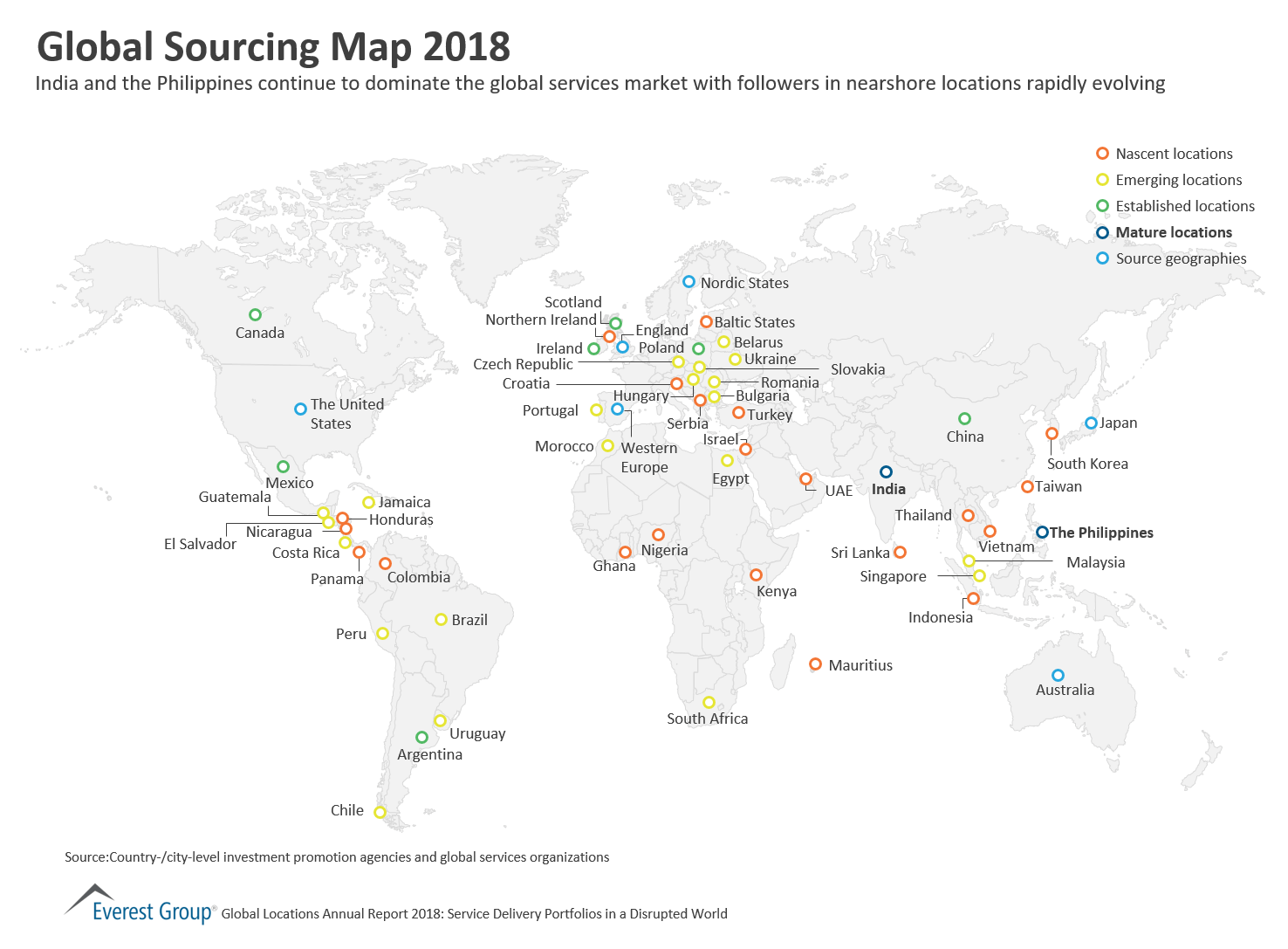

Global Sourcing Map 2018

India and the Philippines continue to dominate the global services market with followers in nearshore locations rapidly evolving

