Blog

Funding Modernization Through Growth Acceleration: A Strategic Pivot from Cost to Value

In our previous blog, “Disrupting the Core by 2030: Enterprise Vision Driving Demand for Agile, Collaborative Core Banking Platforms,” we discussed the big opportunity in core banking modernization. We emphasized how rising customer expectations, real-time service demands, and regulatory shifts have elevated core banking from a back-office agenda to a strategic imperative. Enterprises globally are now pivoting toward agile, cloud-native, and collaborative core banking platforms.

However, an equally important and often overlooked dimension in this modernization journey is how these initiatives are funded and sustained. Traditionally, enterprises have anchored modernization efforts in cost takeout initiatives, leveraging efficiency gains from existing projects to finance future-focused transformation projects.

While pragmatic and effective for incremental improvements, relying solely on cost savings can lead to significant limitations that prevent many enterprises from fully realizing their broader strategic ambitions.

Let’s examine why focusing exclusively on cost-led modernization can create unintended value leakage, and why adopting a growth-led funding strategy can enable enterprises to sustainably scale transformation initiatives.

Reach out to discuss this topic in depth.

Cost-led modernization: The limitations of a one-dimensional play

Enterprises often initiate modernization by targeting cost efficiencies in existing operations, streamlining processes, reducing operational overhead, and automating routine tasks. These cost-driven strategies typically deliver valuable incremental gains and an immediate Return on Investment (ROI). However, this incremental and efficiency-focused approach can inadvertently mask deeper structural limitations that prevent enterprises from fully leveraging the strategic potential of modernization.

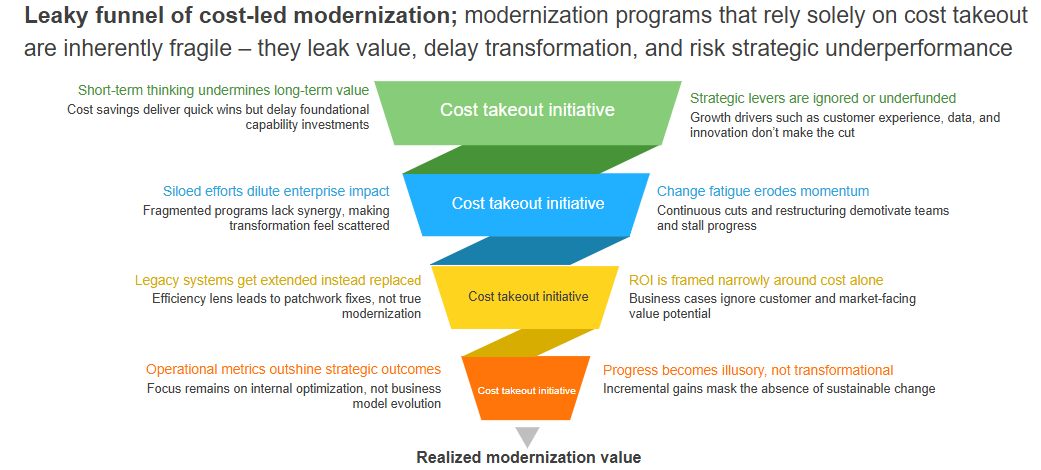

Consider cost-led modernization as a funnel through which enterprises channel their transformation investments. Ideally, resources invested at the top flow smoothly through, delivering fully realized modernization value. However, this funnel can encounter several critical “value leaks,” primarily because cost-driven approaches inherently prioritize short-term efficiencies over strategic, growth-oriented investments.

Short-term thinking, driven by immediate targets, can delay investments in foundational capabilities necessary for sustained competitive advantage. Simultaneously, crucial growth-oriented strategic areas such as enhancing customer experience, advanced analytics, and digital innovation are sometimes deprioritized due to their comparatively longer payoff horizons.

Moreover, cost-driven initiatives may unintentionally lead to fragmented efforts, resulting in isolated departmental projects rather than coordinated enterprise-wide transformations. This incremental and decentralized approach can limit the overall strategic impact, even though it might achieve short-term operational objectives.

Finally, when business cases focus exclusively on immediate cost savings, enterprises may overlook customer-facing or market-expanding strategic opportunities. Operational metrics tend to overshadow strategic outcomes, resulting in a modernization journey that progresses incrementally rather than achieving broader transformative goals. Additionally, a focus on core modernization in isolation can inadvertently lead enterprises to overlook critical surrounding components such as Customer Relationship Management (CRM), Data & Analytics (D&A), and front-end customer experience layers.

This narrow approach can unintentionally create a modernization funnel prone to value leakage, making it difficult for enterprises to fully capitalize on their strategic investments.

