Blog

How to build a European CX contact center: where Europe leads, where it lags, and what sovereignty really means

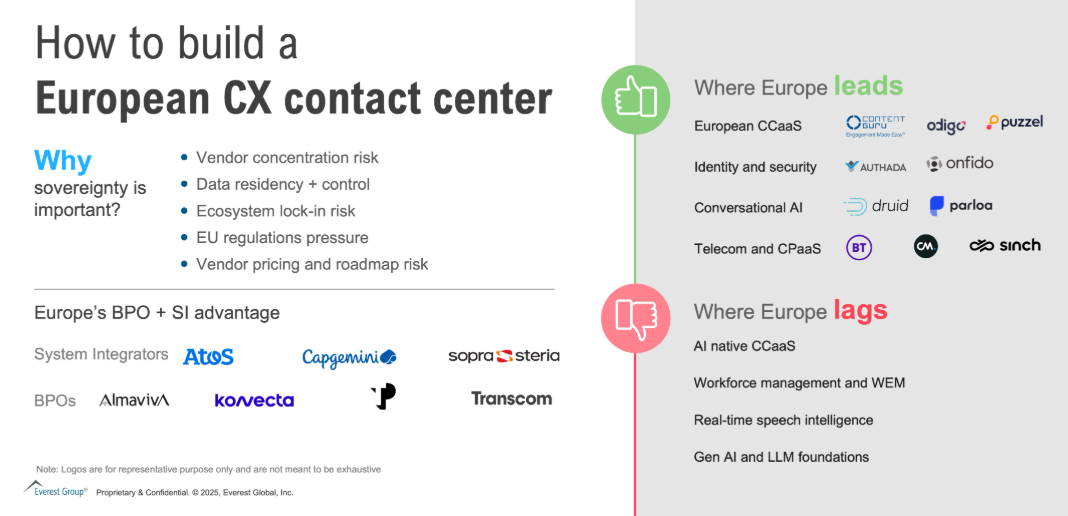

The idea of a sovereign European CX stack is, at its core, a strategic thought experiment. Few enterprises are planning to abandon United States (US) technology altogether, and Europe is not attempting to replace the global CX ecosystem.

But the thought experiment matters because the underlying technology model is shifting. As Artificial Intelligence (AI) becomes the engine behind more customer interactions, enterprises are asking deeper questions:

- How much of our CX stack do we really control?

- Where does our data actually reside?

- What happens if a global provider shifts roadmap priorities, pricing, or AI licensing rules?

- Will emerging European Union (EU) regulations, such as the AI Act, create new compliance tensions?

- Can we build a future-proof platform without being locked into a single AI ecosystem?

These concerns go beyond data sovereignty. They reflect broader strategic motivations around provider concentration risk, commercial leverage, regulatory alignment, and long-term operational resilience.

Enterprises increasingly want optionality, even if they never fully switch to a European-only stack. Examining whether Europe can power a modern contact center is not about rejecting global technology, it is about building resilience, choice, and long-term governance in an AI-first world.

And while American names such as NiCE, AWS, Genesys, or Accenture currently dominate the tech and services landscape in CX, Europe is far more capable of powering a modern contact center than most assume.

This is the story of a region with genuine strengths, emerging innovators, and undeniable gaps. It’s also a story about the ecosystem surrounding the technology itself: the System Integrators (SIs), Business Process Outsourcing (BPO) providers, and services providers that make sovereignty real.

Reach out to discuss this topic in depth.

Where Europe is strong: the foundations built quietly

Europe’s strengths in CX technology rarely make headlines. But they’re real, mature, and closely aligned with the needs of regulated industries.

European Contact Center-as-a-Service (CCaaS): stable, compliant, and aligned with regional requirements

European-born platforms such as Content Guru, Odigo, Puzzel, and Diabolocom have spent years delivering reliable, compliant, and configurable contact center platforms for large public-sector and enterprise environments. These solutions excel at the most critical aspects, including regional data hosting, operational stability, process nuance, and transparent control. For many enterprises with sovereignty concerns, these platforms are better aligned with European regulatory expectations than large US-native CCaaS stacks.

Identity and security: Europe’s global superpower

Europe is the leader in unified, cross-border, government-backed digital identity systems. eIDAS 2.0, along with solutions such as IDnow, Onfido, and Authada, is shaping a secure digital future for the region. In a CX world where fraud prevention, authentication, and trust frameworks are becoming central, this gives Europe a meaningful competitive advantage.

Conversational AI: a surprisingly strong emerging category

Europe has a vibrant and growing ecosystem of applied conversational AI companies. Platforms such as Parloa (Germany) and DRUID (Romania) show that Europe can build sophisticated voice automation and workflow-rich conversational tools that compete credibly with global providers. And while Cognigy is now under NiCE ownership, its rise reflects genuine European talent and innovation in AI orchestration. This category is still evolving, but Europe has momentum, not just presence.