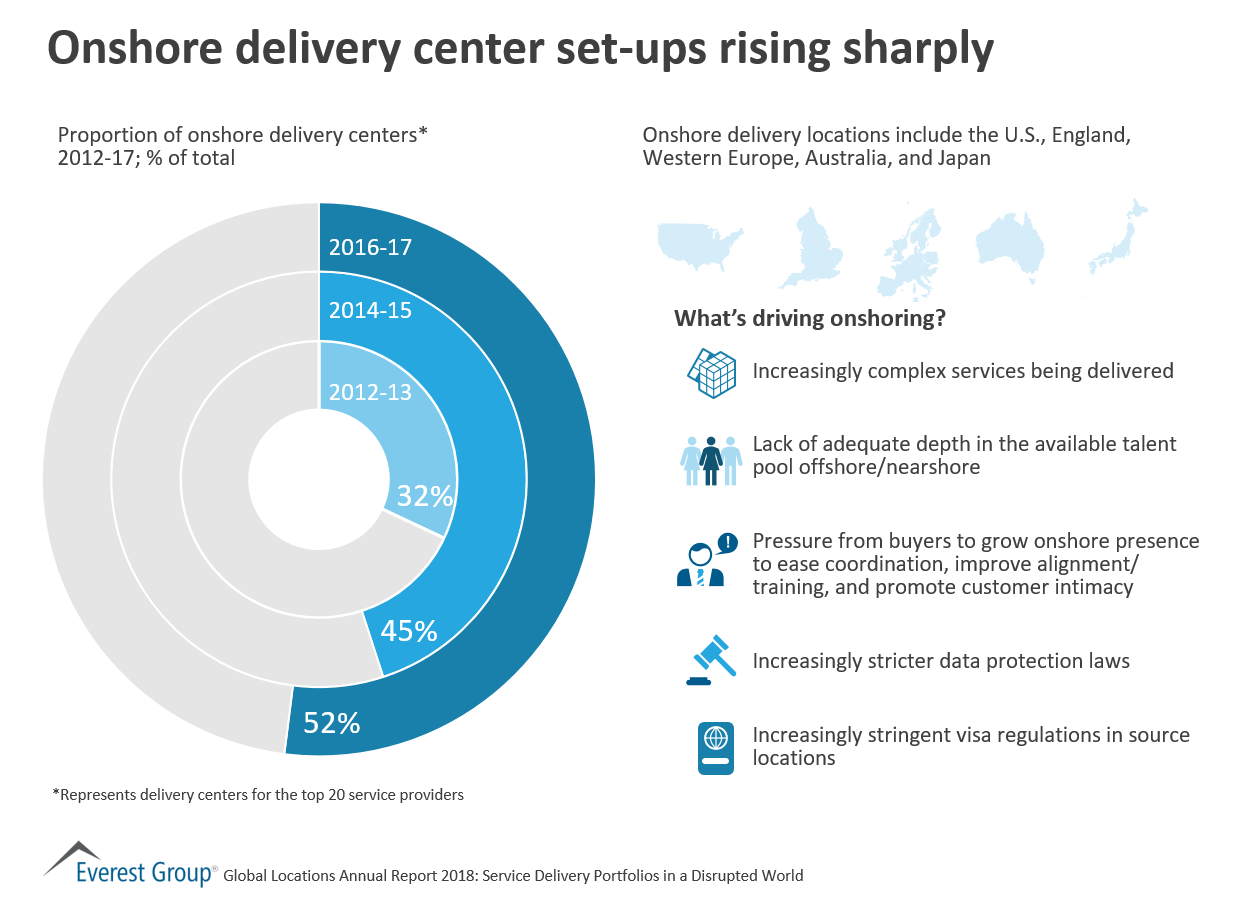

Onshore delivery center set-ups rising sharply: Onshore delivery locations include the U.S., England, Western Europe, Australia, and Japan

