Coronavirus Service Delivery Update | Blog

This is the third in a series of blogs that explores a range of topics related to these issues and will naturally evolve as events unfold and facts reveal themselves. The blogs are in no way intended to provide scientific or health expertise, but rather focus on the implications and options for service delivery organizations.

These insights are based on our ongoing interactions with organizations operating in impacted areas, our expertise in global service delivery, and our previous experience with clients facing challenges from the SARS, MERS, and Zika viruses, as well as other unique risk situations.

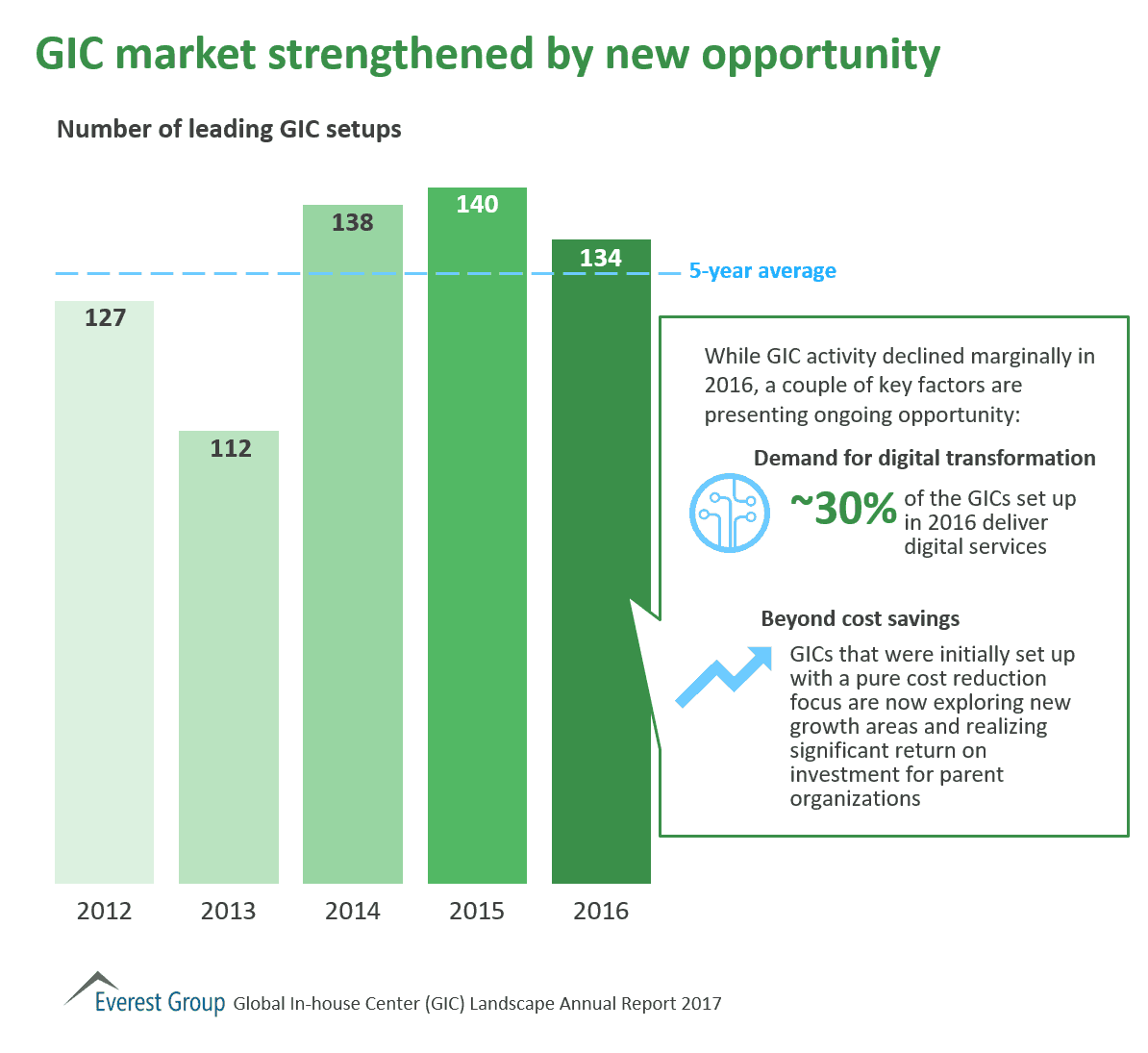

Over the past two to three weeks, media focus has shifted away from China, where the growth rate of new infections has slowed markedly. Hubei province remains the epicenter of the disease, but 8 of the 10 provinces that make up that core group of provinces where the disease has been most prevalent, have seen no new cases for several days. Hubei and the coastal province of Zheijang alone among the 10 are reporting new positive cases. There have been no public reports of service delivery interruption from any of the 44 Global In-house Centers (GICs) inside the core group of 10 provinces. Indeed, the last week has seen a steady return to work outside Hubei province.

