Blog

Financial Turbulence Ahead: Healthcare Providers Must Prioritize Increasing RCM Yield

A comprehensive set of reciprocal tariffs has been introduced by the US administration, including country-specific duties and a uniform 10 percent levy on all imports. When announced, these measures triggered volatility across global markets and supply chains. However, businesses are gradually evolving operational strategies, while governments around the world continue to engage in negotiations to resolve emerging trade friction.

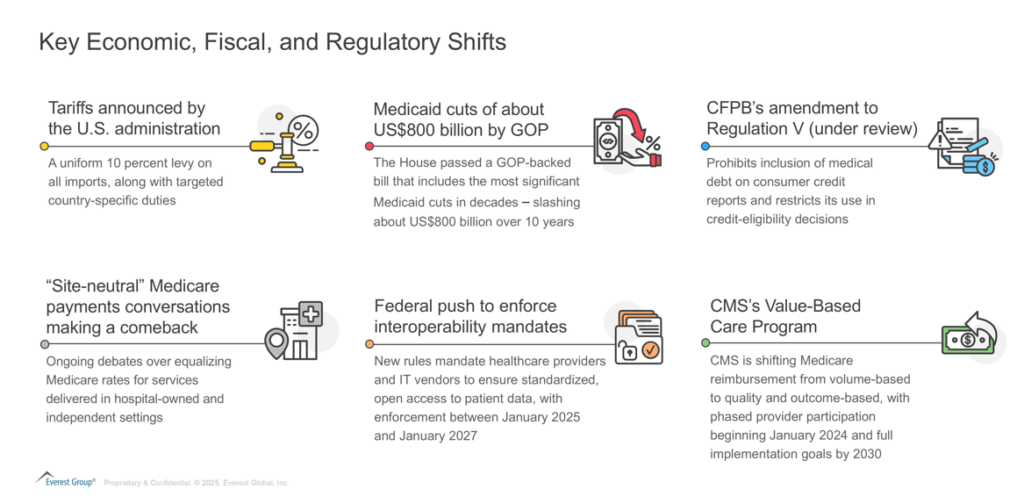

Though the focus of tariffs has been on goods, they will inevitably have a trickle-down effect on the service sector. Tariffs coupled with evolving fiscal decisions such as Medicaid cuts and some proposed regulatory changes such as the Consumer Financial Protection Bureau (CFPB)’s amendment to Regulation V (under review) and CMS’s push for Value-Based Care (VBC), among others, will have a profound impact on healthcare providers’ financial and cash flow position. Let’s understand how!

Reach out to discuss this topic in depth.

Tariffs and Emerging Regulations are Likely to Reshape Healthcare Providers’ Economics

Healthcare providers entered the year 2025 already grappling with staffing shortages, compressed operating margins, rising claim denials, and stretched collections cycles. Now, they face a slew of changes to the economic, fiscal, and regulatory landscape, such as:

Due to the evolving landscape and its associated challenges, healthcare providers will likely face a confluence of pressures.

-

- Escalating cost of medical equipment and supplies: In 2024, the US imported ~US$41 billion in medical instruments. The new tariffs on disposables and capital equipment will elevate purchase prices, tightening margins and potentially constraining care access

- Potential decline in patient footfall: Reciprocal tariffs on imported supplies are resulting in higher operating costs, fueling inflationary pressures and elevating care prices, which will likely prompt patients to defer non-urgent services and focus solely on essential treatments

- Rise in bad debts: Limited financial strength of patients, coupled with emerging regulations like CFPB regulation V, will reduce the leverage providers had with patients, resulting in heightened bad debts

- Payers and regulatory push for VBC adoption: Centers for Medicare & Medicaid Services’ (CMS) push for VBC will drive providers to make upfront investments in technology , care coordination, and process reengineering

- Reduced reimbursements from Medicaid: Medicaid budget reductions of ~US$800 billion over the next decade will not only adversely impact healthcare providers’ revenue, but also lead to a rise in uncompensated care, disproportionately affecting rural and community hospitals and health networks. Also, if CMS shifts to equalize outpatient rates, it will lead to further margin compression for hospitals’ outpatient departments

The Healthcare Provider Blueprint to Effectively Navigate the Evolving Landscape

Given the challenges that healthcare providers face in this dynamic environment, we present a structured approach and propose the following strategies:

1) Re-evaluate ‘cost‐to‐collect’ metrics

– Healthcare providers should focus on reducing the cost of revenue collection through targeted technology interventions in high-FTE dependent areas such as medical coding, Accounts Receivable (A/R) management, etc.

