Blog

Core banking technology outlook 2026: modernization, intelligence, and the path forward

The year 2026 is expected to mark a clear inflection point as multiple forces converge simultaneously. Artificial Intelligence (AI) Artificial intelligence will move beyond experimentation into material business impact, but its effectiveness will remain constrained unless the core can support real-time decisioning, unified data access, and process-level integration. As AI cannot scale on fragmented data, batch-driven processing, or rigid architectures; core modernization will increasingly be framed not as an Information Technology (IT) IT initiative alone, but as a process outcome-first transformation agenda.

At the same time, the long-standing narrative of the “big-bang” core replacement will continue to lose relevance. Banks are expected to recognize that large-scale replacements are too risky, too costly, and too slow for the operating environment ahead. Instead, modernization will become progressive, modular, and outcome-led. While the global core banking technology market will continue to grow steadily, the composition of spend will shift away from monolithic platforms toward cloud -native components, event-driven architectures, Application Programming Interfaces (APIs), and AI-ready data fabrics. Institutions that succeed in the next era will be those that evolve their cores continuously and pragmatically, transforming them into engines of intelligence, resilience, and differentiation rather than static infrastructure.

Reach out to discuss this topic in depth.

Key trends shaping core banking evolution

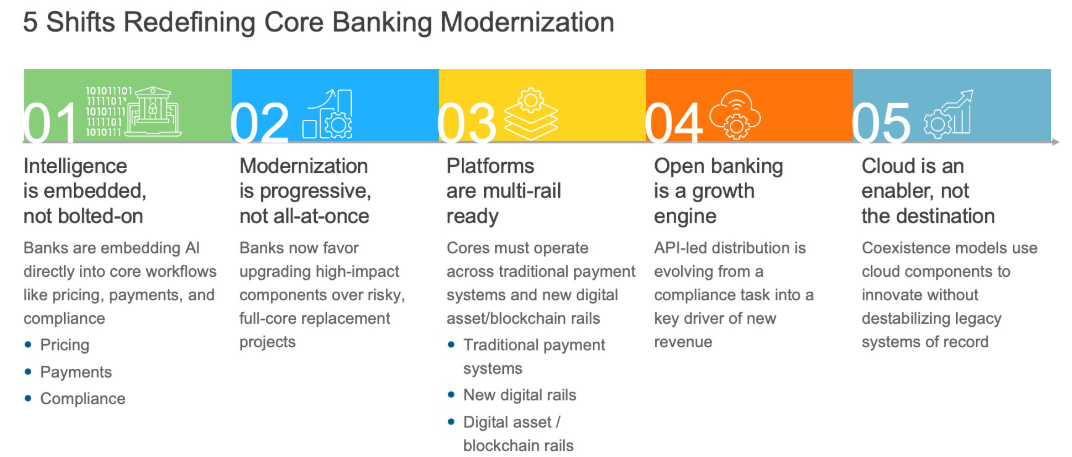

The modernization landscape will be reshaped by a set of structural shifts that represent a clear departure from how banks approached transformation in the earlier decades. These shifts will no longer be optional; they will be direct responses to mounting operational, regulatory, and competitive pressures. While progressive, coexistence-driven modernization is expected to remain the dominant approach, the underlying drivers will point to an industry moving decisively toward intelligence, openness, and multi-rail readiness.

Banks will increasingly embed AI directly into core processes, fueling demand for modernization that begins with activating data trapped across fragmented estates. Intelligence will not operate in isolation; it will need to be embedded into pricing, onboarding, servicing, payments, and compliance workflows. This will elevate the importance of data fabrics, semantic layers, and event-driven processing as foundational enablers of AI-led productivity.

Digital assets and stablecoin-linked deposits are also expected to reshape money movement and liquidity management. As tokenized value flows and real-time settlement gain traction, cores will be pushed toward multi-rail architectures capable of operating seamlessly across traditional payment systems and emerging blockchain-based rails.

Open banking will continue to evolve from a compliance obligation into a growth engine. API-led distribution will enable new revenue streams, deeper partner integrations, and faster product expansion. This shift will force banks to rethink the role of the core as an ecosystem enabler, rather than a closed internal system.