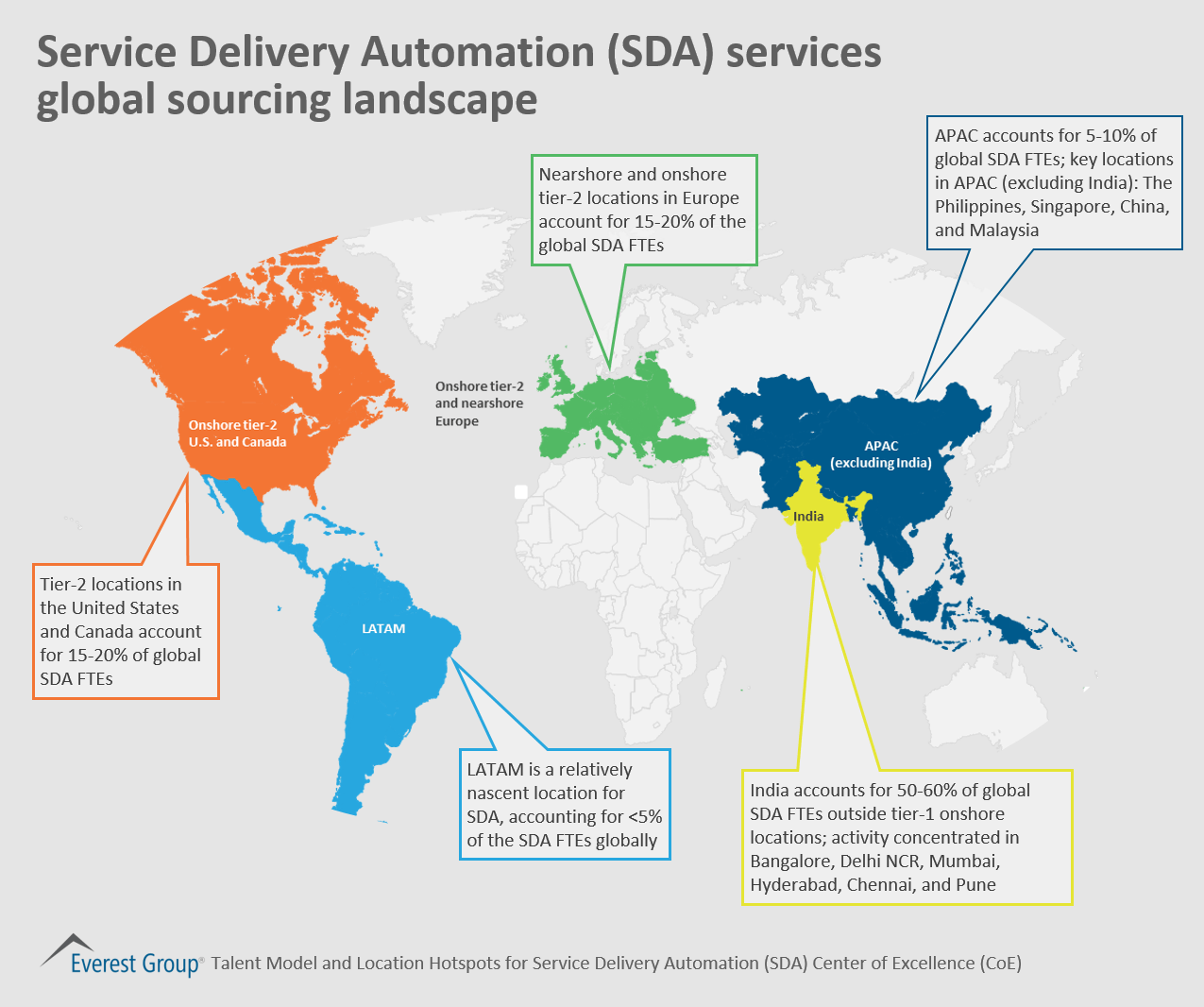

Service Delivery Automation (SDA) services global sourcing landscape: Nearshore, onshore, and tier-2 locations in focus