– Enhance front-end patient registration with accurate cost estimates, point-of-service collections, and prior-authorization management to cut denials and mitigate bad debt

2) Postpone non-critical tech investments:

– Defer non-critical tech investments, such as new Electronic Health Record (EHR) modules, to preserve cash and maintain resilience amid market fluctuations

3) Reconfigure Revenue Cycle Management (RCM) vendor relationships:

– Consolidate RCMs scope of work to eliminate redundant contracts, reduce switching costs and align administrative systems

– Look for RCM vendors that can help drive revenue growth and co-invest in technology, assess software requirements, and service partnerships

Beyond Benchmarks: Cultivating Vendor Relationships for Strategic Advantage

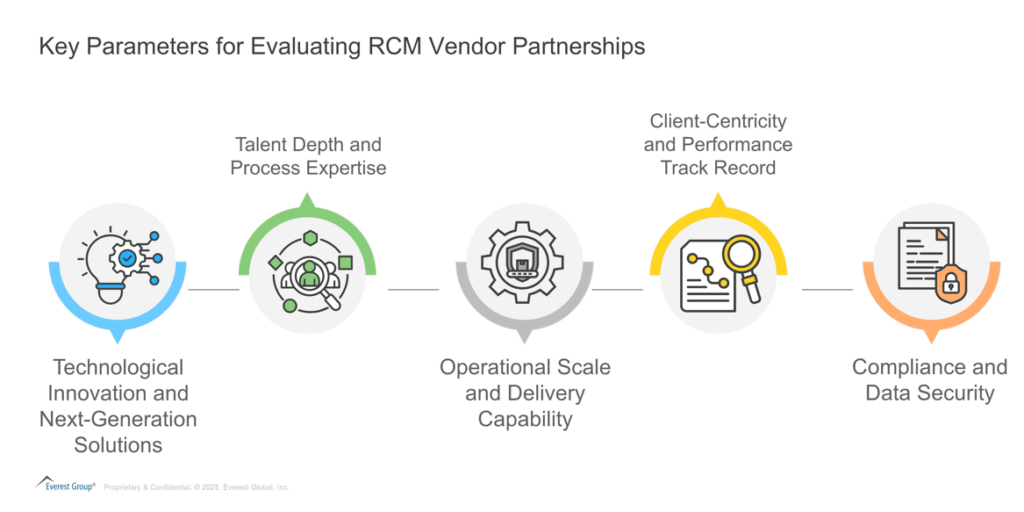

To effectively respond to financial pressures and safeguard operational agility, collaboration with the right RCM vendor can be a strategic enabler. Healthcare providers should conduct a comprehensive assessment when selecting the right RCM partnership for them.

To support this decision-making process, Everest Group has conducted a comprehensive assessment of leading RCM operations vendors. Our 2024 edition of the RCM PEAK Matrix® evaluates providers based on market impact, vision, and capability. Below is how the RCM vendors ranked in the 2024 edition of the assessment.

The imperative for healthcare providers to place Revenue Cycle Management (RCM) at the top of their strategic agenda is clear. Against a backdrop of tariffs, emerging regulatory reforms, and fiscal pressures, healthcare providers that proactively invest in driving RCM yield will distinguish themselves as leaders rather than laggards.

For more information regarding the US administration’s tariffs and to see what the US tariffs mean for the global services market, please visit https://www.everestgrp.com/us-administrations-tariffs/.

If you found this blog interesting, check out our How Will The New Tariffs Affect The Global Services Market? | Blog – Everest Group, which delves deeper into another topic regarding the latest tariffs and how this may affect various sectors in the US and beyond.

To discuss the Revenue Cycle Management outsourcing market, contact Abhishek AK ([email protected]) and Aastha Malik ([email protected]). For a detailed view of the provider landscape, check out the RCM Operations PEAK Matrix® Assessment 2024