Consulting Services

Since Wipro’s March 4, 2021, announcement to acquire Capco, the London-based global management and technology consultancy that provides digital, consulting, and technology services to financial institutions, for US$1.45 billion, reaction has been mixed as to whether it will deliver the synergies and earnings growth Wipro expects. However, Wipro’s consulting-led offerings matched with Capco’s digital capabilities appear to be poised to deliver a powerful, end-to-end service for clients.

Here’s our take.

Wipro, a leading, India-based global IT, consulting, and business process services company, has acquired numerous companies in the last few years, such as Appirio for cloud services, Opus CMC for the mortgage industry, Designit, Syfte, and Cooper for design thinking and strategy, and International TechneGroup (ITI) for its industrial and engineering services. The Capco deal, which is expected to close at the end of June, stands apart from the other acquisitions not only because it’s Wipro’s largest to date but because it will greatly improve Wipro’s digital offerings in the BFS space, Wipro’s largest business unit. This will narrow the gap between Cognizant, Infosys, and TCS, Wipro’s three biggest competitors in the BFS arena.

Also, in 2020, digital contributed to nearly 40 percent of Wipro’s total revenue, making Capco’s digital capabilities integral in positioning Wipro as one of the market leaders.

The Wipro/Capco acquisition will deliver improved benefits to clients, including:

Large-scale acquisitions are not new to Wipro or the BFS industry; however, success from such high-value acquisitions are not always guaranteed. It is, therefore, no surprise that this announcement was received with mixed reactions and speculation from the market as to whether it will deliver the synergies and earnings growth that Wipro has promised.

Overall, we remain optimistic about the deal and believe this acquisition will equip Wipro to better solve BFS clients’ challenges through Capco’s future-ready digital capabilities. Most importantly, the acquisition is complementary in nature and will help Wipro gain scale, speed, and stature.

Wipro’s consulting-led services, together with Capco’s digital capabilities, will provide more meaningful end-to-end long-term support to clients. It would not be surprising to see similar deals coming up across various segments of BFS with the aim of providing bundled offerings, as products lose their charm when offered on a standalone basis. Complementing service offerings with consulting-led delivery capabilities is being seen across various BFS industries, including mortgage and FCC. These capabilities are being acquired not just through acquisitions but also through partnerships, such as the recent one between Genpact and Deloitte in the financial risk and compliance domain.

Though this trend witnessed a slow start, especially for the Indian IT firms, it looks promising and rewarding in the long run and is only expected to gain momentum. Through end-to-end consulting and digital service offerings, enterprises get access to a compelling combination of digital talent at scale with a consulting-led delivery approach, which helps achieve greater business value and gains.

Generally, the value addition to enterprises entirely depends on the speed at which service providers can utilize the enhanced breadth and depth of their offerings post-acquisition. Having said this, the key to achieving significant value addition for both Wipro and Capco’s clients would eventually lie on smooth integration and flawless execution.

For the returns to outweigh the risks, a superior execution policy needs to be in place. The key to inspiring its BFS clients will be to align consulting, design, build and operate capabilities around solving some of the industry’s biggest challenges. For BFS clients, this is namely modernizing legacy systems, providing innovative product and service offerings, ensuring a delightful customer experience, and effectively managing the ever-evolving regulatory landscape. For Wipro’s enhanced capabilities to be successful, it should help reinvent the client’s journey through a rare combination of consulting-led digital transformation.

We would love to hear your thoughts on this acquisition and or others that are following the same trend, reach out to [email protected].