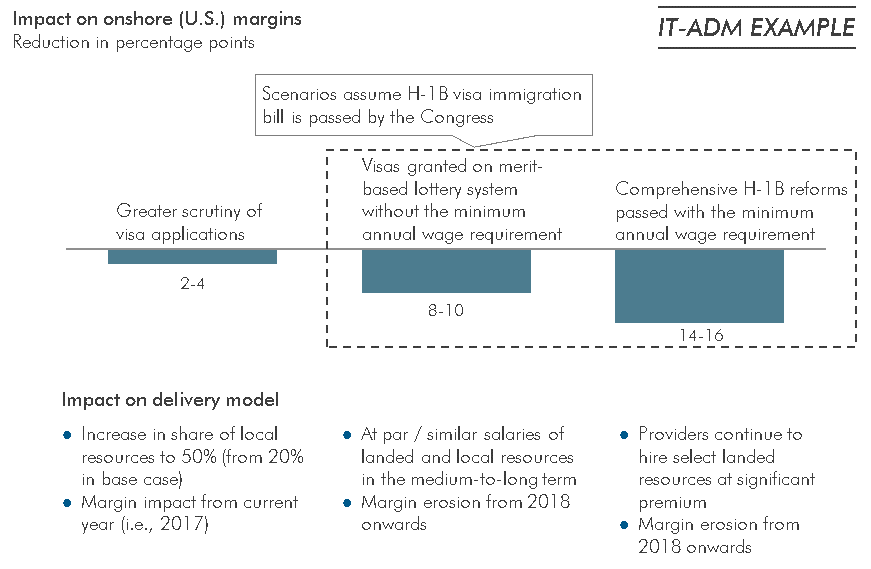

On 25 April 2017, U.S. President Donald Trump moved one step closer to instituting new regulations for granting H-1B visas. At the same time, many IT service providers – especially those of Indian-heritage –moved one step closer to realizing their worst fears! The threat of visa reforms became real when President Trump ordered an inter-departmental review of the H-1B visa program, which would ensure formulation of regulations for hiring only the most skilled or the most highly-paid professionals and “would never replace American jobs.”

While it is universally acknowledged that a stricter visa regime will negatively impact most service providers’ onshore margins, particularly the offshore-centric providers that follow the “landed” resource model (i.e., a delivery model that hires resources from offshore centers to work in the U.S.,) it is important to examine the true nature of this impact. The exhibit below indicates the possible impact on onshore margins under various visa reform scenarios.

Even in a situation where the visa reforms do not translate into full-fledged regulation (the most ideal scenario for Indian-heritage service providers) we expect far greater scrutiny of H1-B visa applications, leading to fewer visa grants. Even in this scenario, we expect more onshore hiring by IT service providers to meet their talent requirements, leading to reduction of service provider margins by 2-4 percentage points.

The probability of the above happening has become more dubious, given recent developments, and it is highly likely that visas will be granted based on either skills/merit or minimum wage requirements of US$130,000. In either case, service providers will need to hire a much higher share of local resources. This further complicates the situation for Indian-heritage providers, as they have a smaller foothold in the U.S. talent market than do the global providers. Whether Indian-heritage or global, hiring landed resources at some/all levels of the delivery pyramid at the minimum salary levels of US$130,000 could drop service provider margins by as much as 14-16 percentage points, resulting in negative returns on onshore deals, at least in the short-term.

While none of the scenarios paint a rosy picture for service providers, the impending visa reforms may act as a catalyst for them to develop more automation solutions and front-end technology products and restructure their talent hiring and value proposition. Interestingly, while onshore resources will increase in U.S.-based contracts, the overall portfolio-level offshore ratios may also marginally increase with providers pushing the offshoring lever to protect their overall margins.

Everest Group has simulated the potential impact on onshore margins using key input variables around existing cost structures, rate cards, staffing pyramid, and onshore-offshore resource mix. Please see our viewpoint on the above topic: “Impact of Changes to H-1B Visa Program on Service Provider Margins” for more details.

The topic of productivity differences in contact center locations has always been of interest to enterprises, GICs, and service providers. In the last few months, there has been a significant increase in firms’ interest in leveraging an integrated global delivery model across offshore, nearshore, and onshore locations for their contact center needs. In addition, the looming prospect of higher barriers to offshoring/nearshoring is also shifting focus from a labor arbitrage model to one of productivity gains.

Against this backdrop, Everest Group conducted targeted research to assess relative differences in contact center productivity across locations, using agent efficiency as a proxy for productivity.

