Blog

Think Oak Ridge, Tennessee Isn't on Your List of Likely Domestic Service Delivery Sites? Think Again | Sherpas in Blue Shirts

Eric Simonson’s recent blog, “John Mellencamp Named Honorary Everest Group Analyst of the Month,” highlighted the dominance of tier-3 locations in the United Sates for onshore service delivery. Now it’s time to take a look at the tier-5 and rural locations in the U.S., per the North America Domestic Outsourcing location landscape study we recently conducted for RevAmerica, an event focused solely on domestic ITO and BPO sourcing.

Given that places such as Oak Ridge, Tennessee, Albany, Georgia, and Jacksonville, Texas have populations below 100,000, with limited presence of colleges and poor connectivity to commercial airports, one would not expect them to contribute significantly to onshore service delivery. However, our analysis of tier-5 and rural locations revealed five interesting facts.

Tier-5 and rural locations are growing and have a sizeable share in the domestic sourcing market

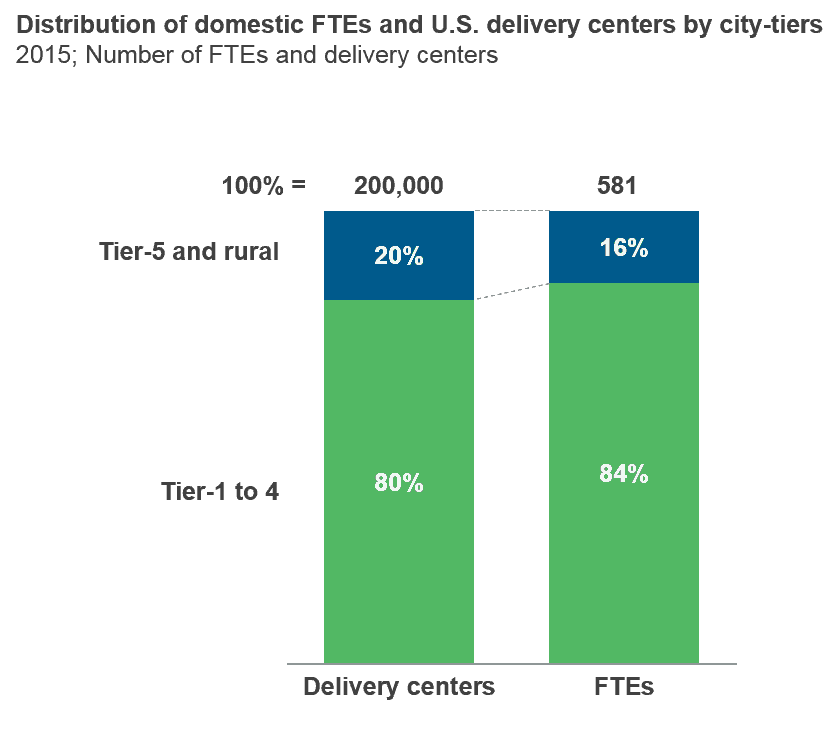

Tier-5 and rural locations account for approximately 20 percent of the total service providers’ delivery centers, and 16 percent of the delivery FTEs in the United States. The Midwest region has the highest share of these delivery centers.