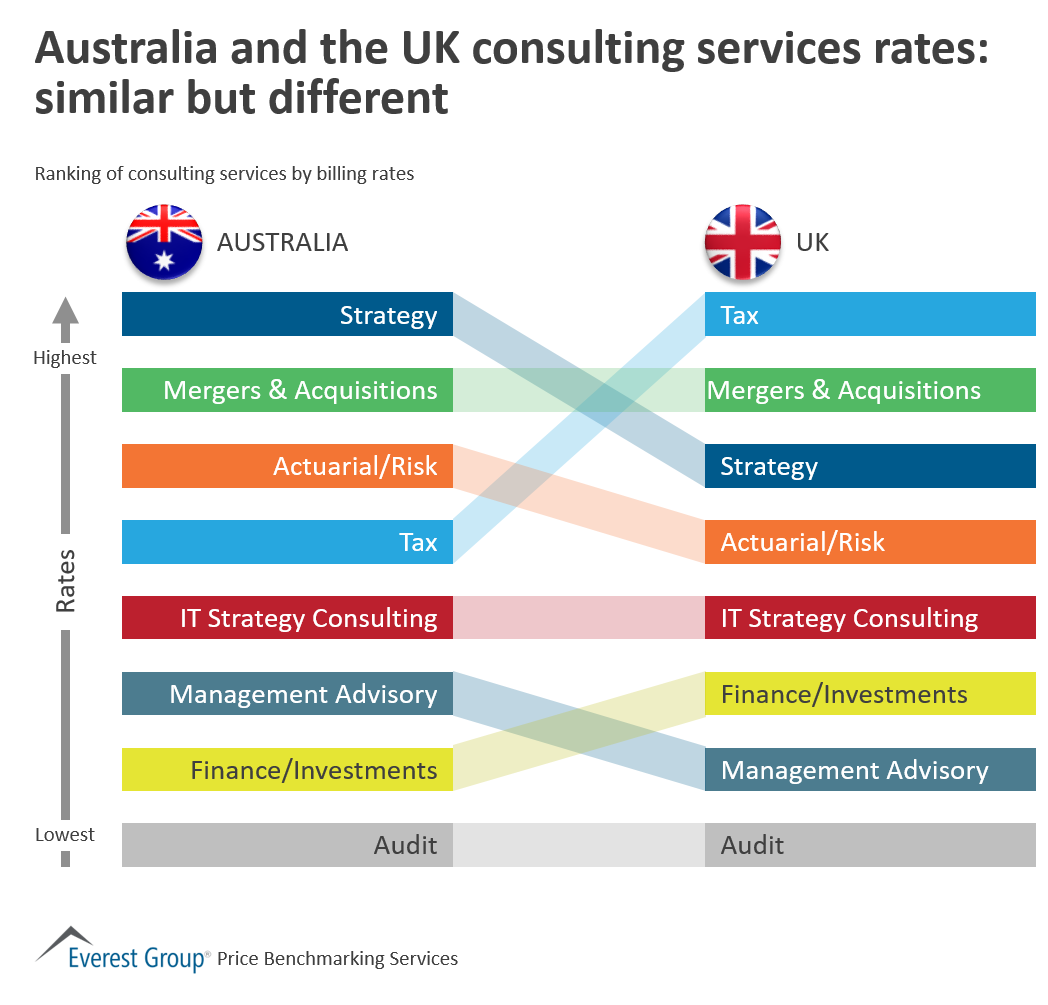

Australia and the UK consulting services rates: similar but different

As applications portfolios become more complex, enterprises seek external support to help manage them

Former Concentra, Salesforce executives bring wealth of experience in developing IT strategies that drive cost optimization, revenue growth and business transformation.

Everest Group—a consulting and research firm that has served 120 Fortune 500 companies and a total of 1,230 enterprises around the world in the past three years alone—today announced the addition of two seasoned professionals to its team. Stephen Chen, formerly chief of staff for the CIO at Concentra, and Matthew Strickler, who previously served as director of transformation consulting at Salesforce, have joined Everest Group as associate partners.

Everest Group CEO and founder Peter Bendor-Samuel said these additions to the consulting team reflect Everest Group’s growth and commitment to delivering results for its global clients. “Our clients throughout the world rely on Everest Group’s global consulting practice to deliver impactful services,” said Bendor-Samuel. “That requires a team of highly experienced professionals who have a track record of shaping profitable, market competitive and transformational business strategies. Stephen Chen and Matthew Strickler bring that uncommon expertise to Everest Group.”

Chen, based in Dallas, brings 20 years of extensive industry and consulting experience to Everest Group. He specializes in corporate restructuring and optimizing SG&A (selling, general and administrative) expenses. His consulting expertise includes IT strategy, business transformations—including IT organization redesigns, service delivery and IT process improvements—and outsourcing.

During his tenure at Concentra, Chen oversaw an US$80 million annual IT budgeting and planning process. He developed and implemented an enterprise portfolio management function designed to align business strategy with strategic initiatives and govern the enterprise portfolio. Chen also assessed Concentra’s IT functional maturity, implementing changes to improve delivery effectiveness and business portfolio alignment. Prior to that, Chen served as a principal in Booz & Company’s IT strategy group, where he spent eight years serving in client delivery and practice leadership roles. His engagements concentrated on IT strategies and functional optimizations, with a focus on health payors and financial services. Prior to Booz, he held various functional roles in supply chain management with Shell Oil Company.

Strickler, also based in Dallas, specializes in spearheading change across client organizations, driving operational improvements with a bottom-line impact, and identifying and assessing investment opportunities. With more than 20 years of global experience spanning multiple industries, his expertise includes helping businesses in the technology sector identify growth and profit opportunities, scale their organizations, and transform their sales capabilities

While at Salesforce, Strickler served a lead role in developing strategic offerings to drive customer-centric transformation. He also developed a more robust and integrated annual planning capability that resulted in significant increases in revenue, headcount, and contribution margin. Prior to that, Strickler served as senior director of operations and strategy of the cloud services business at Hewlett Packard, where he played a key role driving progress for a new web services business model and scaling the organization from inception to private beta launch. Previously, Strickler spent six years at the Boston Consulting Group advising senior executives on growth strategies, assessing merger and investment opportunities, post-merger integration and transformational business models.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields