Blog

The Changing Delivery Location Landscape of the UK Contact Center Market | Sherpas in Blue Shirts

To participants in and watchers of the UK contact center market, it’s obvious there are many changes afoot. These include the third-party service provider landscape, the nature of outsourcing deals, and the maturity of buyers.

One of the key changes Everest Group is seeing is in the locations UK buyers are leveraging for their contact center activities. Let’s examine the contributing elements.

Offshoring

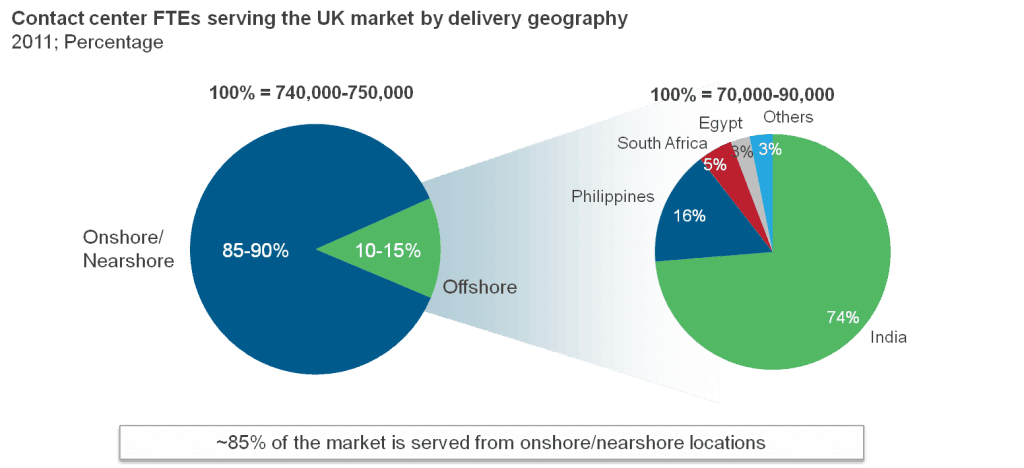

UK companies only offshore 10-15 percent of their contact center work, which in actual job numbers equates to 70,000 to 90,000. Consider this quantity in contrast to the U.S., which offshores greater than 25 percent/400,000 to 500,000 contact center jobs – a comparison we make given English as the common delivery language – and the fact that offshore locations offer 70-80 percent cost arbitrage advantage over locations in the UK There are two clear reasons for the limited share of contact center offshoring from the UK:

- Increasing buyer maturity often leads to increasing openness to move from outsourcing to offshoring. But as adoption of outsourcing in the UK has been relatively narrow due to comparatively lower buyer maturity levels, offshoring uptake has also been limited.

- UK buyers place heavy emphasis on cultural and accent similarity, and native English language speakers. Although the U.S. has comfort level with the Philippines as a key go-to destination for contact center delivery, the UK has not yet found its “Philippines.” Indeed, while India still has the majority of offshored UK contact center jobs, pure voice delivery has decreased over the years, with buyers increasingly leveraging the country’s capabilities for non-voice contact center services such as website, e-mail, and chat support.

However, the forward-looking view on offshore locations for the UK contact center market is much more promising. There is increasing acceptance of South Africa as a delivery location for voice-based and domain specific delivery (e.g., insurance), due to accent similarity and strong cultural affinity. Recent market activity, such as the Serco-Shop Direct deal, WNS’ acquisition of Fusion, and Capita’s purchase of Full Circle are indicators of this affinity. We expect India to continue its uptake of non-voice contact center services from the UK.

