Generation 2.0 of Digital Assets – Modernization Themes Driving the Revolution | Blog

While the future of digital assets was once uncertain, the recent surge in investments, partnerships, and pilot use cases spearheaded by banks and technology giants has laid the doubts to rest. This holds particularly true for cryptocurrencies, stablecoins, and Central Bank Digital Currencies (CBDCs). Our latest research provides valuable insights into the latest trends and the key players shaping the digital asset industry landscape. Read on to learn more.

Reach out to us to discuss this topic further.

Over the past decade, the digital asset industry has undergone a dramatic transformation, evolving beyond its initial cryptocurrency buzz to becoming a diverse ecosystem teeming with innovation and new players. This evolution can be understood by looking at the following two distinct generations:

Generation 1: Laying the foundation (2010s)

Cryptocurrencies and blockchain technology were born in this era, establishing the core infrastructure and sparking public awareness of this nascent space.

Generation 2: Entering the mainstream (2020s)

The current phase is characterized by the growing legitimacy of digital assets fostered by regulatory frameworks and compliance measures aimed at protecting investors. This has attracted financial institutions and corporations and propelled the rise of tokenization as a powerful tool for asset representation.

CBDCs have emerged as a significant focus, driven by their potential to enhance financial inclusion, improve transaction traceability, and streamline cross-border payments. Central banks worldwide are actively exploring CBDCs through pilots, partnerships, and infrastructure development. Similarly, tech giants are focusing on stablecoins, with prominent projects like Diem (formerly Libra) backed by Meta and Coinbase.

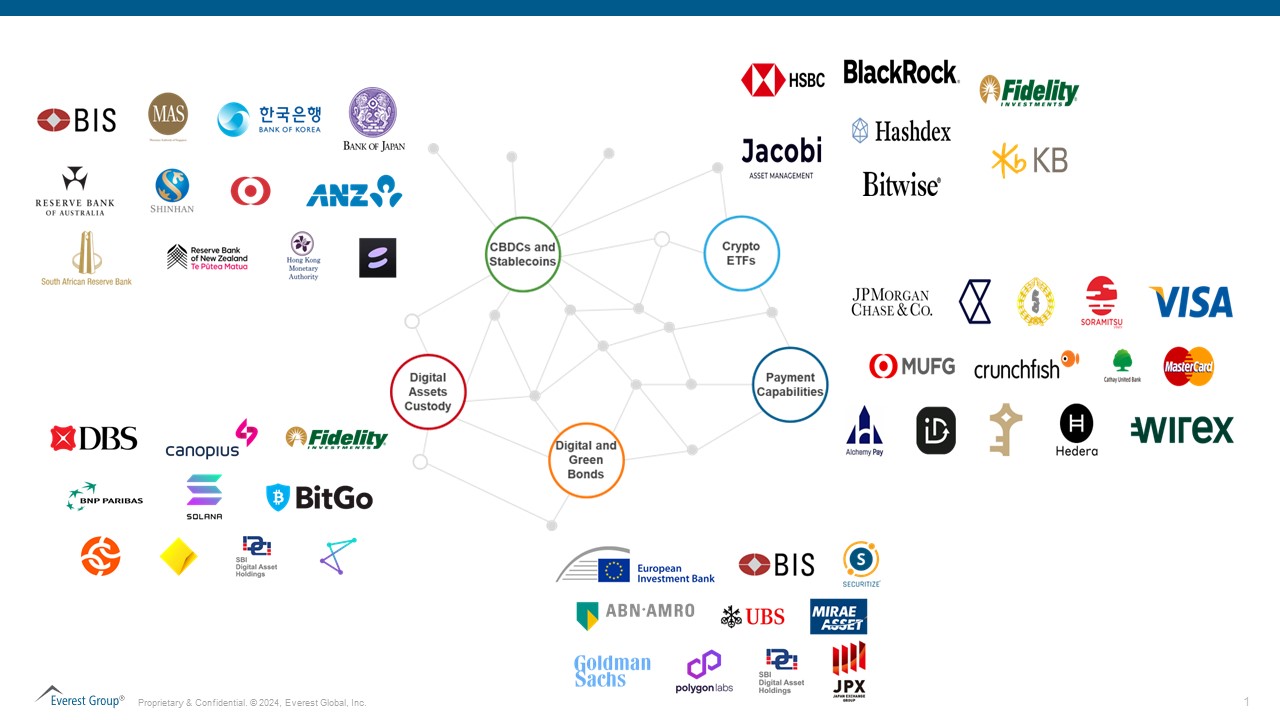

Exhibit 1 provides a visual overview of this dynamic ecosystem.

