Rising customer expectations, pressure to reduce service costs, and the need for faster product iteration are reshaping how insurers orchestrate experiences across acquisition, onboarding, servicing, and claims. As carriers modernize front ends alongside legacy cores, cloud-native CX orchestration platforms (combining omnichannel portals, journey analytics, and compliant communications) have become central to digital-first operating models. Adoption is accelerating for API-centric architectures, low-/no-code tooling, and AI / agentic AI embedded in decisioning and next best action, enabling guided sales, secure first notice of loss, and proactive retention across agent, broker, and policyholder channels.

To support these outcomes, Customer Experience Orchestration Product (CXOP) providers are delivering SaaS ecosystems with packaged industry accelerators, open integration to core PAS/claims/billing, and real-time data unification via customer and interaction profiles. Emerging offerings emphasize modular deployment, configurable portals (producer and policyholder), secure messaging, and event-driven communications with audit trails. Simultaneously, carriers are expanding beyond point solutions, linking CCaaS, marketing systems, and data clouds, while strengthening privacy, security, and accessibility to meet regulatory expectations.

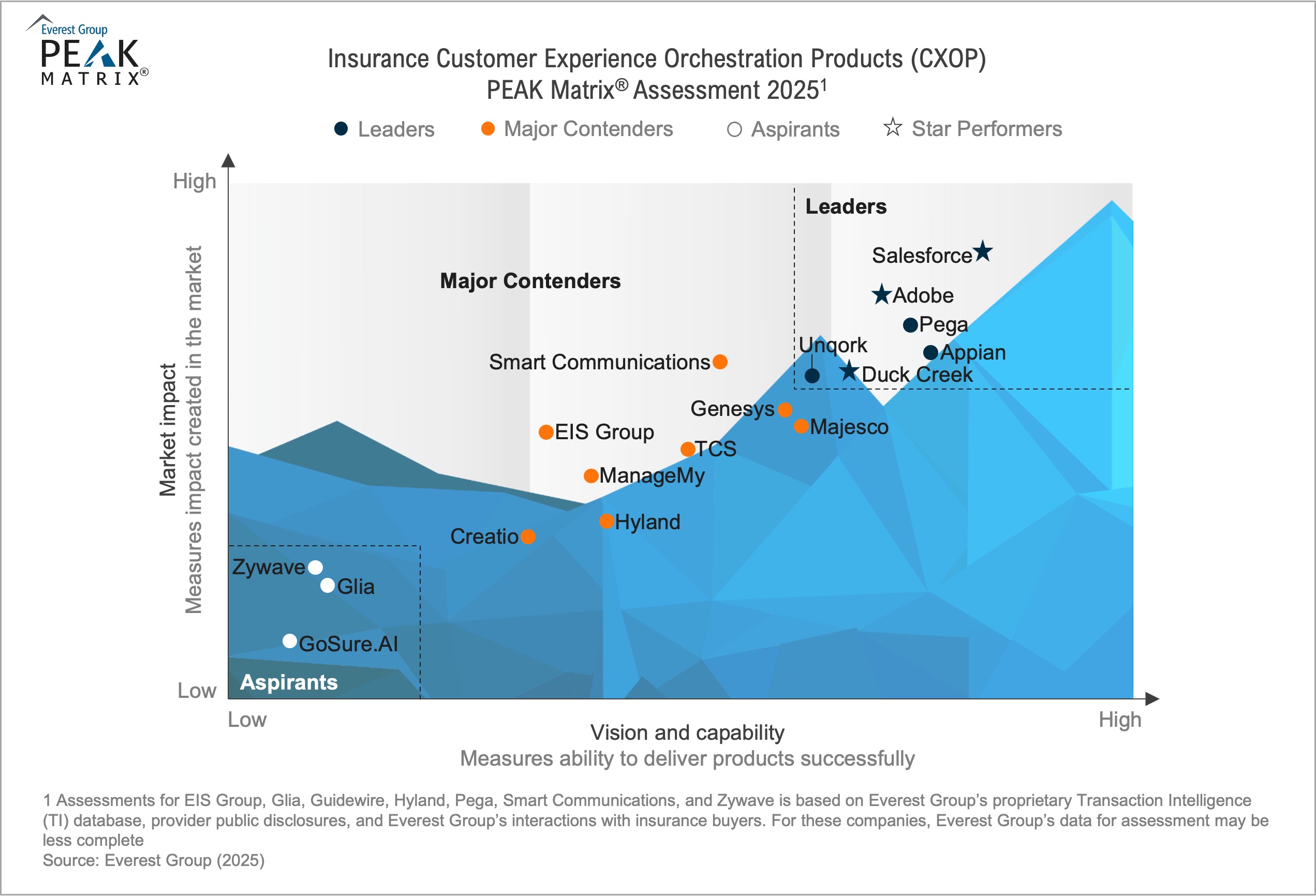

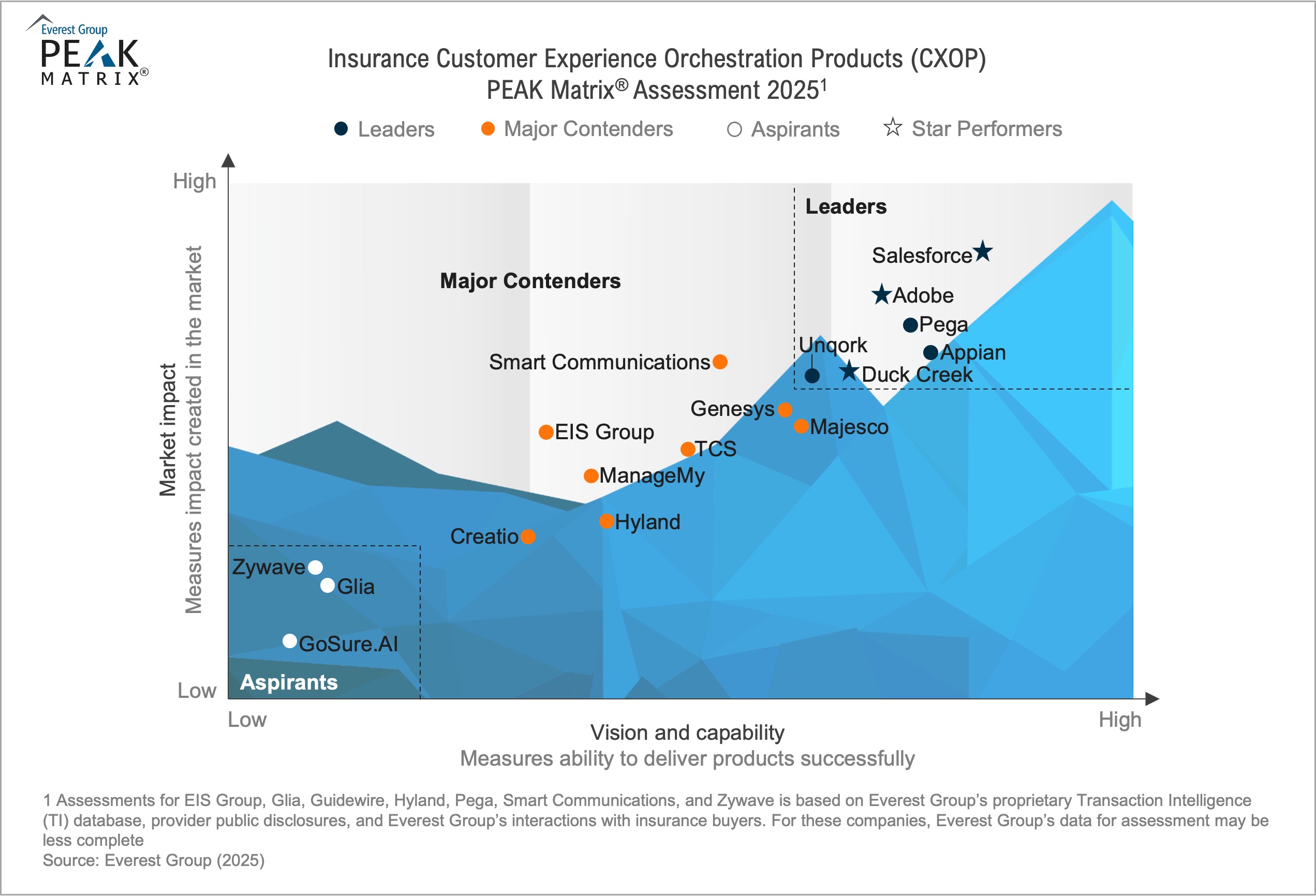

This report comprehensively assesses 17 leading CXOP providers featured on Everest Group’s Insurance CXOP PEAK Matrix® Assessment 2025. Based on our annual RFI process, client feedback, and ongoing market research, it evaluates leading providers’ capabilities in enabling end-to-end journey orchestration, scale cloud architectures, operationalize AI / agentic AI, and deliver measurable business impact through configurable, analytics enabled platforms. The assessment focuses on their abilities to deliver scalable cloud architectures, AI-powered solutions, stakeholder experience initiatives, and seamless integration across the insurance technology ecosystem.