Blog

The evolution of BPS: Why payer operations are becoming intelligent by design | Blog

The US healthcare landscape is grappling with rising costs, regulatory pressure, and eroding trust. Major payers such as UnitedHealth Group, Elevance, Humana, and CVS Health are reporting medical loss ratios (MLRs) near 88-90%, squeezing margins and limiting room for innovation. UnitedHealth’s cyberattack earlier last year exposed how vulnerable payer operations remain, crippling claims processing and compromising sensitive data for millions.

Member experience continues to lag; many payers still struggle to deliver digital-first, self-service experiences and hyper-personalized, high-quality interactions. Fragmented engagement channels lead to long average handle times, low first-call resolution, and inconsistent communication. These challenges, compounded by legacy systems, manual workflows, and poor integration across vendors make it difficult for payers to scale meaningful engagement.

Add to this a sharp rise in data breaches (up 256%) and ransomware attacks (up 264% since 2018) and the ongoing regulatory headwinds, such as the One Big Beautiful Bill’s push toward a sweeping US $1 trillion cut to Medicaid, and the Centers for Medicare & Medicaid Services (CMS) interoperability and prior-authorization rules and a host of other regulations are stacking more requirements on top of already strained operations.

Reach out to discuss this topic in depth.

On the flip side, the rise of generative AI (gen AI) and agentic Artificial Intelligence (AI) offers new ways to redesign operations, but few payers have yet cracked the code on how to apply it at scale without disrupting service or risking compliance.

Amid these financial, operational, and regulatory headwinds, payers are realizing that incremental fixes won’t be enough. The focus is shifting from labor-intensive processes to AI-enabled, intelligence-driven operations that blend automation, analytics, and clinical expertise. By embedding AI, gen AI and agentic AI into the core of their workflows, payers aim to make operations more autonomous, adaptive, and proactive, reducing manual work while improving compliance, speed, and member experience. For example, UnitedHealthcare is developing an agentic AI solution to automatically triage routine approvals and escalate the complex ones; and CVS Health recently piloted AI agents focused on medication adherence and personalized care planning.

Everest Group sees intelligent operations in the healthcare context as an operating model with an enhanced focus on new gen/intelligent tech capabilities “intelligent” includes generative and agentic AI enabling more autonomous, adaptive, and proactive operations. This model not only transforms how work is delivered but also how it is valued and priced, with outcomes increasingly replacing traditional Full Time Equivalent (FTE)-linked structures.

However, technology only amplifies impact, domain expertise remains the control system. Medical-necessity judgment, benefits interpretation, coding nuance, and regulatory context still sit with clinicians and seasoned operations leaders. The way it should work is that AI proposes; domain judgment decides. Intelligent operations works only when domain expertise, governance committees, and continuous upskilling anchor the tech. In short, domain isn’t going away, it’s what makes automation safe, compliant, and relevant. How intelligent operations are redefining payer services

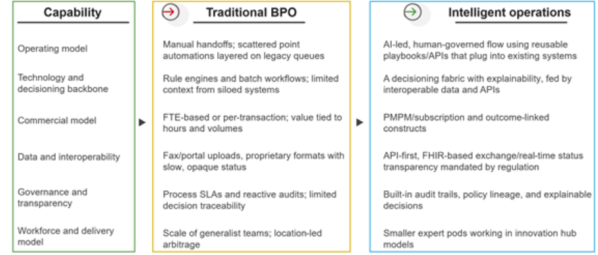

Exhibit 1: Evolution from a traditional Business Process Outsourcing (BPO) model to intelligent operations

Intelligent operations require more than automation or analytics; it demands a redesigned foundation. The following building blocks outline how technology, data, and human expertise come together to create operations that are transparent, compliant, adaptive, and continuously improving. These pillars form the operating fabric that turns AI-driven intent into measurable impact.

