Blog

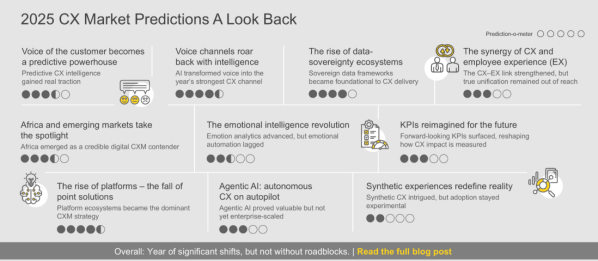

The top 10 CXM predictions: how 2025 really played out

2025 will be remembered as the year in which Customer Experience Management (CXM) moved from experimentation to execution. AI wasn’t just a buzzword. It became embedded across voice, data, and customer operations. But the year also reminded us that technology adoption in CXM is rarely linear: for every breakthrough, there were practical hurdles around data, governance, and scale.

Here’s how each prediction stacked up.

Reach out to discuss this topic in depth.

Prediction 1. Voice of the customer becomes a predictive powerhouse

Prediction-o-meter: 3.5/5

Real-world snapshot: Verizon uses generative AI to predict roughly 80% of call reasons, enabling better routing and reducing churn.

What made it true:

Predictive analytics truly arrived in 2025. Customer Experience (CX) platforms began embedding churn risk, propensity, and satisfaction prediction models into their core workflows. Enterprises used these insights to anticipate customer intent and intervene before escalation. The technology became especially powerful when combined with behavioral and transaction data, enabling faster service recovery and personalized retention offers.

What’s still holding it back:

Most organizations remain far from the holy grail of “digital twins.” Siloed data and consent frameworks limit prediction depth. Many can forecast what a customer might do, but fewer can automatically act on it. Achieving end-to-end predictive orchestration will demand stronger data foundations and automated workflow integration.

Prediction 2. Voice channels roar back with intelligence

Prediction-o-meter: 4.5/5

Real-world snapshot: TP and several other Business Process Outsourcing (BPO) vendors deployed AI accent-neutralization tech (via Sanas and Krisp) for offshore agents, improving voice channel clarity and customer comprehension.

What made it true

After years of “voice is dead” narratives, 2025 saw a resurgence in voice’s importance. Generative voice and speech-analytics models matured to the point where voice interactions became smarter, faster, and more human. Contact centers deployed AI to sense tone, infer intent, and guide live agents with suggestions or summaries. For emotionally charged or high-value interactions, voice once again became the preferred channel.

What’s still holding it back:

While technology caught up, integration didn’t. Most enterprises still manage separate systems for voice, chat, and video. Real-time transcription and translation, especially across dialects, remain compute-intensive. Moreover, scaling privacy-compliant, sentiment-aware voice analytics continues to test data-governance frameworks.

Prediction 3. The rise of data-sovereignty ecosystems

Prediction-o-meter: 4/5

Real-world snapshot: Microsoft’s sovereign-cloud Bleu initiative in France and its broader EU Data Boundary policy set new benchmarks for compliance-first CXM infrastructure. CX providers like TTEC Digital and Capita have quickly followed suit with region-specific cloud hosting for regulated industries.

What made it true:

Data sovereignty moved from a compliance checkbox to a CXM differentiator. Customers wanted assurance that their personal data stayed within national borders, and regulators ensured they got it. Hyperscalers invested heavily in sovereign data architectures, while CXM service providers built parallel systems to handle regional workloads securely.

What’s still holding it back:

Fragmented regulation now creates complexity: different countries require different data-handling architectures, increasing cost and operational overheads. Enterprises also face trade-offs between compliance and global personalization. The very insights that make CX seamless across markets are the hardest to share across boundaries.

Prediction 4. The synergy of CX and Employee Experience (EX)

Prediction-o-meter: 3/5

Real-world snapshot: Comcast implemented an internal Large Language Model (LLM)-based “Ask Me Anything” tool to assist agents in real time, reducing handling time and enhancing EX and CX outcomes.

What made it true:

The Employee Experience (EX)-CX linkage has become impossible to ignore. Automation is chipping away repetitive tasks, allowing agents to focus on empathy and complex problem-solving. Unified dashboards have begun to correlate agent well-being with customer metrics, showing tangible Return on Investment (ROI) on engagement.

What’s still holding it back:

Most organizations haven’t fully operationalized this connection. Human Resources (HR) systems and CX analytics still run on different tech stacks. Aligning incentives, culture, and measurement remains difficult; turning the philosophy into practice will require unified data architecture and leadership buy-in.

Prediction 5. Africa and emerging markets take the spotlight

Prediction-o-meter: 3.5/5

Real-world snapshot: CCI Global (Kenya) announced a large-scale call center investment in Tatu City, creating over 5,000 local jobs and shifting to AI-enabled multilingual delivery.

What made it true:

Africa’s time has arrived. Affordable connectivity, multilingual talent, and AI-based upskilling tools have made the region a credible digital CXM hub. Clients value its cost efficiency and time-zone overlap with Europe. Emerging markets such as Egypt and Kenya have begun serving not just voice, but also chat, social, and back-office CXM functions.

What’s still holding it back:

Infrastructure disparities persist. Power reliability, cybersecurity readiness, and local regulatory frameworks still vary widely. Maintaining consistent quality across global delivery hubs will determine how sustainable this growth is. While there’s been a lot of interest in the region, it pales in comparison to more established offshore locations in terms of scale.

