Capgemini’s Bet on Cloud4C: A Smart Fit, But Success Will Hinge on Execution Discipline

Cloud4C, a Singapore-headquartered managed cloud services provider founded in 2014, has steadily built a differentiated position in the cloud market by blending vertical focus, platform-led delivery, and region-specific execution. In under a decade, it has expanded to over 30 countries, with a strong presence across Asia-Pacific, the Middle East, and emerging Tier-II markets. This growth has been underpinned by a partner-led model with focused investments over the years.

Notably, it is a global premium partner for SAP S/4HANA Cloud (RISE with SAP) and has strong alliances with Microsoft Azure, AWS, and Google Cloud. These partnerships enabled Cloud4C to punch above its weight in delivering complex cloud projects, aligning closely with big vendors to reach joint clients.

Cloud4C’s portfolio spans hybrid cloud services, application-centric managed services, and region-specific sovereign cloud offerings. Its capabilities are reinforced by domain-aligned GTM motions, regional transformation CoEs, and industry-specific frameworks, with a particularly strong presence in regulated sectors such as BFSI, healthcare, and government. Cloud4C serves both mid-sized enterprises and large multinational organizations.

In this context, Capgemini’s agreement to acquire Cloud4C marks a strategic step in strengthening its consult, transform, and operate muscle across private and hybrid cloud environments. The acquisition comes at an inflection point when enterprises are rethinking infrastructure choices around automation, compliance, and infrastructure decisions. While the portfolio fit is clearly complementary, the long-term value will depend on Capgemini’s ability to preserve and scale Cloud4C’s distinct strengths without diluting what has made it competitive in high-growth markets.

Reach out to discuss this topic in depth.

Capgemini’s acquisition trajectory

Capgemini has pursued a deliberate acquisition and inorganic expansion strategy over the past few years to reinforce its position as a global leader in data-driven transformation, intelligent operations, and digital engineering. The firm has focused on three clear priorities: (1) building deep data and AI capabilities, (2) enhancing verticalized consulting and operations expertise, and (3) scaling digital and engineering services in high-growth areas such as capital markets and industrial digital twins.

The acquisitions of Syniti, WNS, and Cloud4C mark the culmination of this phase, signaling a pivot from foundational capability building toward scaling AI-powered operations and end-to-end transformation delivery.

Why the Cloud4C deal matters

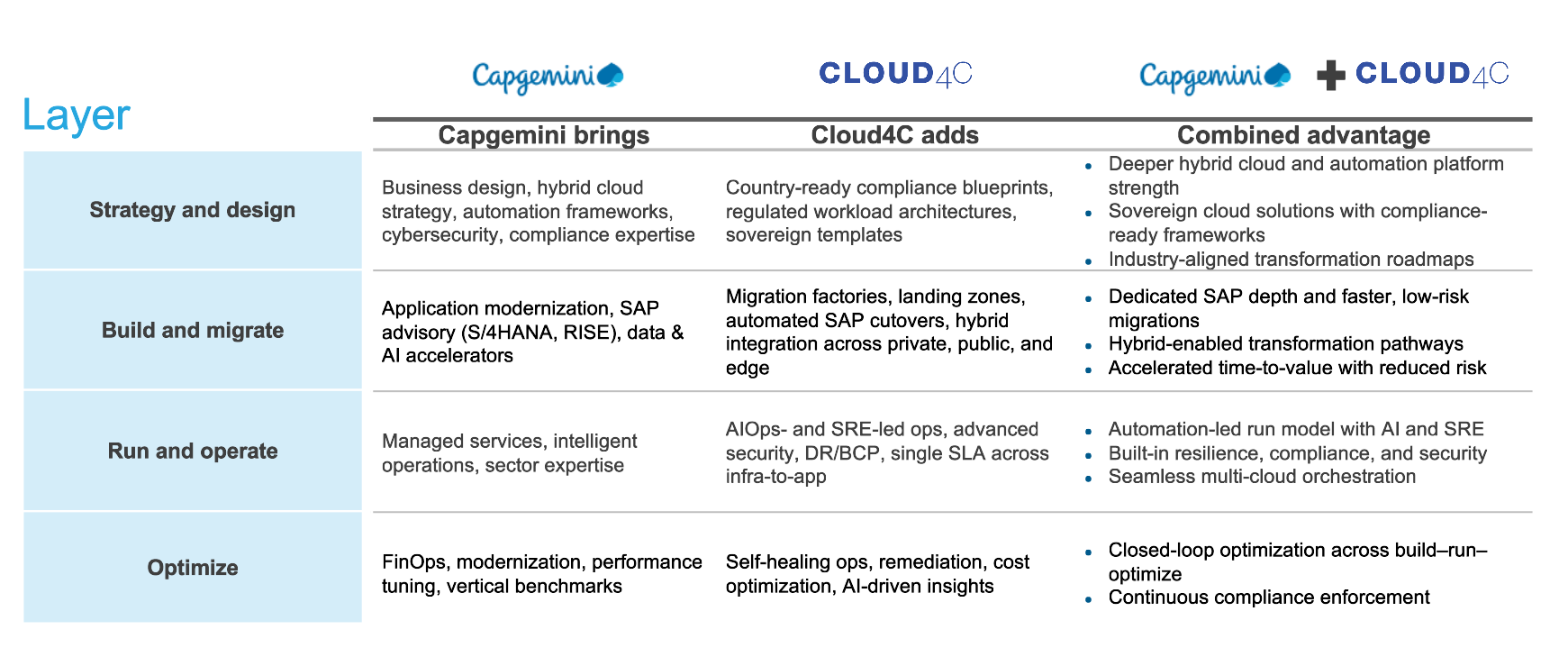

The acquisition of Cloud4C gives Capgemini an opportunity to enhance its position in automation-first, platform-led, and sovereignty-aligned private and hybrid cloud services. Clients are increasingly demanding cloud models that are resilient, compliant, and simple to consume. Cloud4C brings depth in precisely these areas, allowing Capgemini to reposition itself as a stronger lifecycle partner that can consult, build, run, and optimize. Exhibit 1 highlights how the integrated stack could look.