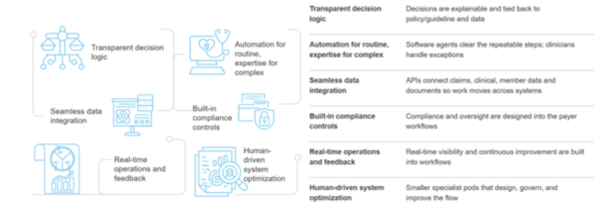

Exhibit 2 below highlights the essential building blocks of intelligent operations

Exhibit 2: Key building blocks of intelligent operations

- Transparent decision logic: Blends rules, Machine Learning (ML), and retrieval so the system can cite which guideline/policy was applied and why a path was chosen, while keeping Human-in-the-Loop (HITL) for judgments. Emphasis is on responsible AI, explicit guardrails, and HITL validation on judgment-heavy cases, so decisions are faster and auditable

- Automation for routine, expertise for complex: Orchestrated “agent stacks” that navigate legacy systems, assemble evidence, and propose actions, with clinicians approving edge cases. This “machine proposes, expert disposes” pattern reduces handoffs without losing clinical governance

- Seamless data integration: Application Programming Interface (API)-first + clean data layers let agents pull guidelines, eligibility, and case context. Pre-integrated cores and rich APIs make these flows snap into existing payer stacks

- Built-in compliance control: Compliance and audit oversight are embedded directly into workflows, with proactive checks such as bias testing, security validation, and HITL checkpoints ensuring every decision meets regulatory standards

- Real-time operations and feedback: Workflow systems show real-time queues, outliers, and exceptions. Issues feed back into continuous updates, so prompts, rules, and models improve week by week and near-real-time dashboards make this visible to operations, clinical, and compliance teams

- Human-driven system optimization: Smaller specialist teams (clinical reviewers, data stewards, AI/operations engineers) aligned to specific processes. Focus on joint labs and ongoing training programs to upskill teams and co-design improvements

The new commercial logic: pricing and contracts

As payers move to intelligent operations, deals are shifting from buying hours to buying productized capability and accountable outcomes. For smaller plans, the need is modular solutions with flexible, lower-risk terms, while national plans lean into deeper platformization with shared-risk constructs. With pricing models, there are several gaining prominence with intelligent operations:

- PMPM/subscription: Platform-enabled operations are increasingly priced per member per month, bundling technology, delivery, and oversight into a single construct. This approach started in administrative functions such as claims or enrollment but is expected to extend into adjacent areas like care management and quality programs as platforms become more connected and clinically aware

- Outcome-based models: Contracts now often include an outcome component layered on top of a base subscription or transaction fee. Payments are tied to throughput, accuracy, or quality improvements, reflecting the ability of intelligent operations to track and attribute results transparently. As explainability and audit readiness mature, these models are expected to expand into more complex measures such as cost avoidance and Stars performance

- Hybrid pricing models: While less common, hybrid pricing structures blend a fixed-fee component with an outcome-linked share, aligning baseline service costs with performance-based incentives. This aligns incentives with automation impact, payers get value for improvement, providers are rewarded for innovation rather than hours

The evolution of traditional BPO isn’t about abandoning operations, it’s about re-architecting them. Intelligent payer operations bring together technology, data, and human expertise in a more accountable, explainable, and outcomes-driven model. Pricing is evolving to reflect this new value equation, where subscriptions, Internet Protocol (IP), and shared outcomes replace hourly effort.

For payers, the shift means buying capabilities that learn and adapt rather than static labor blocks. For service providers, it means proving impact, not just efficiency. Over the next decade, competitive advantage will rest with those who can blend automation, clinical judgment, and transparent economics into one intelligent operating fabric.

As the payer landscape continues its shift toward intelligent operations, Everest Group is deepening its own research coverage to track and benchmark this evolution. For more, visit our Intelligent payer operations research coverage https://www.everestgrp.com/research-agenda/

If you found this blog interesting, check out Healthcare Outsourcing In 2025: Mergers, Momentum, And Make-or-Break Moves | Blog – Everest Group, which delves deeper into the healthcare sector.

If you have any questions or want to discuss the ever-evolving healthcare sector in more depth, please contact Sabyasachi Bhattacharjee ([email protected]) and Vivek Kumar ([email protected]).