Blog

From Interface to Orchestration: Why Underwriting Workbenches Must Evolve into Systems of Execution

Underwriting has always been core to insurance , but today, it sits at a strategic inflection point. Climate volatility, litigation risk, macroeconomic disruption, distribution channel expansion, and underwriting leakage are making it harder for carriers to profitably underwrite at scale.

In response, insurers have invested heavily in workflow tools, submission platforms, and digital interfaces. At the center of this transformation is the underwriting workbench, the primary interface through which underwriters evaluate submissions, access data, apply pricing logic, and document decisions.

Yet despite this progress, most workbenches remain passive. They consolidate information but stop short of enabling intelligent execution. They surface insights but require users to act on them manually. In short, they have modernized the look of underwriting, but not the logic or the flow.

We believe the next leap forward requires reimagining the workbench as something more powerful: a System of Execution. This blog explores what that means, and how vendors must evolve to lead.

Reach out to discuss this topic in depth.

Why orchestration is not enough

In recent years, “underwriting orchestration” has gained traction as a concept, and rightly so. Orchestration platforms promise to connect the dots across rating engines, submission portals, document repositories, and risk models. They help streamline workflows, enforce Service Level Agreement (SLA) logic, and automate repetitive tasks.

This is progress, but it is not transformation.

Most orchestration solutions today stop at coordination. They ensure the right information reaches the right person at the right time, but still rely on the underwriter to interpret, decide, and act. They bring order to the process, but not intelligence. They automate tasks, but not outcomes.

What is missing is enterprise execution, the ability to act autonomously, trigger decisions in real time, and continuously adapt workflows based on business signals. This is where orchestration must evolve.

The workbench as the execution surface

While underwriting orchestration enables coordination, Systems of Execution enable execution. And the place where that execution must be made visible, usable, and intelligent is the underwriting workbench.

Historically, the workbench has served as a centralized interface, consolidating access to rating engines, document repositories, and task checklists. It has improved visibility, standardized processes, and helped underwriters manage complexity. But it was never designed to act. It presents decisions. It does not drive them.

That is changing. As carriers embrace real-time underwriting and agentic artificial intelligence (AI), the workbench is evolving into something more strategic: a control surface for intelligent execution. Rather than simply surfacing information, the workbench must now:

-

- Ingest data from multiple internal and external systems in real time

- Trigger dynamic pricing and risk logic based on business signals

- Orchestrate multi-step workflows with contextual awareness

- Escalate exceptions and re-route decisions automatically

- Embed compliance logic directly into execution flows

This shift repositions the workbench from a user interface to a System of Execution interface, a place where decisions are not just informed but activated.

From passive portals to Systems of Execution: Mapping the evolution

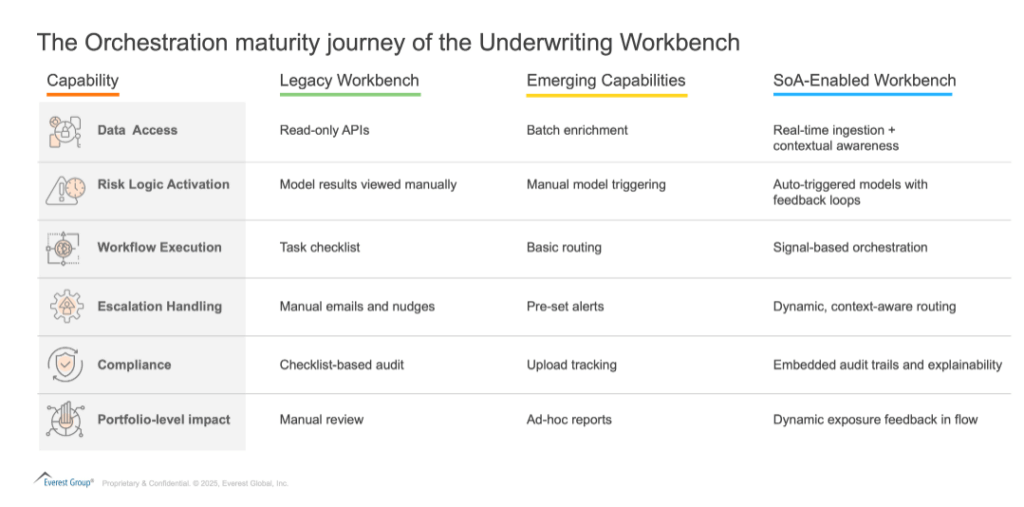

Not all workbenches are equal. While many platforms today offer consolidated views and Application Programming Interface (API) integrations, very few support dynamic, real-time execution. We see the journey to a System of Execution as a staged evolution, from passive portals to truly orchestrated, adaptive underwriting environments. The exhibit below outlines this maturity curve.

