Shared Services / GIC Set-Up Options | Market Insights™

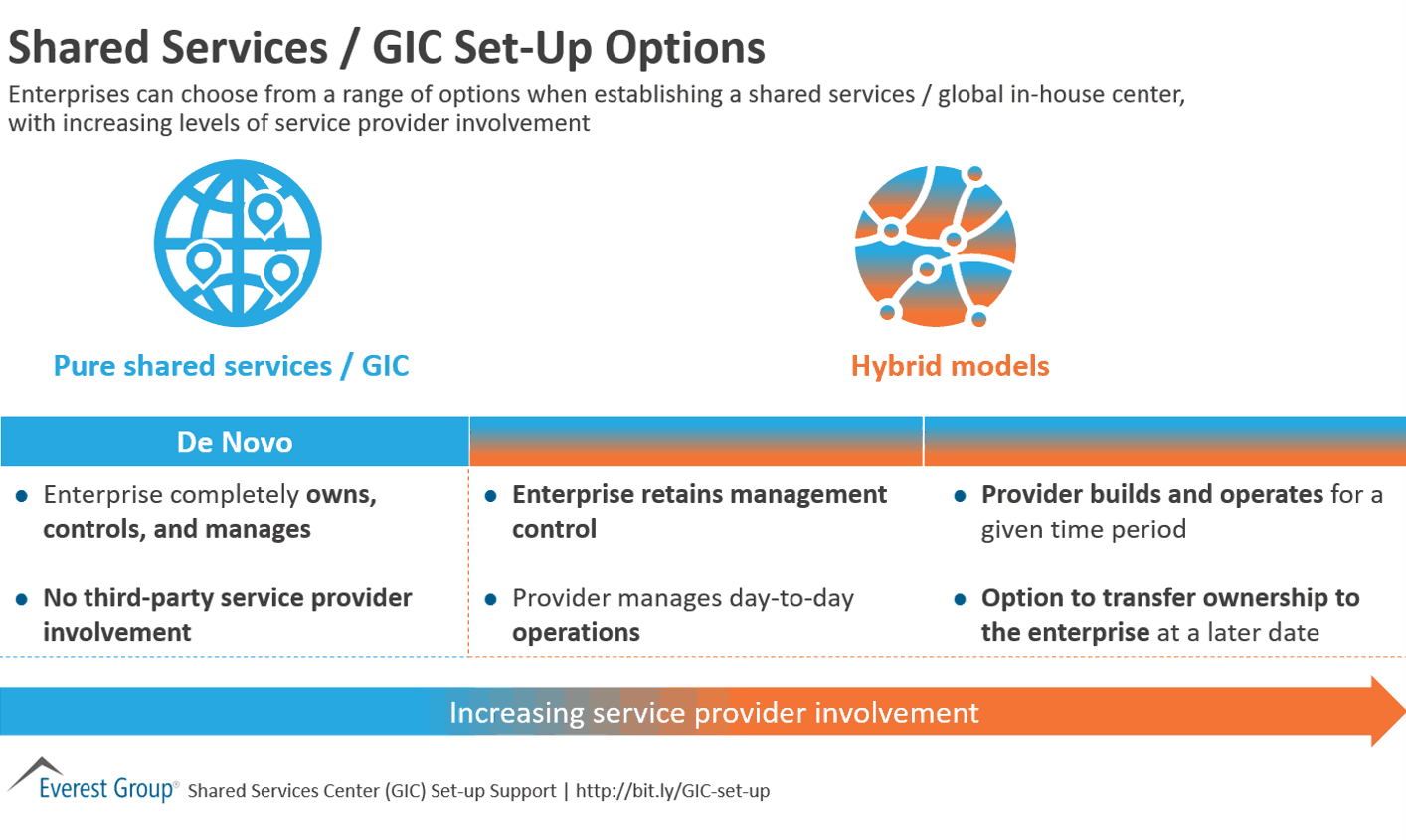

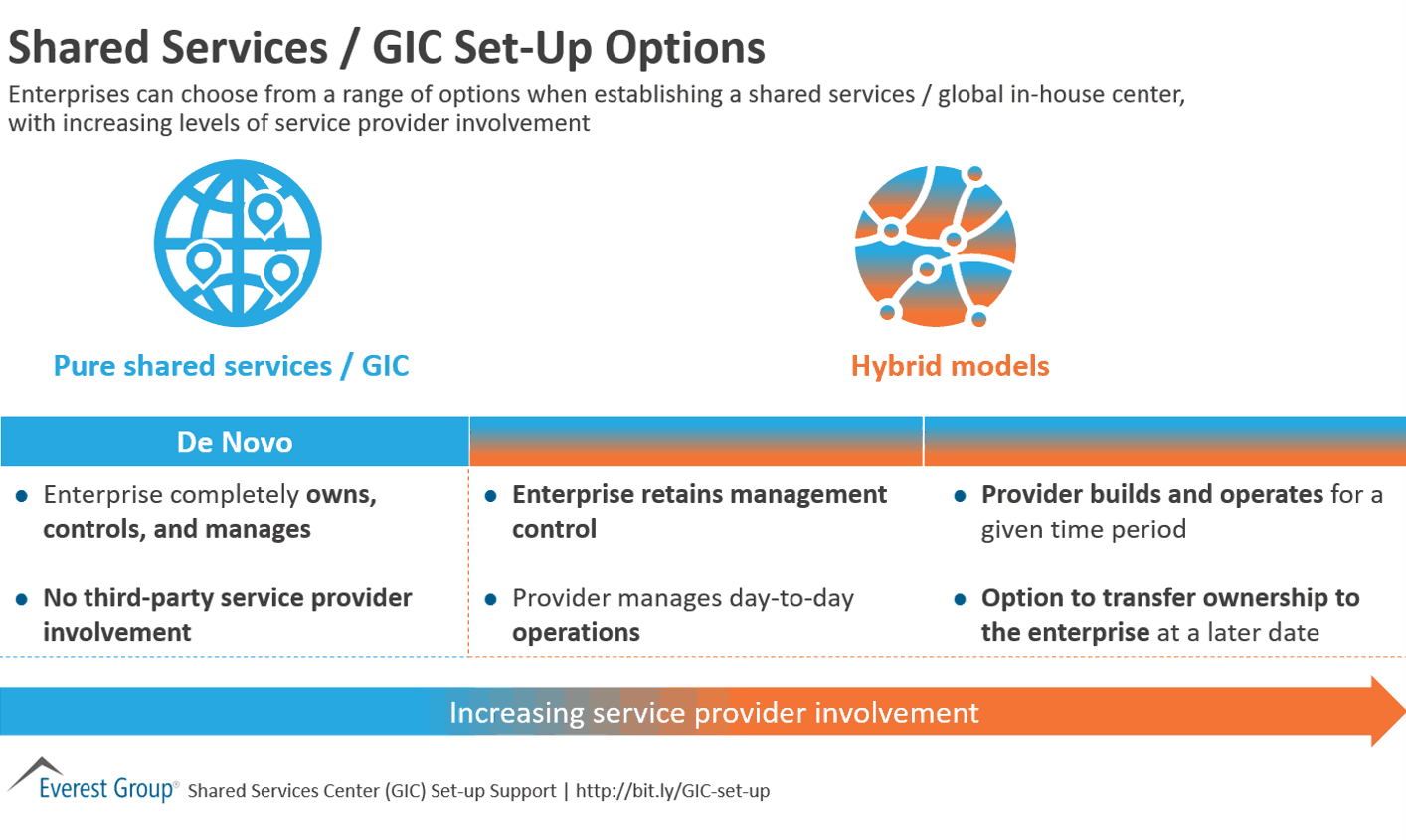

Enterprises can choose from a range of options when establishing a shared services / global in-house center, with increasing levels of service provider involvement

