Blog

The AI value marathon in insurance

The road from insight to action: Agentic AI and the insurance value chain

Agentic Artificial Intelligence (AI) systems with autonomous decision-making capabilities, is reshaping insurance operations from underwriting to claims and service.

By 2030, nearly every core process in insurance will be streamlined by AI-driven automation, especially in high-volume, data-rich areas. Everest Group’s Systems of Execution (SoE) research shows that insurers must evolve beyond systems of record and engagement to platforms that activate decisions at scale and act on it autonomously.

Reach out to discuss this topic in depth.

In practical terms, this means moving from today’s largely manual workflows to a future state of autonomous execution, where AI agents handle routine decisions instantly, and humans focus on oversight and complex cases. Crucially, this transformation is a marathon, not a sprint. Insurers are cautiously embracing Agentic AI, balancing its vast potential value with practical adoption challenges like data readiness, trust, and regulatory compliance.

However, as the insurers, suppliers and providers ecosystem invest in adopting Agentic AI solutions in business processes, they grapple with few common questions like, how to prioritize use-cases, what to build, and how to allocate resources, to name just a few.

In this blog, we introduce two frameworks: one to prioritize processes that are likely to take a lead in the transformation journey, and another to cover resource allocation across processes that will have different levels of Agentic AI readiness due to complexity, regulatory risk, or judgment-dependent nuances.

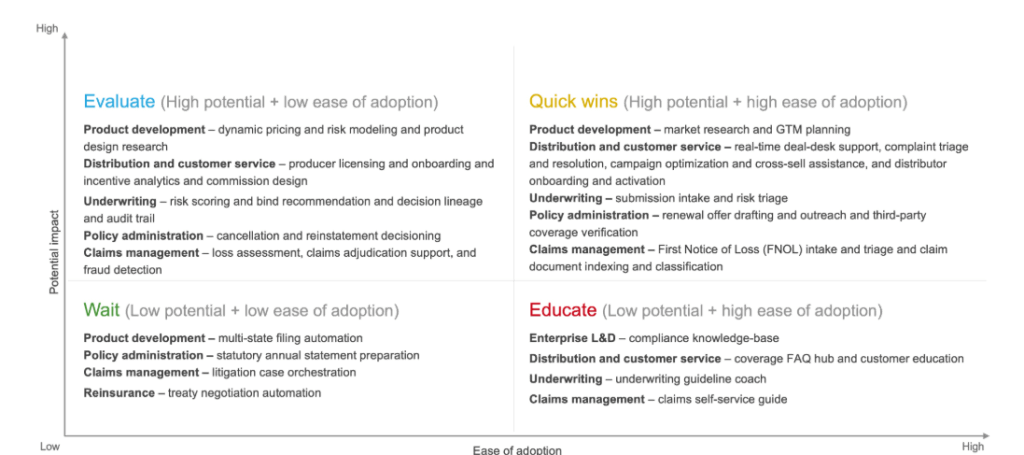

- Prioritizing use-cases across the insurance value chain: A 2×2 lens to evaluate feasibility and impact.

This matrix prioritizes Agentic AI use cases by mapping potential business impact on the vertical axis and ease of adoption on the horizontal axis. It groups processes and subprocesses into four categories to guide insurers in informed decision-making on which use-case to prioritize.

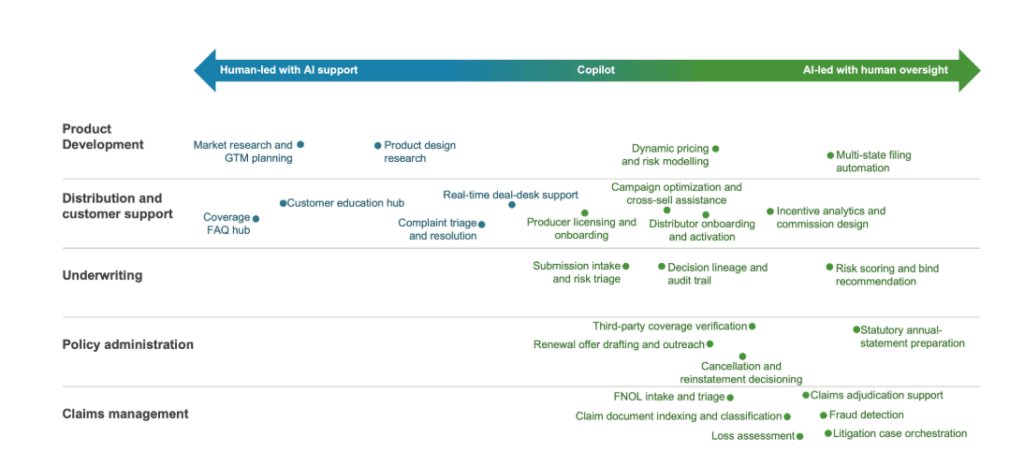

- Target-state value contribution: While adopting transformational technology such as Agentic AI, decision-makers need a framework to align distribution of resources optimally. This framework offers a strategic lens to navigate the Agentic AI adoption. It focuses on the shared responsibilities between humans and AI across processes in the target state (post-implementation) for optimal resource allocation. Mapping workflows from human-led with AI support to AI-led with human oversight.

