How Analytics and Automation Can Help Health Plans Improve Medicare Advantage Star Ratings | Blog

Customer analytics and automation solutions can be a key differentiator in helping health insurers achieve better Medicare Advantage (MA) Star Ratings with changes that emphasize the customer experience coming by 2023. At a time when delivery of high-quality healthcare services is a priority and competition is intensifying, taking the right steps now can make a difference for both providers and patients. To learn more, read on.

Why the MA Star Ratings are important

Health care quality and MA enrollments have significantly improved since the Centers for Medicare & Medicaid Services (CMS) introduced a five-star rating system in 2007 that scores each plan’s performance across numerous measures over a prior 18-month period.

The major goals of the MA Star Rating program are to incentivize insurers to improve their performance and to help patients compare and choose high-quality plans. These Star Ratings have become a crucial yardstick to help beneficiaries select the best plan for themselves.

As a result of the program, more customers are enrolled in higher-quality health plans. According to Medicare, MA enrollment has more than doubled in the past decade, with 26 million Americans currently enrolled this year.

What led CMS to change the ratings?

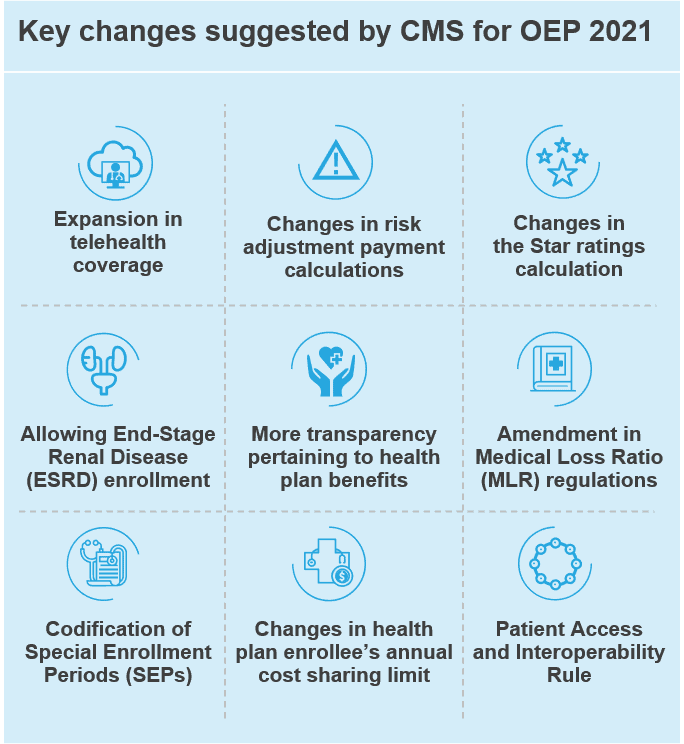

Over the years, the criteria used to assess plan performance has become more stringent, with CMS changing the cut-point levels to achieve the ratings across 47 different measures. Even after raising the standards, average scores have improved, reflecting a continued push by providers to improve the quality of services.

