Blog

The Cost-control Countdown: How 30 Days Could Redefine US Drug Pricing

An Overview of the Executive Order

What the executive order includes

On May 12th, 2025, US President Donald Trump signed an executive order targeting prescription drug prices as part of a broader effort to combat inflation. At its core, the order invokes a “most-favored-nation” (MFN) pricing policy, which would require US drug prices to match the lowest price available in peer nations.

Key provisions include:

-

- A 30-day window for pharmaceutical manufacturers to voluntarily reduce US prices by 59% to 90%, aligning them with international benchmarks

- Authorization for the Department of Health and Human Services (HHS) to facilitate direct-to-consumer (D2C) drug sales at international prices, bypassing traditional PBM and insurance channels

- A directive for the Federal Trade Commission (FTC) to crack down on anti-competitive behavior that suppresses generic drug competition

- A mandate for the HHS to plan the imposition of MFN price caps and explore expanded drug importation if voluntary compliance fails

Winners, trade-offs, and what’s at stake

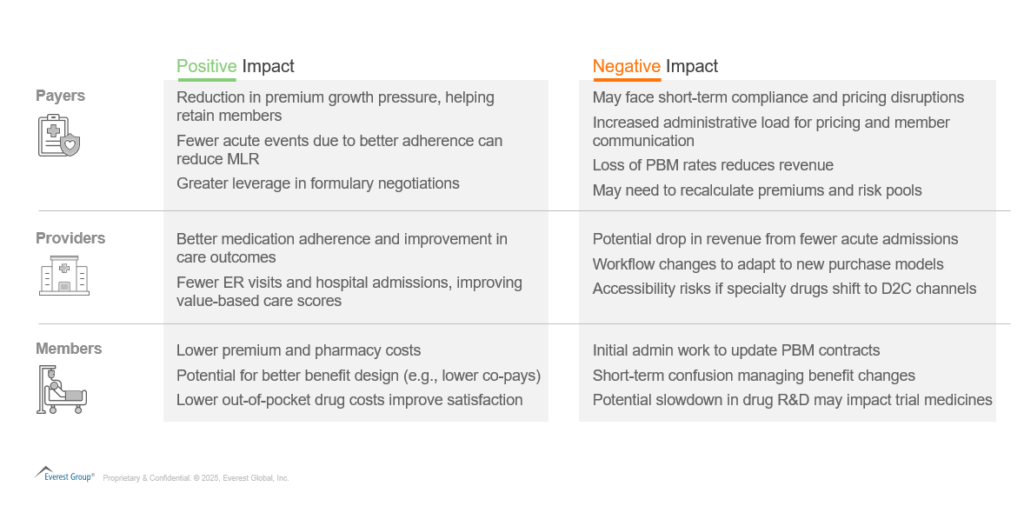

The policy direction is clear, but its operational implications remain complex. For healthcare payers and providers, the proposed drug pricing reforms present a mix of potential gains and emerging risks. The following sections outline key considerations for each segment of the healthcare ecosystem.

Lower drug prices translate directly into savings for payers and members. “When drug prices go down, you pay less,” claims America’s Health Insurance Plans (AHIP). As per the American Hospital Association, nearly 30% of Americans skip doses because of cost, and more than 1.1 million Medicare patients could die in the next decade if affordability doesn’t improve. Taken together, these views signal that pricing reform is not only a financial lever for premiums but also a critical determinant of long-term population health. What does this mean for the three biggest stakeholders? Let us look below.

The service provider angle: risks and opportunities

The implementation of MFN-based drug pricing – if realized – will prompt operational and structural changes across the healthcare ecosystem. Business process outsourcing (BPO) providers will need to reassess their value propositions as payer and PBM workflows shift.

-

- Claims management will feel the volume surge and rule volatility: Lower drug prices mean more prescriptions, so claims intake, benefit checks, and adjudication all pick up speed. Payers with flexible, automated claims systems can handle the extra load without extra staff; manual-heavy shops could struggle to meet service levels.

- Care management and pharmacy services should expect an adherence upswing: When drugs cost less, more members start and stay in therapy. That naturally drives up the number of refill reminders plans must send, the volume of nurse outreach calls to check on adherence, and the need for remote monitoring of chronic-condition patients who are now taking their medications more regularly. Providers that pair strong adherence tools with adaptable UM teams can shift nurses from paperwork to higher-value coaching.

- Risk & compliance becomes the control tower: Plans must show that savings reach members under medical-loss-ratio rules and update contracts to fit the new pricing model. Platforms that track international prices and produce audit-ready MLR reports – plus contract teams that can bulk-update agreements – could face higher demand.

- Resilient payment Integrity practice to become important: Auditors will need fresh rules to flag over- and under-payments, price-file mismatches, and new fraud tactics that exploit lower list prices. Automated post-pay review tools, data-matching against weekly price feeds, and analytics that spot sudden prescribing spikes will all become more important.

International reference pricing is no longer a thought experiment, it is a live policy variable that will reshape volumes, workflows, and margin pools across US healthcare operations. The winners will be payers and service partners that pivot early: automating claims edits, redeploying care-management talent, and tightening compliance analytics before mandates lock in. Those still treating drug-pricing reform as a distant possibility risk scrambling later, on costlier, less flexible terms.

Discover more about how Everest Group helps healthcare leaders with research-led insights and guidance: https://www.everestgrp.com/healthcare-industry/

If you have any further questions, please contact Vivek Kumar ([email protected]) and Aadarsh Ashok ([email protected]).