Blog

From defense to intelligence: The future of litigation management in insurance

Reach out to discuss this topic in depth.

Litigation has become one of the most significant and fast-growing cost pressures for Property and Casualty (P&C) insurers. Litigation-related expenses have increased by nearly 20% between 2018 and 2023 and have pushed total Loss Adjustment Expenses (LAE) to around US $21-25 billion for P&C insurers. This surge underscores how rising legal complexity and claim disputes are not only inflating operational costs but also testing the industry’s ability to sustain profitability and pricing discipline.

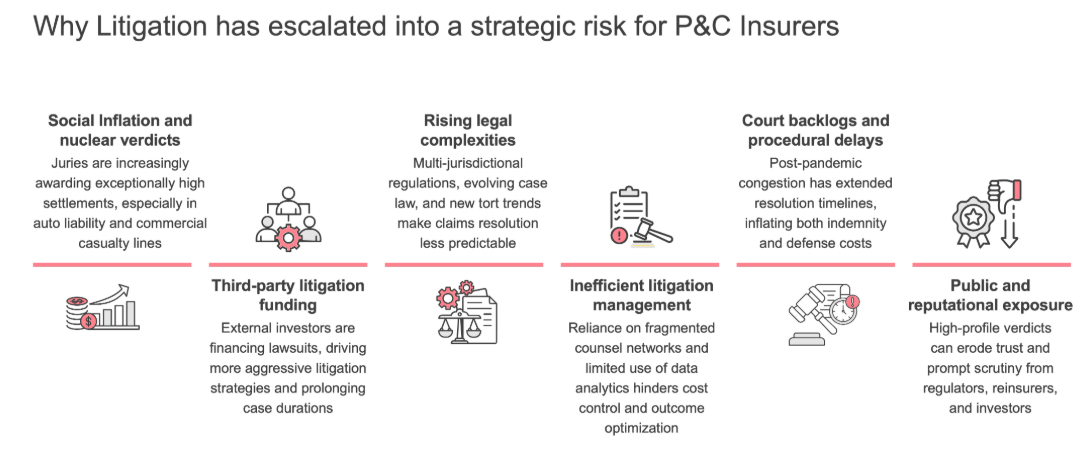

In recent years, legal expenses have risen sharply as claims have become more frequent, complex, and expensive to defend. This increase is not just the result of inflation in legal costs, but a fundamental shift in how lawsuits are being pursued and resolved. Juries are issuing larger settlements, external investors are funding cases that last longer, and congested courts are slowing the pace of resolution. At the same time, the growing complexity of multi-jurisdictional claims, coupled with evolving liability trends such as cyber and climate-related exposures, has increased both uncertainty and cost.

Inside insurance organizations, operational inefficiencies are compounding the issue. Many carriers still rely on fragmented counsel networks, manual workflows, and limited use of analytics, which makes it difficult to manage costs and outcomes effectively. Each large or public verdict now carries reputational and regulatory implications that extend far beyond the courtroom. Together, these pressures have turned litigation into a strategic risk that directly influences profitability, underwriting discipline, and customer confidence.

Turning the tide: How insurers are tackling litigation today

As litigation pressures mount, insurers are realizing that they cannot treat it as an unavoidable cost of doing business. The most forward-looking P&C carriers are gradually moving from reactive defense to strategic litigation management, powered by disciplined counsel partnerships, and better use of external expertise.

The industry is currently in a transition phase from intuition-driven practices to data-driven decision-making. Some of the best practices that only a few insurers currently follow include:

- Aligning counsel strategy with outcomes: Carriers are re-engineering how they select and manage defense counsel. Instead of relying on legacy relationships, they are using analytics to match the right firm to the right case, considering venue, complexity, and past results. Outcome-based fee models and tiered incentives are replacing hourly billing procedures. Zurich North America, for instance, operates a centralized Litigation Management Group that actively manages panel counsel and in-house attorneys to align case staffing with desired outcomes and efficiency

- Building data-driven litigation command centers: Modern litigation teams are supported by dashboards that bring together data on costs, outcomes, and venue trends. Legal spend analytics identify outliers, track panel efficiency, and benchmark defense costs. Predictive analytics now guide the “settle or try” decision, turning litigation management into a quantifiable science. Liberty Mutual has developed a “Universal Value Outcome Dashboard” that integrates spend and outcome data to guide counsel selection and improve litigation performance

- Strengthening pre-litigation resolution tracks: Leading insurers are embedding mediation and early settlement mechanisms directly into claims workflows. Offer-optimization tools are helping adjusters and attorneys design fair settlements before claims escalate into full-scale lawsuits

- Streamlining discovery and documentation: Investments in e-discovery and case-management tools have reduced manual burden and improved compliance. This has resulted in faster preparation and better documentation control across jurisdictions. Insurers such as Hanover and Allstate have implemented an end-to-end e-discovery platform using Exterro to automate legal hold, collection, and review processes

Collectively, these advances reflect a maturing litigation ecosystem, but they remain largely siloed. While insurers have made operational gains, the next phase of litigation management requires a more connected, intelligent, and adaptive approach, one that combines analytics, automation, and ethical governance.

