The Evolving Role of Retail and CPG Shared Services Centers | Blog

Over the past few years, India has emerged as an attractive destination for both the expansion of existing shared services centers – or Global In-house Centers (GICs) – and new GIC setups by retail and CPG enterprises. This change is due largely to access to skilled talent, especially for digital services, and the relatively low operating costs. Today, India accounts for 20-25 percent of offshore retail and CPG GICs, of which roughly 50 percent were set up in the last five years.

While these GICs initially focused on the delivery of services such as IT, HR, F&A, and contact center, the need for digital integration to obtain faster results and innovation is driving retail and CPG GICs to help deliver core operations by leveraging next-generation technologies such as AI, advanced analytics, and automation.

In recent years, India-based retail and CPG shared services centers have started to deliver complex, judgment-intensive work such as sourcing and procurement, merchandising and inventory planning, sales and marketing, supply chain and logistics, and customer experience management; this work was earlier managed in-house by enterprises themselves.

In fact, best-in-class GICs have been aggressively pushing the envelope by building capabilities to deliver niche/complex processes for core operations. For instance, an American multinational CPG that set up its GIC in India in 2019 focuses only on the delivery of core services such as consumer science, packaging, and product development from the facility.

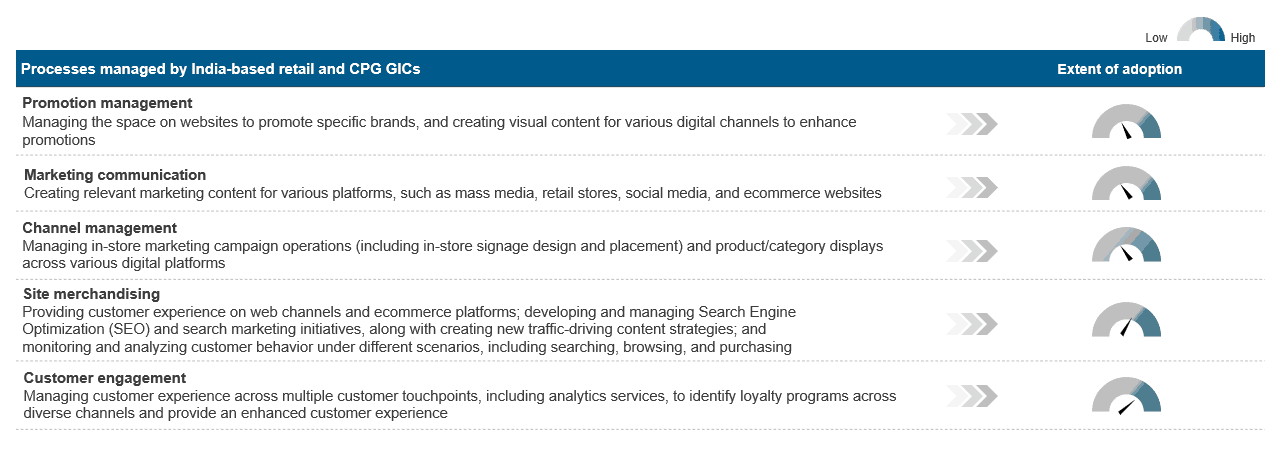

And that’s only one among many examples of enterprises leveraging shared services centers to deliver core functions. In the sales and marketing function, for example, India-based retail and CPG GICs are delivering some of the most niche/complex processes within the function. Here’s a look at these processes and the extent of GIC adoption for process delivery.

As you see, India-based centers are increasingly delivering processes like customer engagement and site merchandising, and there’s significant delivery potential for processes such as promotion management, marketing communication, and channel management.

Of course, the availability of skilled talent is key for the successful delivery of these core processes from India. Even when most companies globally face an acute talent shortage, best-in-class India-based GICs have been quick to scale up niche talent to deliver both core operations and digital services by hiring resources from adjacent industries. For instance, an American retailer’s shared services center has hired employees with TV, visual media, and digital content experience from the domestic advertising industry to support less-adopted processes such as promotion management and marketing communication. The GIC plans to establish structured upskilling programs to familiarize these new hires with global delivery operations.

Over the coming years, we expect this trend of GICs delivering core operations to continue and, in fact, increase significantly. Doing so will drive accelerated innovation, as the centers’ talent will have the advantage of deeper business context.

To learn more about the growing synergies between enterprises and GICs, please reach out to Bharath M or Ranjith Reddy.