The Capital One Merger with Discover Potentially Signals a Shift in the US Banking Landscape | Blog

Capital One’s planned US$35.3 billion acquisition of Discover Financial Services would combine two of the largest credit card companies, creating the most dominant US credit card firm. This deal holds the potential to significantly impact the banking and financial services (BFS) IT services market and providers. Read on to learn the looming risks and what to pay attention to.

Contact us to discuss the topic further.

Acquiring Discover would give Capital One access to a credit card network of more than 300 million cardholders. If the Capital One merger clears antitrust regulations, the combined entity would become the sixth-largest US bank by assets and a leading card issuer and network provider for the US payments market.

Let’s explore the following four implications of the Capital One merger on the BFS technology and IT services sectors.

- Increased deal activity will help banks sharpen their focus on core operations

Macroeconomic uncertainty and rising interest rates slowed financial services dealmaking in 2023. However, S&P predicts regional and community banks will be interested in mergers of equals this year. In these challenging times, banks want to understand the potential synergies of the merged entities clearly. They also require deeper due diligence than in the past, as exemplified by the failed merger of TD Bank Group and First Horizon.

Traditionally, acquisitions were an opportunity to enter new product lines and geographies, gain new capabilities, and achieve cost savings and operational efficiencies through technology modernization and streamlining processes and systems.

Recent banking sector acquisitions underscore a clear strategic focus on directing resources to targeted areas. Banks are divesting or seeking partners for non-core or insufficiently scaled units that lack a distinct competitive edge and demand substantial investment.

- Investments in data and Artificial Intelligence (AI)/Machine Learning (ML) will rise

Our analysis indicates that merger and acquisition (M&A) activity among regional and community banks will increase, driven by the need to achieve greater scale. This strategic move is essential for these financial institutions to compete effectively with larger players, particularly as customer engagement transitions from physical to digital platforms.

By joining forces, these banks will be better positioned to develop new competencies in data management, AI/ML, open application programming interfaces (APIs), and advanced analytics, aligning with the growing digitalization of banking services. The merged entities will benefit from larger resource pools, facilitating improved alignment between skills and talent.

- Service provider portfolios will likely reshuffle

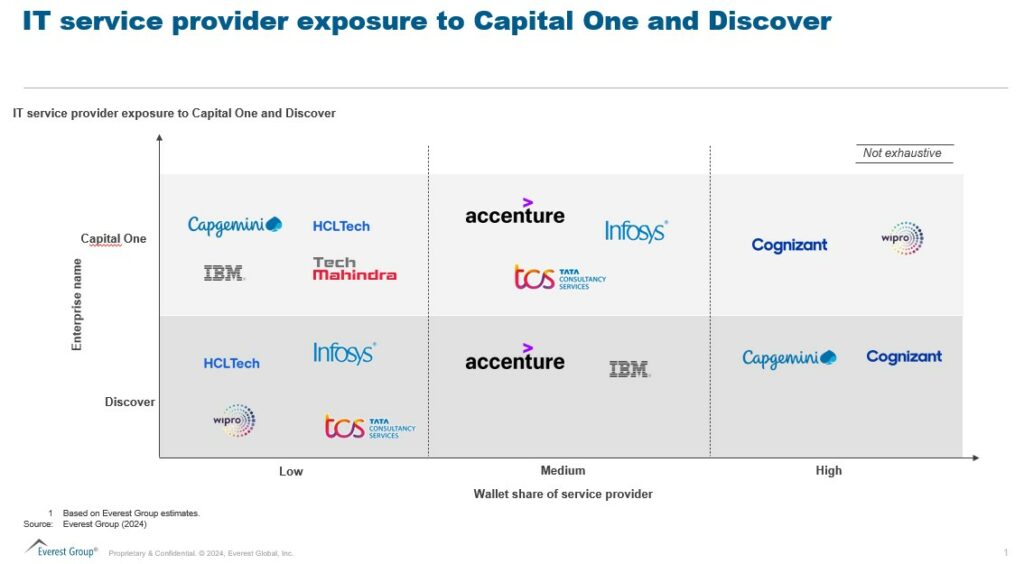

Discover and Capital One have traditionally relied heavily on outsourcing to two or three major service providers. In mergers, providers with significant contracts with both entities typically stand to lose revenue because spending by the merged entity will not be as large as it was under the separate relationships unless they gain wallet share from competitors.

Suppliers that solely provide services to Discover are at risk of having their portfolio consolidated and moved to Capital One. However, providers who bring intellectual property or a niche capability may maintain the business through the consolidation.

Discussions about increased regulatory scrutiny are emerging, as even the regional banking market is at the cusp of such transactions. Moreover, this transaction can potentially increase competition for giants Mastercard and Visa.

- Banks will require substantial consulting and system integration support

M&As spur increased short-term spending on post-merger integration and consulting services. By rationalizing vendor portfolios and IT infrastructures, merged entities can substantially cut costs by eliminating redundant applications and platforms. BFS firms will need partners to devise modernization roadmaps to create long-term value.

Merged entities must swiftly adapt their operational models, delivery strategies, and sourcing decisions to excel in the evolving landscape. Investing in specific technologies and tools is essential to foster growth and ensure operational continuity. Emphasizing core operations becomes a prerequisite as firms assess the appropriate valuation before crafting their integration strategy.

The road ahead for the Capital One merger

Richard Fairbank, founder, chairman, and CEO of Capital One, has emphasized that the merger with Discover presents a unique opportunity to unite two highly successful companies with complementary strengths and franchises.

The Capital One merger aims to establish a payments network capable of rivaling the industry’s most extensive networks and companies. However, the potential impact of increased market concentration from this combination will face regulatory scrutiny.

Providers should closely monitor system integration opportunities, as Capital One plans to expand its 11-year technology transformation initiative to encompass all of Discover’s operations and network.

The new entity will invest in growth initiatives, including faster time-to-market, innovative products and experiences, and personalized real-time marketing efforts. Operationally, underwriting, efficiency, risk management, and compliance enhancements will drive data and technology investments.

We are closely watching the market and regulatory actions. To discuss the Capital One merger and its impact on the US banking landscape, reach out to Ronak Doshi, [email protected], Kriti Gupta, [email protected], or Pranati Dave, [email protected].

Join this webinar to hear our analysts discuss Global Services Lessons Learned in 2023 and Top Trends to Know for 2024.