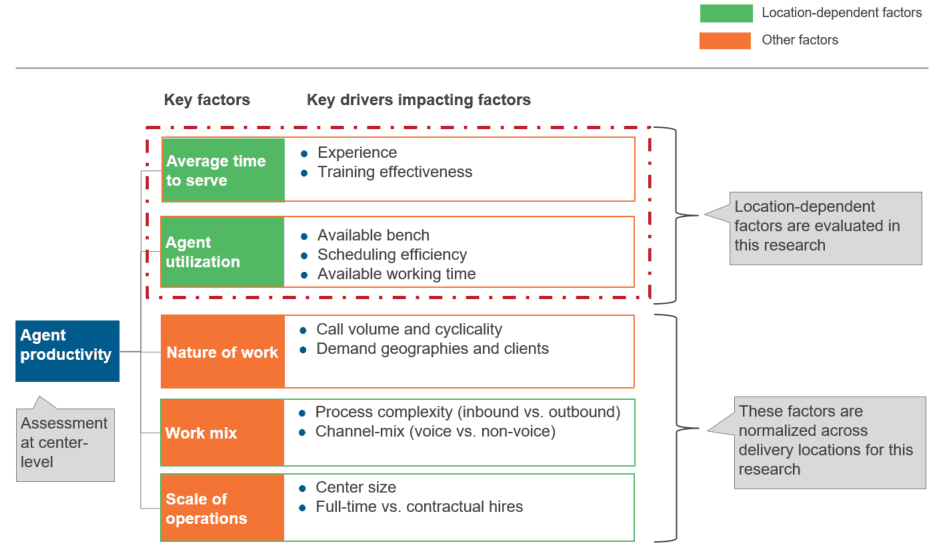

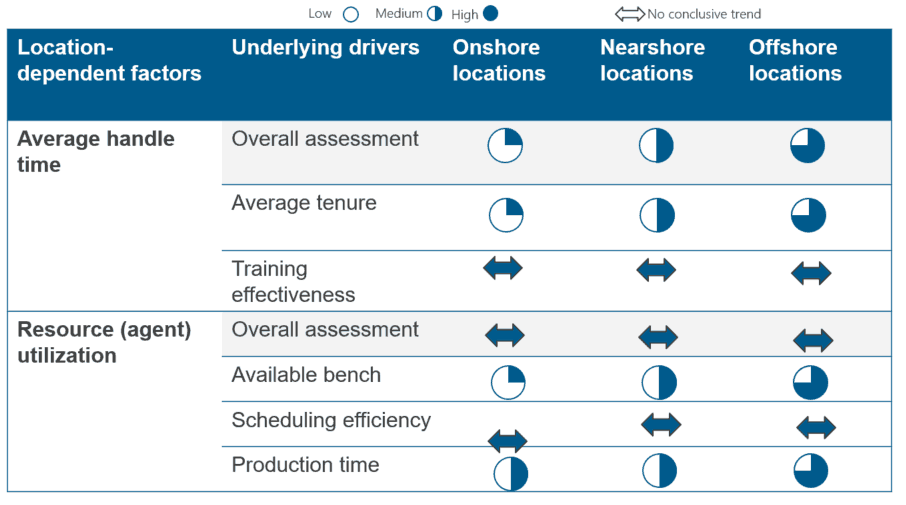

Our research uncovered an interesting finding: while there are location-specific variations, agent productivity does not consistently vary by location category (i.e., onshore versus offshore/nearshore). While agent productivity is influenced by multiple factors, only two – average call handling time and agent utilization – are largely location-dependent. Even after normalizing for other factors such as nature of business, work mix, and scale of operations, there is no evidence to suggest that productivity is higher in onshore locations than in offshore/nearshore locations.

The reason that productivity variations are not location specific is that both average call handling time and agent utilization are, in turn, impacted by drivers that largely do not vary consistently across location category. For example, both scheduling efficiency and training effectiveness are influenced more by center-specific policies and work environment than location category. Thus, it’s the interplay of these and multiple other drivers, which often negate and counterbalance each other, that are the key contributors to productivity variations, not the locations themselves.

These findings have some important implications for firms:

For a detailed analysis of this topic, please see our viewpoint entitled “Are There Productivity Differences across Contact Center Locations?”

