Blog

Agentic payments: Reinventing payments for the AI era

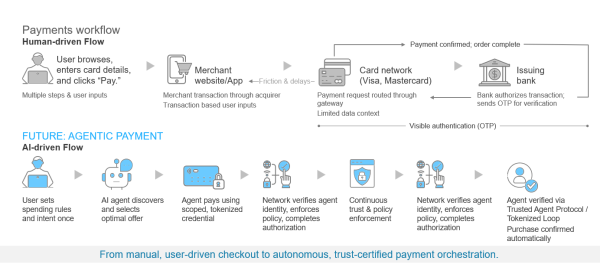

Agentic payments, transactions initiated and completed by intelligent agents under user-defined rules, mark a shift from manual authorization to policy-driven, machine-to-machine execution. As AI becomes embedded across consumer, merchant, and enterprise ecosystems, every payment will need to be verifiable, tokenized, and governed in real time.

For banks and card networks such as Visa and Mastercard, this isn’t a future scenario, it’s a present strategic imperative. The control plane of payments is shifting upstream, from “click to pay” to “configure and let act.” Whoever owns the trust, consent, and orchestration layer of this new world will own the future of payments.

Reach out to discuss this topic in depth.

The next frontier: from open loops to intelligent and closed systems

Traditional payments evolved in an open-loop environment, where fragmented participants connected by shared protocols and reconciled transactions after the fact. But agentic flows require low-latency, closed-loop coordination.

In a closed-loop system, the issuer, acquirer, and network share a common trust layer that ensures identity, consent, and compliance are enforced automatically. The need isn’t just speed; it’s trust at machine scale:

- Each AI agent must carry a digital identity certificate, cryptographically linked to its user

- Each transaction must use a scoped token (defining amount, merchant category, and validity)

- Each network hop must enforce policy and consent metadata so disputes can be resolved deterministically and compliance guardrails for fraud and Anti Money Laundering (AML) are enforced

Visa’s Trusted Agent Protocol (TAP) and Mastercard’s Agent Pay frameworks are first-generation efforts to formalize this trust fabric. Both aim to make agent-initiated payments as secure and auditable as human ones. When combined with closed-loop systems, where identity, policy, and settlement are unified, the result is a self-reconciling, continuously governed payments ecosystem. This is where the wave of reinvention begins.

Reimagining payment workflows: eliminating human friction

Today’s payment journey involves multiple user interventions such as search, checkout, authentication, and confirmation. Each adds latency and abandonment risk. Agentic payments compress this journey into three invisible steps:

- Intent capture: the user defines spending rules or authorizes categories once

- Agentic execution: Agents discover, negotiate, and execute within those rules using scoped tokens

- Autonomous settlement: the network validates agent identity, applies fraud policy, logs rich metadata, and completes authorization, all in the background

What changes isn’t just the interface, it’s the nature of trust. Instead of verifying the consumer each time, networks will verify the agent’s right to act. Instead of one-off approvals, standing policies will define when and how funds move.

Additionally, agentic payments will go beyond checkout process and revolutionize areas such as B2B treasury management, where agents can autonomously manage working capital, choose optimal payment rails (card, real-time payments, cross-border foreign exchange) based on real-time cost analysis, and execute supplier payments under complex corporate policy rules. In procurement, an agent can negotiate and pay for cloud services or physical goods without human intervention, leading to significant efficiency gains across enterprise finance.

Exhibit 1 highlights this change: on the left, today’s human-driven checkout with multiple screens, acquirer hops, and user inputs; on the right, tomorrow’s agentic flow where an AI agent securely transacts through a tokenized, trust-certified loop where the user only sets parameters.

Business model reinvention: from fee-per-transaction to trust-as-a-service

Agentic payments don’t simply digitize the old model, they reconfigure economics. Card networks and banks will still earn from transaction fees, but new value pools emerge at the intersection of trust verification, orchestration, and data context.

- Trust services: Every agentic transaction requires verification of who acted, under what policy, and within what limits. Networks can charge metered micro-fees for identity verification, policy evaluation, and consent audit logs. Even a few cents per transaction at scale can translate into hundreds of millions annually.

- Context and data services: When AI agents act on behalf of users, contextual data, Stock Keeping Unit (SKU)-level detail, merchant identifiers, and offer IDs, becomes critical for dispute resolution and personalization. Banks and networks that can attach and monetize this context will transform payments from opaque back-end plumbing into insightful, value-rich infrastructure.

- Embedded finance monetization: With agents driving continuously, low-value, high-frequency flows, credit, insurance, and Foreign Exchange (FX) can embed dynamically at the point of transaction. For example, a treasury agent can auto-select the cheapest rail or activate just-in-time liquidity, creating new fee-bearing events beyond interchange.

With just agentic commerce to drive almost US$3 trillion in global Gross Merchandise Value (GMV) within five years, and one-third flows through card rails, trust and data services priced at an average of 0.03% could unlock US$200-300 million in incremental annual revenues for networks and issuers alike. Over time, this will expand as multi-rail orchestration fees replace static swipe-based pricing.

