Blog

The Dichotomy of Pricing in Cybersecurity Services

remains one of the fastest-growing segments of enterprise Information Technology (IT) spending. Despite broader economic headwinds (such as inflation, slowdowns, budget cuts, or geopolitical uncertainty) and shifts in global IT priorities, cybersecurity spend continues to rise, driven by the expanding digital footprint of enterprises, the escalating sophistication of cyber threats, and increased regulatory pressures.

We expect the global cybersecurity market to grow at a double-digit rate this year, at the same time, the emergence of artificial intelligence (AI)-driven tools, cloud -native architectures, and automation is prompting enterprises to seek more value from their cybersecurity investments.

Reach out to discuss this topic in depth.

Considering recent cybersecurity pricing trends and the evolution of cybersecurity costs over the past few years highlight a notable market shift:

While rates for cybersecurity professionals have generally risen due to high demand for specialized skills, the cost of certain managed services has declined, driven by automation, standardization, and productivity gains.

This cybersecurity pricing dichotomy reflects the industry’s evolving landscape, where premium expertise is valued, yet efficiency improvements continue to reduce costs in select service areas. This blog explores these trends, their underlying factors, and the broader implications for the cybersecurity sector.

Recent trends in cybersecurity pricing

Over the last 2-3 years, we’ve observed varying pricing trends across traditional and next-generation cybersecurity services. The rapid pace of digital transformation, paired with increasingly sophisticated cyber threats, has driven demand for specialized security skills and managed services. However, these trends play differently depending on the nature of the service or expertise involved.

Strong demand for specialized skills drove FTE price changes (2021–2024)

-

- Traditional cybersecurity skills: FTE rates for traditional skills increased by 6-10% and this rise was driven largely by strong client-side negotiation and the commoditized nature of these roles, which kept pricing change relatively modest

-

- Next-gen cybersecurity skills: For more advanced skills like application security, Managed Detection and Response (MDR), and threat management, the demand has been particularly high compared to traditional skills. FTE rates for these next-gen services have seen an increase of 9-13%, reflecting the high demand and specialized expertise required. Overall, this has contributed to higher deal values in advanced security services over the past three years

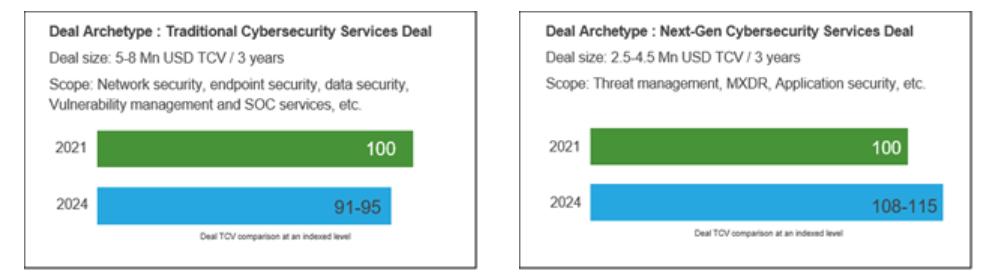

Impact on managed services deal pricing

-

- Traditional security services: In contrast, while traditional FTE rates have risen, the overall deal sizes for traditional security services have declined by 5-9% over the past three years. Factors contributing to this trend include increased offshoring to lower-cost regions, process automation, standardization, and growing market competition

-

- Next gen managed services: Services such as Application Security and Managed Extended Detection Services have seen a surge in deal prices. The prices of these deal archetypes have increased by 8–15% over the past three years. This is due to factors such as the rising demand for these services, the premium charged for specialized skills, the increased complexity of the threat landscape, and the strong need for compliance

Exploring the pricing dichotomy: Why prices vary

Several key drivers have led to this dichotomy, where certain managed service costs decline, even as FTE rates for cybersecurity expertise increase:

-

- Offshoring and cost efficiency: Increased offshoring to regions with lower operational costs has helped mitigate some price increases, especially for traditional security services. This trend has led to smaller deal sizes in traditional managed security offerings. Furthermore, with talent saturation in Tier-1 locations, service providers are increasingly exploring Tier-2 cities as cost-effective hubs for skilled resources, ensuring sustainable workforce expansion

-

- Automation and standardization: As cybersecurity solutions mature, many cybersecurity services have benefited from automation and standardization. Automation tools and standardized processes drive efficiency, allowing managed services providers to reduce prices while maintaining quality. Moreover, the emergence of Generative AI (gen AI) is beginning to demonstrate its impact on productivity, with early use cases showcasing enhanced operational efficiencies

-

- Sophisticated threat landscape: Next-gen services, which require high levels of specialized expertise, have seen price increases in line with the complex threat environment. For example, MDR and advanced threat management services command a premium due to the expertise needed to handle the evolving cyber landscape and comply with regulatory demands. Additionally, the rise of AI-driven cyber threats has increased the demand for specialized security analysts and threat hunters, further driving up costs

-

- Strategic importance and volume of work: Large-scale enterprises often secure better pricing based on their strategic value to providers and expected volume of work, particularly in long-term deals. This factor has also contributed to price stabilization in managed services, even with FTE rate increases

-

- Regulatory and compliance: Stringent global regulations such as General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), Digital Operational Resilience Act (DORA), and Securities and Exchange Commission (SEC) cybersecurity rules have driven demand for compliance-focused managed services. Providers offering specialized Governance, Risk, and Compliance (GRC) services often command a premium due to the complexity and criticality of meeting regulatory requirements

-

- Consolidation and vendor rationalization: Enterprises are increasingly consolidating security vendors to streamline operations and reduce costs. This has led to bundled pricing models, where providers offer discounts for multi-service engagements while maintaining higher rates for standalone offerings

The contrasting trends in cybersecurity pricing highlight the industry’s adaptability to market demands and technological progress. While next-generation security expertise continues to command a premium, automation, offshoring, and service consolidation are reshaping managed services costs, benefiting clients and expanding access to advanced security solutions.

Understanding these pricing dynamics will help organizations strategically plan their cybersecurity budgets. By aligning their cybersecurity investments with these pricing shifts, they can gain a competitive edge, optimizing costs while building a resilient and cost-effective cybersecurity strategy that ensures robust security.

If you found this blog interesting, check out our The Power Of Pricing In The Success Of CPG Brands: 2025 And Beyond | Blog – Everest Group, which delves deeper into another topic regarding pricing.

To share your perspectives and to hear more about the latest advancements for pricing in the cybersecurity sector, please reach out to Vamsi Krishna ([email protected]), Vinamra Shukla ([email protected]) and Ricky Sundrani ([email protected]).