The new global focus is on a group of high-risk countries including South Korea (Daegu and Cheongdo), Iran and Italy (specifically the whole of the north of the country and not just the provinces of Lombardy and the Veneto), and on a secondary group comprising Japan, Singapore, Laos, Thailand, Vietnam and Myanmar.

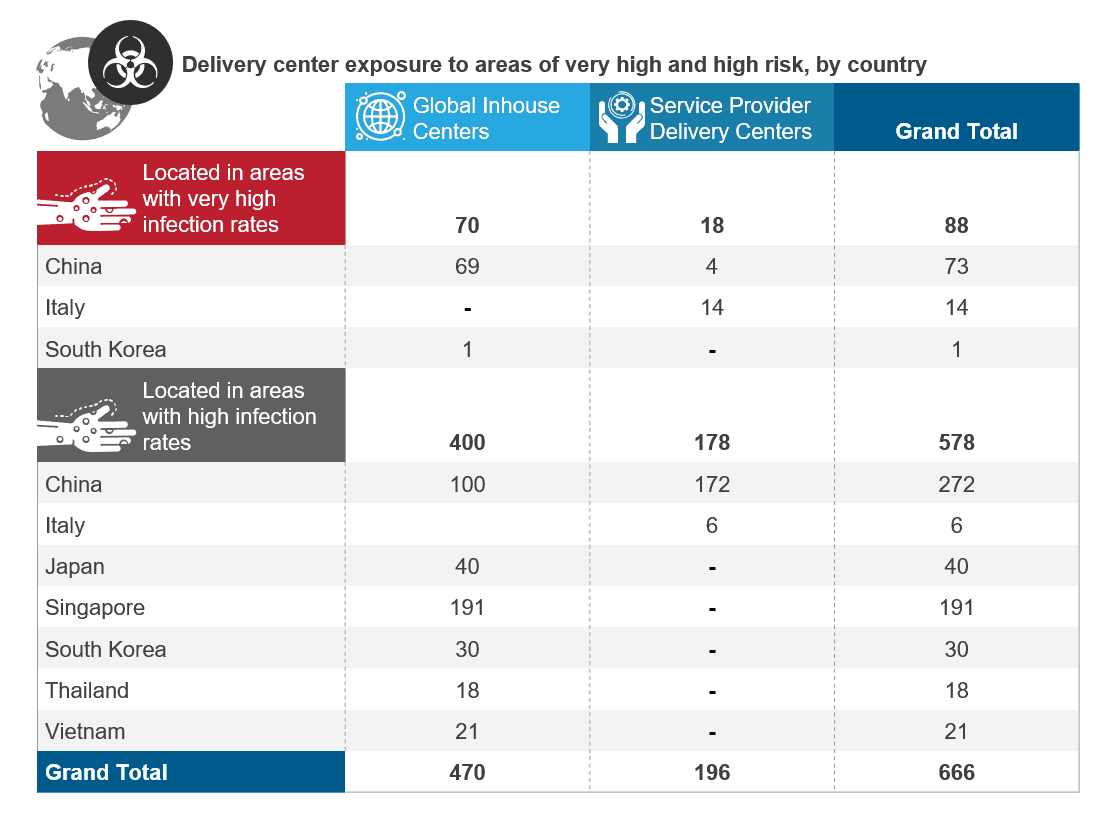

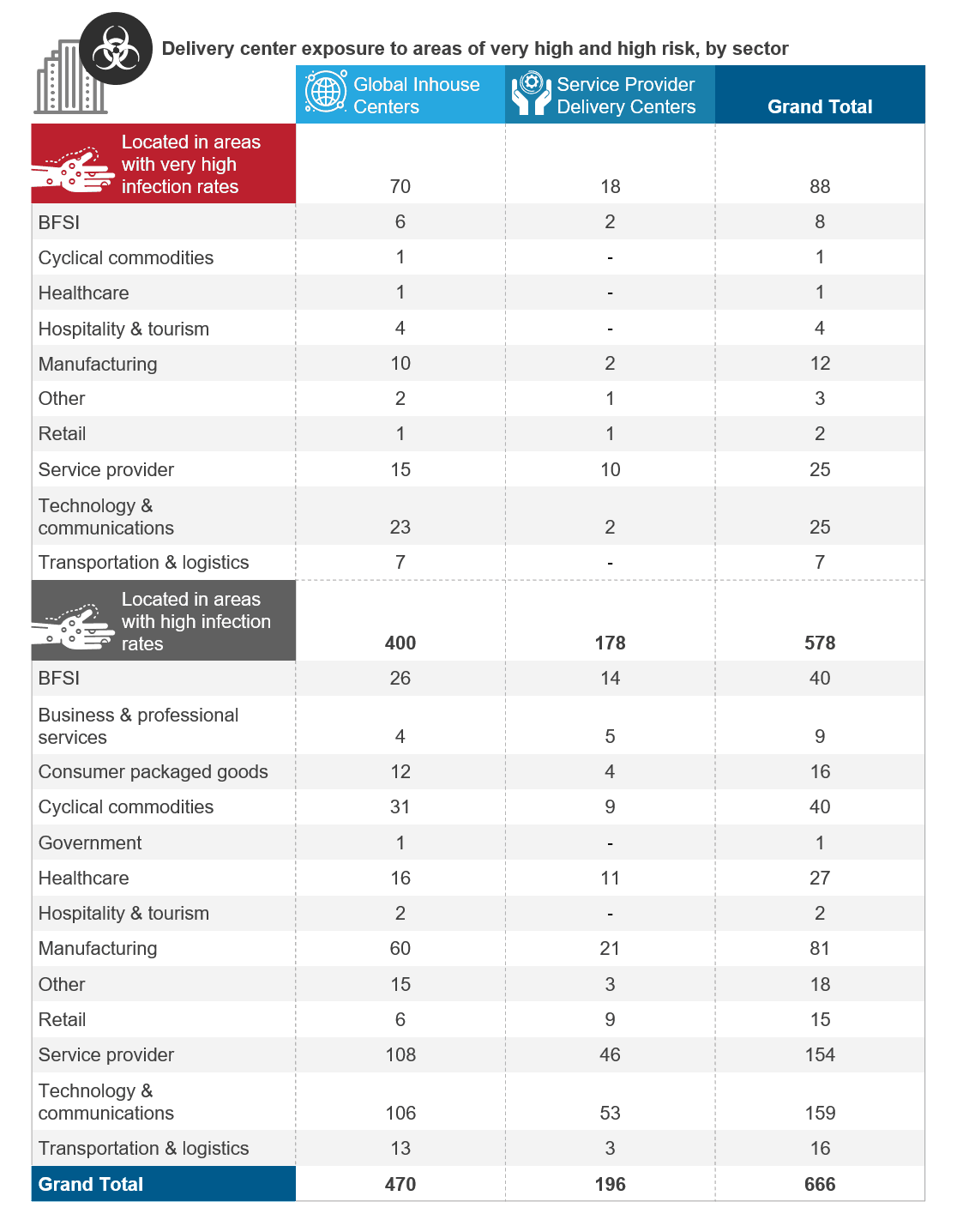

Data from Everest Group Market Intelligence (EGMI) shows that there are 470 Global Inhouse Centers (GICs) – or shared services centers – and 196 service provider delivery centers located in China and across these additional nine countries. Based on travel advisory and media reporting of regions that are more or less severely impacted, China still has the greatest exposure to delivery risk, with 73 delivery centers in high impact areas, and a further 272 in areas that are likely seeing little or no impact. Italy has 14 service provider delivery centers in the high-risk Northern provinces. South Korea has one or two GICs in Daegu, the city most affected by coronavirus infections. See details by country and sector in the two tables below.

In view of restrictions imposed by governments, or companies implementing business continuity protocols, or simply out of fear of contracting the virus through proximity to large numbers of people, it is highly likely that most, if not all, of the delivery centers in high impact areas are closed and will remain so until further notice.

