Blog

Salesforce Acquires Informatica: The Missing Link in Its AI Ambitions

Why is Salesforce betting on Informatica – and why now?

On May 27, 2025, Salesforce announced a US$8 billion all-cash acquisition of Informatica, a company recognized for its expertise in data integration, metadata management, and master data management (MDM). The move reflects Salesforce’s effort to broaden its focus beyond CRM and enhance its role in supporting enterprise data and AI initiatives.

As we explored in our earlier blog, Will Every Enterprise Platform Become a Data Company?, we anticipated a shift where application-layer platforms would increasingly evolve into data-centric infrastructure providers. That forward-looking view now seems increasingly relevant and timely. The Salesforce – Informatica deal doesn’t just align with that trend; it sharpens it. It demonstrates how even established CRM players are repositioning themselves to compete not just on features, but on owning and orchestrating enterprise data at scale.

Unlike Salesforce’s prior large acquisitions, such as Tableau (US$15.7 billion) and Slack (US$27.7 billion) – this transaction is expected to generate a more measured return. There is a projection of a 7% ROI, pointing to a shift toward infrastructure investments that support long-term platform integration rather than short-term market expansion. From an enterprise perspective, this acquisition signals a shift in the kind of problems Salesforce wants to solve for its customers. It is no longer just about managing customer relationships, but about managing the entire enterprise data lifecycle. Could this acquisition help reduce the complexity of your stack, or will it create new dependencies?

From CRM to System of Execution: what Informatica enables

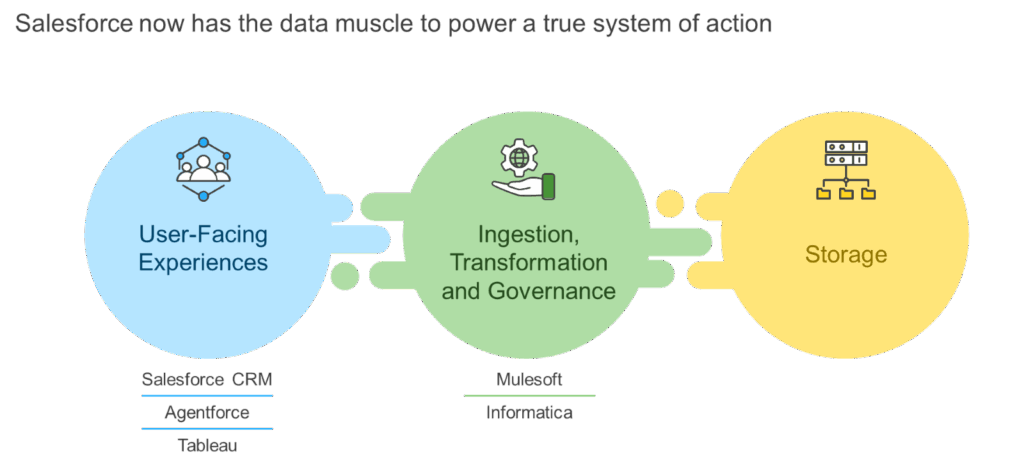

If the acquisition signals a strategic shift, the real transformation lies in what Informatica enables Salesforce to become – not just a CRM leader, but a System of Execution for AI-driven enterprises. Agentforce, Salesforce’s autonomous AI agent platform, will likely be the first real test of this transformation. Built to act, not just assist, it relies on high-integrity data to operate reliably in complex enterprise environments. Informatica provides the control layer that enables this – helping Salesforce deliver AI that can drive decisions, not just surface insights.

For enterprises already using Informatica, this may offer a more streamlined path to unifying front-end intelligence with backend governance. For those on Salesforce, it could expand AI use cases into more regulated or mission-critical workflows. And for those on neither platform, it’s a cue to reconsider Salesforce’s evolving position in enterprise data and AI strategy.

This acquisition aligns with Salesforce’s broader architectural ambition. Recent moves – from Spiff and Zoomin to Tenyx and PredictSpring – point to a deliberate strategy to own more of the operating stack that powers intelligent enterprise workflows. A bigger picture is emerging: Salesforce is building the infrastructure layer for AI-driven businesses.

Will enterprises embrace that vision – or keep Salesforce on the front end while letting others own the core? And more critically, are they ready to trust it to power decisions, not just manage relationships?

Can Salesforce thoughtfully navigate integration to realize Informatica’s potential?

Salesforce’s history with acquisitions offers valuable insight into the complexity of platform integration. Previous deals have underscored the importance of aligning teams, products, and delivery roadmaps. Integrating a company focused on data infrastructure presents both significant promise and the need for thoughtful execution.

A key to realizing value will be maintaining the integrity of what is being acquired – its people, capabilities, and ecosystem value. For enterprises, this means watching how well the transition is managed, not just in product updates but in strategic alignment. Most enterprises rely on multiple cloud and data platforms, so adding a new integration layer even with clear intent may introduce complexity if not carefully aligned. While the acquisition offers a chance to unify data and AI under one architecture, its success will depend on how well it fits into existing ecosystems. If integrated effectively, it could streamline workflows and improve governance. If not, it risks adding complexity.

A potential challenge lies in the fact that many enterprises already rely on a patchwork of data integration, ETL, and governance tools that are tightly embedded within their architecture. Replacing or consolidating these with a new integration layer, even one backed by Salesforce, may raise concerns about disruption, interoperability, and cost of change. The outcome may also influence how Salesforce’s broader ecosystem, including partners and cloud providers, evolves around a more data-centric strategy. Informatica could become the foundation for a more cohesive, AI-ready enterprise stack, but its impact will depend on Salesforce’s ability to deliver interoperability in a way that enhances rather than disrupts existing enterprise architectures.

Is this Salesforce’s play to lead the enterprise AI stack?

As Salesforce integrates Informatica and seeks to deepen enterprise trust, it enters a race already well underway. In the evolving enterprise AI landscape, metadata, governance, and orchestration have shifted from peripheral concerns to essential enablers of scale, actionability, and trust. Leading vendors are rapidly consolidating this layer – Microsoft with Purview, Databricks with Unity Catalog, Snowflake with Horizon, and ServiceNow with data.world. With Informatica, Salesforce joins the ranks of platform players shaping the future of enterprise AI.

While the value may be most obvious in regulated sectors such as public services, healthcare, and financial services, the relevance is broader. Any enterprise building AI-driven workflows at scale – where explainability and interoperability are critical – will be watching how this integration unfolds. With Informatica, Salesforce now has the opportunity to stitch together its broader platform story – connecting MuleSoft, Data Cloud, Tableau, and Agentforce into something more unified, modular, and trusted.

Looking ahead, more consolidation is likely. As the pressure to deliver integrated, AI-ready platforms grows, vendors across the ecosystem will accelerate their bets – through acquisitions, partnerships, or both. As data and governance capabilities become table stakes, differentiation will hinge less on what vendors own and more on how well they orchestrate value across data and AI ecosystems.

Bold and timely, this acquisition positions Salesforce to reshape its role in the enterprise AI stack. Whether this vision translates into platform leadership will depend on how well Salesforce executes and how quickly it can deliver measurable value.

To learn more or discuss this topic further, contact Suseel Menon ([email protected]), AS Yamohiadeen ([email protected]), Mansi Gupta ([email protected]), Anju Kattakathu ([email protected]), or Amitayu Krishna ([email protected]).