Enterprises can choose from a range of options when establishing a shared services / global in-house center, with increasing levels of service provider involvement

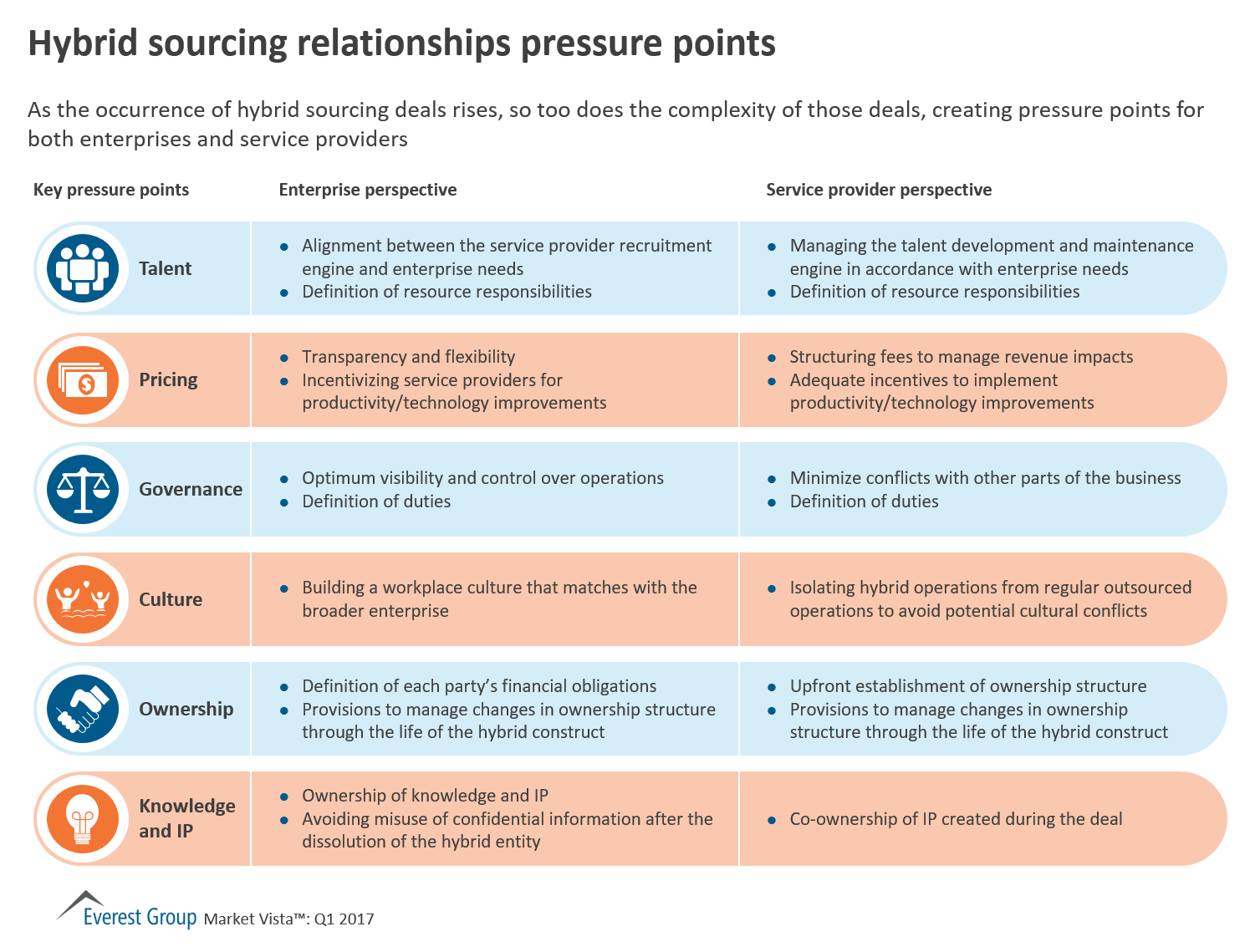

As the occurrence of hybrid sourcing deals rises, so too does the complexity of those deals, creating pressure points for both enterprises and service providers

The Global in-house Center (GIC) model continues to grow across industries, functions, and emerging markets ‒ from the financial services and technology industries to most verticals, from call center and R&D to a diverse set of functions, and from India to most emerging markets.

