Life Sciences ITS Membership

Make more confident decisions in the fast-moving life sciences IT market

Get always-on access to Everest Group’s life sciences IT services research, data, and expert perspectives so you can clarify options, weigh tradeoffs, and act with conviction

Your life sciences ITS advantage

With the Life Sciences ITS membership, you gain access to on-demand insights, access to analysts, and access to future market trends – guided expertise to support your key challenges and published resources to shape strategic thinking.

-

Who it’s for

Who it’s for

- Life sciences IT service providers seeking contextual, industry-specific, fact-driven research and decision support

- Teams that want a flexible engagement model with analyst inquiries, executive connections, and strategic briefings to solve provider-focused challenges

-

What you get

What you get

- On-demand analyst support that delivers real-time insights for confident decisions

- Dedicated support through expert analyst inquiries

- Actionable insights via executive connections

- Structured interactions that fit your cadence, from focused sessions, executive connections, executive briefings, benchmarks, inquiries, speaking engagements, PEAK Matrix® debrief sessions, and State of the Market briefing sessions

-

Outcomes members achieve

Outcomes members achieve

- Give you confidence in the decisions your organization makes by learning how peers have navigated similar situations

- Gain strategic insights from senior leaders on how top firms are adapting to evolving industry and market conditions

- Combine analyst inquiries and executive connections to get contextualized data and insights to refine and build strategy for targeting the market space

Areas of coverage

-

Life sciences IT services landscape

Cloud and infrastructure services (CIS), application services (AS), digital services (DS), data and analytics services (D&A), and enterprise platform services (EPS).

-

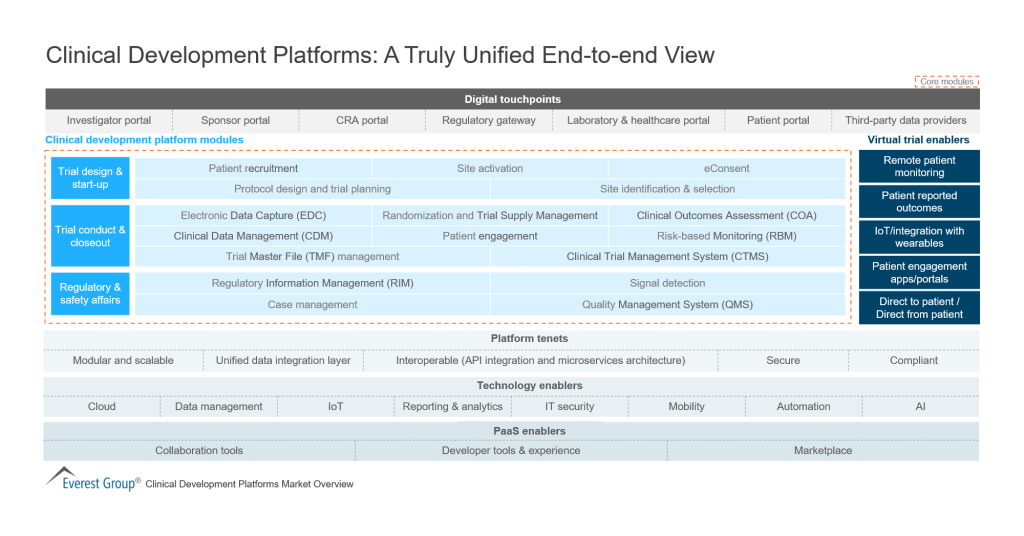

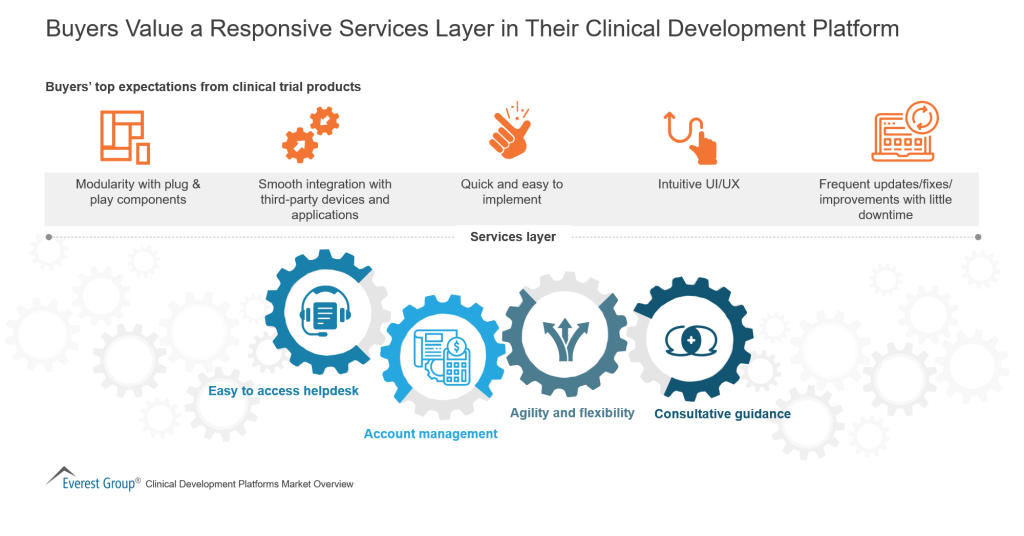

Platforms and point solutions

Enterprise platforms such as ERP, SCM, CRM, commercial and connected health platforms, plus point solutions across clinical, pharmacovigilance, regulatory compliance, clinical trial management, customer reference data, and sales force effectiveness.

