The Payments IT services market is undergoing a significant transformation. For years, enterprises focused on compliance, scheme-specific upgrades, and incremental improvements to legacy platforms. That approach is no longer sufficient. Rising transaction volumes, real-time expectations, interoperability mandates, and data-rich standards such as ISO 20022 are increasing both technical and operational complexities. Simultaneously, global momentum around instant payments, digital assets, and cross-border corridors is placing new demands on scalability, resilience, and ecosystem integration.

Enterprises are responding with modernization programs that replace legacy processors, consolidate multi-rail infrastructures, adopt cloud-native payment hubs, and build stronger data foundations. ISO 20022 is acting as both a compliance requirement and a catalyst to unlock value from structured payments data. In parallel, fraud, sanctions, and financial crime controls are being reassessed, as real-time and cross-border flows introduce new risk vectors that require intelligence-driven defenses.

AI is emerging as a key transformation enabler. Enterprises are deploying generative and agentic AI to accelerate development, automate testing and certification, enhance message validation and reconciliation, and improve monitoring and risk decisioning. While adoption is measured and governed, early implementations are driving tangible gains in productivity, quality, and responsiveness. Providers are expected to bring responsible AI frameworks, explainability, and domain-safe controls aligned with regulatory expectations.

These shifts are changing what enterprises expect from their IT partners. Organizations are consolidating providers and prioritizing those that can support end-to-end transformation, from architecture and advisory to implementation and managed services. Buyers are looking for engineering depth, payments domain expertise, modernization toolkits, and experience navigating multi-market regulatory environments. A provider’s ability to collaborate across ecosystems – hyperscalers, payment networks, payment service providers, FinTechs, and platform vendors, is becoming a key differentiator.

Sourcing models are evolving as well. Enterprises are seeking pricing models tied to measurable outcomes such as time-to-market, straight-through processing, resilience, and efficiency. Providers are being asked to co-innovate, take greater accountability, and deliver modular, automation-enabled solutions that reduce friction and accelerate modernization.

