The banking IT services market is structurally resetting. The old model, under which banks relied on labor arbitrage, large offshore teams, and periodic technology upgrades, no longer delivers. Higher delivery costs, tariff uncertainties, wage pressures, and cautious customer spending have reduced its effectiveness, while interest rates, margin pressures, and stricter rules around resilience, cyber risks, third party oversight, and data governance are placing more demands on technology programs. Customer expectations are also rising as real-time and personalized interactions become standard.

Banks are responding by launching modernization programs that update core systems, replace aging payments platforms, strengthen cloud and data foundations, and redesign development and operations for greater speed, reliability, and control. AI is becoming a central part of these programs – banks are using it to improve developer workflows, code modernization, streamline documents and review processes, support risk and fraud decisions, and enhance daily operations.

These changes are reshaping what banks expect from their IT partners. Institutions are rethinking their vendor portfolios and forming deeper partnerships with providers that can offer engineering strength, banking expertise, reusable assets, and credible cloud and AI partnerships. The focus is on providers that can support modernization from end-to-end, improve time-to-value, reduce risks, and help banks meet regulatory expectations.

There is also a shift toward commercial models that link pricing to outcomes. Banks want greater confidence that transformation programs will produce real business impact such as higher productivity, better customer experiences, improved resilience, and lower risks. Providers are expected to help redesign operating models by bringing technology and operations teams closer together, aligning programs with business goals, and embedding compliance and resilience into delivery from the start.

