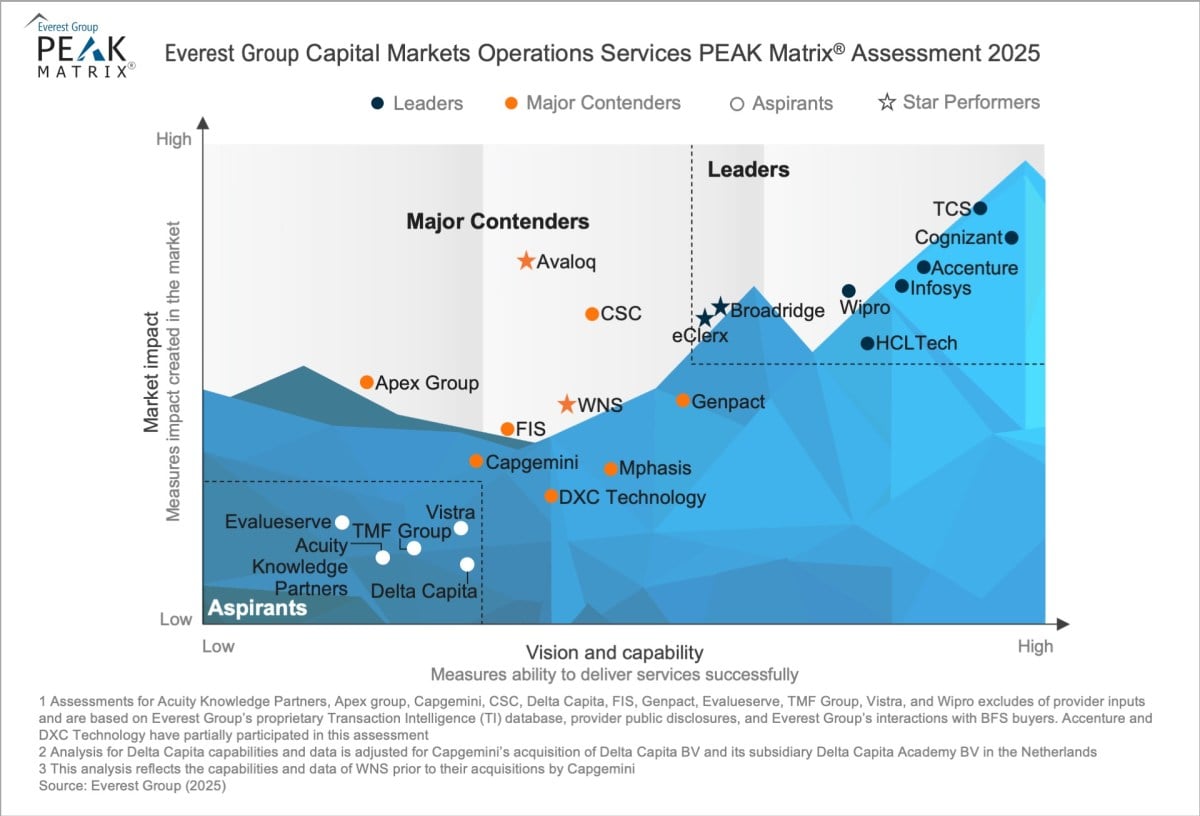

Capital Markets Operations Services PEAK Matrix® Assessment 2025

The global capital markets operations landscape is rapidly advancing as institutions seek to serve a fast-growing pool of wealth, pension, and alternative asset investors while maintaining margin pressure and heightened regulatory scrutiny. Demand from asset and wealth managers and private credit firms is surging fast, driving the need for scalable back-office operations and enhanced client experiences. Market-infrastructure entities now seek partners for domain-rich support across data and pre-trade research, accelerating the shift toward outsourced operating models. Enterprises are strengthening operational resilience through cloud-native platform modernization, modular BPaaS constructs, and digital risk frameworks. Flexible BPaaS and SaaS services that can be deployed in public, private, or hybrid cloud environments are becoming the preferred route to achieve these agendas. Providers are scaling their capabilities across the trade life cycle with an advisory-led stance and significant investment in next-generation technologies. Generative AI and agent-based automation are now embedded in exception management, email routing, research generation, and corporate-action workflows, driving measurable time savings and improved control. Predictive and prescriptive analytics, tokenized-asset servicing, and distributed-ledger solutions are moving from pilots to scaled delivery. ESG profiling and compliance support for regimes, such as MiFID, EMIR, FATCA, and new ESG mandates, have become integral to transformation programs.

This report is available to members.