CBDCs and stablecoins

Both CBDCs and stablecoins are vying for prominence in the digital asset industry, but their paths diverge on key points. Central banks wield the reins with CBDCs, ensuring strict regulations and government backing. This, however, makes banks wary of stablecoins outshining their controlled offspring. Conversely, stablecoin adoption could weaken central banks’ monetary policy influence by redirecting deposits from banks to digital wallets, hindering loan disbursement.

Despite this tug-of-war, CBDCs are gaining momentum. Many countries are setting regulatory frameworks, with active projects like Project Dunbar and Project mBridge testing retail and wholesale applications. While retail CBDCs face hurdles in building confidence, wholesale versions are generating more traction due to their potential to streamline interbank settlements through fewer intermediaries.

Collaboration is key in this evolving arena. Central banks are actively partnering with regional banks for pilot programs. ANZ and Commonwealth Bank have joined Australia Central Bank to explore offline “digital cash” models. Technology providers like Soramitsu are also lending their expertise, facilitating initiatives like a Pan-Asian payment system built on Cambodia’s CBDC.

Crypto ETFs

Crypto ETFs are making digital assets as accessible as buying stocks. This digital asset trend isn’t lost on global giants like HSBC, who are actively expanding into “crypto-friendly” regions. Take Hong Kong, where they’ve launched Bitcoin and Ether ETFs, allowing everyday customers to buy and sell these digital goldmines through familiar channels. Similar initiatives are brewing in South Korea, with KB Kookmin Bank joining the fray and hinting at potential crypto ETFs alongside their CBDC efforts.

The validation doesn’t stop there. BlackRock, the world’s investment behemoth, recently tweaked its proposed spot Bitcoin ETF, potentially cracking open the door for broader Wall Street participation. This move sent ripples of optimism through the cryptoverse, especially after a rough patch triggered by industry meltdowns.

However, the road to crypto nirvana isn’t paved with pure optimism. The Securities and Exchange Commission (SEC) has historically been skeptical, rejecting numerous spot Bitcoin ETF applications, including one from Fidelity. Their concerns? Potential market manipulation and the threat that cheaper ETF access could undermine major exchanges.

Payment capabilities

The digital asset industry landscape is buzzing with innovations aimed at propelling crypto beyond speculation and into everyday use. Revolutionizing payment capabilities and transaction mechanisms is a key focus area. From fintechs to card giants, everyone’s in the game, forging partnerships and rolling out solutions to boost crypto acceptance, scale cross-border transactions, and enhance liquidity management. Let’s look at some examples:

FinTechs – Alchemy Pay, a crypto payments provider, is bridging the gap between crypto and fiat by partnering with domestic payment systems in Australia and New Zealand (ANZ), making crypto purchases a breeze. Imagine buying groceries with Bitcoin – Alchemy Pay makes it possible. And their reach extends far beyond this, with millions of transactions processed for users in over 170 countries. They’ve even teamed up with Legend Trading to further extend their global reach and enhance user experience with seamless crypto purchases and fiat support in major currencies.

Big banks – Financial giants like JP Morgan are embracing the blockchain revolution. The JPM Coin, initially used in US dollars, is now available in euros, streamlining fund transfers between their branches and corporate clients, enabling 24/7 payments and smoother liquidity management. MUFG’s Progmat Coin joins the scene as a blockchain-based stablecoin platform, aiming to become a universal digital payment method that is compatible with other digital assets.

Payments platforms – Wirex, a crypto payments platform, has made a strategic move by partnering with Visa. This alliance grants them Visa membership in the Asia Pacific region and the UK, paving the way for them to directly issue crypto-enabled debit and prepaid cards in over 40 countries. Imagine swiping your Bitcoin-loaded card at your local cafe – that’s the future Wirex is building.