Exhibit 1: The integrated “Build–Run–Optimize” stack

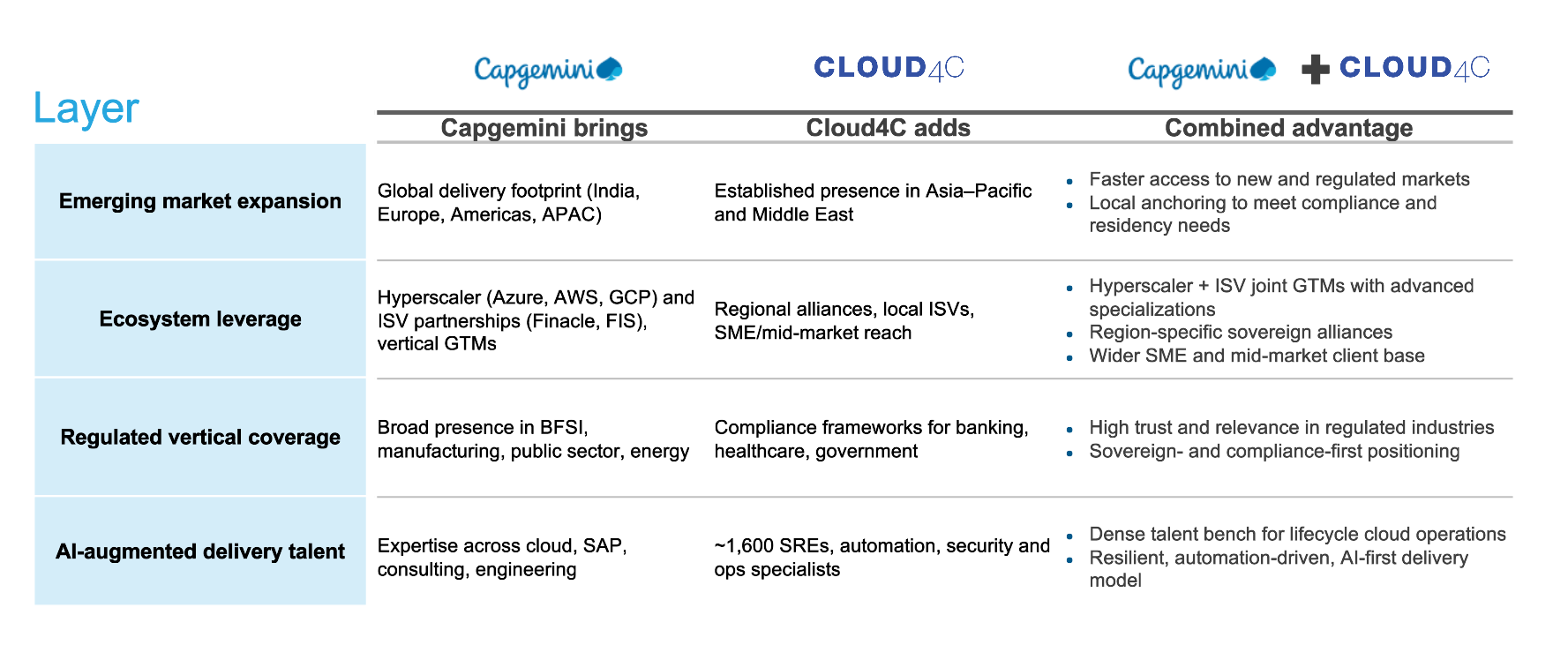

While the integrated Build–Run–Optimize stack (Exhibit 1) gives Capgemini a stronger architectural play to deliver automation-first and compliance-aligned hybrid cloud services, this capability on its own is not sufficient to win in an increasingly fragmented and regulated market. The real differentiation lies in how these technical strengths intersect with talent density, vertical credibility, and geographic anchoring (Exhibit 2).

Capgemini + Cloud4C is not just a richer services stack; it is a repositioning move that enables Capgemini to credibly compete where resilience, sovereignty, and local trust are non-negotiable. This strategic alignment converts operational enhancements into market access and client stickiness, creating a more defensible growth path.

Exhibit 2: Capgemini + Cloud4C – strategic synergies across talent, verticals and geography

While the strategic logic of the acquisition is clear, its success will ultimately be judged on execution. Capgemini’s ability to both articulate and embed Cloud4C’s distinct strengths across its global client base will shape the outcome.

Key factors that will influence success include:

-

- Where Cloud4C sits in the portfolio – The priority is to embed Cloud4C’s IPs, frameworks, and operating models into delivery teams and client engagements. The question is how Capgemini can internalize an automation-first, platform-centric mindset within its delivery fabric while preserving the essence of Cloud4C’s DNA and maintaining its expertise as the business scales

-

- Productization at scale – How Cloud4C’s platform and automation-based offerings are standardized and extended across Capgemini’s global scale and operations will be critical. This will allow Capgemini to evolve its traditional infra-led services into a more platform-powered, productized cloud transformation approach

-

- GTM and delivery cadence – The challenge is to ensure that the attributes of agility, client intimacy, and innovation are retained at scale. This will be central to delivering faster operations, improved time-to-market, and differentiated value for clients

If Capgemini communicates this positioning crisply to clients and then demonstrates it in delivery at scale, the acquisition will read as added capability, not just added capacity.

Read more on cloud services and the providers in this market in our Cloud Services for Mid-market Enterprises PEAK Matrix® Assessment 2025.