Blog

Tracing Digital Breadcrumbs: How Graph Neural Networks Are Reshaping Fraud Management

Financial fraud is becoming more complex and connected. Traditional rule-based systems and legacy machine learning models are increasingly unable to keep up. Today’s fraudsters operate across networks of accounts, devices, and identities, making it harder to spot malicious activity by looking at isolated transactions.

To respond, financial institutions are turning to Graph Neural Networks (GNNs), a new breed of artificial intelligence (AI) that helps trace hidden connections across customer behaviors and digital touchpoints.

This blog explores how GNNs are helping fraud teams move from reactive detection to proactive prevention, and what enterprise leaders should consider as they explore this powerful new approach.

Reach out to discuss this topic in depth.

Traditional tools are losing their edge

For years, fraud detection has relied on rules and conventional machine learning models that evaluate each transaction on its own. While these tools can catch known fraud types, they often miss subtle connections, like when a fraudster uses a familiar device under a new identity.

This siloed view leads to false positives, inefficient investigations, and blind spots when fraud patterns evolve. To keep up, financial institutions need tools that can recognize the bigger picture and connect the dots across their data.

GNNs bring a network view to fraud

Graph Neural Networks are designed to analyze data as a web of relationships. In this setup, nodes represent things like accounts, devices, or phone numbers, while edges represent how they are connected shared emails, Internet Protocol (IP) addresses, or transaction history.

GNNs go beyond static thresholds or simple pattern-matching. They bring in context, allowing institutions to understand not just what happened, but how it fits into a broader pattern of behavior.

What early adopters are seeing

Organizations that have started using GNNs are already seeing strong results:

-

- Wayfair used GNNs to catch promo abuse and account hopping, saving millions of dollars by improving fraud precision

- AWS helped a large online marketplace use GNNs to uncover 10 times more fraudulent accounts than its previous models

- NVIDIA reported up to a 40 percent improvement in fraud detection accuracy when it combined GNNs with traditional models

- Global banks piloting GNNs have noted better results in credit card fraud detection, more accurate Anti-Money Laundering (AML) alerts, and faster investigations

These examples show that GNNs are not just theoretical. They are making a real impact in production environments.

A technology ecosystem ready to support adoption

Until recently, GNNs were largely confined to research teams. That’s changing fast. Today, a growing set of tools and platforms are making it easier for enterprises to put them into action:

-

- AWS offers prebuilt GNN pipelines using SageMaker and Neptune

- NVIDIA provides accelerated computing frameworks like RAPIDS and Morpheus for real-time detection

- TigerGraph and Neo4j offer graph databases with built-in support for machine learning

- Service providers and AI consultancies are offering implementation and advisory support to help financial institutions build their first graph models

Together, these resources are helping even mid-sized firms explore GNNs without needing to start from scratch.

Why GNNs stand out from traditional models

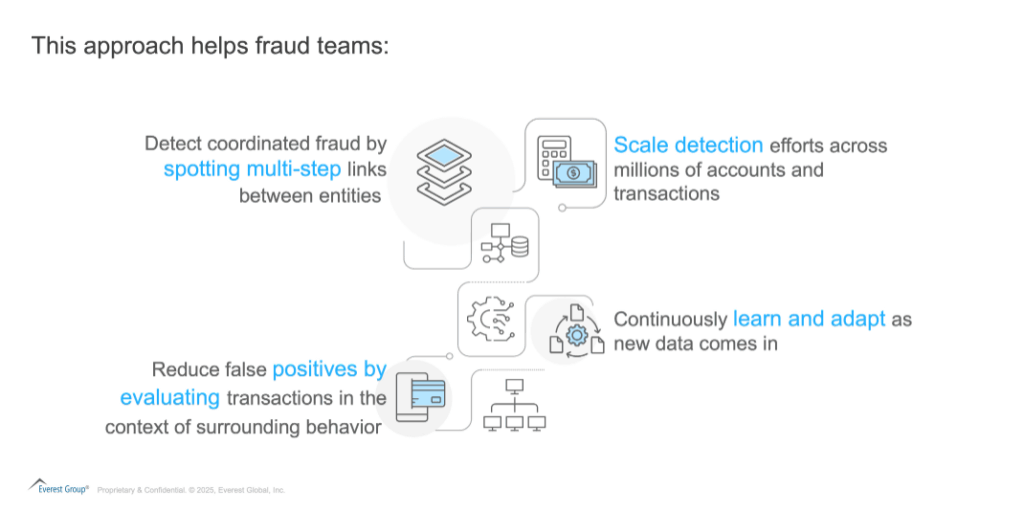

Unlike traditional models that rely on hand-crafted features, GNNs learn directly from the structure of the data. This means:

