Unpacking The Potential of a Hybrid Copilot Strategy: A Roadmap for Success | Blog

“We are the Copilot company; we believe in a future where there will be a Copilot for everyone and everything you do.” – Satya Nadella, CEO Microsoft

A hybrid Copilot strategy delivers the benefits of purchasing ready-made Copilots and developing custom solutions. Discover a six-step roadmap for devising a successful hybrid Copilot strategy and compare buying versus building in part two of our blog series.

Read our previous blog to explore the emerging Copilot trend, M365 Copilot opportunities for service providers and enterprises, and why a hybrid strategy represents the future for Copilot. Reach out to us to discuss more in depth.

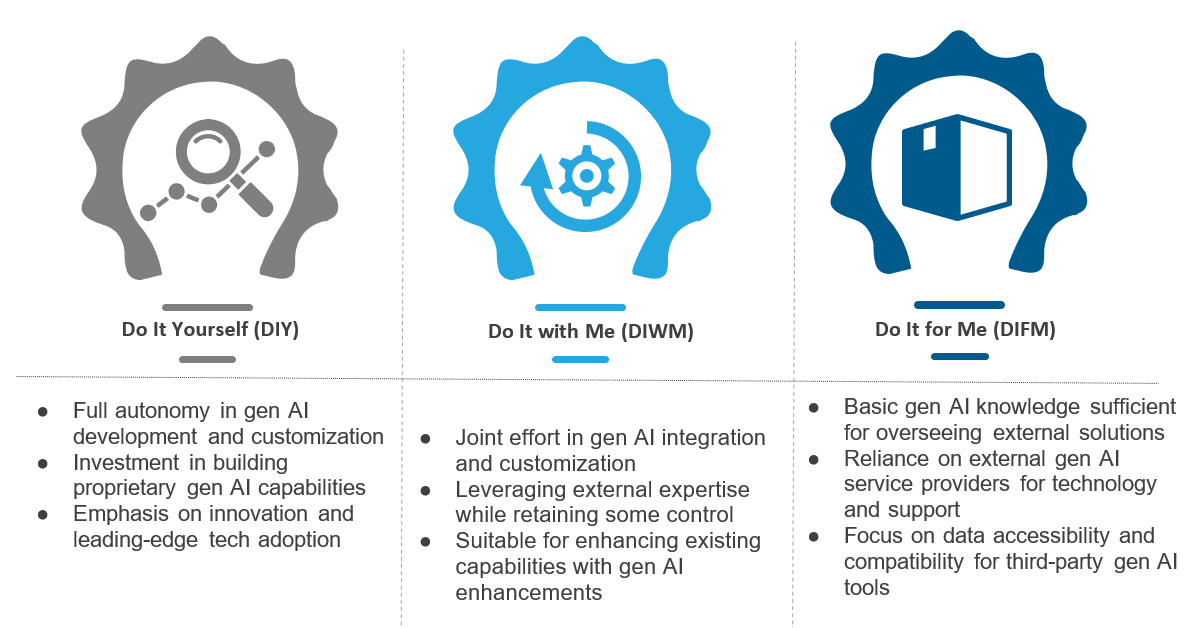

Hybrid Copilot is an innovative approach that seamlessly blends out-of-the-box offerings procured directly from vendors (Buy Copilots) and customized solutions built by the user with native tools or no-code/low-code platforms such as Microsoft Copilot Studio, Azure Open AI Service, Google Vertex AI, Open AI GPT Builder, AWS PartyRock, and others (Build Copilots). This synergy empowers enterprises to overcome the limitations of purchasing or developing, unlocking unprecedented potential within their environments.