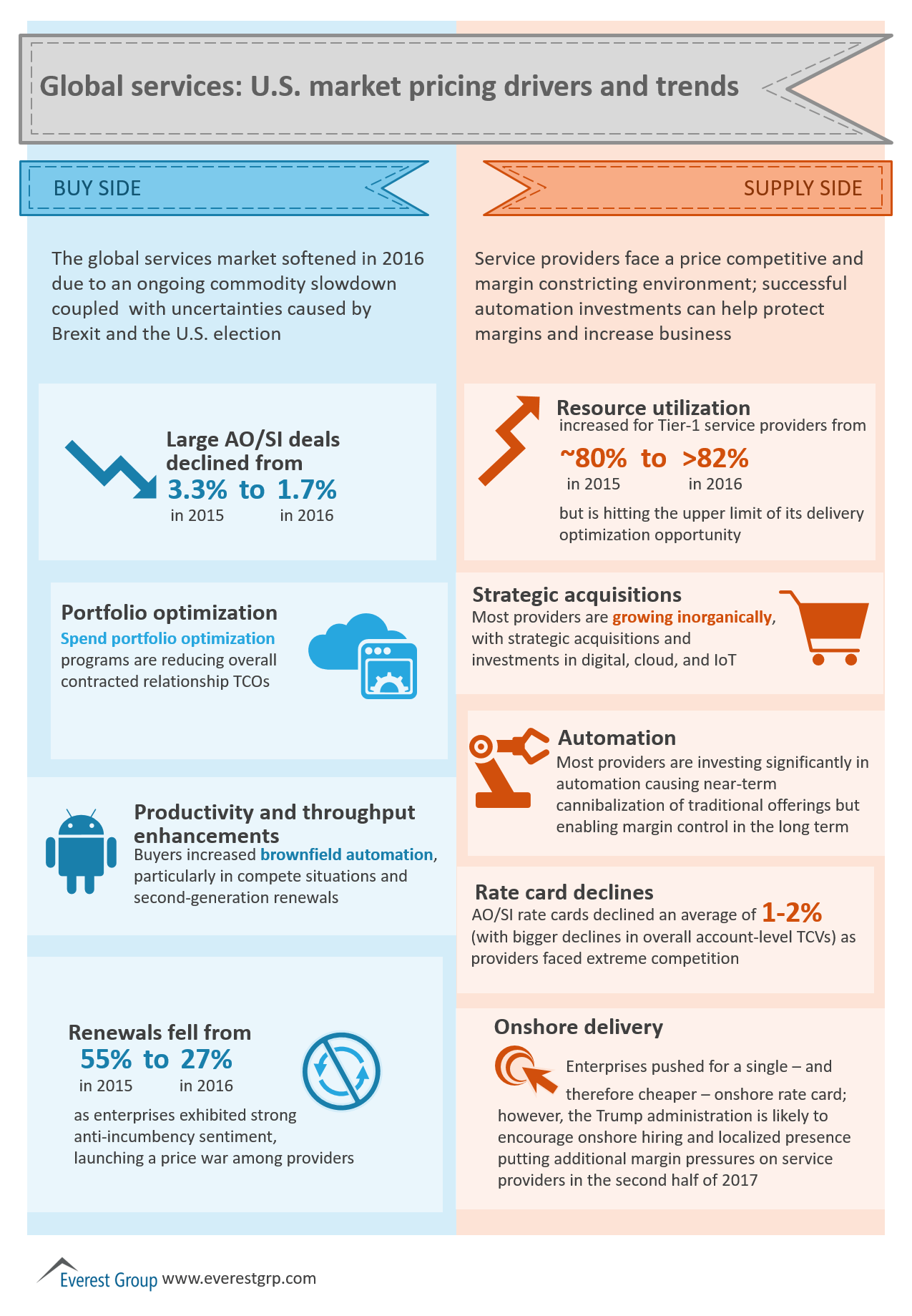

Buy- and supply-side drivers and trends of U.S. global services market trends

Recently, corporate developments, such as management changes, corporate governance, and investor activism across Indian IT service providers, have bombarded the investor community. Many investors perceive the initiatives taken by these companies to be a watershed moment in their histories.

Furthermore, with next generation automation, digital services, artificial intelligence (AI), and other disruptors creating massive, requisite, and unavoidable change in the IT services industry, investors and service providers are in increasingly opposing schools of thought. However, many of the investment firms we work with struggle to correlate these developments with their investments and returns.