-

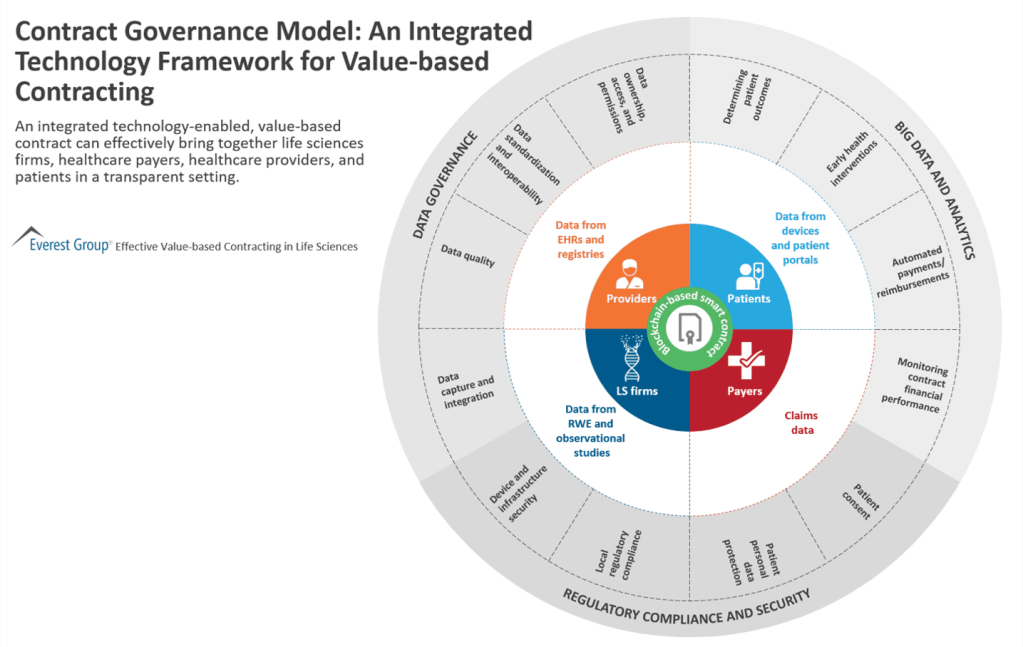

Data and analytics

Enterprise data management, advanced analytics, reporting and dashboarding, use-case-based analytics, data governance, and data privacy and security.

-

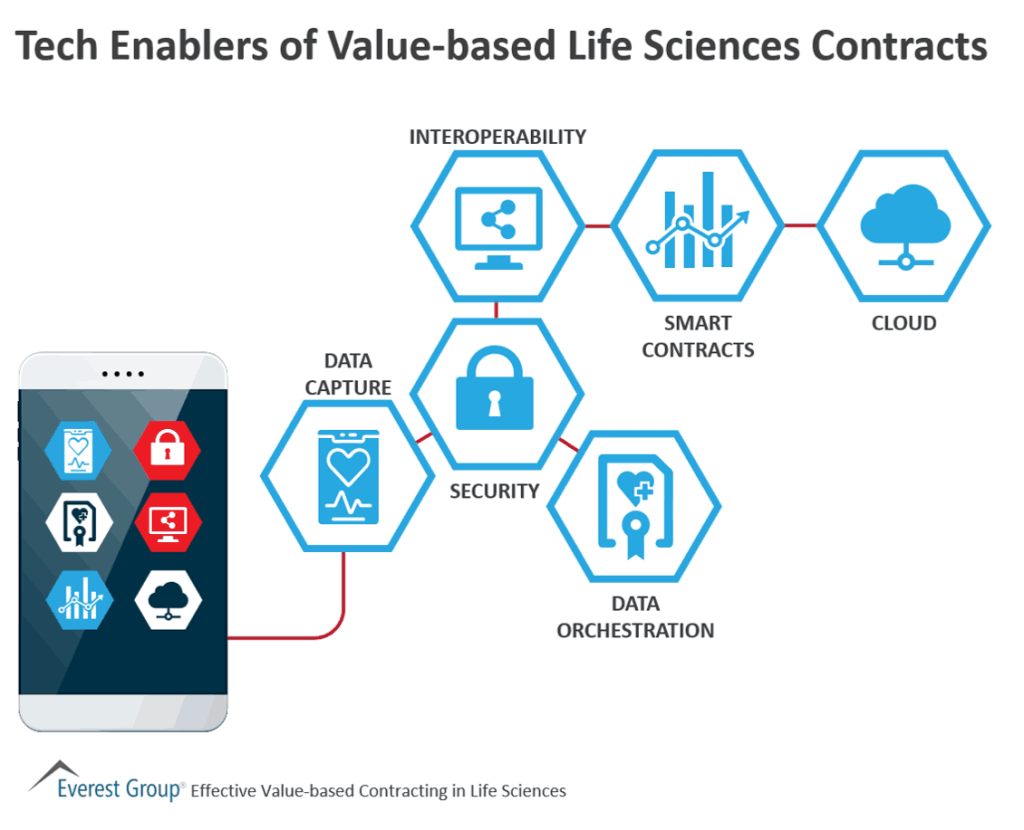

Themes shaping the market

Connected medical devices, AI-driven drug discovery, generative AI, agentic AI, real-time customer insights, hybrid commercial models, supply chain visibility, smart manufacturing, evolving GCC landscape, and the Veeva–Salesforce divorce.

Recent reports

Our latest thinking