The two frameworks align phased investment with execution maturity: insurers can prioritize high-value use cases and allocate talent, data, and governance resources precisely where each process sits on the autonomy spectrum, ensuring scalable implementation rather than disconnected pilots.

Framework 1 tells carriers what to tackle first, highlighting “quick-win” opportunities such as First Notification of Loss (FNOL) intake and triage or routine policy endorsements that score high on both criteria.

Framework 2 then illustrates how we can think about Agentic AI’s contribution in a dynamic target state (visualized state to act as iterative milestone). This includes shared responsibility between human and agentic system(s) inside those workflows, ranging from human-led activities, like complaint triage to co-pilot tasks such as dynamic pricing and risk modelling, and finally to AI-led operations under human oversight, for example multi-state filing automation or claims document indexing.

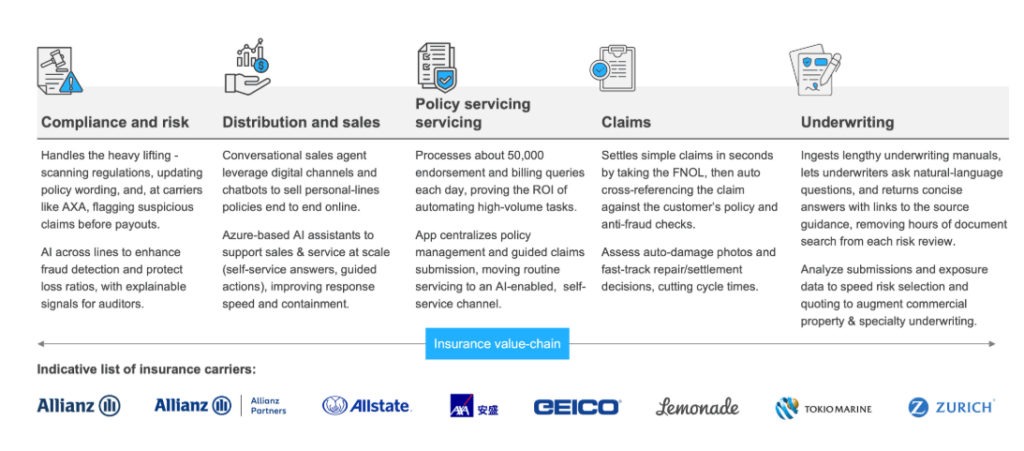

Illustrative examples of AI assistant-led process transformations across the Insurance value-chain

Looking ahead

To lead the insurance market by 2030, carriers must turn Agentic AI from scattered pilots into an enterprise operating model. That means defining a vision that links autonomous agents to the biggest value streams, prioritizing quick-win use cases matched to current tech maturity, and backing it all with robust governance mandates.

At the same time, organizations need to reskill frontline talent into “AI orchestrators,” empower citizen-developers to spin up co-pilots, and cultivate a robust ecosystem of technology and services partners.

- Set a clear target-state vision

- Tie AI agents to key value streams (product design, distribution, underwriting, admin, claims)

- Use prioritization frameworks to pick quick-win use cases that match your tech readiness

- Establish an enterprise-wide mandate

- Create a cross-line-of-business “AI Governance Board” to steer agent roadmaps and Key Performance Indicators (KPIs)

- Start pilots in high-volume, low-risk areas to build trust and proof points

- Embed agentic ways of working

- Re-skill underwriters, adjusters, and product teams to become “AI orchestrators.”

- Launch citizen-developer programs so subject-matter experts can build co-pilots quickly

- Partner for scale

- Success will come from a strong ecosystem of tech vendors, consultants, and service providers – with governance at the core

Insurers that pace themselves through this AI value marathon will:

- Significantly cut claims and underwriting cycle times

- Reduce operational expense ratios significantly

- Deliver near-instant customer experiences while meeting rising regulatory expectations

- Unlock capacity for innovation in new products and emerging risks

The destination is clear: an enterprise where humans and intelligent agents run in concert, each focusing on their comparative strengths. Insurers that start with quick wins, invest in data and governance, and design for flexible co-pilot models today will lead the pack tomorrow, turning Agentic AI from a promising experiment into a core competitive engine for the decade ahead.

Our latest report “Agentic AI in Insurance 2025” provides a practical blueprint for where to start and how to scale. It includes a use-case prioritization matrix (impact vs. ease) to prioritize investments and a model to design the resource allocation based on the dynamic understanding of human/AI role split in the target-state.

The report also highlights risk-mitigation playbook and implementations guidelines to help organizations balance autonomy with accountability and deliver durable, compliant value.

Report link – Agentic AI in Insurance 2025

Reach out to Vigitesh Tewary ([email protected]), Chinmay Pathak ([email protected]), Faisal Arfeen ([email protected]), to discuss in depth about our insights and offerings. To explore our full portfolio of insights, visit our Insurance IT Services hub.