Given the scale of the IT industry and the pace of disruption happening in the entire ecosystem, it’s valuable to take a few minutes to dissect and analyze the situation.

Growth vs. profitability equation – digital arbitrage vs. labor arbitrage

For the past two decades, Indian IT service providers have reported a stellar net profit margin in the range of 18-25 percent. The business grew on the investments made in human resources. The players achieved impressive returns primarily due to their grip on labor arbitrage. The investor community embraced the stocks, and experienced significant returns. For instance, an investment of US$350 in one of the top Indian IT service providers in 1992 would have yielded US$377,643 in 2015!

The emerging IT services model – driven by digital disruptors – gives little emphasis to labor arbitrage or the providers’ earlier factory model, and instead focuses on innovation and value creation for enterprises that extends far beyond greater efficiency. Not many IT service providers have demonstrated a mindset aligned to these new requirements. They are still hesitant to loosen their noose on profitability, as they set investor expectations very high with their earlier business model.

What is bothering investors?

Investment firms we work with believe that most disruptive technologies will drive lower profitability for Indian IT service providers likely in the 8-15 percent net profit range. They also believe that technology disruption will not allow the same level of offshoring as before, and will further erode profitability.

As most of the Indian IT service providers have zero debt and own huge piles of cash, investors think they should receive distributions in the form of dividends. Their demand is stronger when they learn the providers are going to invest in low-margin digital businesses, as they believe they will not receive the optimal reward they are due.

A twist

Believing that the market is undervaluing their stocks, IT service providers are planning share buybacks, spinning them as a way to reward shareholders. However, they actually plan to reduce tax leakages caused by dividend distribution, as Indian tax law stipulates they pay a 15 percent Dividend Distribution Tax (DDT) on dividends paid. Additionally, the share buybacks help them increase their control over the company.

What is the reality?

Both these opposing schools of thought fail to think in the long term.

Investors looking for dividends aren’t acknowledging Berkshire Hathaway’s theory of dividends. If a business can deliver promising returns in the long-run, dividends act as a negative catalyst for growth. In an attempt to pacify their investors, most of whom are technology novices, most Indian IT service companies are relabeling their old offerings as “digital.” Instead of dividends, investors need to ask IT service providers’ leadership tough questions on how they plan to use their large cash piles relative to their IP, platforms, acquisition, talent development, and client relationship strategies. How do they plan to differentiate in this crowded market? When large-scale offshore development centers fail to provide the needed competitive advantage, what does their armory contain to create shareholder value?

The way in which IT service providers are surrendering to investor pressures gives the impression that they are not willing to utilize their cash for digital technology investments. This in turn reinforces the popular opinion that Indian IT service providers are not confident enough to tide over the current transition. That some of the providers are distributing cash instead of putting the money in beneficial investments is making some market observers uncomfortable.

Furthermore, if the providers are not planning to distribute cash, they must ensure that they use the money for useful investments rather than just share buybacks. This is a win-win situation, as the providers get a boost to their topline and ability to endure the current business transition, and shareholders get maximized wealth in the long term. Net-net, firms that invest wisely are going to withstand the changeover, while those that use their cash piles to temporarily shut out investors are likely to witness a tough time.

Are these companies capable of implementing the business model?

As the adage goes, easier said than done. Although service providers are vocal about re-skilling employees opening onshore centers focused on digital services, the viability of these initiatives are questionable. The majority of these companies have amateur design thinking capabilities, and their DNA is around supplying people, not innovation and strategic partnerships. Indeed, in our recently published report “Customer (Dis) Satisfaction: Why Are Enterprises Unhappy with the Service Providers,” enterprises only gave providers a score of five out of 10 on their strategic partnering abilities.

Only time will tell whether service providers made the right move in distributing cash or investing in low-margin businesses.

The global sourcing industry has seen a surge in setup activity in onshore location in recent years, according to outsourcing consultancy and research firm Everest Group.

After seeing significant declines in onshore location expansion in 2013 and 2014 due to a global slowdown, the percentage of new onshore versus offshore delivery locations among the top 20 service providers rose from 45 percent in 2014 to 52 percent during 2015 and the first half of 2016, according to Everest Group. That brings the proportion of onshore locations to an unprecedented high in the industry.

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields