October 3, 2023

Deal pricing teams have evolved from providing traditional cost-plus functions to becoming strategic commercial and negotiation partners. Modern pricing teams offer market insights, innovative pricing, and contractual models that enhance deal profitability and success. Learn about the changing dynamics of deal teams, their structures across various types of service providers, and other valuable insights from our analysis of pricing support teams in this blog.

Recognizing that pricing is one of the most important aspects of winning any deal, service providers have created the dedicated function of deal pricing teams to help sales, presales, and solution teams build compelling pricing proposals.

Pricing teams play a vital role in securing pivotal business agreements and ensuring deal success by shaping pricing strategies and contracts. These teams empower sales units to effectively respond to proposals and requests for quotes, ensuring they meet client expectations while also supporting the company’s financial goals.

Today’s pricing teams have transformed into strategic partners to the organization that provides market insights, innovative pricing, and contractual constructs. Their involvement throughout the deal cycle ultimately ensures deal profitability and long-term business success. Let’s first explore how their role has taken on increasing importance over time.

How traditional pricing teams functioned

Traditionally, deal pricing teams were comprised of pricing experts with finance and accounting backgrounds who prepared commercial proposals in addition to other tasks like periodic numbers closing, tracking account level parameters, financial reporting, tracking budgets, etc.

In the past, the primary role of pricing support teams has been limited to one or more of the following activities:

- Estimating resource costs based on products and services estimates prepared by the solutions, sales, and presales teams (known as the “pursuit team”) and calculating margins

- Reviewing and approving commercials prepared by other teams

- Safeguarding the organization’s margin and commercial guidelines

- Advising deal teams on finance-related contract clauses

- Offering pricing support and negotiating deal contracts at arm’s length

Our analysis of various pricing teams across different service providers over the past decade reveals a noteworthy trend to watch: These teams are becoming increasingly important within their organizations and gaining traction as strategic partners in bringing more business.

A deal lifecycle generally consists of anywhere from seven to ten steps from pursuit preparation to final negotiation and contract signing. Historically, the pricing team had limited influence and would only get involved in the last stages of commercials derivation or approvals, pricing proposal preparation, and client negotiation support.

Typically, they were not involved until the commercials preparation stage, and even then would only base their work on the pursuit team’s inputs and the prior decisions made to win the deal, including aspects like solution strategy, commercial modeling, competitive price points, and client pricing options.

The team would calculate the commercial aspects using Excel or web-based tools configured with resource rate data and other financial guidelines, such as margins, contingencies, and discount percentages.

Pricing would be based on two key parameters – resource effort estimates provided by the pursuit team and the cost rates/salaries embedded into the tool, along with commercial guidelines. Depending on the pricing function maturity, the standardization of these tools could vary significantly among service providers.

Next, let’s look at how their roles have progressed.

The emergence of new-age pricing teams

Leveraging extensive experience in managing deals and accounts over time, the pricing team has started wielding significant influence in mid to large-sized deals. Harnessing their expertise strategically has become a standard practice. However, the impact the deal pricing team has in winning proposals still varies widely based on the maturity of providers across different segments.

Key traits of modern pricing teams

Service providers have been taking steps to empower their pricing teams and transform them into strategic partners. New-age pricing teams in today’s competitive market landscape share the following traits:

- Early involvement in pursuits: The pricing team makes a significant impact on a deal if they are involved early in a pursuit. They can help identify win themes, make quick go/no-go decisions, decide on favorable pricing strategy, prepare preliminary estimates for the base case, and bring in past deals/account level intelligence during storyboarding

- Bringing in experience and knowledge: With their experience in handling pricing for multiple deals and contracts and tracking account performance, deal pricing teams bring in a wealth of account-level insights. They work closely with the sales, account teams, and pursuit leaders to generate client-specific insights that can be leveraged to better address client’s requirements

