Blog

Advancing Rating & Pricing Decision Intelligence: A Strategic Imperative for Next-Gen P&C Insurers

A wake-up call: unprecedented losses and a changing risk landscape

The property and casualty (P&C) insurance industry is facing a profitability stress test unlike any in recent memory. 2024 marked another year of record-breaking catastrophe losses, with insured losses surging to US$146 billion globally (up from US$125 billion in 2023 and far above the US$108 billion ten-year average).

The total economic losses from disasters hit US$318 billion, and a staggering 57% of that remained uninsured, leaving a protection gap of roughly US$181 billion. This gap highlights that rising risk is outpacing insurance coverage, exposing societies to enormous, unbuffered shocks.

Reach out to discuss this topic in depth.

Structural shifts in risk are accelerating. Climate change is amplifying the frequency and severity of secondary perils, while urbanization concentrates on assets in megacities. A single flood or quake now causes outsized damage in dense economic hubs. Meanwhile, new liability classes are emerging, from cyberattacks to climate liability, creating unmodeled exposures for insurers. The result is a risk landscape in flux: richer in data, but also more complex and unpredictable.

Insurers know they must respond. Yet, many carriers are finding their traditional approaches pushed to a breaking point. Legacy pricing methods and tools, developed in a bygone era of more stable risk, are struggling to keep up with today’s real-time, systemic challenges.

The escalating losses and widening protection gap are a wake-up call that doing nothing is not an option. P&C insurers must adapt, not by tweaking rates upward (which can price customers out and widen the gap further), but by transforming how they understand and price risk at a fundamental level. This is where Advanced Pricing Decision Intelligence (APDI) comes in as a strategic imperative.

Traditional pricing approaches at a breaking point

The over-reliance on static actuarial models and siloed processes is leaving insurers flat-footed in the face of fast-moving risk dynamics. Many non-life insurers still update their technical pricing models only once a year, and even mid-term price adjustments often rely on stale risk assumptions due to lengthy model update cycles.

Incredibly, Excel and other manual tools remain pervasive at many carriers, spreadsheets and Visual Basic for Applications (VBA) scripts are used in numerous pricing steps, making the process tedious, fragmented, and slow. These legacy practices cannot deliver the responsiveness that is now required.

The limitations of traditional pricing manifest in several ways:

-

- Data siloes and blind spots: Actuarial pricing has historically drawn on a narrow set of data, primarily historical loss experience and a handful of rating factors. This leaves massive blind spots when confronting novel risks for which past data is sparse or non-existent. Moreover, data often resides in silos (underwriting, claims, finance), so critical insights are lost in translation – pricing teams often lack timely external data (like Internet of Things (IoT) sensor readings, social inflation trends, or real-time catastrophe indicators) that could improve risk predictions

- Slow feedback loops: Traditional pricing operates on long feedback cycles. An insurer sets rates, underwrites policies, and only months or years later sees the full loss of outcomes to adjust pricing. This lag is perilous when risk conditions are changing quarter to quarter. Insurers unable to iterate quickly on pricing are essentially driving through the rear-view mirror, by the time their models catch up to reality, the market or exposure has shifted again

- Legacy infrastructure and bottlenecks: Many carriers are stuck with legacy Information Technology (IT) systems and a shortage of skilled talent to modernize them. Actuarial and underwriting teams are stretched thin, creating bottlenecks in model development and rate filing. Minor model tweaks can take weeks to code, test, and deploy, by which point opportunities may be lost

Considering the current risk climate, traditional pricing models are often too rigid, disjointed, and slow to respond, preventing actuarial teams from recalibrating portfolios in real time and leaving underwriters without timely, data-driven guidance during peak peril periods or emerging risk scenarios.

This outdated approach can result in mispriced policies, either undercutting profitability or ceding market share. To address these challenges, the industry requires a more intelligent, agile pricing framework – laying the groundwork for Advanced Pricing Decision Intelligence (APDI) as a next-generation solution.

Enter APDI: from actuarial models to decision intelligence

Advanced Pricing Decision Intelligence (APDI) is not merely a technology trend; it marks a fundamental shift in how insurers approach rating, pricing, and risk management. At its essence, APDI brings real-time data, advanced analytics, and continuous learning into the pricing process, enabling decisions that are increasingly intelligent, timely, and forward-looking.

It represents a fully integrated capability, combining actuarial science, data science, artificial intelligence (AI) / Machine Learning (ML), and automation to elevate pricing from a periodic activity to a strategic, always-on function that drives sustained competitive advantage.