Cards – Mastercard enters the mix with its APAC-first digital wallet integration with Stables. This partnership allows users to convert stablecoins to fiat, enabling global spending at Mastercard-accepting merchants. Additionally, Mastercard is actively fostering innovation through its fintech accelerator program, supporting startups in the crypto and blockchain space.

Beyond the usual players – Deep tech ventures are also pushing boundaries. Crunchfish, a company developing a Digital Cash platform for banks and CBDC implementations, has partnered with LISNR, a proximity verification specialist. Together, they’re offering a groundbreaking proximity-based payment solution for merchants and banks. Envision paying for your coffee just by being near the counter – that’s the futuristic vision Crunchfish and LISNR are bringing to life.

Digital and green bonds

Tokenization, the process of converting traditional assets into digital tokens, is rapidly changing the financial landscape, with digital bonds and green bonds taking the lead. This has spurred enterprises to explore and invest in these innovative assets, attracted by their potential to streamline processes, enhance transparency, and unlock new opportunities.

Financial giants like Goldman Sachs and UBS are already revving their engines. Goldman Sachs’ Digital Asset Platform (GS DAP™) powered the European Investment Bank (EIB) in issuing the world’s first fully digital bond on a private blockchain. Similarly, UBS launched a three-year senior bond on Distributed Ledger Technology (DLT) through SIX Digital Exchange, showcasing the potential for efficient and secure bond issuance.

Green bonds, with their focus on financing environmentally beneficial projects, also are finding their tokenized groove. Project Genesis, a collaboration between the Bank for International Settlements (BIS) and the Hong Kong Monetary Authority (HKMA), developed a prototype platform to tokenize retail green bonds and track their environmental impact. This initiative, along with others from ABN Amro, the Japanese Exchange Group (JPX), and the BIS Innovation Hub, demonstrates the growing interest in tokenizing sustainable investments.

Digital assets custody

The digital asset landscape thrives on partnerships and innovation, and nowhere is this more evident than in custody solutions. While other areas remain entrenched, custody is forging a path forward, laying the groundwork for a robust future built on trust and security. These developments, fueled by partnerships and even the entry of insurers, are poised to propel digital asset adoption.

Let’s look at some key partnerships shaping the landscape:

BNP Paribas – The banking giant plans to offer custody services for Bitcoin and other digital assets, teaming up with fintech heavyweights Metaco and Fireblocks to build a secure and reliable offering.

Zodia – Recognized for its institutional focus, Zodia Custody has set foot in Singapore, aiming to meet the rising demand for bank-grade custody services across Asia-Pacific. Backed by industry stalwarts like Standard Chartered, SBI Holdings, and Northern Trust, Zodia leverages cutting-edge technology and stringent compliance to fuel digital asset adoption in the region.

Canopius – This leading (re)insurer has made its mark by underwriting a groundbreaking digital asset custody product in Singapore. This first-of-its-kind offering establishes Canopius as the pioneer on Lloyd’s Asia platform to provide local coverage for digital asset custody.

These partnerships and developments signify a critical shift. Custody solutions are no longer an afterthought but a cornerstone for building a secure and trusted digital asset ecosystem. With renowned institutions and insurers stepping in, the foundation for mass adoption is getting stronger, brick by brick.

Fueled by technology providers, the current digital asset generation is expected to dominate the market for the next two to three years. However, the true revolution lies on the horizon with the imminent arrival of Generation 3.0. This era will witness a surge in meaningful collaborations across communities, bringing forth a wave of tangible use cases for the public. Tokenization will shift from being a niche concept to a readily accessible tool for everyone.

In this dynamic landscape, competition will be fierce. To thrive, service providers must embrace partnerships and actively build their capabilities. The stark reality they face is either to join the ecosystem or get left behind.

If you would like to share your observations or have questions about the evolving digital asset industry and digital asset trends, please reach out to [email protected] or [email protected].

Discover what changes are likely to occur in sourcing spend, sourcing strategy, and locations, and which digital services and next-generation capabilities are expected to be in demand in our webinar, Key Issues 2024: Creating Accelerated Value in a Dynamic World.