As the model continues to grow, with GICs evolving from low-cost service delivery centers to strategic entities driving value beyond cost savings, they face strategic and operational challenges: demand fluctuation management, talent management, driving further optimization through adoption of industry best practices, and knowledge management, to name just a few.

Third-party service providers can come into play here, helping GICs overcome these challenges by providing:

In this hybrid sourcing model, the GICs use service providers and/or manage their delivery on behalf of the parent organization. This also includes situations in which the GIC is driving or supporting sourcing initiatives (e.g., service provider selection or contracting) on behalf of the parent organization.

Everest Group, in collaboration with the Shared Services and Outsourcing Network (SSON) and NASSCOM, recently conducted a survey on hybrid sourcing adoption trends in offshore GICs. Eighty percent of the respondent GICs have adopted hybrid sourcing, leveraging service providers predominantly to manage volume fluctuations, lower costs, and access best practices. As the graphic below shows, most (80%) responded that hybrid sourcing is meeting or exceeding their expectations.

Our research shows that service delivery improvements and governance enhancements are the top priorities for the GICs. Therefore, it is not surprising that GICs collaborate with service providers across three key associated areas – supporting service provider delivery, supporting/implementing the parents’ service provider sourcing program, and identifying global sourcing opportunities and designing the sourcing model strategy. As GICs evolve in their operating models, they are likely to look for more opportunities to work with service providers in these priority areas to enhance the overall impact.

Going forward, it is safe to assume that there are multiple opportunities for service providers to work with the GICs. However, further adoption of hybrid sourcing in GICs will be driven by their ability to influence the mandate from the parent organization, and service providers’ ability to assess the opportunities. Understanding GIC maturity will also be a critical factor driving these collaboration opportunities.

Everest Group has recently released a report on adoption of hybrid sourcing that provides a detailed landscape of current adoption and future trends for this model. For more information, please download a preview of the report, “Adoption of Hybrid Sourcing in GICs – Driving Impact through GIC-Service Provider Collaboration.”

Hybrid sourcing constructs: Build Operate Transfer (BOT), Joint Venture, Assisted/Virtual GICs

GIC service provider engagement models shifting from tactical to strategic: GICs increasingly engaging service providers beyond staff augmentation

Related Research

Evolution of the GIC Model: Do GICs Really Add Value Beyond Cost Arbitrage?

Mature GICs have broad involvement with service providers; engagement goes beyond service provider delivery to global services program support and strategy

Related Research

Evolution of the GIC Model: Do GICs Really Add Value Beyond Cost Arbitrage?

While hybrid sourcing is a well established delivery model across GICs, its adoption is more evolved in IT services compared to business process services

Related Research

Evolution of the GIC Model: Do GICs Really Add Value Beyond Cost Arbitrage?

The Global In-house Center (GIC, formerly referred to as captives) market was once thriving with unprecedented statistics – 97 new GIC set-ups in 2009, 105 in 2010, and 103 in 2011. Then there was a dip, with only 75 new centers in 2012, and 69 in 2013. This, coupled with numerous acquisitions of GICs by service providers, (e.g., KBC Group’s financial arm by Cognizant, Bayer’s Indian IT operations by Capgemini, and Hutchison Whampoa’s India-based call center operations by Tech Mahindra), is likely to raise questions and concerns about the future of the in-house model.

Let us look at the ground realities of the GIC model’s growth and evolution:

Further, while buyers’ moves from an outsourced to an in-house model rarely receive considerable fanfare, they do paint a picture of the health of the GIC model. For example, HP had been General Motor’s main IT vendor per a US$2 billion contract awarded in 2010, but in 2012 the automaker decided to insource a huge amount of its services as part of its new strategy, leaving HP with only a few. AstraZeneca plans to reduce its outsourcing work, which is currently spread across multiple Indian software service providers. BT plans to have more control of its processes by taking back its outsourcing contracts from service providers, and increasing its capacity in existing shared services centers in India and Malaysia.