Exhibit 1:

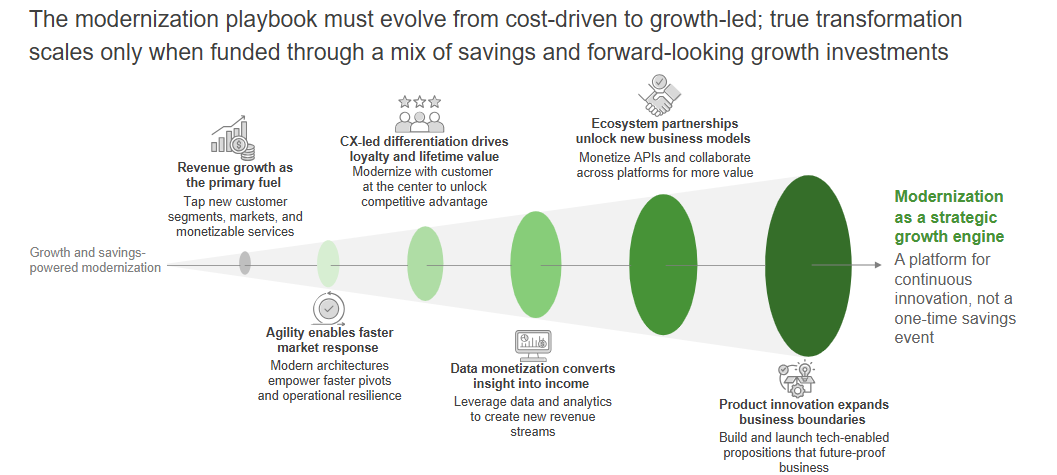

Pivoting from cost to growth acceleration

Recognizing these limitations, forward-thinking enterprises are redefining their modernization funding models to balance immediate efficiency with growth-led strategies. Rather than relying on cost savings, enterprises now view modernization as a strategic growth engine, leveraging both efficiency and revenue expansion to sustainably fund and scale transformation efforts.

Imagine modernization as a rocket with dual propellants: cost efficiency provides baseline stability, while growth initiatives add significant acceleration.

For instance, a typical mid-sized enterprise investing around US$15-25 million upfront in modernization initiatives could realize around 25-30% cost-efficiency savings on Information Technology (IT) operating costs within three-four years’ timeframe, generating meaningful operational gains.

However, by incorporating even modest growth initiatives such as accelerating digital products, monetizing data assets, and enhancing customer experience, enterprises could also unlock an additional 2-5% uplift in annual revenue, translating roughly to US$10-15 million incremental revenue annually at a 25-30% contribution margin.

In this balanced model, modernization delivers outcomes directly aligned with strategic growth objectives:

-

- Revenue growth: Modernization initiatives intentionally focus on expanding into new markets and customer segments, opening new revenue streams

- Customer-centricity: Investments directly improve customer experiences, driving greater loyalty and increased customer lifetime value

- Data monetization: Enterprises convert analytics insights into new revenue streams, providing additional funding sources for continued transformation

- Product and platform innovation: Modernized platforms enable rapid and agile deployment of digital offerings, enhancing competitive positioning

- Enterprise agility: Modernization builds adaptability, enabling enterprises to respond swiftly to market changes and new opportunities

- Ecosystem partnerships: Leveraging open platforms and Application Programming Interfaces (APIs) unlocks innovative business models and collaborative opportunities within the broader ecosystem

Each of these elements contributes to the modernization journey, creating a reinforcing cycle of continuous improvement. Instead of unintentionally losing value, growth-led modernization allows enterprises to amplify and sustain their transformation momentum.

Exhibit 2:

Why has balancing growth and savings been challenging?

While business leaders acknowledge the importance of balancing growth and efficiency, it has been challenging to achieve both simultaneously. Several reasons contribute to this difficulty:

-

- Misaligned incentives and accountability: Traditionally, modernization initiatives were primarily IT-led, limiting active involvement from product and business leaders. Without shared accountability, modernization efforts often became purely technical projects rather than strategic growth initiatives

- Short-term financial focus: Immediate cost-saving mandates from executive leadership frequently overshadow longer-term, growth-focused strategies, inadvertently deprioritizing projects with extended payback periods

- Siloed organizational structures: Functional silos hinder collaboration between IT, product, and business teams, impeding strategic alignment required for holistic modernization

- Inflexible legacy systems: Overly complex, outdated technology infrastructures create resistance to change, encouraging incremental, cost-driven improvements rather than comprehensive transformation.

Here is a snapshot of how enterprises can adopt a balanced approach and avoid the challenges effectively.

Exhibit 3:

The strategic imperative: Why enterprises must act now

The shift toward a combined savings-and-growth approach is essential in today’s rapidly evolving market environment. By clearly articulating why past challenges existed and how modern approaches resolve them, enterprises can fully leverage both immediate efficiency and future-oriented growth.

Embracing this balanced modernization strategy positions enterprises to continuously innovate, scale effectively, and achieve sustained competitive advantage. Enterprise leaders must now optimize the blend of savings and growth, turning modernization from an incremental efficiency project into a strategic transformation accelerator.

To learn more about the ongoing evolution in core banking and modernization strategies, explore our blog “The Evolution of Core Banking Technology: From Foundations to a New Horizon,” where we discuss the foundational shifts shaping today’s banking ecosystems.

For a closer look at the leading providers shaping the future of core banking technology, explore our Leading 50™ Core Banking Technology Providers 2024 report. Discover the rankings, market insights, and innovations driving transformation in the banking industry.

To learn more about core banking, contact Ronak Doshi, [email protected], Kriti Gupta, [email protected], and Laqshay Gupta, [email protected].