The payments Business Process Services (BPS) landscape is entering a transformative growth phase as enterprises reimagine payments as a strategic enabler rather than a cost center. The proliferation of real-time payment rails, cross-border flows, and digital currencies is creating unprecedented complexities in processing, compliance, and reconciliation, compelling organizations to seek domain-led, technology-enabled outsourcing partners. Across the ecosystem, banks, payment networks, PayTechs, and processors are recalibrating their operating models to balance speed, scalability, and regulatory rigor.

Providers are scaling horizontally and vertically – combining operations, technology, and advisory capabilities to deliver integrated solutions that move beyond efficiency toward growth and value realization. The rapid infusion of AI and automation is redefining traditional processes such as fraud management, dispute resolution, and exception handling into near real-time, self-healing workflows. Meanwhile, intensifying regulatory mandates such as ISO 20022, PSD3, PCI DSS, and the advent of central bank digital currencies and tokenized assets are reshaping compliance frameworks, driving demand for interoperable and auditable payment operations.

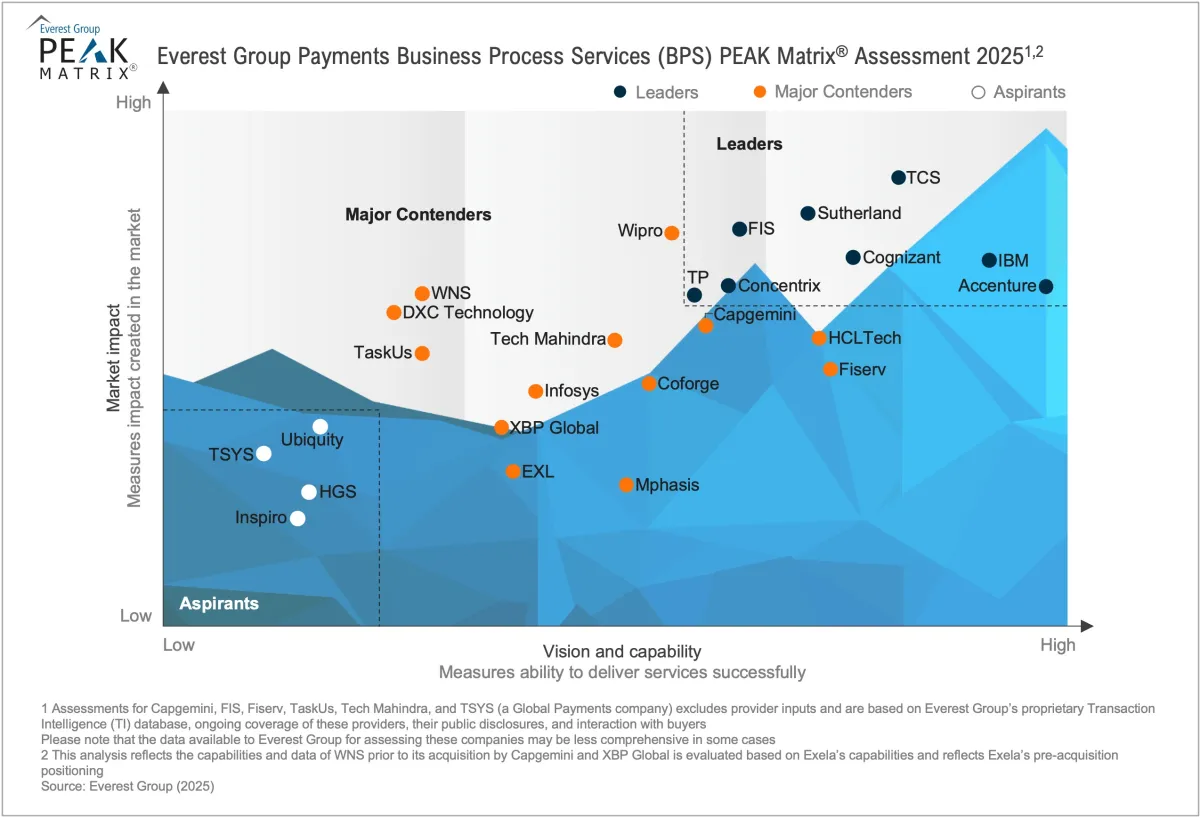

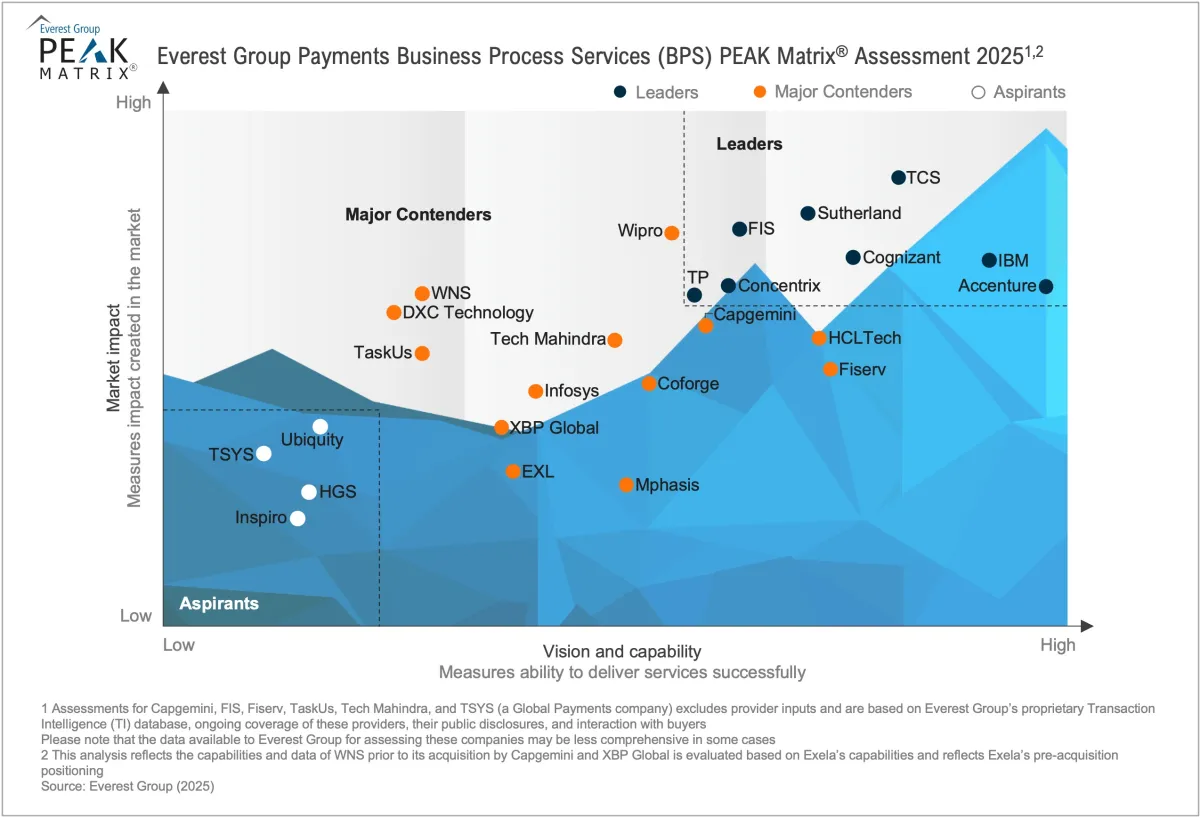

This research compares provider strategies, market performance, and delivery capabilities across the payments back-office operations value chain.