Healthcare Payer

VIEW THE FULL REPORT

Healthcare Payer

VIEW THE FULL REPORT

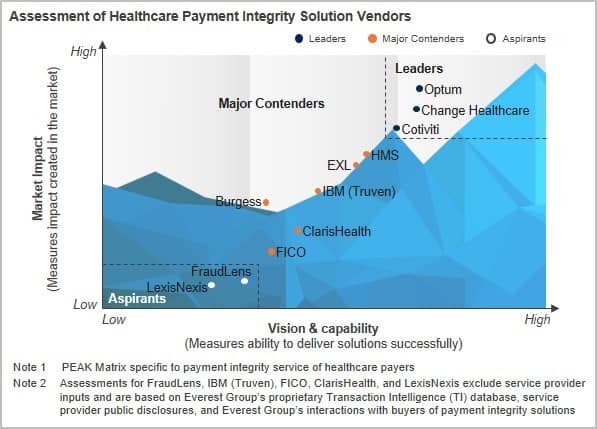

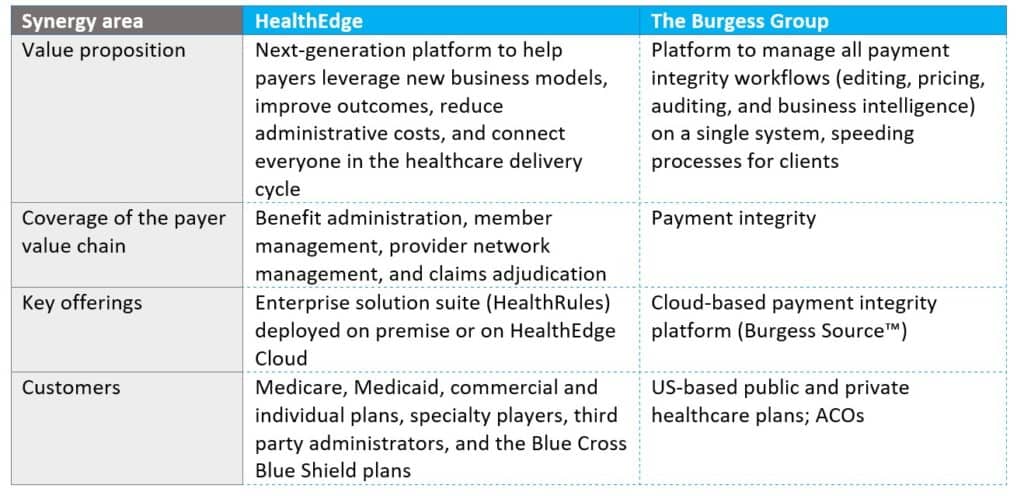

On July 21, 2020, HealthEdge announced its acquisition of The Burgess Group, which we recently recognized as a Major Contender on our Healthcare Payer Payment Integrity Solutions PEAK Matrix™ Assessment 2020.

Here’s our take on this deal.