The ecosystem dynamic: collaboration over competition

Agentic payments can’t scale in isolation. They demand shared incentives across banks, networks, merchants, FinTechs, and hyperscalers. The new ecosystem must align with both economics and governance:

- Networks provide the trust substrate, agent identity registries, token issuance, and compliance frameworks

- Banks and issuers provide account connectivity, policy governance, and real-time fraud detection.

- Hyperscalers and AI platforms host agent frameworks and model governance layers.

- Merchants and Payment Service Providers (PSPs) ensure agent-friendly catalogs, agent-to-agent Application Programming Interfaces (APIs), and metadata visibility.

- System integrators modernize legacy payment stacks to support agent-ready workflows.

Creating incentives for win-win collaboration is essential for scale. Data reciprocity can form the foundation, where merchants gain richer attribution and banks and networks gain transaction context for risk analytics.

Shared savings from automated dispute resolution and reduced fraud can be redistributed through lower fees or loyalty bonuses. Co-owned innovation funds across banks, PSPs, and hyperscalers can accelerate open verification standards, while revenue-sharing models distribute trust-service fees to issuers and AI partners that uphold network integrity.

The result is an ecosystem that rewards cooperation over dis-intermediation, ensuring every participant benefits from higher security, lower cost, and richer intelligence.

Where agentic payments will struggle

The path forward is promising but not frictionless. Several structural and behavioral barriers could slow adoption if left unaddressed.

- Regulatory ambiguity: Regulators have yet to define liability when an AI agent makes an unauthorized or erroneous payment. Who bears responsibility, the user, the bank, or the agent platform? Until this is codified, banks will hesitate to scale fully autonomous flows

- Data privacy and consent complexity: Continuous agent monitoring requires large-scale data sharing across entities. Balancing personalization, compliance (General Data Protection Regulation (GDPR), AML, California Consumer Privacy Act (CCPA)), and user trust will be complex.

- Interoperability gaps: Competing token standards and agent frameworks risk fragmenting the ecosystem, similar to the early days of digital wallets. Without common protocols, interoperability across banks and networks may falter

Overcoming these challenges will determine whether agentic payments become an everyday reality or remain confined to niche digital-first ecosystems.

Strategic priorities for banks

Banks stand at the center of the agentic payments opportunity. To remain indispensable in an era where the “customer” may soon be a digital entity, banks must act now on four fronts:

- API-enablement: Expose account, balance, and credit products via secure APIs consumable by agents. Without this, the bank’s product is invisible to the new ecosystem

- Agent governance: Develop “Know Your Agent” frameworks parallel to Know Your Customer (KYC), certify agent credentials, define consent boundaries, and monitor anomalous agent activity

- Dynamic risk and fraud models: Move from static transaction scoring to continuous behavioral analytics that profile agents across time, not just individual transactions

- Loyalty and context integration: Encode rewards, benefits, and offers into agent rules so the AI automatically optimizes customer value, keeping the bank top-of-wallet even when the user isn’t choosing manually

For banks, partnerships with networks, processors, and FinTechs can deliver these capabilities “as a service.” Collaboration here is not optional, it’s the bridge between surviving and scaling in an AI-mediated market.

Closed loop and agentic: the future of reinvented payments

The next generation of payments will fuse closed-loop efficiency with agentic intelligence. Closed loops bring speed, visibility, and control; agentic systems bring autonomy, adaptability, and scale. Together, they redefine the payment network as a real-time, intelligent orchestration platform. This convergence will:

- Reduce latency through end-to-end visibility and pre-approved policy scopes

- Minimize fraud by anchoring every transaction to a verified agent identity

- Enable embedded decisioning, AI agents can choose rails, financing, or currencies dynamically

- Drive resilience through autonomous retries, exception handling, and continuous learning

For banks, this isn’t just about processing more transactions, it’s about becoming the policy and intelligence layer behind every transaction. For card networks, it’s about ensuring that every payment, whether on card, Real Time Payments (RTP), or digital token, still runs through their trust fabric.

Final thoughts: Building the new control plane for payments

Agentic payments represent more than a technological evolution, they signal the reinvention of payments as an intelligent, self-governing network. The control plane is shifting from human approval to machine-verifiable consent, from isolated systems to interoperable trust loops.

To stay ahead, banks must transform from processors to orchestrators, from static compliance to dynamic policy governance. Networks must evolve from carriers to trust enablers, embedding agent verification and consent into every flow.

The incentive is clear that those who move first will define the standards, control the trust, and capture the economics of the next payments era. The risk is equally clear that those who wait will process someone else’s agent’s transactions.

The future of payments isn’t about who owns the checkout, it’s about who owns the trust fabric of autonomous money movement and who has the conviction to build it now.

If you found this blog interesting, check out Google’s Agent Payments Protocol (AP2): A New Chapter In Agentic Commerce | Blog – Everest Group, which delves deeper into the ever-evolving landscape of agentic payments.

If you have any questions or want to discuss agentic payments in more depth, please contact Ronak Doshi ([email protected]) and Laqshay Gupta ([email protected]).