What the future holds: Agentic and generative AI in litigation

The next phase of litigation management in insurance will be shaped by Agentic automation and generative AI (gen AI) . These technologies will not only streamline routine processes but also transform how insurers plan, manage, and close litigated cases. This will represent a shift from manual execution to intelligent decision-making, where systems continuously learn, adapt, and optimize outcomes.

Here’s how generative AI and Agentic automation are poised to redefine litigation across insurance operations.

- AI-driven triage and case routing: Artificial Intelligence (AI) agents will assess every new lawsuit at the time of intake, analyze claim details, venue, and historical outcomes to recommend the most effective resolution path. High-risk or high-value cases will be flagged for early mediation or senior review, while lower-complexity cases will move through automated workflows for faster closure

- Automated discovery and document management: Agentic AI will manage discovery end-to-end by reviewing, categorizing, and indexing vast volumes of documents. It will extract relevant facts, identify privileged content, and generate structured summaries, significantly reducing preparation time and enhancing compliance accuracy

- Intelligent drafting and motion preparation: Gen AI will assist legal teams by creating first drafts of contentions, motions, and deposition summaries based on prior case data and approved templates. Attorneys and adjusters will then refine these drafts, focusing more on strategy and advocacy rather than time-consuming document creation

- Predictive counsel and venue insights: Advanced litigation analytics will identify which law firms, venues, and judges will deliver the best results for specific case types. These insights will enable insurers to assign counsel more strategically and tailor defense strategies to the nuances of each jurisdiction, improving both cost efficiency and win rates

- Negotiation and settlement optimization: AI-driven modeling will simulate negotiation scenarios, assess offer ranges, and recommend optimal settlement timing. By learning from prior negotiation outcomes, AI systems will help insurers achieve faster resolutions and reduce the likelihood of runaway verdicts

- Continuous learning and responsible governance: Every closed matter will feed fresh data into predictive models, refining triage logic, settlement recommendations, and counsel evaluations. Alongside this, robust governance frameworks will ensure that all AI-driven activities remain transparent, ethical, and compliant, with human oversight guiding critical decisions

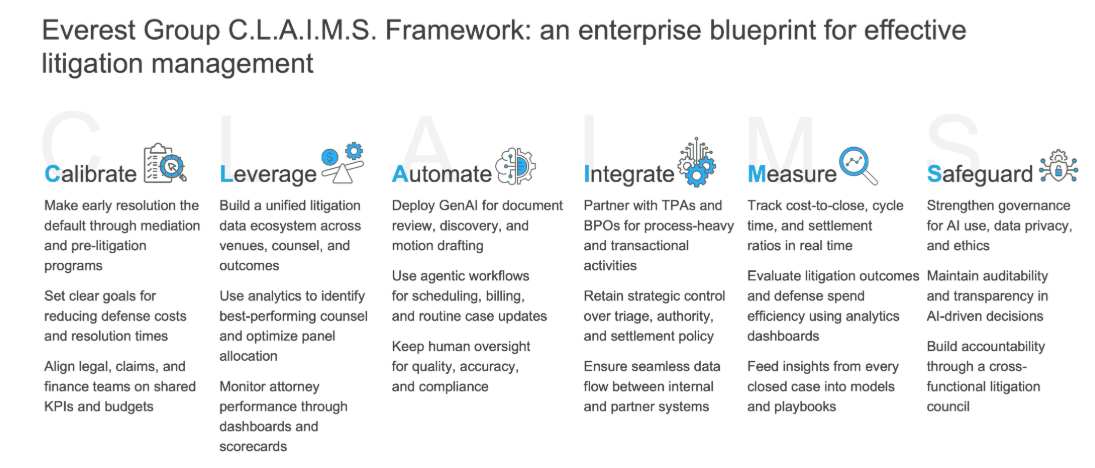

As litigation becomes more complex and costly, insurers need a comprehensive and connected approach to manage the litigation lifecycle. The Everest Group C.L.A.I.M.S. Framework serves as a strategic roadmap for enterprises to define and strengthen their litigation management strategy. It outlines six interconnected pillars that will help insurers to build an ecosystem driven by early resolution, analytics, automation, integration, performance measurement, and ethical governance.

Litigation is emerging as one of the most pressing and complex challenges for P&C insurers. If your organization is planning to strengthen its litigation management approach, Everest Group can help by assessing your current litigation management strategy and redefine it to meet evolving business, regulatory, and operational needs. Our research-backed insights and advisory expertise can guide you in designing a data-driven, technology-enabled, and ethically governed litigation operating model.

If you enjoyed this blog, check out our research on Property and Casualty (P&C) Insurance Third Party Administration (TPA) Market Outlook 2025 and Subrogation’s Moment to Shine: The Profit Lever Insurance Enterprises Need Now – Everest Group Research Portal for more insights on insurance claims excellence and stay tuned for our research across other process areas within claims.

To know more about litigation, please reach out to Abhimanyu Awasthi ([email protected]) and Ritvij Tripathi ([email protected]).