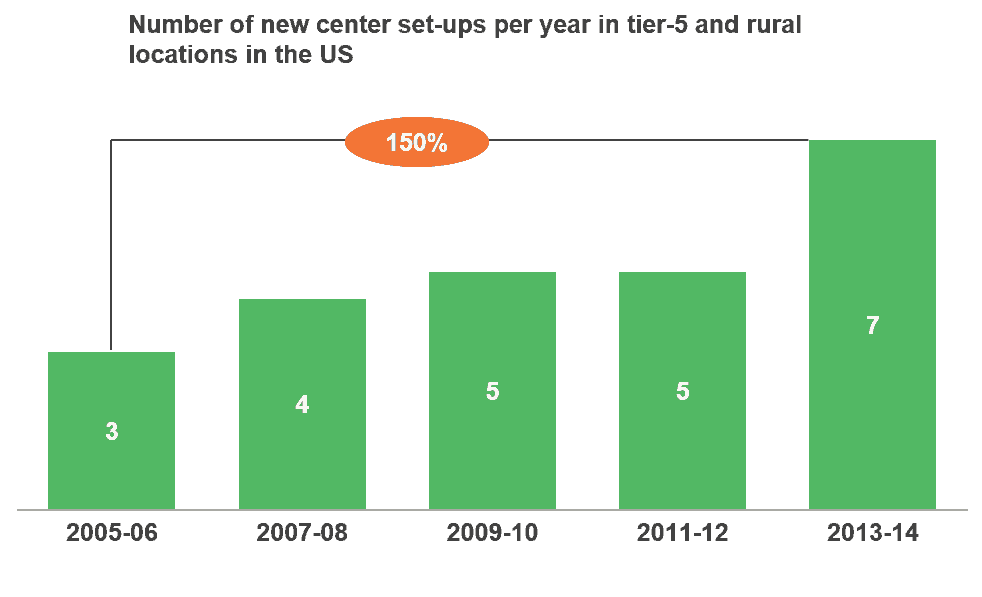

While onshoring in general has been on the rise, the leverage of tier-5 and rural locations has witnessed significant momentum. In the last decade, the number of new delivery center set ups in these locations has increased by ~150 percent, from an average of three centers per year in 2005-2006 to seven centers in 2013-2014.

At the same time, the share of tier-5 and rural locations in new U.S. delivery center set ups has gone up from ~19 percent in 2005-2006 to 25 percent in 2013-2014.

There are 100+ tier-5 and rural cities to choose from

More than a hundred tier-5 and rural locations are currently being leveraged by service providers for onshore service delivery. There are also a number of other potentially viable locales. Given the wide range of options these locations provide, they become an important consideration for players looking to establish a wider U.S. presence.

A large number of contact centers call these locations home

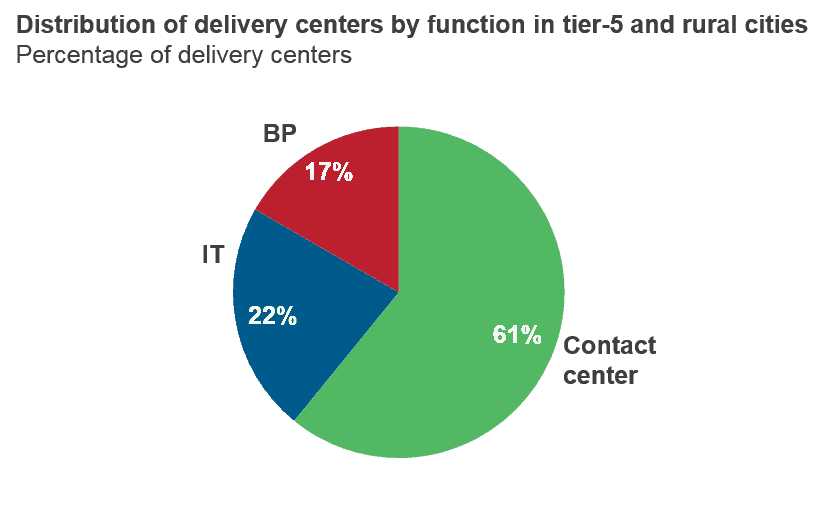

~61 percent of the existing centers in these locations deliver contact center services, as compared to 22 percent for IT services, and 17 percent for business process services. Leading multinational players such as Alorica, Convergys, Sitel, Sykes, Teleperformance, and Teletech leverage these locations for contact center service delivery.