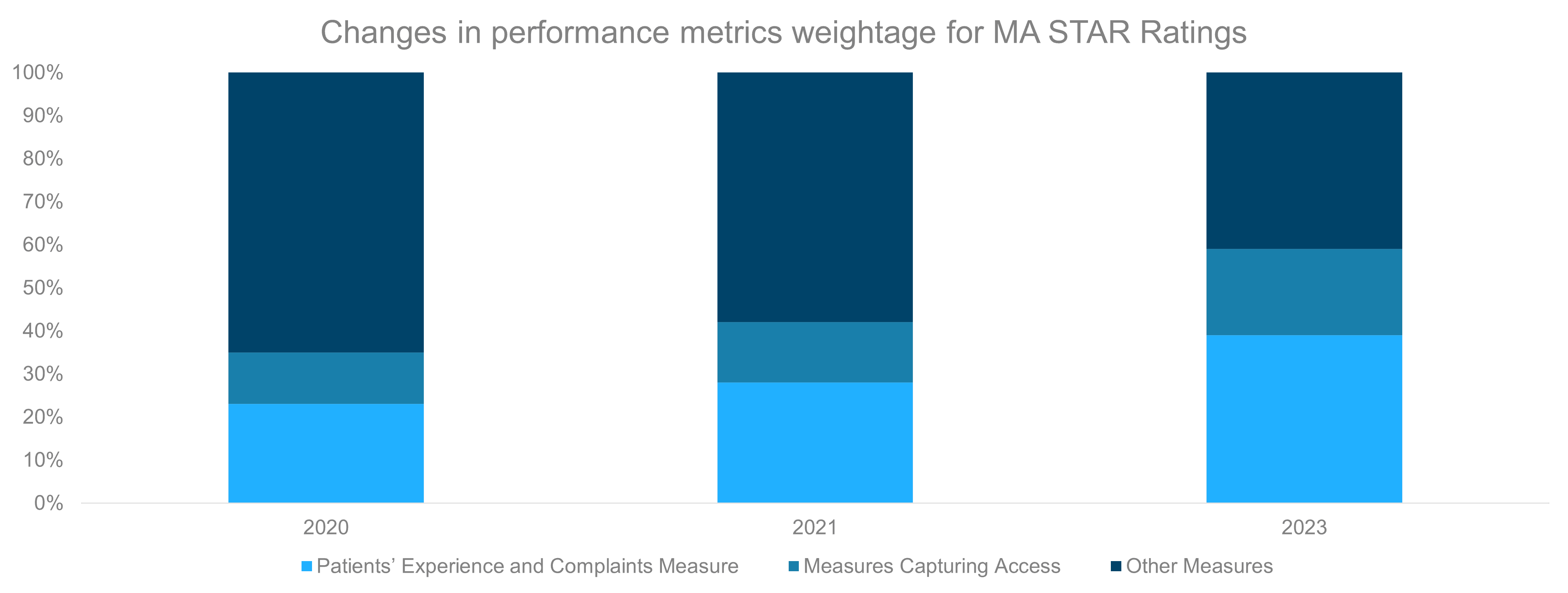

The Star Rating divides the measures into separate categories and assigns a different weight to each area. In May 2020, CMS increased the weight given to measures related to customer experience, such as patient experience, complaints, and barriers to receiving care, from 35 percent of the total score last year to comprising nearly 60 percent of the overall rating by 2023.

CMS made this change to encourage plans to provide the best service to beneficiaries, resulting in better engagement and health outcomes.

Patients’ Experience and Complaints Measure: These reflect beneficiaries’ perspectives of the care they received

Measures Capturing Access: These reflect processes and issues that could create barriers to receiving needed care

How does this impact health plans?

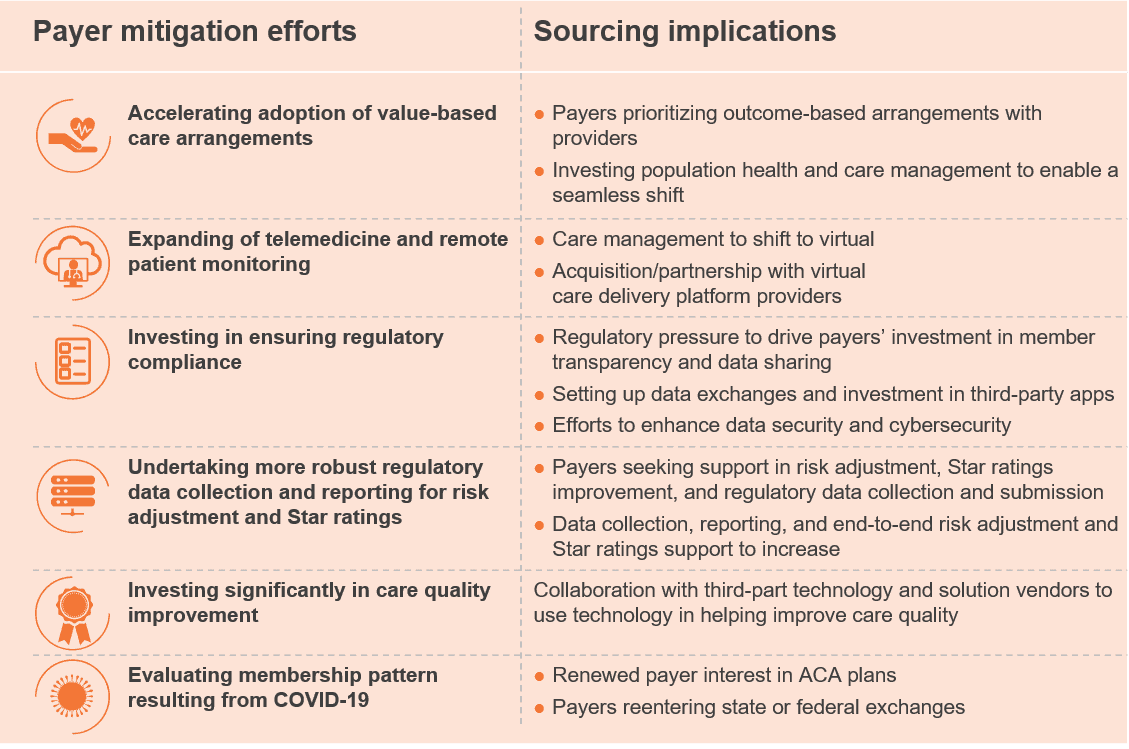

The changes in the Star Ratings can bring significant value to plans in the following ways:

- Increased revenue – Better Star Ratings can lead to an increase in member enrollment, resulting in higher revenue

- Financial incentives – CMS offers financial incentives in the form of bonus payments known as Quality Bonus Payments (QBPs) to plans that achieve high star ratings. In addition, the share of savings that plans must provide to enrollees as the beneficiary rebate is tied to the plan’s rating. Plans that are awarded four or more stars earn a five percent bonus payment. They also receive higher rebates that are returned to the members in the form of supplemental benefits or lower premiums

- Improved customer engagement – By improving their ratings, plans also benefit from higher plan renewals and lower attritions while driving down operational costs

Insurers will have to strategize differently to understand how the rating changes affect them. For example, a plan that currently has the highest 5-star overall rating but average scores in customer metrics will see a decline in its overall ratings if it maintains similar scores in 2023 because of the increased weight given to customer-related metrics.

