The Evolution of the Technical Support Engineer Job Role

Once viewed primarily as troubleshooters who solely fix computer issues, today’s technical support engineers are complex problem solvers delivering next-generation solutions who also are emphatic brand champions. This new breed of talent plays increasingly sophisticated roles in enhancing the customer product experience and realizing value for leading enterprises. The soft and technical skills needed for this integral position are morphing. To learn more about how the technical support engineer job role is rapidly evolving in the current era and where to find this expertise, read on.

For more on our continuing coverage of how digitalization is changing technical support functions, also see our blog on the Strategic Role of Technical Support in Driving SaaS Adoption.

What are technical support engineer roles and responsibilities?

Technical support engineers help clients fix technological issues related to specific products or overall technical infrastructure, either virtually or in person. They ensure products and systems function as desired and provide the technical skills needed to keep them working properly. These individuals also provide the required know-how to help customers understand the complete functionality of their products to maximize their value and proactively prevent issues. Activities performed by technical support engineers range from low-complexity queries such as account activation and troubleshooting known bugs to complex platform support activities and analytics support for product enhancement.

As companies heavily rely on technical support services to swiftly run their business, technical support engineers act as the face of the technology solution provider’s brand when engaging with the end-user and reflect their values and brand promise. Technical support engineers bring varied skill sets that are important for their job success.

Traditional skills and expectations from technical support engineers include:

- Technical and product knowledge: A technical support engineer must be technically sound to troubleshoot, solve client problems, and initiate the work. They also need an in-depth understanding of technology solution providers’ products to quickly troubleshoot and solve problems

- Problem solving: To turn things around swiftly, critical thinking ability and solving complex problems are musts for technical support engineers. This is especially relevant when supporting more complex and time-sensitive queries for enterprises

- Interpersonal skills: Starting from actively listening, understanding, and explaining the resolution to the user, a technical support engineer is expected to possess excellent interpersonal skills

- Client systems and platform knowledge: Clients often leverage multiple platforms and technologies that are interconnected and interdependent, making it critical for the technical support engineer to have an overarching knowledge of the client’s technology landscape

Changes to the technical support engineer job role

With companies around the world digitalizing rapidly and embedding technology in every business aspect, the adoption of as-a-service business models is bringing the importance of technical support to the forefront.

Along with increasing cloud adoption, the shift towards a SaaS-based model, and continuously evolving data governance regulations, the technical support engineer function has also been expanding. Technical support engineer roles and responsibilities have gone from traditional technical support work focused on “break-fix” hardware and software support elements to being customer success champions.

Modern technical support engineers play an important part in driving brand loyalty, increasing product and service consumption, and providing analytics-driven product enhancement insights. They offer proactive support capabilities and a differentiated client experience that maximize the end client’s value realization.

Let’s look at seven new competencies needed for this vital role:

Soft skills:

- Innovative mindset: The growing number of technologies, products, and tools demand technical support engineers to think out-of-the-box and provide innovative solutions to solve both simple and complex problems for clients

- Management capabilities: With more complex queries and increased interlinkage between products and platforms from multiple technology vendors, the technical support engineer job has progressed from being purely technical to having managerial aspects of coordinating between different stakeholders to arrive at quick and effective solutions

- Empathy: Leading companies realize the importance of technical support in reinforcing and mirroring the brand promise and values. Technical support engineers need to be empathetic to user problems and deliver an optimal experience

Technical skills:

- Data analytics: As support services become more dynamic and data-backed decision-making is more infused in businesses, analyzing data and proactively finding issues is an integral part of the role

- Handling complex problems: With low complexity queries now increasingly solved by self-service and chatbots, technical support engineers are expected to handle more complicated queries

- Adapting to next-generation solutions: The adoption of modern technologies and solutions such as cloud-based solutions, automation, and Artificial Intelligence (AI)-based solutions has demanded that individuals in these roles adapt to these new requirements