Cloud migration, however, will remain constrained by decades of customization and technical debt. Rather than full replacement, banks will increasingly adopt coexistence models and cloud-native components that allow innovation without destabilizing the system of record. Cloud will function as an enabler of modularity, resilience, and speed, not a destination in itself.

Modernization approaches by bank segment

Modernization priorities will continue to vary significantly by institution type, reflecting differences in scale, complexity, risk tolerance, and strategic ambition.

Large global banks will enter modernization carrying the dual burden of massive scale and deeply customized legacy estates, often spanning regions, business lines, and decades of incremental change. Their priorities will center on operational resilience, regulatory confidence, and enterprise-wide intelligence enablement. Given the high risk of disruption, these institutions will favor domain-led modernization and coexistence architectures, allowing new capabilities to operate alongside existing cores while progressively reducing dependency on legacy systems.

Mid-tier and regional banks will be driven by speed, predictability, and cost efficiency. Their modernization journeys will remain more targeted, focusing on one domain at a time, such as lending, onboarding, or servicing, or introducing cloud-native components that plug into existing environments. SaaS-based upgrades and next-generation domain platforms will provide faster, lower-risk paths to improved customer experience and operational performance, reinforcing a pragmatic, outcome-led approach.

Community banks will pursue modernization primarily to simplify operations and access capabilities they cannot build internally. Integrated, full-suite platforms combining digital banking, payments, servicing, and analytics will remain attractive. Cloud-based cores and Software-as-a-Service (SaaS) ecosystems will reduce complexity, ease compliance burdens, and improve agility without requiring a large IT footprint.

Credit unions will modernize with a strong emphasis on member experience, trust, and service continuity. Their priorities will favor enhancements that deepen personalization, strengthen financial wellness offerings, and streamline everyday interactions. Modernization efforts will focus on upgrading digital channels, connecting to real-time payment infrastructure, and adopting cloud-based servicing components that improve efficiency while preserving the member relationship.

Implications for the banking technology ecosystem

These shifts will have significant implications for the broader ecosystem supporting core banking modernization.

Core platform providers will need to evolve beyond traditional system-of-record capabilities. Banks will increasingly expect composable, API-first architectures that support coexistence rather than enforce wholesale replacement. Providers that embed AI-ready data models, event-driven workflows, and flexible orchestration layers will be positioned as strategic partners, not transactional vendors.

System integrators and consulting firms will continue to move from implementation-centric roles toward transformation orchestrators. Modernization will demand deep expertise across cloud, data, AI, cybersecurity, and regulatory resilience. Integrators will play a central role in designing progressive modernization portfolios, integrating cloud-native components with legacy systems, and ensuring that transformation delivers measurable business outcomes.

Hyperscalers will become increasingly indispensable participants in the modernization journey. Their industry clouds, reference architectures, data platforms, and marketplaces will help banks accelerate innovation while de-risking transformation. As banks adopt hybrid and multi-cloud patterns, hyperscalers will underpin portability, resilience, and ecosystem integration.

Next steps for enterprises

As banks move into the 2026 modernization cycle, success will begin with clarity on the outcomes they need to deliver. Core modernization will only create value when it improves how the bank serves customers, makes decisions, and runs operations. AI will not scale if underlying data remains fragmented. Cloud will not create value if it simply replicates legacy complexity.

The first step, therefore, will be strengthening foundations: unifying data, enabling APIs, and supporting real-time processing before attempting deeper structural change. Progress will come from treating modernization as a series of coordinated, high-impact steps rather than a single transformation program. Banks that focus on modernizing payments, improving onboarding, introducing real-time decision engines, and simplifying ledger structures are likely to see faster results with lower risk.

Designing for coexistence from the outset will ensure that new components can operate alongside existing systems and connect into broader ecosystems as opportunities emerge. Banks that sequence modernization carefully and act with purpose will be better positioned to turn the core into a source of differentiation in an AI-driven economy. Those that delay, or treat modernization as a purely technical upgrade, will increasingly find themselves constrained by legacy systems that cannot keep pace with real-time expectations.

If you enjoyed this blog, check out, The Evolution of Core Banking Technology: From Foundations to a New Horizon – Everest Group Research Portal, which delves deeper into another topic relating to core banking.

To learn more about core banking, contact Ronak Doshi, [email protected], Kriti Gupta, [email protected], Laqshay Gupta, [email protected], and Rakshit Gupta [email protected].