Onshoring/Nearshoring

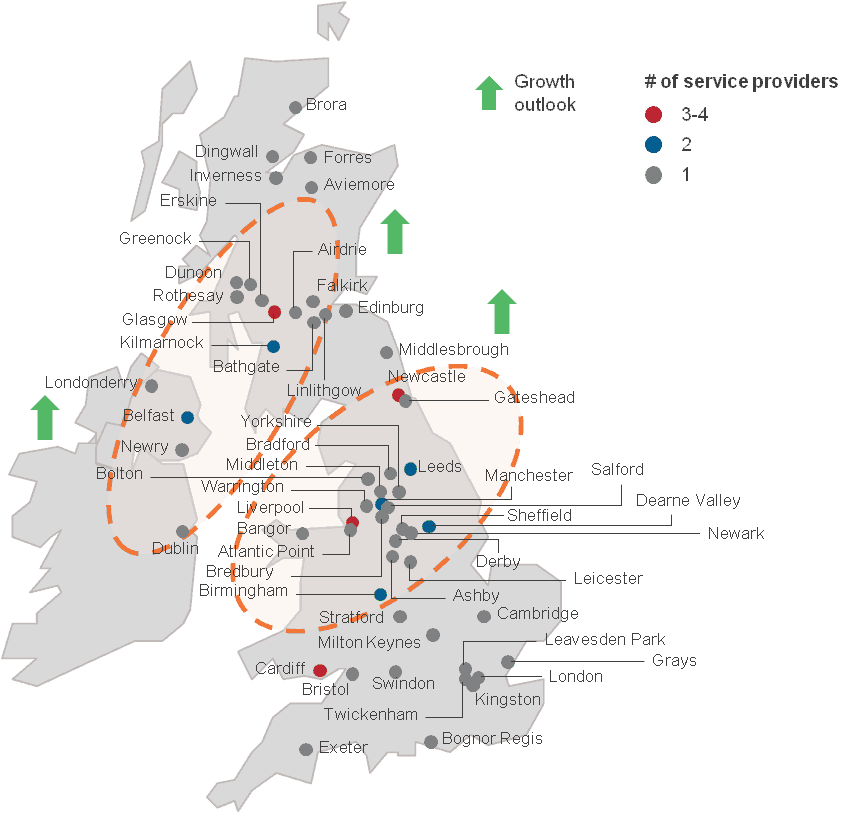

Contact center work within the UK is moving to low-cost locations in Northern England and to other areas such as Scotland and Northern Ireland. While there is still a higher concentration of contact centers in Southern England (the Greater Thames region), this is more of a legacy effect rather than the result of new or recent activity. The new/greenfield activity is largely moving contact center work up north to Liverpool, Leeds, Manchester, and Newcastle-Gateshead in England, Glasgow, Edinburgh, and Kilmarnock in Scotland, and Belfast and Londonderry in Northern Ireland, driven by:

- Lower operating cost

- Salary: Locations in Northern England (e.g., Liverpool) offer 5-10 percent savings over established locations in Southern England (e.g., Twickenham), and locations in Scotland and Northern Ireland (e.g., Glasgow and Belfast) offer 10-15 percent savings

- Real estate cost: Real estate rentals in the northeast (e.g., Newcastle) and northwest (e.g., Liverpool) are 10 percent lower than in the south of England (e.g., Twickenham); and rentals in Northern Ireland are 30-50 percent lower than locations in England

- Sizeable agent pool: Birmingham and Leeds, for example, have considerable talent pools (40,000-70,000 experienced contact center agents)

- Lower attrition and unemployment: Established locations (e.g., south of England) have higher contact center attrition and unemployment rates relative to other regions in the UK, thus influencing movement to areas north of England

- Government incentives: Most less-established locations in the UK offer multiple incentives programs, such as employment and training grants, for contact centers. This makes their value proposition competitive, especially for greenfield operations. For example, Northern Ireland provides a one-time incentive of GBP 3,000-7,000 per job created in this sector

UK Locations leveraged by leading service providers

Everest Group believes that while onshore/nearshore delivery of UK contact center services will continue to remain the predominant model over the next three to five years, offshoring will grow faster. Buyers’ comfort with the offshore model, particularly with alternatives to India, such as South Africa, for voice-based services is likely to increase. Cost pressures are liable to propel buyers to adopt offshoring and other low-cost delivery alternatives, such as less expensive locations within the UK Finally, the market movement toward multi-channel contact center delivery capabilities, resulting in higher usage of web, chat, and e-mail customer support, will further support the growth of offshore delivery.