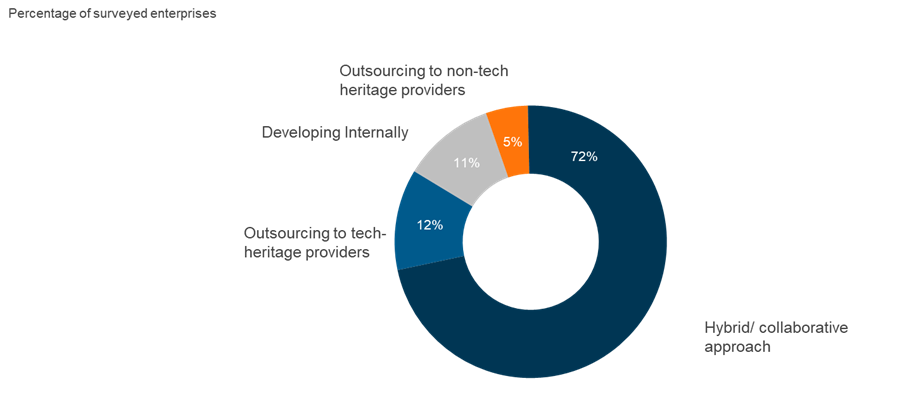

While the traction for out-of-the-box Copilots like M365 Copilot is palpable, enterprises are increasingly recognizing the value of building Copilots. A shift is underway with more customers developing Copilots rather than defaulting to M365 Copilot.