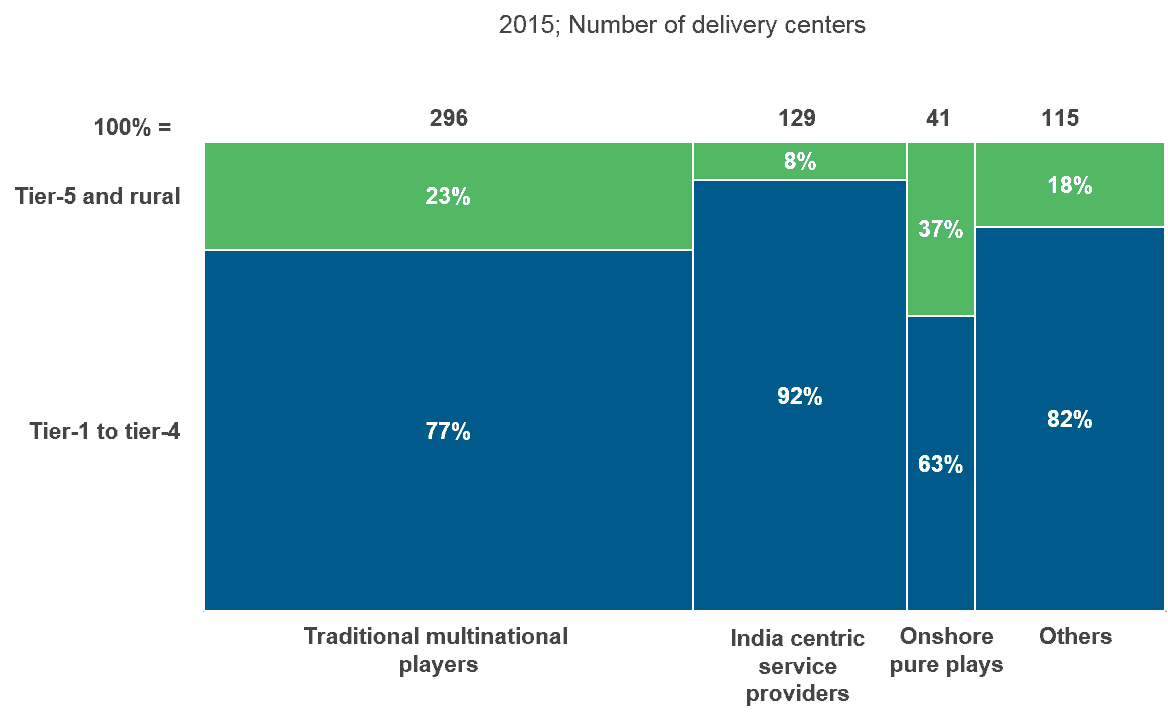

These locations play a meaningful role in the location portfolio for domestic pure-plays

The leverage of tier-5 and rural locations is highest for domestic pure-plays – e.g., CrossUSA, Eagle Creek Software Services, Onshore Outsourcing, and Rural Sourcing Inc. – which have ~37 percent of their delivery centers in these locations. On an overall basis, traditional MNC’s still dominate the market landscape as they have significantly large number of delivery centers in the United States as compared to other players.

The talent pool is sizeable enough to support 1-2 moderate sized delivery centers per location

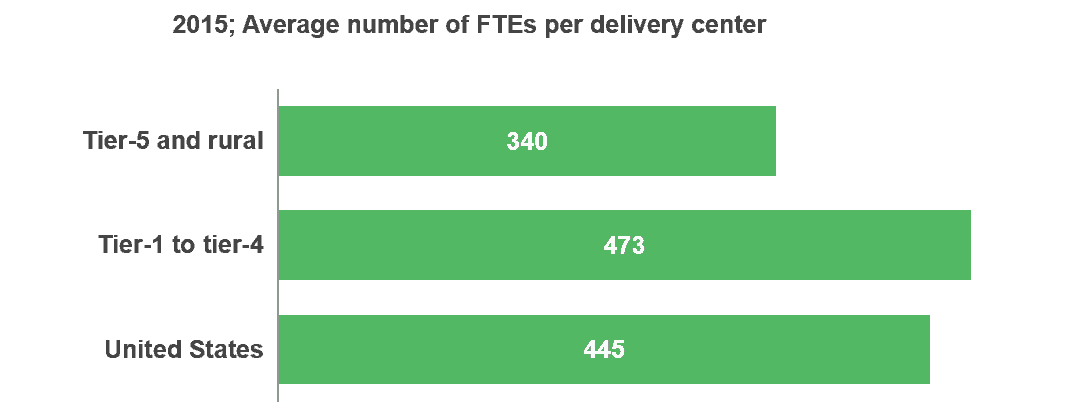

While talent availability in tier-5 and rural locations is generally lower than in tiers 1 to 4, they still offer a pool capable to support one or two moderate sized delivery centers. The typical delivery center size in these places is ~340 FTEs, as compared to a national average of ~445 FTEs. However, there is evidence of players achieving a scale of above 500 FTEs, especially for contact center services, where high school graduates are utilized.

As onshoring grows in the United States, leverage of tier-5 and rural locations will also grow. Service providers are establishing their presence in these locales due to their lower costs and lesser competitive intensity. Hence, there is a significant opportunity for economic development agencies in these locations to attract potential investors and create employment opportunities.

To download a full copy of our research on domestic delivery, please visit: https://research.everestgrp.com/Product/EGR-2015-2-R-1455/North-America-Domestic-Outsourcing-Services-Providers-Embrace-

For more Market Insights™ on this topic, please visit:

https://www.everestgrp.com/tag/domestic-sourcing

To download our presentation from the RevAmerica event, please visit: http://www.revamerica.com/program/

Photo credit: Wikipedia