Prediction 6. The emotional intelligence revolution

Prediction-o-meter: 2.5/5

Real-world snapshot: SupportLogic and other vendors offer voice-analytics tools that detect sentiment and flag emotional triggers in real-time for CXM operations.

What made it true:

Emotion analytics became a genuine tool, with AI helping agents recognize stress or frustration in a customer’s voice, guiding them to empathetic phrasing or escalation. This fusion of technology and emotional intelligence improved retention in sectors like telecom and travel.

What’s still holding it back:

“Emotion-as-a-Service” still sounds better than it performs. Cultural bias, accuracy limitations, and data-privacy debates keep adoption cautious. Organizations are learning that while machines can measure emotion, authentic empathy still needs a human.

Prediction 7. Key Performance Indicators (KPIs) reimagined for the future

Prediction-o-meter: 3/5

Real-world snapshot: Enterprises are starting to engage in conversations around measuring customer success using next-generation Key Performance Indicators (KPIs) and not just legacy Customer Satisfaction (CSAT) / Net Promoter Score (NPS).

What made it true:

Measurement is finally starting to catch up to modern CXM. Predictive indicators, such as likelihood to repurchase or intent decay, are giving leaders a more forward-looking view. CX teams are also using AI to correlate emotional tone, effort, and outcome to future loyalty.

What’s still holding it back:

Industry-wide standardization hasn’t arrived. Emotional engagement scores or personalization indices differ by provider, making benchmarking hard. Until a common vocabulary emerges, adoption will remain fragmented and executive trust limited.

Prediction 8. The rise of platforms – the fall of point solutions

Prediction-o-meter: 4.5/5

Real-world snapshot: Verint Systems repositioned itself as an open, AI-powered CX automation platform, while Salesforce Service Cloud Einstein and AWS Connect became orchestration backbones for many enterprises. NiCE acquired Cognigy for native AI capabilities.

What made it true:

Consolidation dominated 2025. Enterprises, tired of managing dozens of disconnected tools, embraced platform ecosystems that unify data, analytics, and engagement. The result: simpler procurement, faster time-to-value, and integrated AI across the CXM stack.

What’s still holding it back:

Platform lock-in is emerging as a new worry. Some mid-sized firms balk at ecosystem pricing and reduced flexibility. The sweet spot will be open architectures, including platforms that enable integration with best-of-breed solutions, not isolation.

Prediction 9. Agentic AI: autonomous CX on autopilot

Prediction-o-meter: 3/5

Real-world snapshot: Research on “agentic AI” deployments (e.g., a pilot by Minerva CQ) shows AI agents in live production managing customer-interaction workflows, making decisions and triggering next-steps.

What made it true:

Agentic AI moved from theory to action. In 2025, we saw systems that could perceive context, decide next steps, and execute workflows, from password resets to post-call summarization, without explicit programming. CX operations began scaling service capacity without parallel headcount growth.

What’s still holding it back:

Full autonomy still scares enterprises, while several pilots have failed to scale up. Governance, bias control, and brand-risk mitigation keep humans firmly in the loop. The next stage will be about defining responsible-AI frameworks that balance speed with oversight.

Prediction 10. Synthetic experiences redefine reality

Prediction-o-meter: 2/5

Real-world snapshot: Several retail and consumer-tech brands piloted avatar-based virtual assistants or immersive support experiences via generative media, though core CXM operations remain less penetrated.

What made it true:

Generative AI blurred the boundary between human and digital experience. Early pilots showed that synthetic brand representatives can deliver high-engagement, low-latency assistance, making them ideal for marketing and guided buying journeys.

What’s still holding it back: High compute cost and limited trust still confine synthetic CX to niche pilots. Customers appreciate novelty but question authenticity. The technology is promising, but widespread use in service environments will need lower costs and clearer ethical standards.

Looking back: the state of CXM in 2025 and expectations for 2026

When we made these predictions at the start of 2025, we expected acceleration and the year delivered. Many of the 10 bets delivered: AI-driven voice, platform consolidation, data sovereignty, and agentic automation, all moved significantly from vision into reality. Others such as predictive customer twins, Emotional-Intelligence-as-a-Service, unified EX-CX measurement, and immersive synthetic CX showed good progress but need more time.

What stands out is that CXM is no longer evolving, it’s transforming. The move from “doing digital” to “being digital” is now clear: where predictive, agentic, and platformized models are becoming the new foundation of customer engagement.

For CXM leaders, the next chapter is about:

- Scaling what works: voice AI, predictive models, agentic workflows, platform consolidation

- Building trust and governance: data sovereignty, ethical AI, human-agent integration

- Experimenting with the frontier: synthetic experiences, emotional intelligence at scale, unified EX-CX measurement while being pragmatic about timing

The CXM revolution we forecasted is not on the horizon anymore. It’s here and accelerating. 2026 promises to be another exciting year for the industry, and we are working on coming out with our boldest predictions for the upcoming year. Stay tuned.

If this blog interests you, check out, CXM Meets Agentic AI: Are We Ready to Scale Yet? – Everest Group Research Portal, which relates to another topic regarding AI.

To take the conversation forward, please contact Sharang Sharma

([email protected]).