From Labor Arbitrage to Digital Arbitrage: Shareholder Value in the New IT World | Sherpas in Blue Shirts

Recently, corporate developments, such as management changes, corporate governance, and investor activism across Indian IT service providers, have bombarded the investor community. Many investors perceive the initiatives taken by these companies to be a watershed moment in their histories.

Furthermore, with next generation automation, digital services, artificial intelligence (AI), and other disruptors creating massive, requisite, and unavoidable change in the IT services industry, investors and service providers are in increasingly opposing schools of thought. However, many of the investment firms we work with struggle to correlate these developments with their investments and returns.

Given the scale of the IT industry and the pace of disruption happening in the entire ecosystem, it’s valuable to take a few minutes to dissect and analyze the situation.

Growth vs. profitability equation – digital arbitrage vs. labor arbitrage

For the past two decades, Indian IT service providers have reported a stellar net profit margin in the range of 18-25 percent. The business grew on the investments made in human resources. The players achieved impressive returns primarily due to their grip on labor arbitrage. The investor community embraced the stocks, and experienced significant returns. For instance, an investment of US$350 in one of the top Indian IT service providers in 1992 would have yielded US$377,643 in 2015!

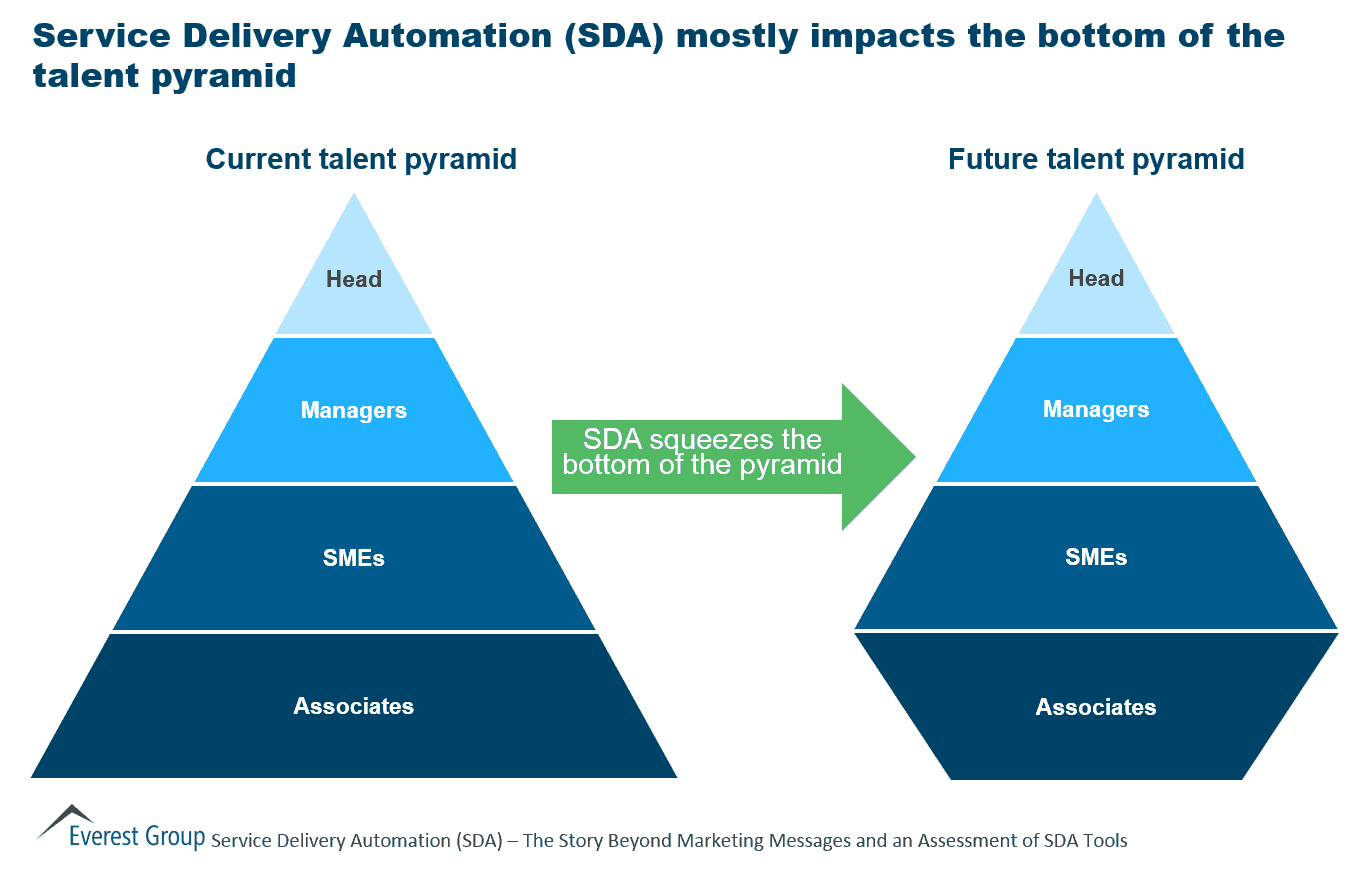

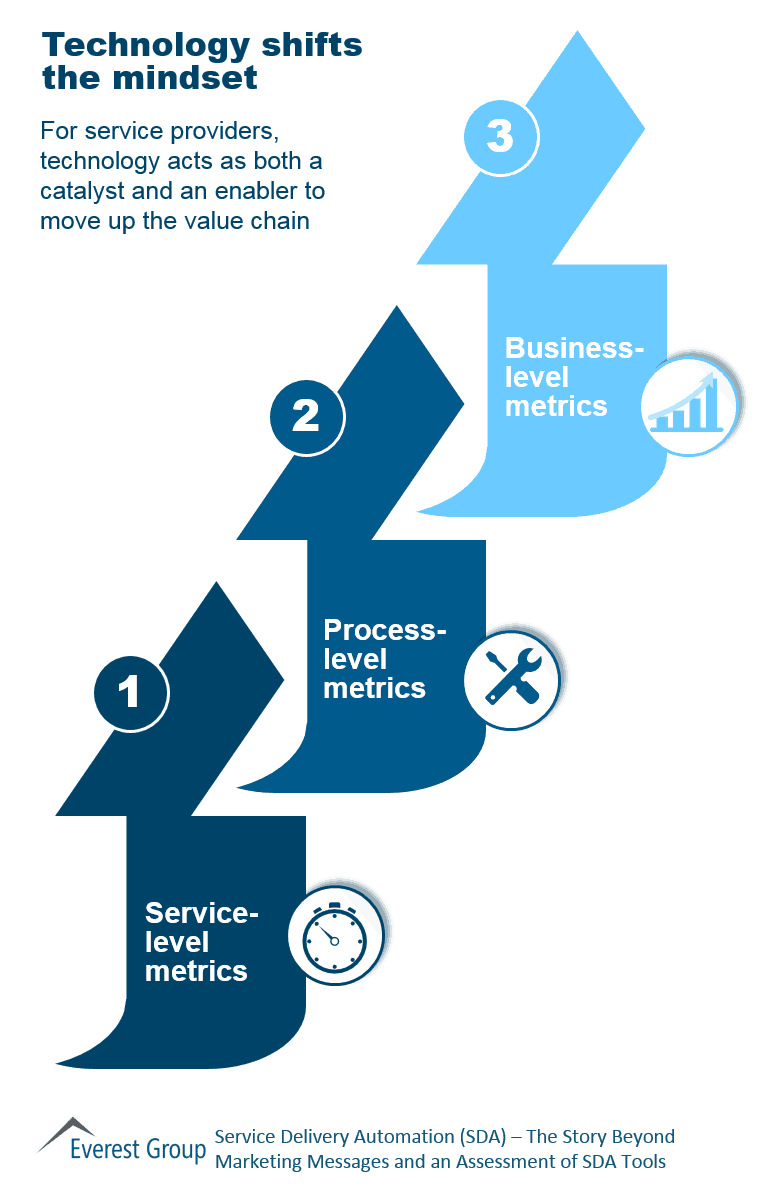

The emerging IT services model – driven by digital disruptors – gives little emphasis to labor arbitrage or the providers’ earlier factory model, and instead focuses on innovation and value creation for enterprises that extends far beyond greater efficiency. Not many IT service providers have demonstrated a mindset aligned to these new requirements. They are still hesitant to loosen their noose on profitability, as they set investor expectations very high with their earlier business model.

What is bothering investors?

Investment firms we work with believe that most disruptive technologies will drive lower profitability for Indian IT service providers likely in the 8-15 percent net profit range. They also believe that technology disruption will not allow the same level of offshoring as before, and will further erode profitability.

As most of the Indian IT service providers have zero debt and own huge piles of cash, investors think they should receive distributions in the form of dividends. Their demand is stronger when they learn the providers are going to invest in low-margin digital businesses, as they believe they will not receive the optimal reward they are due.

A twist