Many multinational corporations with offices in China and Hong Kong have imposed either complete travel bans (Amazon, Apple, Citigroup, Credit Suisse, Ford, Goldman Sachs, Google, HSBC, JP Morgan, LG, Salesforce) or have banned non-essential travel (GM, Johnson & Johnson, P&G, PwC, Siemens) to and from mainland China, Italy, Japan, and South Korea. In some cases, cross-border travel has been suspended indefinitely.

The same imposition of a work from home policy for all staff of multinationals in China and Hong Kong, which is beginning to ease, is now the norm for many businesses in Milan, the capital of Lombardy. The cancellation of meetings or conferences involving even modest numbers of international participants is now a daily occurrence.

The outward spread of the disease has also started to impact major service delivery locations, especially India, which comprises 40 percent of the world’s global services delivery capacity. As of March 6, 2020, 30 Covid-19 cases have been confirmed in the country. Initially, only passengers from high-risk countries were being checked at airports, but the government has implemented universal screening for all passengers flying into the country. Multiple companies such as Cognizant, PayTM, Wipro, and KPMG have temporarily closed select offices in Delhi NCR and Hyderabad and stepped up their employee safety efforts. In addition to encouraging the remote working model, these efforts include disinfecting and sanitizing office spaces, putting hand sanitizers at entry and exit points, discouraging staff from conducting physical meetings, restricting the entry of outsiders in office premises and distributing N95 masks amongst employees.

We continue to monitor these locations.

Visit our COVID-19 resource center to access all our COVD-19 related insights.