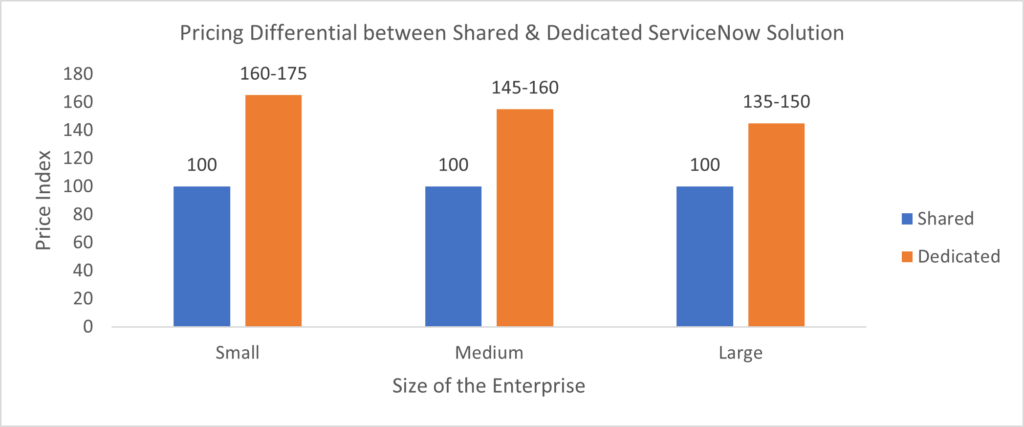

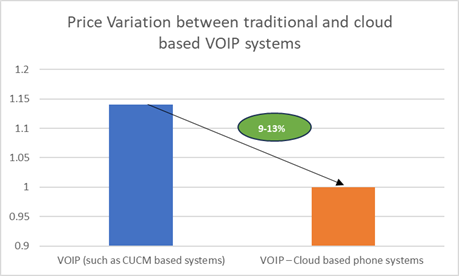

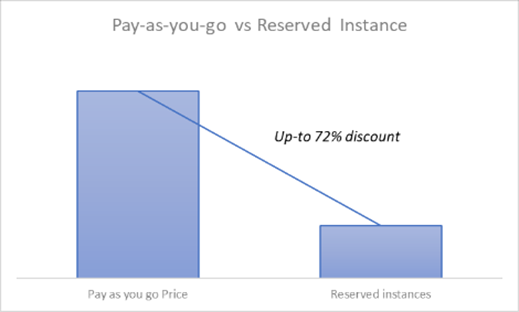

- Market and competitive intelligence: New-age pricing teams have access to multiple third-party benchmarking vendors, advisors, and other industry experts. Combining knowledge gained from working with various service providers with insights garnered from external sources, pricing teams have built a huge repository of the latest market and competitive pricing/solution data. This information is continuously refreshed on an annual/bi-annual basis. Accessing this intelligence gives them a competitive edge in any pursuit

- Pricing strategy formulation: Mature pricing teams work closely with the pursuit teams to make early decisions on a deal’s commercial structure to finalize various financial levers, such as volume discounts, margin percentages, alternate commercial models, etc.

- Proposal writing and review: Typically, pursuit teams own the end-to-end bid response formulation and writing, including the pricing proposal. Modern pricing teams have matured into a partnership role. They now review the overall proposal to ensure the client’s ask is addressed and the key messages highlighting their unique capabilities are comprehensively demonstrated. Pricing teams take charge of leadership review cycles of the pricing proposals and also compare the solution to other deals of similar nature and size drawing on market intelligence from their benchmarking third-party advisors

- Leading negotiations: Empowered pricing teams today are not just supporting pricing and contract negotiations with clients, they are leading this important stage along with the pursuit teams. In addition to designing fallback options and in-room tactics, pricing leaders are making real-time decisions to win deals by leveraging data-based insights on markets, accounts, and competition

- Building a deep knowledge base: Organizations have come to recognize that making faster data-based decisions on pricing and solutioning deals can position them well ahead of the competition in any pursuit. Consequently, pricing teams have evolved beyond merely collecting data for deals, which often is underutilized for insights. Instead, they now leverage many data sources for each parameter, enriched with intelligence from diverse origins. This comprehensive dataset is employed in every pursuit to make informed decisions within short timelines

- Deploying and using advanced tools: These teams leverage advanced tools that offer flexibility and robustness to generate various pricing scenarios with all financial parameters, as well as real-time market intelligence analysis. Possessing this ability is viewed as a characteristic of mature players. The turn-around time from resource estimates to final pricing figures has always been a critical factor in judging any tool’s capabilities. Pricing teams play a key role in developing and deploying new-age integrated tools for specific needs

Emergence of tech tools to aid pricing teams

Pricing tools have come a long way in terms of technology, data, and pricing process maturity. Advanced players today leverage a gamut of connected tools that cover every key aspect of the deal lifecycle, starting from deal qualification to contract signing and then supporting delivery teams after the deal closes.

All parties involved in a pursuit leverage pricing tools at some stage. Tools that seamlessly integrate with critical systems such as Customer Relationship Management (CRM) and knowledge repositories while also harnessing advanced data analytics capabilities have become a prevailing norm within mature pricing organizations.

As Generative Artificial Intelligence (GAI) emerges, the analytical prowess embedded within these tools will push these players significantly ahead of their competitors, making it imperative to establish a solid foundation for these technologies.

Equipped with advanced tools, pricing teams can more accurately anticipate customer needs, enabling them to design pricing strategies precisely and respond to market changes in real time. This degree of agility and customer-centricity will propel organizations far ahead.

The current state of providers in this transformation journey

Let’s take a look at where different types of service providers stand in their pricing team’s transformation journey.

- Traditional service providers: Most players in this group have dedicated pricing teams that leverage standard deal pricing tools (web- and excel-based) with basic to advanced financial and operational capabilities. These teams generally have well-aligned structures with clearly defined roles and responsibilities. However, they still have room to progress to enhance their ability to influence overall pricing and solution strategy and create a structured knowledge base with sufficient resources to leverage it efficiently

- Consulting heritage firms: These players are on the journey to deploy dedicated pricing teams with well-defined structures and roles and responsibilities. They use tools with basic financial capabilities. Pricing teams serve more as advisors to the pursuit teams with low decision-making influence and play a limited role in a deal cycle

- Niche consulting organizations: This group does not have dedicated pricing functions, and the pursuit team mainly handles deal pricing. They have very low maturity in using data and insights. Overall, the pricing function within niche consulting organizations is lagging by a good distance compared to the other two groups

It is important to note that certain players stand out in their maturity level when compared within the category.

In today’s landscape focused on value realization, organizations must comprehensively analyze all pricing support function aspects on a maturity scale. This is an essential initial step to determine the organization’s current standing and identify ways to stay competitive. Effectively partnering with modern deal teams can improve an organization’s success in winning new business and ultimately succeeding.

For more information about pricing support teams, please contact Achint Arora, Abhishek Biswas, and Amit Dhiman.

Check out the webinar, Current Solution Trends and Their Impact on Outsourcing Deals and Pricing, to learn why is solution sizing important in today’s competitive deal environment.