-

- Less manual feature engineering

- Better ability to detect complex or evolving fraud schemes

- More nuanced insights, especially when combined with explainable models like decision trees

GNNs don’t just look at isolated red flags, they ask how a transaction fits into the bigger web of activity.

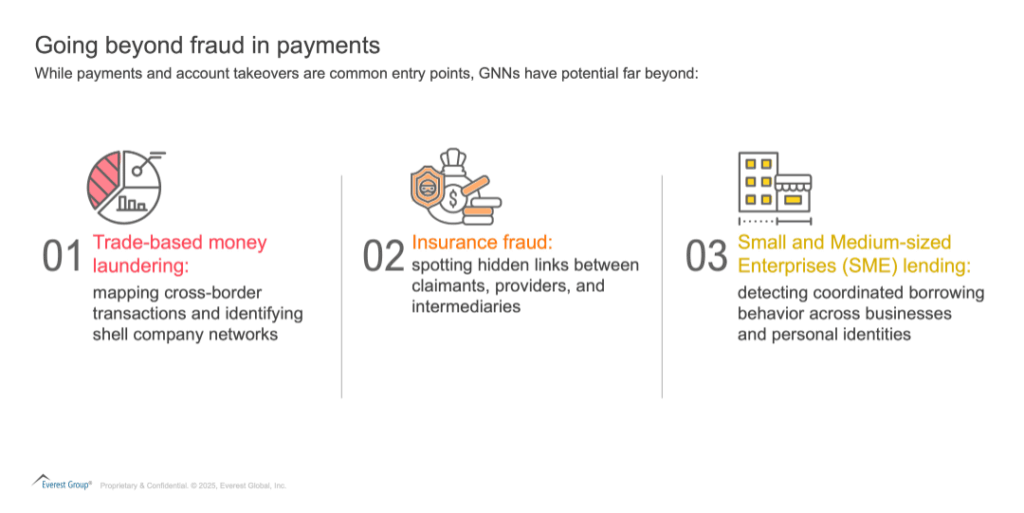

Going beyond fraud in payments

These broader use cases show that GNNs are not just a niche tool, but a core capability for tackling network-based financial crime.

What enterprises should be thinking about

For institutions considering GNNs, the path forward doesn’t need to be overwhelming. Start with focused pilots in areas where relational data already exists. Payments, AML, and onboarding are strong candidates.

Key considerations include:

-

- Data readiness: make sure you can link entities and relationships across systems

- Cloud infrastructure: leverage platforms that support fast prototyping and scaling

- Explainability: integrate GNN insights into existing fraud workflows in a transparent way

The goal is not to replace current tools but to enhance them, giving analysts and systems the broader context they need to make smarter decisions.

Final thoughts: seeing the full picture

Fraud is no longer just about spotting suspicious transactions. It’s about understanding how people, behaviors, and data points are connected. Graph Neural Networks help institutions do exactly that, shifting fraud detection from isolated checks to full-picture analysis.

For financial services firms, adopting GNNs can mean better detection rates, fewer false alarms, and stronger defenses against fast-changing fraud tactics. It’s a strategic investment that can improve resilience, reduce costs, and build trust with customers.

As fraudsters grow more sophisticated, the institutions that succeed will be those that learn to see and act on the connections that matter.

If you found this blog interesting, check out our Riding The Real-time Wave: How Enterprise Demand For Payments BPS Is Poised For Growth | Blog – Everest Group, which delves deeper into another topic regarding payments.

If you have questions or want to discuss payments and GNNs further, please contact Rahul Mittal ([email protected]) and Ronak Doshi ([email protected]).