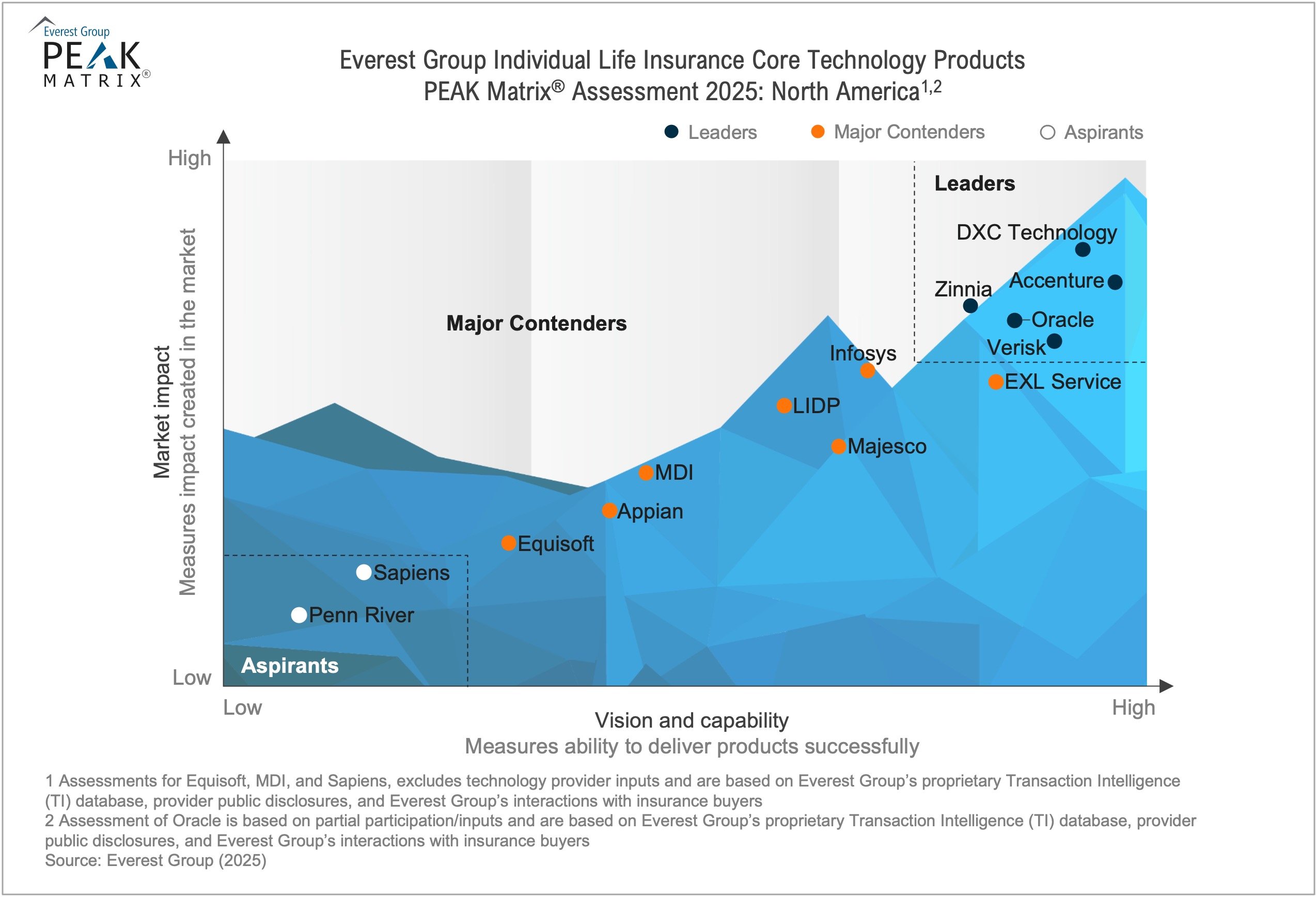

Individual Life Insurance Core Technology Products PEAK Matrix® Assessment 2025: North America

The North American Life and Annuity (L&A) insurance industry is rapidly transforming, driven by evolving customer expectations, rising competitive pressures, and the growing need for operational agility. As insurers look to modernize their core legacy systems, cloud-native Policy Administration Systems (PAS), AI-driven automation, and low-/no-code development platforms are essential to business transformation.

As insurers focus on delivering hyper-personalized products, improving risk assessment accuracy, and accelerating time-to-market, platform providers are offering API-driven, SaaS-based solutions with built-in regulatory compliance, third-party integration, and advanced analytics. Many are also adopting hybrid TPA and SaaS models to deliver end-to-end operational support and next-generation servicing capabilities.

This report comprehensively assesses 14 leading core technology providers featured on Everest Group’s Individual Life Insurance Core Technology Products PEAK Matrix® Assessment 2025. Based on our annual RFI process, client feedback, and ongoing market research, this report evaluates leading providers’ capabilities in enabling digital-first insurance operations. The assessment focuses on their abilities to deliver scalable cloud architectures, AI-powered solutions, stakeholder experience initiatives, and seamless integration across the insurance technology ecosystem.

This report is available to members.