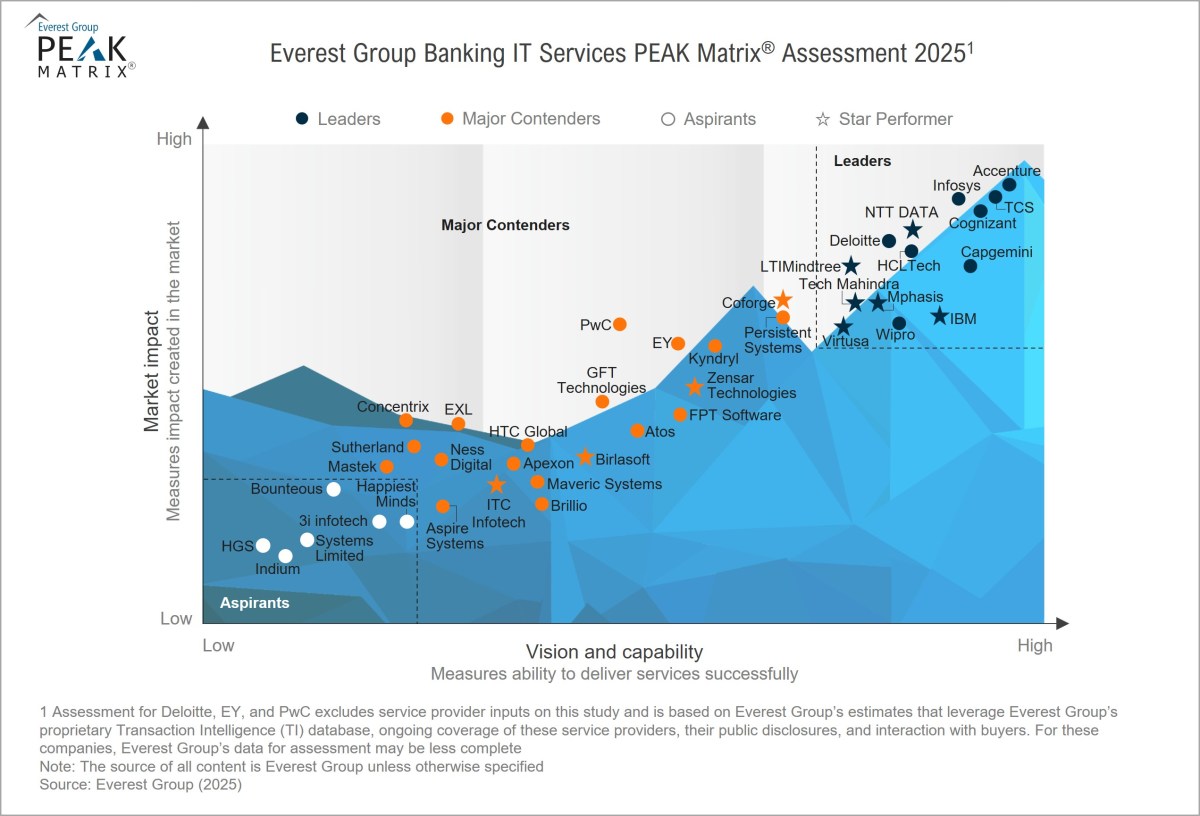

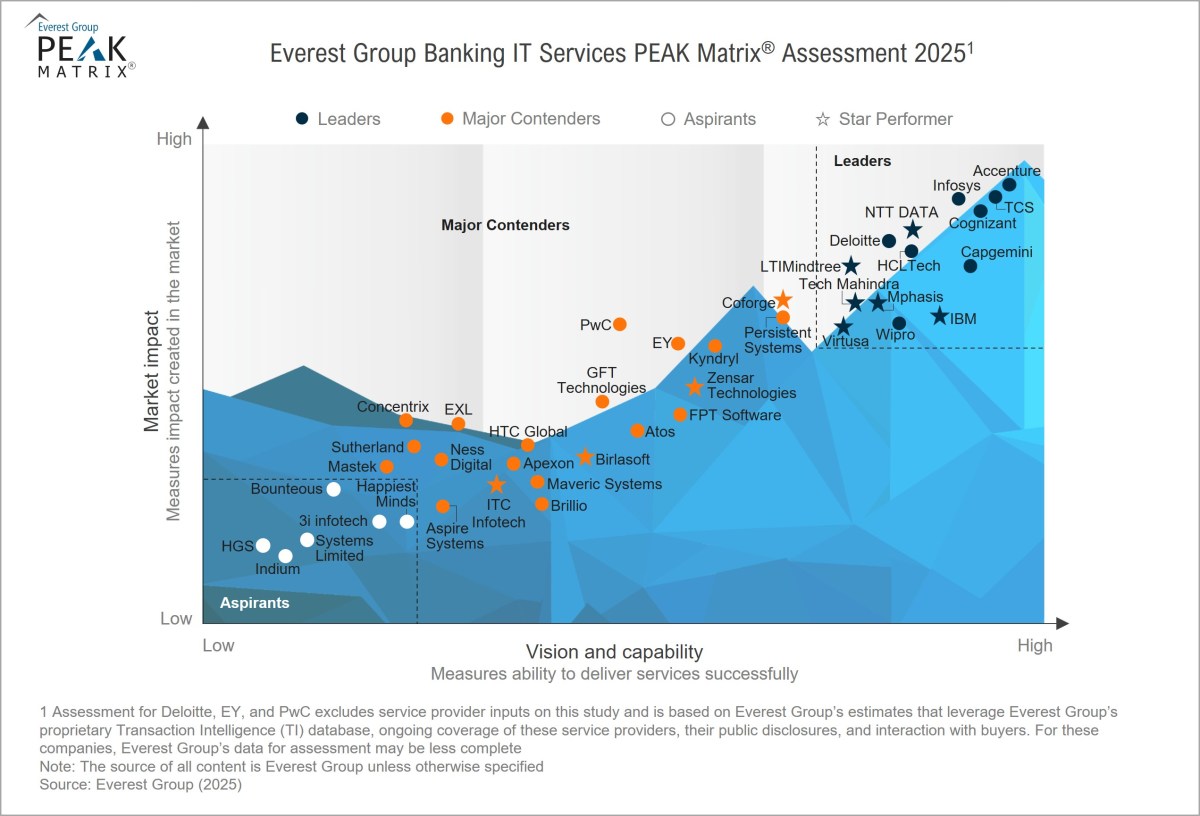

This research evaluates 41 IT providers on their ability to meet these expectations. It highlights which firms have the capabilities, investments, and delivery approaches needed to support modernization, adopt agentic AI in a responsible and scalable way, and help banks manage cost pressures, regulatory complexities, and rapid technology changes.