The bottom line is that while GIC set-up growth may be slowing, the model continues to be an integral component of organizations’ sourcing strategy. Firms continue to leverage both sourcing models (service providers and GICs) based on best fit with their sourcing needs, cost and value objectives, and services demand profile.

For more insights on the GIC model landscape, please refer to our recently released report “Global In-house Center (GIC) Landscape Annual Report 2013.” The report provides a deep-dive into the GIC landscape and a year-on-year analysis of the GIC trends in 2013, comparing them with trends in the last two years. The research also delivers key insights into the GIC market across locations, verticals, and functions, and concludes with an assessment of strategic priorities for GICs.

In a recent blog I noted that there is a new wave of shared services activity. But don’t dismiss that news with an assumption that new starts in shared services just means taking a slice of business away from third-party service providers. Here are my tips for shifting this potential business loss to a new revenue stream.

Tip #1: Be patient

If a company has decided to go down the shared services path, your trying to convince them to use purely outsourcing is not likely to succeed. However, we know that over time companies that decide to embark on a shared services journey later decide to use third-party providers in their shared services mix, to a lesser or larger degree. So be patient. These activities take years to develop.

Tip #2: Be an ally

Don’t be an enemy of their decision to take the shared services path. Instead, be an ally and assist them on their journey. You can help them build out their shared services approach and use that relationship to identify where they could use a third party for part of of the services.

Tip #3: Cede control

At some point a shared services unit probably will adopt a hybrid approach to services. Even so, companies moving to shared services inherently favor maintaining control; so the types of services you offer them should be designed to allow them to exercise control.

Much of the outsourcing model is about giving the provider control so the provider can operate in an efficient manner and give the customer a low price. That approach won’t work in a hybrid shared services model. Instead, take an approach along the lines of “Let us help you craft control” so you can participate going forward.

During a panel on which I participated at the recent Shared Services and Outsourcing Week conference in Orlando, the topic of “hybrid models” came up again. Most of the market bandying about the term were illustrating their, or their clients’, “sophisticated” mix of outsourcing and captive shared services, when in reality – with all due respect – they were actually describing a non-complementary mish mash of uncoordinated legacy delivery model decisions made across business units, operating entities, etc.

If we are to get any tangible – and extra – value from hybrid model, we need to get real about what creates that value. Further, a hybrid is not appropriate for every process or function.

What is a real hybrid sourcing model? Let’s look at automobiles as an analogy. You may have an electric motor-run Chevy Volt and a gas-powered Honda Civic in your garage, but that only means you have two different types of cars that get you to your desired destination using different power sources. On the other hand, the hybrid Toyota Prius uses both gas and electricity, switching back and forth between the two power sources as needed to achieve optimum efficiency, performance and cost savings (and, of course, to be kind to the environment.)

By extension, true hybrid sourcing combines the strengths of outsourcing and captive shared services into a single model designed to capture added value – e.g., delivery speed and flexibility, operational resiliency and investment leverage – not available, or not as easily attainable, when integration of the above two delivery models is lacking.

Against that description, I encourage you to step back and ask yourself, “Is the services delivery model in use within my organization really a hybrid, or did I, or my service provider, simply rebadge it with the provocative, sophisticated-sounding hybrid moniker?”

Of course, the name you ascribe to your delivery model isn’t of much consequence. But it is critically important to determine whether or not a hybrid model is appropriate and advantageous for your organization, as there are times when separate outsourcing and captive shared services models are a better fit. Key indicators that hybrid is right for you include: 1) if there is a service delivery platform that can be shared and re-leveraged; and 2) if a given process is prone to volume and budget changes.

So…is your delivery model really a Prius? Should it be?

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields