Finance and Accounting Outsourcing (FAO) PEAK Matrix® Assessment 2025

However, the global multi-process FAO market experienced relatively slower-than-expected growth in 2024 due to economic and geopolitical uncertainties and delayed decision-making in the second half of 2024, especially in large-scale deals. As a result, while short-term growth may remain constrained due to inflation, recessionary concerns, and global instability, long-term market momentum is expected to persist, driven by steady demand for core F&A services and the need for ancillary services to support AI infrastructure readiness.

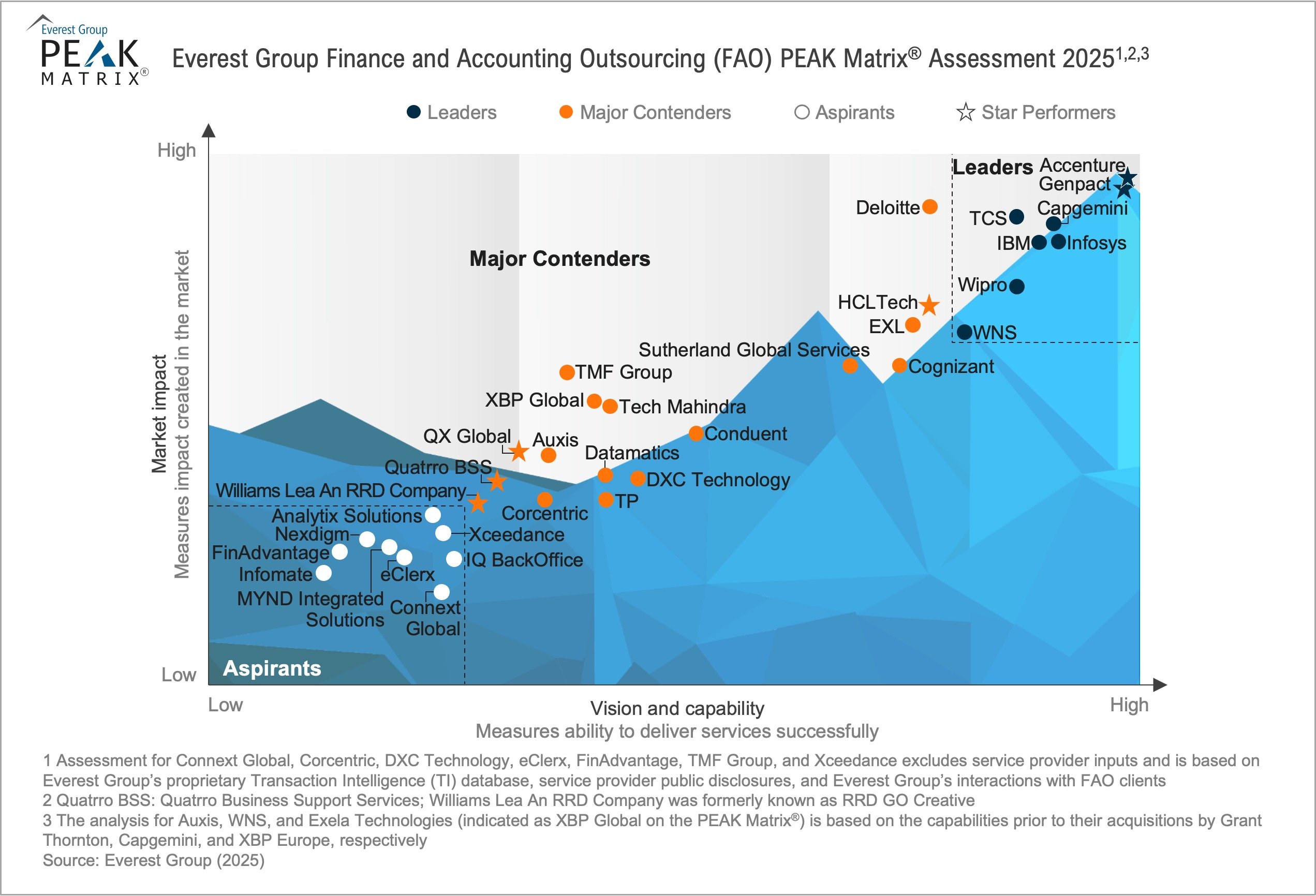

In this research, we assess 34 FAO providers based on their vision and capabilities and impact on the FAO market and position them on the FAO PEAK Matrix® assessment.

This report is available to members.