Telecom and Communications Platform-as-a-Service (CPaaS): deep regional expertise

Europe’s telecom and communication infrastructure remains world-class.

Providers such as Sinch, Orange Business, BT, and Deutsche Telekom continue to underpin the region’s contact center capabilities with strong network resilience and strict data residency. This is one of the most sovereignty-ready segments of the CX stack.

Where Europe falls short: the AI-heavy layers that define the modern contact center

Even with strong foundations, Europe lacks the advanced AI and real-time intelligence layers that now define world-class CX.

Real-time speech intelligence and analytics

Modern contact centers rely on real-time interpretation of voice and text.

Europe currently lacks mature equivalents to US leaders in areas such as transcription, conversational analytics, automated Quality Assurance (QA), agent assist, and emotion/intent modeling. This is arguably Europe’s largest technology gap in CX.

AI-native CCaaS platforms

While European CCaaS platforms excel at core functionality, they don’t yet match the AI-rich ecosystems that NiCE, Genesys, AWS, and Five9 have built.

Capabilities such as predictive routing, AI-driven optimization, and real-time orchestration remain US-led for now.

Workforce Management (WFM) and Workforce Engagement Management (WEM)

Europe’s WFM heritage is solid (for example, injixo), but US participants still dominate the deeply integrated WEM suites that combine coaching, sentiment, forecasting, and real-time guidance.

Knowledge management

Europe offers strong UX-focused knowledge tools but not the deep enterprise-grade knowledge engines needed for large-scale, AI-assisted support environments.

Generative AI and Large Language Model (LLM) foundations

While LLMs aren’t a CX category in themselves, they power many emerging CX capabilities and process large amounts of operational data. This is where Europe is starting to develop alternatives, most prominently Mistral, but these models are still maturing and are not yet CX-specialized. Europe’s long-term sovereignty in CX will depend on having multiple options in this foundational layer, not a single emerging provider.

Europe’s SI and BPO ecosystem: a vital enabler of sovereignty

Software alone doesn’t build a contact center. The center comes to life through the people, processes, and expertise wrapped around the technology. This is where Europe holds a quiet but undeniable advantage.

Unlike other regions where SI and BPO capabilities cluster around a few dominant markets, Europe has a geographically distributed, mature, and globally significant services ecosystem.

A deep bench of European SIs

While global firms such as Accenture, Deloitte, and Infosys naturally operate across Europe, the region also hosts its own heavyweight integrators with deep local roots and strong CX transformation capabilities. Providers such as Capgemini, Atos, Sopra Steria, T-Systems, and Reply are long-standing partners for integrating large-scale CX stacks, especially in regulated industries.

BPO providers: Europe’s operational powerhouses

Europe is home to some of the world’s largest and most sophisticated BPO organizations that don’t just run contact centers but increasingly influence the CX technology stack itself. These include prominent names such as Teleperformance (France), Konecta (Spain), Almaviva / Almawave (Italy), and Transcom. Many have become early adopters of conversational AI, digital-first service models, and hybrid delivery (onshore, nearshore, and EU-shore) strategies.

So, can you build a European CX contact center today?

The answer is nuanced: Yes, if you’re building the CX foundation. However, for the AI-intensive heart of the contact center, enterprises will still need to draw from the US ecosystem.

A modern, high-performing, sovereignty-aligned CX stack typically includes:

- European core systems (Customer Relationship Management (CRM), CCaaS, identity, conversational AI, telecom)

- European service partners for implementation and operations

- Selective global components for speech AI, advanced analytics, agent assist, and deep WEM

- Balanced use of global foundation LLMs while local options mature

This isn’t a compromise. It’s a pragmatic, high-performance hybrid that gives enterprises the control they need without sacrificing innovation.

The bottom line

Europe has the foundation, the innovators, and the services ecosystem to power much of a sovereign CX stack. What it lacks for now are the AI-heavy engines that drive the most advanced experiences.

However, the momentum is real. As European conversational AI platforms scale, identity providers expand into trust orchestration, and European LLMs evolve, the gap will narrow.

Sovereignty in CX isn’t about replacing global technology. It’s about building an architecture with choice, optionality, and control. Europe is already closer to that reality than most assume.

If you found this blog interesting, check out, CX Tech Edge: Contact center as a service is evolving into enterprise CX OS: Why enterprises must take note now – Everest Group Research Portal, which delves deeper into another topic relating to CX.

To take the conversation forward, contact Sharang Sharma ([email protected]) and David Rickard ([email protected]).