Believing that the market is undervaluing their stocks, IT service providers are planning share buybacks, spinning them as a way to reward shareholders. However, they actually plan to reduce tax leakages caused by dividend distribution, as Indian tax law stipulates they pay a 15 percent Dividend Distribution Tax (DDT) on dividends paid. Additionally, the share buybacks help them increase their control over the company.

What is the reality?

Both these opposing schools of thought fail to think in the long term.

Investors looking for dividends aren’t acknowledging Berkshire Hathaway’s theory of dividends. If a business can deliver promising returns in the long-run, dividends act as a negative catalyst for growth. In an attempt to pacify their investors, most of whom are technology novices, most Indian IT service companies are relabeling their old offerings as “digital.” Instead of dividends, investors need to ask IT service providers’ leadership tough questions on how they plan to use their large cash piles relative to their IP, platforms, acquisition, talent development, and client relationship strategies. How do they plan to differentiate in this crowded market? When large-scale offshore development centers fail to provide the needed competitive advantage, what does their armory contain to create shareholder value?

The way in which IT service providers are surrendering to investor pressures gives the impression that they are not willing to utilize their cash for digital technology investments. This in turn reinforces the popular opinion that Indian IT service providers are not confident enough to tide over the current transition. That some of the providers are distributing cash instead of putting the money in beneficial investments is making some market observers uncomfortable.

Furthermore, if the providers are not planning to distribute cash, they must ensure that they use the money for useful investments rather than just share buybacks. This is a win-win situation, as the providers get a boost to their topline and ability to endure the current business transition, and shareholders get maximized wealth in the long term. Net-net, firms that invest wisely are going to withstand the changeover, while those that use their cash piles to temporarily shut out investors are likely to witness a tough time.

Are these companies capable of implementing the business model?

As the adage goes, easier said than done. Although service providers are vocal about re-skilling employees opening onshore centers focused on digital services, the viability of these initiatives are questionable. The majority of these companies have amateur design thinking capabilities, and their DNA is around supplying people, not innovation and strategic partnerships. Indeed, in our recently published report “Customer (Dis) Satisfaction: Why Are Enterprises Unhappy with the Service Providers,” enterprises only gave providers a score of five out of 10 on their strategic partnering abilities.

Only time will tell whether service providers made the right move in distributing cash or investing in low-margin businesses.