The strategic intent behind the deal

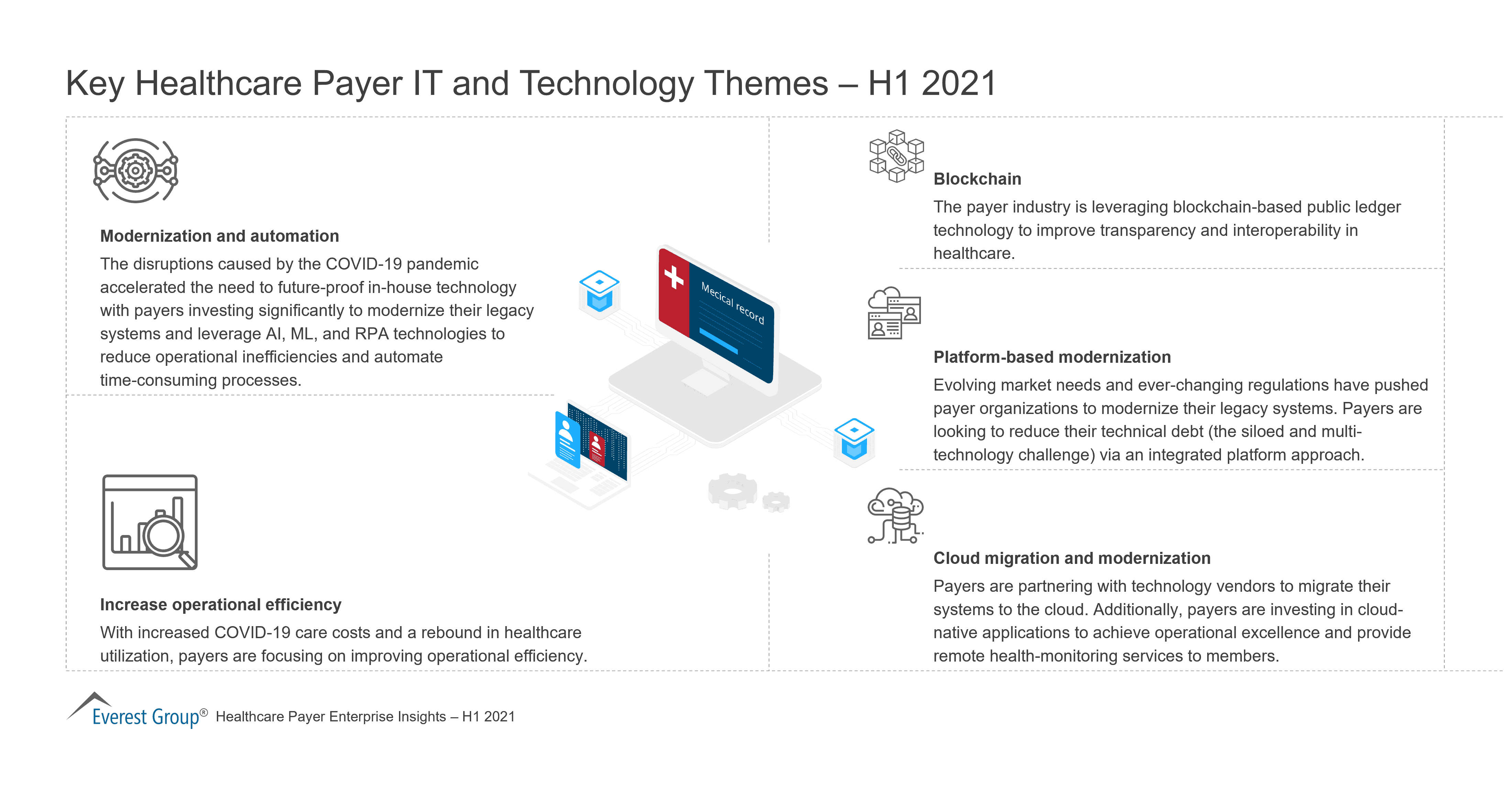

The healthcare payer industry is plagued with notoriously old infrastructure. While healthcare payers are working to increase data transparency, offer member-centric solutions, and adopt a value-based care model, they’re obstructed by high reliance on dated, disconnected, and non-interoperable systems. Cost management is another endemic issue impacting the payer industry. One of the key reasons for this financial distress is the high share of expenditure on administrative costs in the US healthcare system, driven by redundant processing and limited automation. To address these roadblocks, payers are increasingly leveraging a core-admin platform approach.

The interesting fact here is that medical costs account for 80-85 percent of the total payer cost, while only 15-20 percent are admin and IT costs. Payers leave a lot of value on the table when they manage these costs separately. Payment integrity is one of the principal tools to manage medical costs and, hence, is a key functionality that payers value in core-admin platforms. By adding The Burgess Group’s offerings to its own expertise, HealthEdge’s goal is to create an integrated claims processing, payment integrity, and adjudication platform that addresses both administrative and medical expenses.

Another point worth noting is that Blackstone completed the acquisition of a majority stake in HealthEdge in April 2020, giving HealthEdge the financial muscle it required to make the right investments to expand its product offerings and compete with the other big players such as Cognizant (TriZetto), HM Health Solutions, Mphasis, and NASCO.

Unpacking the companies’ synergies

The acquisition offers several synergies.

Ram Jagannath, global head of healthcare at Blackstone Growth and chairman of HealthEdge, has stated that the acquisition of Burgess is a great strategic fit for HealthEdge to enter the large, high-growth payment integrity market, helping address the estimated $1 trillion in wasteful spending in the US healthcare system.

We are positive about this deal, particularly for what it means to the market and current market demand. However, it remains to be seen how HealthEdge leverages this investment, while also mitigating the major concerns that enterprises cite around using platforms, including integration, interoperability, scalability, and user experience.

Platforms that can address medical costs while encouraging data-driven process efficiency are generating growing interest in the market. If HealthEdge can partner with payers to create tightly knit contracts with strong risk mitigation and guaranteed savings clauses, this comprehensive platform can unlock tremendous value for payers. We’ll be tracking this one closely.

Reach out to me at [email protected] with your thoughts on this acquisition or the market in general.

ITO and BPO to grow steadily as healthcare payers play catch-up on digital solutions to navigate industry convergence and a shift in focus from B2B to B2C