Exhibit 1: The orchestration maturity journey of the Underwriting Workbench

What makes a workbench a System of Execution

Most underwriting workbenches today are designed to help underwriters access information, but Systems of Execution are designed to help them execute. The difference is not cosmetic; it is architectural.

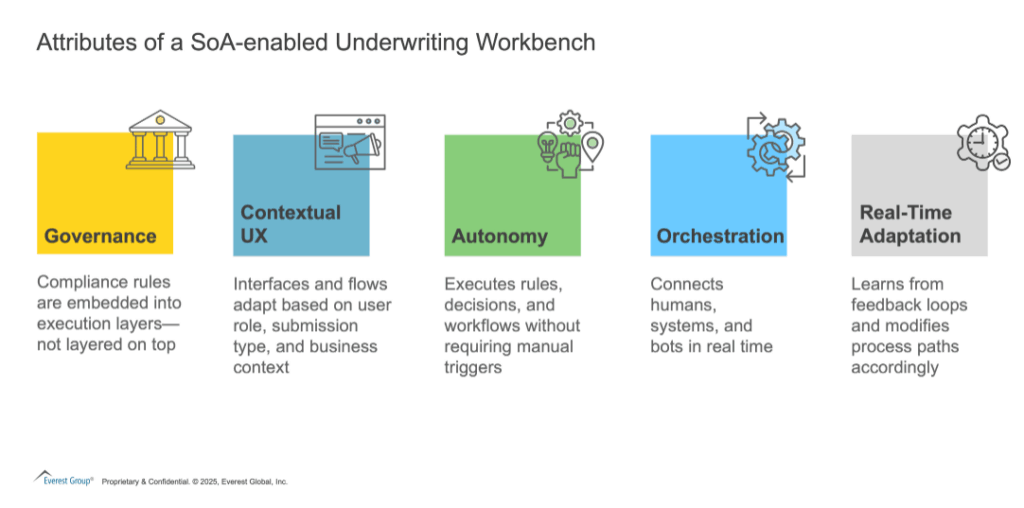

A System of Execution-enabled underwriting workbench embeds intelligence, orchestrates processes, and activates decisions in real time. It learns from outcomes, governs through embedded logic, and adapts based on evolving signals across lines of business.

In a true System of Execution, execution becomes intelligent, explainable, and autonomous. This is not an evolution of User Interface (UI). It’s a redefinition of how underwriting is done.

Exhibit 2: Attributes of a System of Execution-enabled Underwriting Workbench

Why most platforms still fall short

Despite growing momentum around underwriting orchestration, most platforms still fall short of enabling intelligent execution. The gap is not due to lack of investment or ambition; it is due to architecture.

Too many workbenches are built as engagement layers. They display insights but do not activate them. They manage tasks but don’t make decisions. They offer integration but lack orchestration logic. In essence, they stop just short of what matters most: action.

Vendors often focus on surface-level features—clean interfaces, consolidated views, customizable layouts—while neglecting the deeper system logic required to trigger actions, escalate intelligently, and adapt in real time.

Becoming a System of Execution requires a different mindset. It means:

-

- Moving from hard-coded workflows to signal-based execution

- Embedding compliance logic into the process – not bolting it on

- Empowering underwriters with intelligent suggestions – not more fields

- Designing platforms that act first and explain second

This is the frontier. Most platforms today are not yet Systems of Execution. But those that begin building toward it will define the next chapter of underwriting innovation.

Execution will define the future of underwriting

Underwriting is evolving. What began as a push for automation has matured into orchestration. And now, the industry stands on the edge of something far more transformative: execution intelligence.

The future of underwriting won’t be built on better portals. It will be built on platforms that can act, learn, and adapt in real time. Systems that close the gap between insight and outcome. Systems that don’t just support underwriters but scale them.

This is the promise of the System of Execution. It’s not a feature set. It’s an architectural evolution. And it’s the direction the market is heading.

As orchestration matures, vendors and insurers alike must reimagine the underwriting workbench, not as a screen to look through, but as a system that thinks and acts. The winners in this space will be those who orchestrate the future.

Everest Group is launching the Underwriting Technology for Property & Casualty (P&C) Insurance – Products PEAK Matrix® Assessment 2025. This assessment will evaluate underwriting orchestration and risk and pricing intelligence products across multiple dimensions such as market impact, vision and strategy, functional capabilities, innovation, and market impact.

Participate in the assessment or reach out to [email protected] and [email protected] for more information.

If you found this blog interesting, check out our research on Leading 50™ Property & Casualty (P&C) Insurance Technology Providers 2024, which covers leading P&C technology providers across underwriting (orchestration, pricing and rating) and claims.

To share your perspectives and to hear more about underwriting innovation in insurance, please reach out to Aurindum Mukherjee ([email protected]) and Divya Jaiwar ([email protected]).