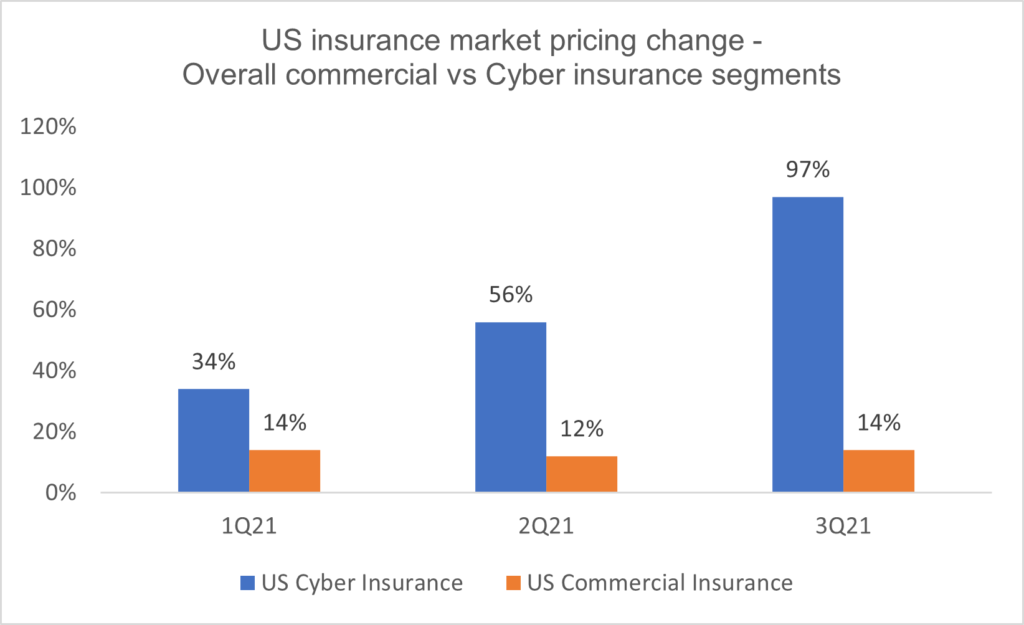

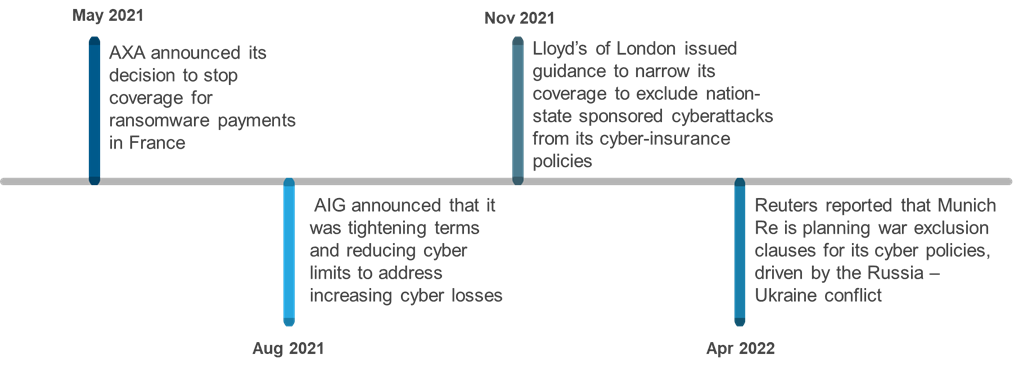

- Understanding cyber security: Because cyber security is of paramount importance today, technical support engineers need to keep up with the evolving threats and proactively make users aware of the possible security risks

Evolving profiles of technical support engineers

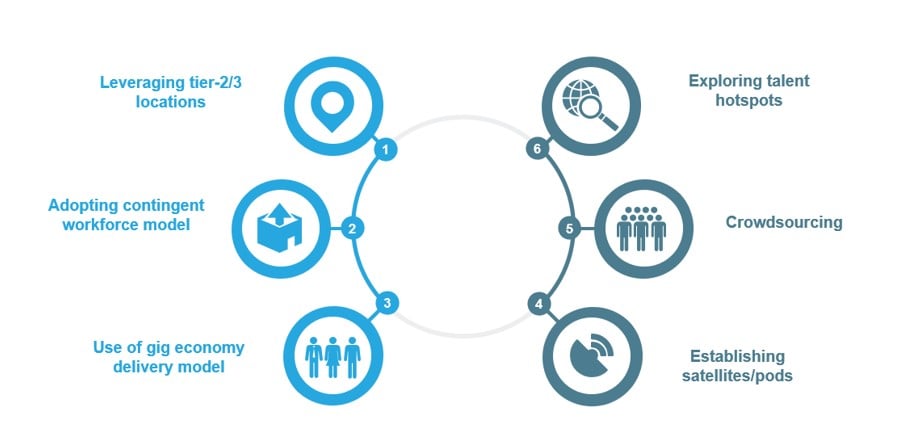

With the evolving skill profile required from technical support engineers, service providers are increasingly looking to leverage new avenues for differentiated talent. Here are some of the key demographics actively being tapped:

Tech-savvy millennials: The global workforce has been shifting towards an increasingly large segment of tech-savvy millennials who have greater comfort with new-age products and technologies. This demographic stays up-to-date with the changing technology landscape and is better geared to handle complexities associated with the platforms and systems used by clients and technology solution providers

Industry expertise: Job candidates who have industry expertise are better suited for technical support roles, especially in energy, automotive, and manufacturing segments where industry-specific knowledge is difficult and time-consuming to attain. Employing technical support engineers who have first-hand experience with the problems they are solving is advantageous

Enterprise-specific experience: Individuals who have been associated with the brand and understand its technologies, work environment, and internal processes are better equipped to support it. Technical support engineers with previous experience working with the same or similar clients are desirable

With the changing technological landscape and evolving business models, the role of technical support engineer is expanding further to handle increasing customer expectations, product complexities, and changing dynamics. The need for technical skills in security, cloud infrastructure, analytics, and application development will further define the future role of technical support engineers. Emerging client demographics also are carving out new roles with differentiated skills that will be important going forward.

If you have questions or would like to discuss the technical support engineer job role and how it is evolving, please reach out to David Rickard, [email protected], or Chhandak Biswas, [email protected].

Explore our webinar, Building Successful Digital Product Engineering Businesses, to learn about investments in next-generation technologies and talent are now crucial in successfully building digital product engineering businesses.