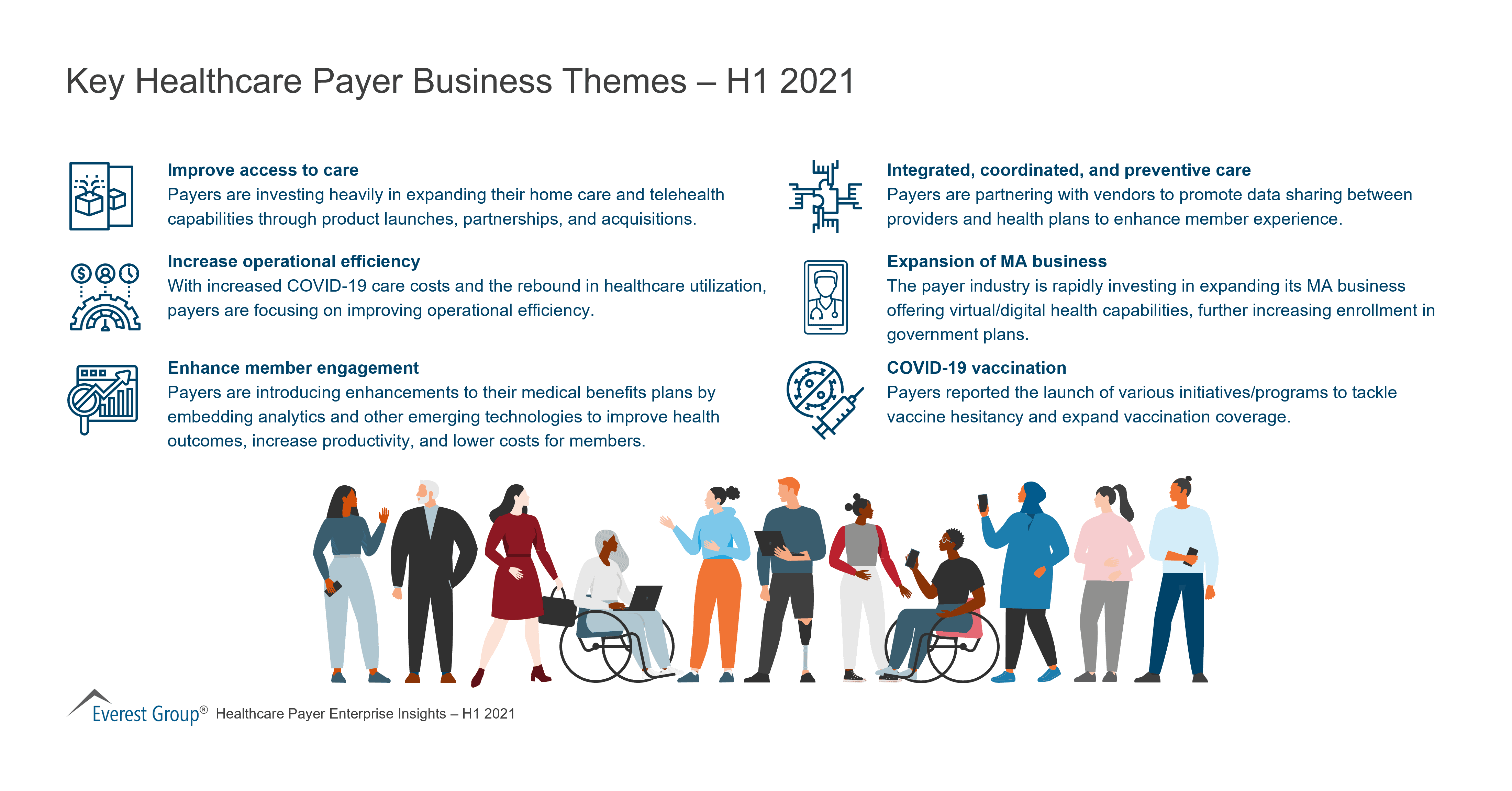

Healthcare is lagging behind other industries in adopting digital strategies, but radical changes in the marketplace—such as the advent of Walmart and Amazon as players in the space and the disintermediation of Pharmacy Benefit Managers (PBMs) like Express Scripts and CVS—are cultivating a fertile field for digital solutions.

Everest Group describes the current healthcare market as a shape-shifting industry, with once disparate players in the market—payers, providers, PBMs and pharmaceutical companies—converging, and the focus of healthcare payers shifting from business-to-business (B2B) to business-to-consumer (B2C). To successfully navigate these industry shifts, healthcare payers must adopt radically different, technology-based approaches to the way they serve members, reimburse providers, operate their internal systems, and adapt to changes in government regulations and programs, according to Everest Group.

“Take the typical healthcare payer’s internal IT systems and processes, as just one example,” said Abhishek Singh, practice director at Everest Group. “They are plagued with disparate information systems, fragmented member information, legacy IT burdens, insufficient transparency in financial records, and inflexible, manual processes. The need of the hour in this regard is systems integration, data standardization and homogenized processes. For this reason, we expect the healthcare payer IT-BPS market to grow 8 percent by 2020.”

In its recently published report, Healthcare Payer Annual Report: Payers Look at Digital to Reinvent in a Turbulent Healthcare Market, Everest Group examines in detail the myriad changes impacting the healthcare and life sciences market and describes specific steps healthcare payers need to take in four key areas to be future ready.

“We will see payers relying on sourcing partners to address data flow and integration; the adoption of digital levers such as mobility, cloud automation and analytics; and process standardization and reengineering,” said Singh. “These technology and operations mandates will be the key factors that determine whether payers’ are able to successfully transition to a future-ready state.”

***Download a complimentary abstract of “Healthcare Payer Annual Report: Payers Look at Digital to Reinvent in a Turbulent Healthcare Market” here.***

©2023 Everest Global, Inc. Privacy Notice Terms of Use Do Not Sell My Information

"*" indicates required fields