For plans that have ratings below 5-star, this change represents a big opportunity to significantly increase their overall ratings by improving their customer metrics.

What’s next?

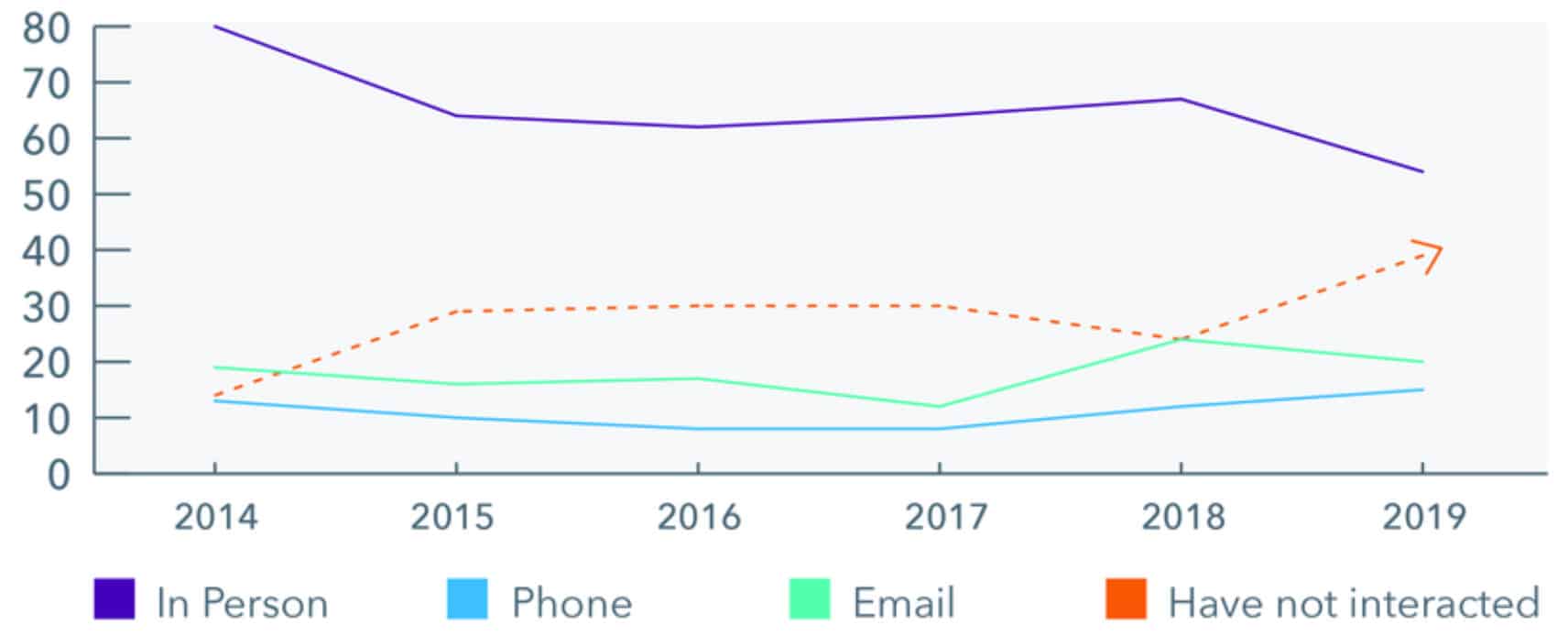

Currently, nearly all plans use customer analytics and automation in some capacity to drive customer engagement. Following the changes in Star Ratings, the creation of a personalized, seamless experience across the customer journey that result in holistic engagement should be the end target for plans to realize the maximum benefits.

As competition in the health plan landscape intensifies over expanding their MA customer base, lowering the churn rate, and generating more revenue, efficiently leveraging analytics and automation solutions will become the key differentiator. Here are some ways users can gain a competitive advantage by using technology:

- Deploying automation solutions to optimize call center operations that automate script/process tools and eliminate the repetitive tasks to support high-call volumes. This will allow human agents to dedicate more of their efforts towards high-priority customer segments to improve the customer experience and reduce operations cost

- Leveraging analytics solutions such as customer journey analytics, channel analytics, and sales analytics to analyze customer history and behaviors for enhanced member segmentation and profiling. This will allow the plans to have seamless omnichannel outreach and engagement initiatives across different member segments

In the short term, existing analytics and automation solutions will need to be optimized and scaled to enhance customer engagement. Moving forward, customer analytics and automation will need to be integrated and deployed across the value chain of health plans to realize the full potential.

The ball is now in the court of health plans to capture this opportunity and turn the new Star Ratings in their favor by taking the right steps. While the outcome for health plans remains to be seen, these changes will certainly improve the member experience, especially at a time when delivery of high-quality healthcare services is a key priority.

To share your experiences on the CMS Medicare Advantage Star Rating changes, contact [email protected] or [email protected].