December 17, 2012

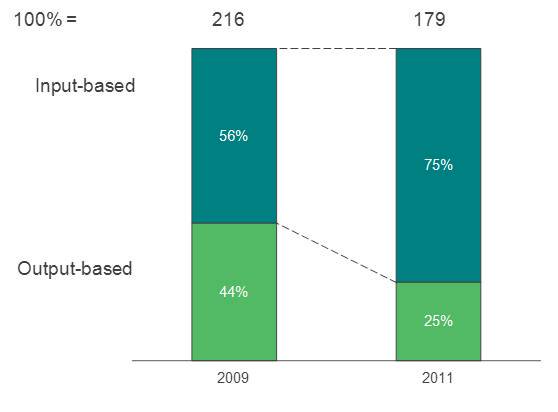

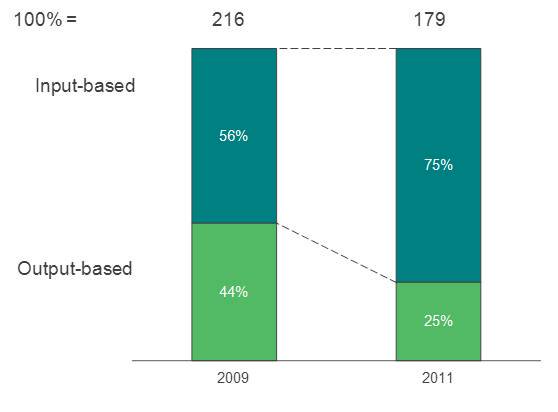

Input-based pricing has traditionally been the preferred engagement model for buyers of application outsourcing (AO) services. Their penchant for input-based pricing is indicative of their ability to own more risk. However, when lightning struck in the form of the economic downturn, buyers began revisiting their engagement models to derive the best value from their IT contracts, and in 2009, we saw a surge in output-based pricing contracts for AO services. But the choppy shift was short-lived, and by 2011, buyers opted to play it safe and stick with tested input-based pricing contracts:

AO deal share by pricing model

Although their motivation for moving to output-based pricing was driven by cost and quality aspirations, buyers quickly found the shift was far from easy, and fraught with challenges.

The difficulties with output-based pricing – then and now – include:

Complexity: The setup involved with an output-based pricing model is considerably more complex, as these contracts require transactions to be defined unambiguously and measured over multiple time periods.

Volume uncertainty: Buyers need to be able to predict future volumes to a reasonable level of accuracy, and overall transaction volumes must be sufficiently high for service providers to derive equitable scale benefits.

Process scope: Service providers must have a good understanding of the process in order to price transactions effectively. Additionally, output-based pricing is not suited for processes that are heavily reliant on people skills, e.g., development of cutting-edge technology apps.

Organizational change: The concept of internal charging in a buyer organization may require expectation settings and change management. Further, as benchmarking data may not always be readily available, a significant data collection effort is required during the contract negotiation phase.

Before transitioning to an output-based pricing model, buyers must ask themselves the following questions:

- What is really important to me?

What is driving my aspiration to shift to output-based pricing? Is it innovation, or leverage, or cost savings? IT contracts should always be drafted in-line with a buyer’s primary motivation.

- How do I define consumption units?

What resource unit should I use for billing? The choice of resource unit reflects organizational context and trade-offs. For example, when pricing a helpdesk offering, a US$/ticket and US$/user supported have distinct and varying impacts on productivity improvements.

- How do I manage demand variation?

How can I help control over-staffing or under utilization of resources? Baseline pricing and banded pricing are often used mechanisms for services that are subject to demand variation. For a successful transition, buyers must – as cited above – be able to forecast future volumes with a sound degree of accuracy.

Buyers must also carefully consider when to transition to output-based pricing for AO services. In an application maintenance outsourcing contract, output-based pricing is viable if the environment is mature and stable, and good baseline data is available on staffing, costs, and service metrics such as notice tickets, bug fixes, enhancements, etc. In an application development outsourcing contract, output-based pricing is suitable when the requirements and specifications are clearly defined and agreed.

If your organization has made the pricing model jump, what experiences – good, bad, or ugly – with the transition to output-based pricing can you share with your peers?