Blog

The New Battleground: How Rapid Competition in Digital Workplace Services Will Shape the Future

After a period of rapid growth fueled by pandemic-driven hybrid work investments, the digital workplace services market has experienced a slowdown, primarily due to global macroeconomic challenges.

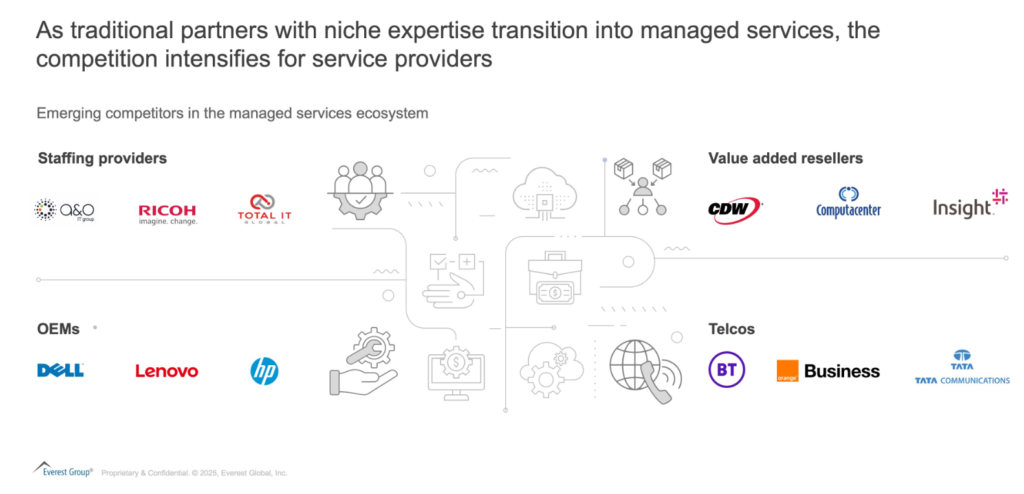

Despite this, notable developments are now reshaping the competitive landscape. Original Equipment Manufacturers (OEMs) like Lenovo, Dell, and HP are venturing into the services space, while Value-Added Resellers (VARs) such as Zones and Computacenter are broadening their digital workplace service portfolios.

Furthermore, a growing number of players from ancillary sectors, including staffing and telecommunications, are making inroads into the digital workplace managed services market, but the question is how and why?

Reach out to discuss this topic in depth.

The entry of OEMs into the services market is particularly intriguing. With the hardware market growth and margins stagnating, entry into managed services offers these players a promising avenue for growth and an opportunity to strengthen their balance sheets. This move also positions them as strong competitors to traditional service providers like HCL, TCS, and Accenture. A key benefit for enterprises in engaging with OEMs is also their ability to leverage their hardware supply chain strength, along with software and services, in order to offer an end-to-end and integrated managed services offering.

How does the disruption in the digital workplace vendor ecosystem impact enterprises?

Many enterprises are now looking to streamline their vendor contracts and prefer having a single provider accountable for both hardware and services.

While the concept of Device-as-a-Service (DaaS) has been around for some time, it often results in inflated costs, as either the service provider partners with an OEM, or vice-versa. With OEMs now directly entering the services space, we may see a more competitive market with smoother service delivery.

Since most of the OEMs already have a foot in the door in these enterprises as part of their hardware contracts, cross-selling and up-selling of managed workplace services has garnered decent success in enterprise deals for these OEMs.

The key question now though, is whether these OEMs will be able to deliver high-quality services, particularly as enterprises place greater emphasis on user experience. OEMs will need to enhance their capabilities to offer a compelling value proposition.

For traditional service providers, the growing presence of OEMs in the market could now lead to increased competition, potentially resulting in price wars. While service providers have a clear edge in service expertise, OEMs hold the advantage in hardware and asset management.

In conclusion it will be interesting to observe whether OEMs can successfully build their services capabilities and shift the digital workplace market dynamics away from traditional service providers toward OEMs, Telcos or VARs in the coming years. What the next 12 months holds is something that may transform industries forever!

If you found this blog interesting, check out our blog focusing on Unpacking The Potential Of A Hybrid Copilot Strategy: A Roadmap For Success | Blog – Everest Group, which delves deeper into another topic covered by our authors.

To discuss this and other insights from our research on OEMs, please reach out to Rohan Pant ([email protected]) and Udit Singh ([email protected]).