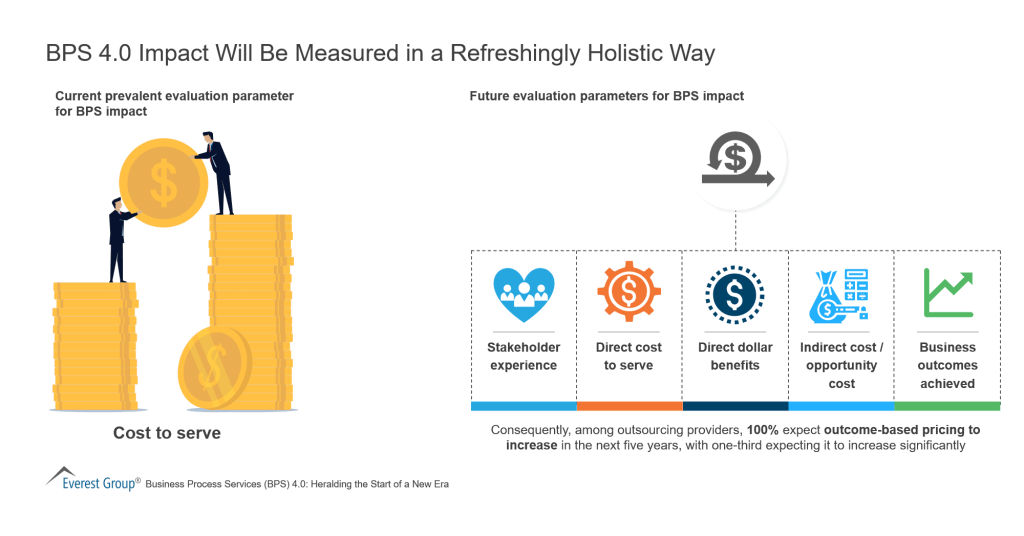

A deeper look at outcome-based pricing models

While the current percentage of outcome-based pricing models is small, the model is well-suited for engagements where the majority of work is transactional in nature, the client wants pricing clarity and guarantees, and the service provider has no explicit motivation to improve performance beyond service levels.

In fact, we believe that the transition to these as-a-service models is both critical and inevitable for enterprises with engagements matching these criteria, which exceed 15% of our database. Why?

- They ensure enterprises pay for deliverables, not for time

- They are more closely tied to enterprises’ business activities, as they provide flexibility and visibility into the expected spend

- They allow enterprises to remain engaged at a strategic level, without worrying about day-to-day responsibilities

- Since the pricing is delinked from the underlying number of FTEs, process improvements are driven by the service provider’s motivation to reduce internal costs and improve margins

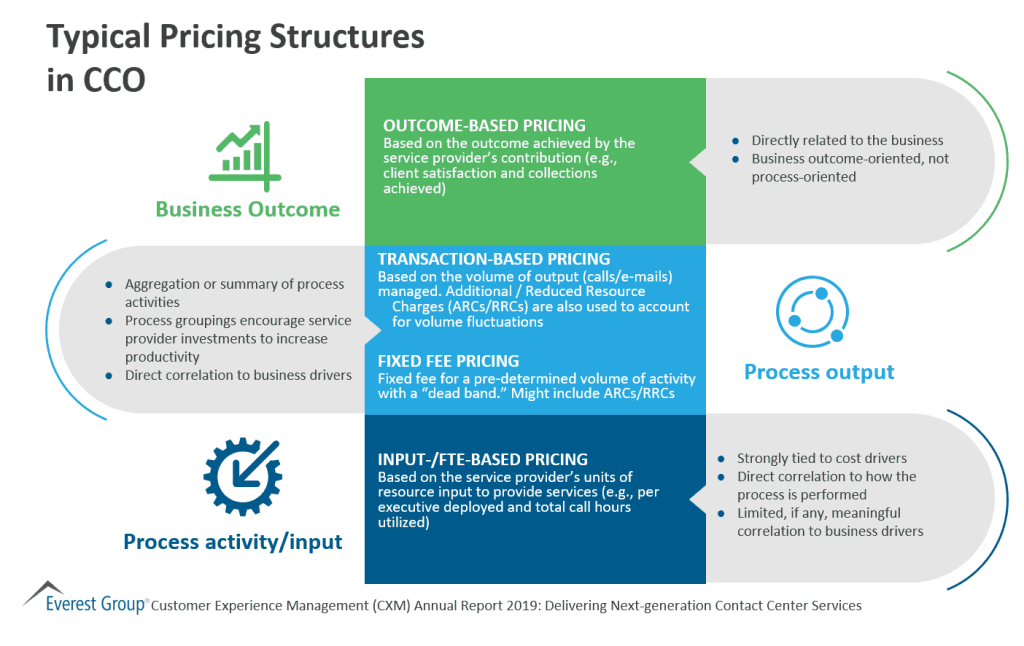

At the same time, outcome-based pricing models pose different types of challenges than other types of contracting options, and enterprises must be prepared to address them to achieve success. For example:

- Due to their fairly complex structure, these contracting models require sophisticated governance and strong due diligence

- They are not easily benchmarked because to ensure an apples-to-apples comparison, the benchmarking exercise needs to normalize for all the underlying environmental characteristics

- In multi-vendor environments where there are more dependencies, moving to output- or outcome-based models may increase costs as providers bake the higher risk into their fees

Most enterprises going down the outcome-based pricing model path will be best served by phasing in the adoption. Doing so will help enterprises reduce risks and enable them to appropriately update their systems to create and put in place sufficient governance mechanisms for the new contracting regime.