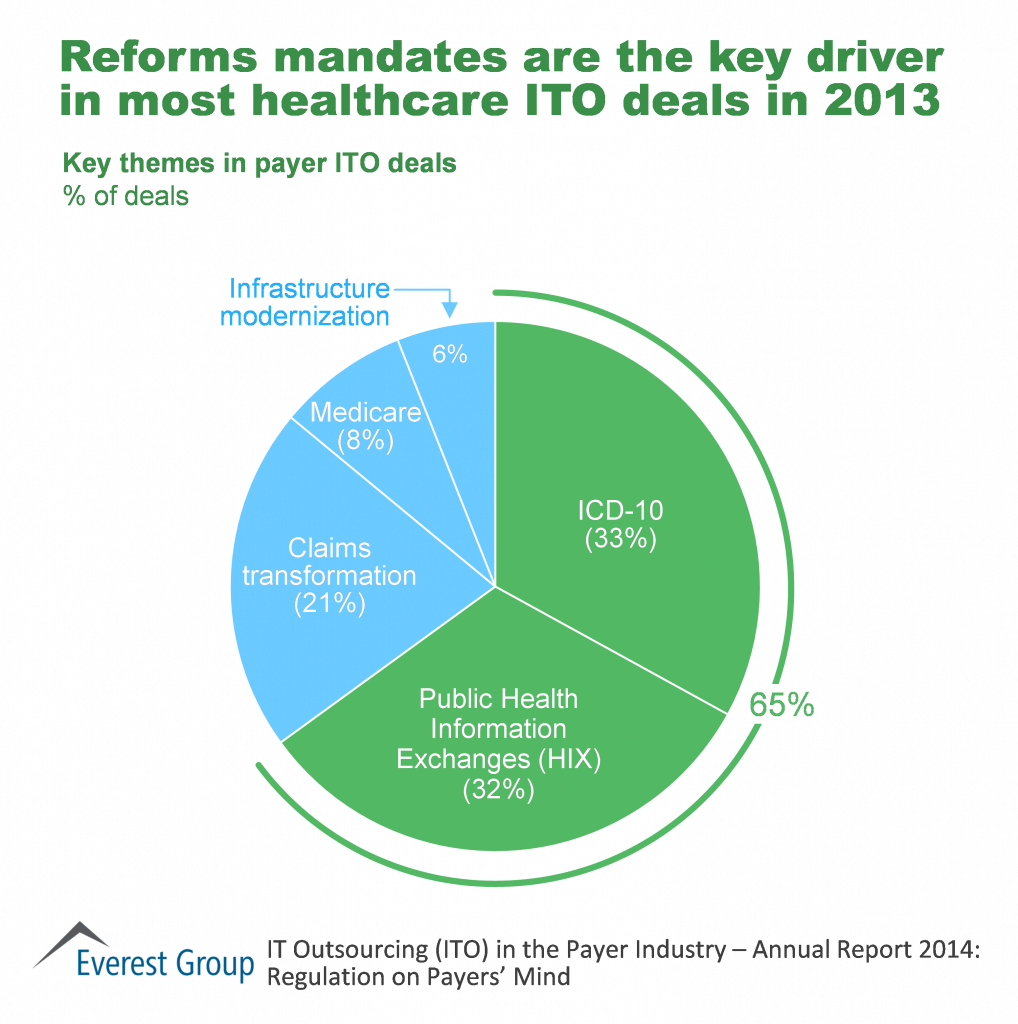

Reforms (primarily rising from the Affordable Care Act, or Obamacare) are reshaping health plans’ operating model. The onset of a value-based reimbursement model (moving from “defined benefits” to “defined contribution”) raises fundamental questions about current business paradigms. The impetus provided to Accountable Care Organizations (ACOs) and the blurring lines between payers and providers are leading to a fundamental realignment of incentives, ownership, and priorities. Obamacare and ICD-10 have had a sizable impact on payers’ technology portfolios as they look to leverage next-generation IT and modernize legacy platforms.

Payers are embracing the challenge of consumerization as their customers take increasing ownership of health outcomes, signaling the shift from large national accounts to the individual segments. This directly impacts their sales, outreach, and member engagement channels and methodologies. There is a renewed focus on approaching traditional buyer segments through non-traditional channels, primarily Health Insurance Exchanges (HIX) and direct engagement. These wide-sweeping changes are leading to a rethink of current systems, processes, interfaces, and vendors.

Payers Looking Ahead

Payers are marrying reform-driven changes with their overall technology portfolio in an effort to pivot from a primarily B2B business to a B2C model. These regulatory changes call for increased systems integration efforts, establishment of public portals, customer outreach, remediation, testing, and revenue cycle program management.

Healthcare reforms, a dynamic regulatory landscape, and consumerization of demand are transforming the healthcare industry. Payers need to understand, assess, and be proactive in navigating these choppy waters.

For further insight, check out our recent publication, “IT Outsourcing (ITO) in the Payer Industry – Annual Report 2014: Regulations on Payers’ Mind.” This report provides an overview of the ITO market for the payer industry. Analysis includes market size and growth, forecasts (up to 2020), demand drivers, adoption and scope trends, key areas of investment, and implications for buyers and service providers.