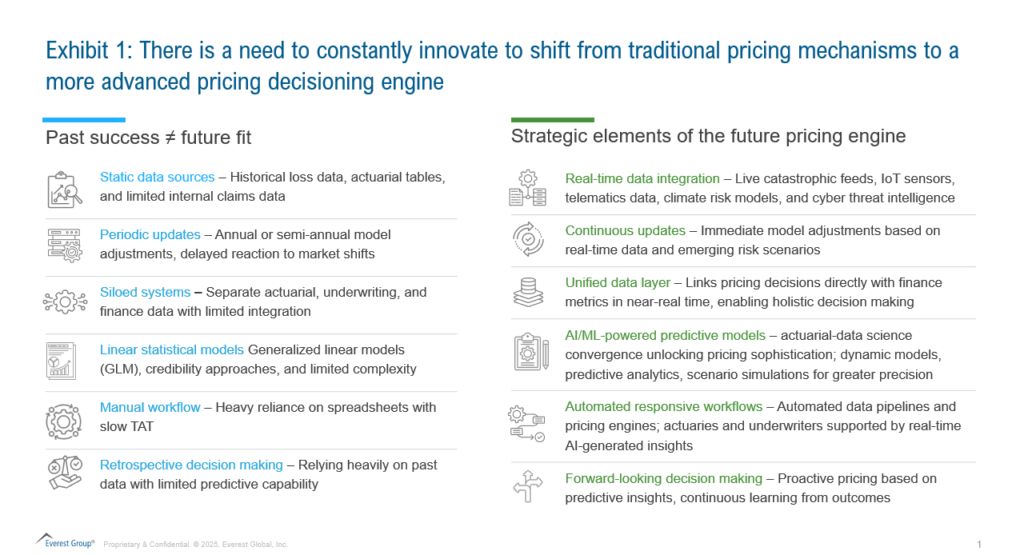

Exhibit 1 demonstrates key elements that define what APDI entails.

APDI represents a strategic transformation, not merely an IT upgrade. It shifts the insurer’s pricing approach from a traditionally retrospective, schedule-based model to a forward-looking, event-driven framework.

APDI fosters a “sense and response” culture, where pricing algorithms continuously monitor environmental and portfolio changes and adapt accordingly with real-time insights. This creates a dynamic feedback loop in which each pricing decision, and its subsequent outcome, such as policy cohort performance, feeds back into the system, refining future decisions. Over time, the pricing function evolves into an intelligent, self-improving capability, building a continuously learning data asset that strengthens the insurer’s competitive edge.

Insurers that successfully adopt APDI can gain a distinct competitive advantage, not only achieve greater pricing accuracy, but also accelerating innovation. They will be better positioned to confidently enter new markets and rapidly tailor products to evolving customer needs – capabilities that less agile competitors will struggle to match.

From spreadsheets to smart systems: the pricing maturity curve

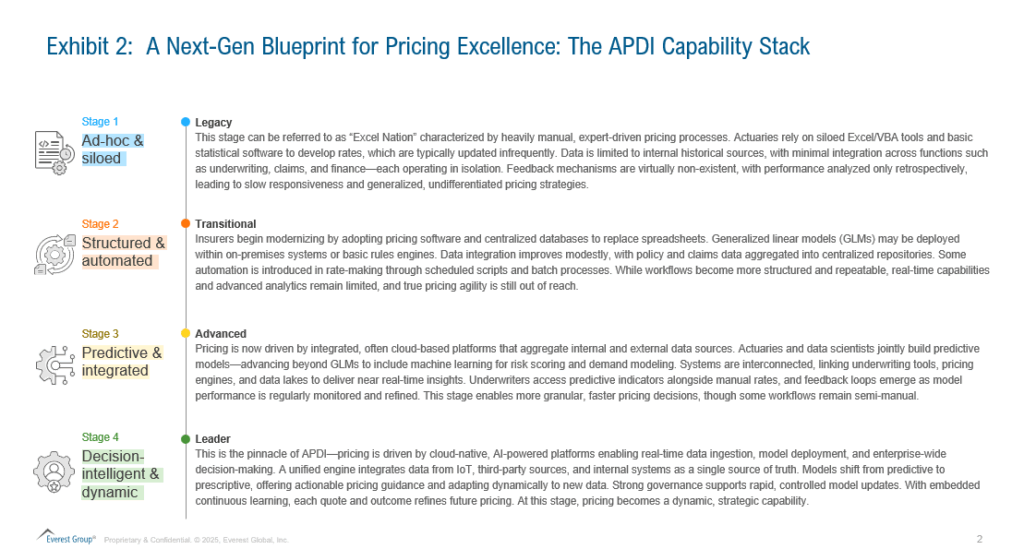

Insurers evolve toward Advanced Pricing Decision Intelligence along a maturity curve, moving through distinct stages of capability.

Exhibit 2 demonstrates an illustrative maturity model for pricing decision intelligence that might include the following stages.

While insurers will progress through this transformation at varying speeds, the trajectory is unmistakable: a shift from today’s fragmented, slow-moving pricing processes to a future defined by unified, real-time pricing intelligence.

The contrast is clear, current pricing functions are often hindered by legacy systems and talent constraints, whereas the future state is powered by real-time analytics, integrated actuarial and finance ecosystems, and cloud-scalable models such as Hyperexponential hx Renew or Moody’s AXIS.

The APDI maturity model reinforces that this is an evolutionary journey, one that demands strategic investment in technology, data infrastructure, and organizational capabilities.