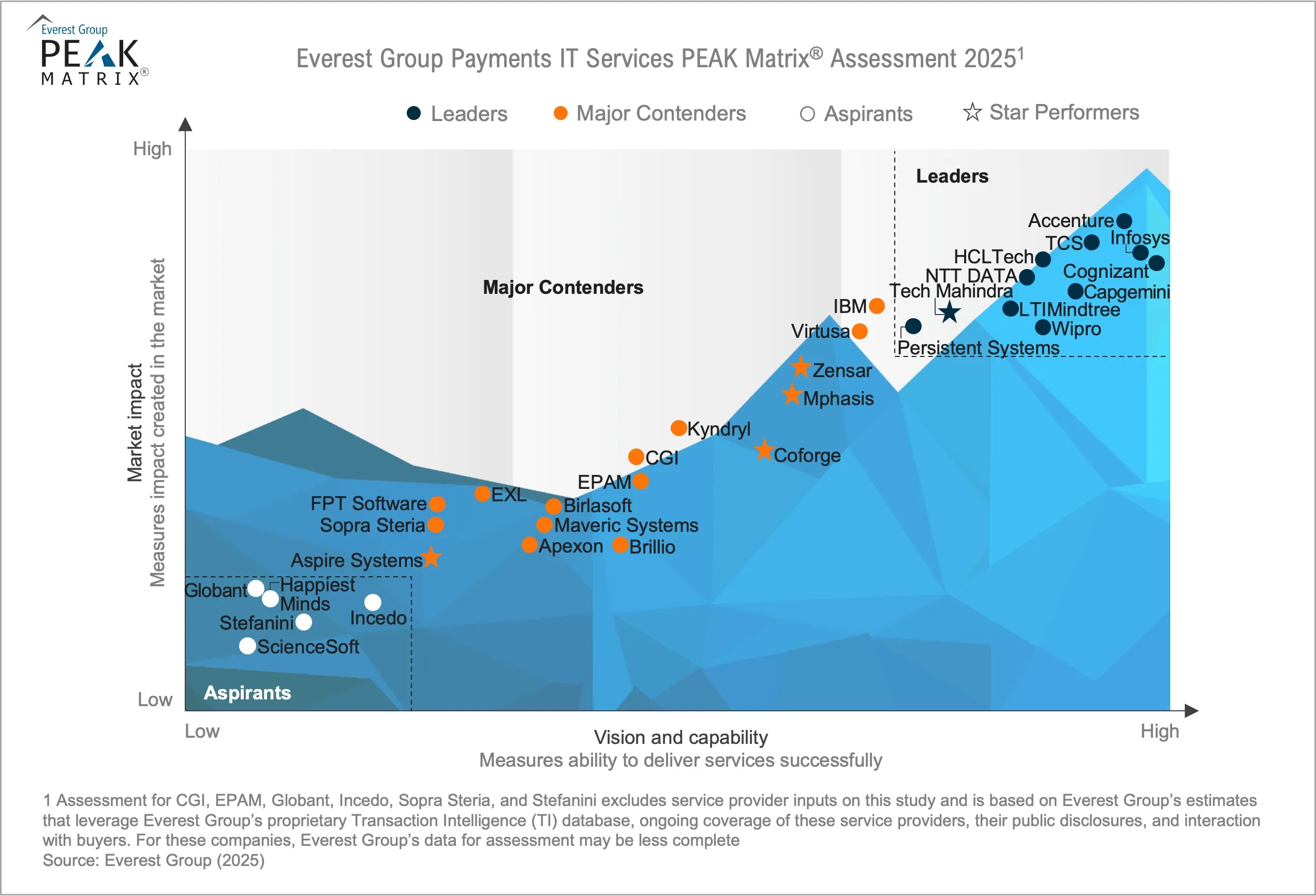

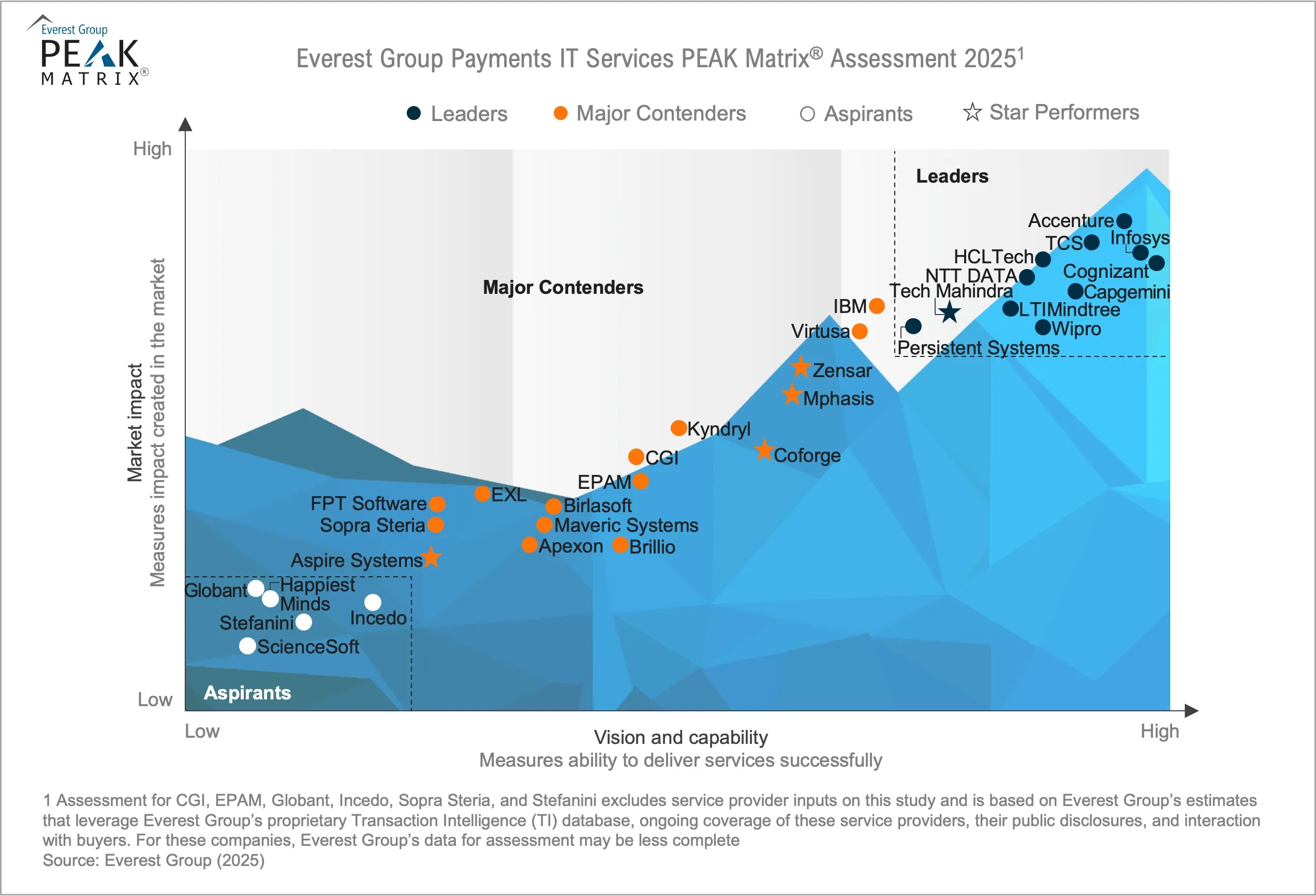

This PEAK Matrix® assessment evaluates 32 IT service providers on their vision, capabilities, and market impact in the global payments IT services landscape. It highlights which firms are best positioned to help enterprises navigate rising complexities, adopt responsible AI, and build future-ready, scalable payment architectures that support the next generation of real-time, data-rich, and interoperable payment ecosystems.