Architecting the APDI capability stack

Implementing APDI is not about deploying a standalone solution; it requires orchestrating a cohesive stack of interdependent capabilities. To realize its full value, insurers must architect (or strategically partner to access) an integrated technology and process ecosystem encompassing four foundational layers, as illustrated in Exhibit 3:

When effectively architected and integrated, the APDI stack transforms pricing into a high-frequency, data-informed decisioning system. It empowers insurers to seamlessly absorb new inputs, such as updated catastrophe models, re-score entire portfolios in real time, dynamically adjust pricing in impacted geographies, and equip underwriters with immediate, context-specific guidance.

What once required a lengthy pricing committee cycle can now be executed in near real time. In doing so, the APDI stack operationalizes the strategic imperative of faster, smarter, and scalable pricing decisions.

Evolving roles: What’s next for actuaries and underwriters?

The transition to APDI naturally prompts a critical question: how do traditional roles, particularly actuaries and underwriters, evolve within this new paradigm? Rather than displacing these roles, APDI enhances their strategic value, shifting focus from manual execution to high-impact decision-making.

-

- Actuaries as scenario architects and model stewards – In a legacy environment, actuaries were burdened with manual tasks, data preparation, spreadsheet management, and infrequent model updates. APDI automates much of this work, enabling actuaries to assume more strategic functions. They become designers of scenario frameworks, stewards of model governance, and custodians of AI integrity. Their responsibilities expand to include configuring models to reflect emerging risks, conducting scenario analysis (e.g., assessing the pricing impact of autonomous vehicle adoption), and ensuring regulatory and ethical compliance through explainability and fairness reviews. Actuaries evolve into trusted advisors, focused on the “why” behind pricing decisions, rather than the mechanics of calculation

- Underwriters as risk strategists and market sensors – Historically, underwriters have applied market judgment to refine actuarial pricing. With APDI, they are equipped with richer, real-time intelligence, benchmark pricing, customer value scores, and dynamic risk indicators at the point of decision. This transforms them into portfolio managers and market strategists, with reduced time spent on routine processing and greater focus on exceptions, relationship management, and product innovation. Underwriters contribute critical frontline insights into the model refinement process and collaborate on the development of new offerings, supported by agile pricing models. Their role becomes more analytical and forward-looking, augmented, not replaced by intelligent systems

Implications for insurers

-

- Invest decisively in modern data infrastructure and platforms capable of ingesting and processing high-volume, high-velocity, and high-variety data in real time. A cloud-native, API-enabled architecture is critical to support advanced analytics and real-time decisioning

- Foster a data-driven, agile mindset by adopting a culture of experimentation and agility, prioritizing data-driven insights over legacy intuition where appropriate. Upskilling efforts should focus on analytical fluency and comfort with AI-supported tools

- Break down functional silos and legacy barriers between actuarial, underwriting, and finance teams. Cross-functional collaboration should be enabled through integrated platforms that unify workflows, data access, and decision logic

- Adopt an incremental build-and-scale approach rather than pursuing enterprise-wide transformation at once, insurers should pilot APDI capabilities in targeted areas, such as launching a cloud-based analytics sandbox or deploying an AI-powered pricing tool for a specific product line, then scale proven successes across the organization

- Reposition pricing intelligence at the C-suite level as a core strategic enabler of growth, profitability, and resilience in a volatile risk environment. This requires sustained investment in technology, talent development, and organizational change

- Forge strategic partnerships with leading technology providers as well as niche InsurTechs to accelerate capability development and offer advanced analytics, AI, and cloud-based pricing platforms

Implications for technology providers

-

- Build pricing solutions that reflect the specific operational and regulatory requirements of insurers. This includes cloud-native, modular architectures that allow insurers to embed their own models and datasets seamlessly

- Prioritize explainability and transparency – support full traceability of pricing decisions to meet internal governance and external regulatory standards. Explainable AI capabilities are essential to demystify pricing recommendations and enable stakeholder confidence

- Enable continuous learning through feedback loops, capturing real-world outcomes, and enabling iterative model refinement. Moving beyond static, one-time models to dynamic, learning systems is a critical differentiator

- Ensure seamless integration with core insurance systems – open APIs and flexible integration frameworks are vital. Solutions must easily interoperate with insurers’ existing ecosystems, including policy administration, claims, reserving, and finance platforms, to avoid disruption and maximize usability

- Act as strategic enablers and long-term transformation partners, not just software suppliers, supporting insurers throughout their transformation journey with capabilities in data curation, governance tooling, model lifecycle management, and continuous improvement

Everest Group is launching the inaugural Underwriting Technology for Property & Casualty (P&C) Insurance – Products PEAK Matrix® Assessment 2025. Participate in the assessment or reach out to [email protected] and [email protected] for more information about it.

If you found this blog interesting, check out our Agentic AI In Insurance: Transforming Risk, Relationships, And Results | Blog – Everest Group.

If you have any questions or want to discuss the latest developments in insurance in more depth, please contact Vanshika Notani ([email protected]) and Aurindum Mukherjee ([email protected]).