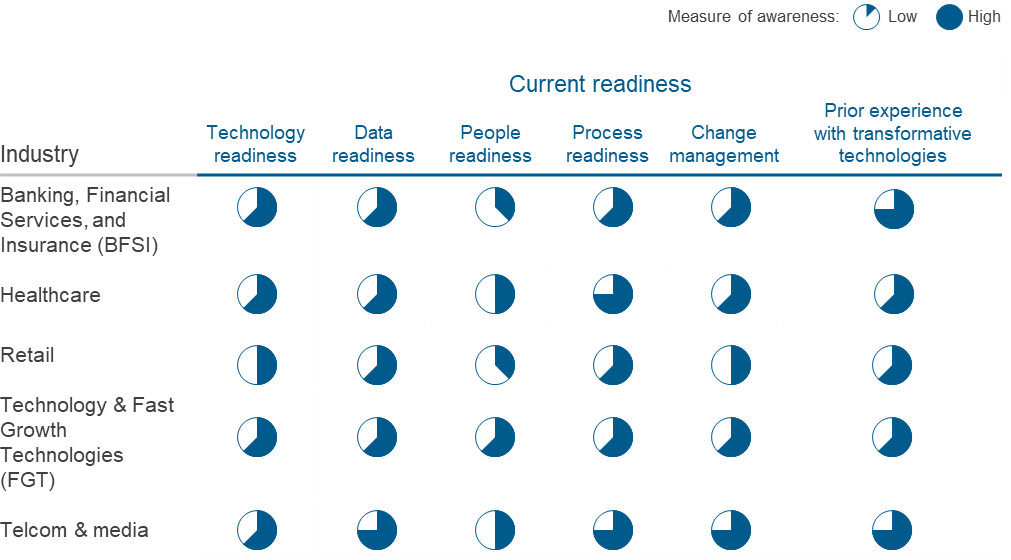

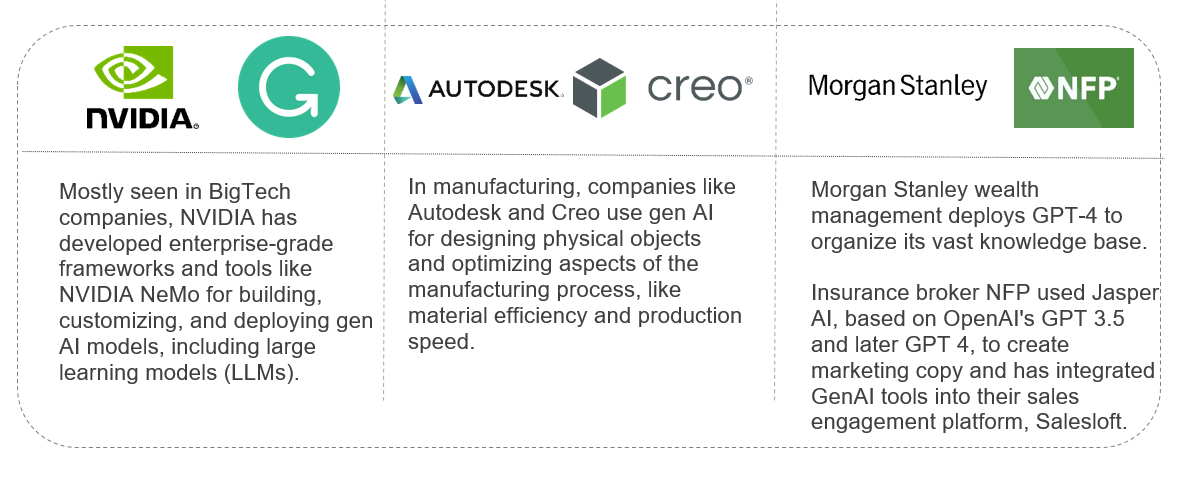

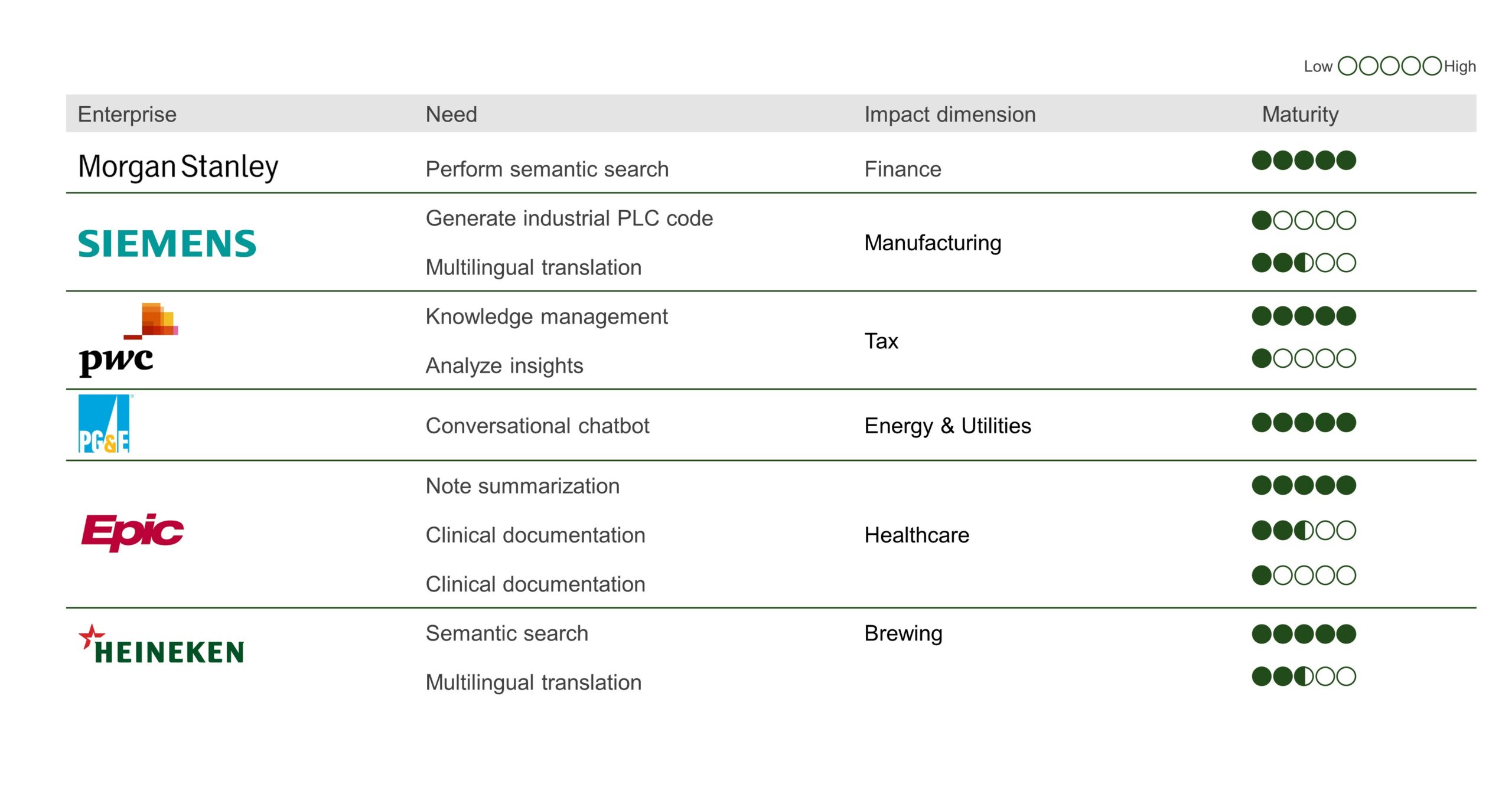

The exhibit below summarizes the rising momentum for Build Copilots among enterprises in various sectors, signaling a growing demand for custom solutions tailored to unique requirements.

In two months, more than 10,000 organizations have used Copilot Studio to either tailor Copilot for Microsoft 365 or create their own custom Copilots, Microsoft announced in its second quarter earnings call.

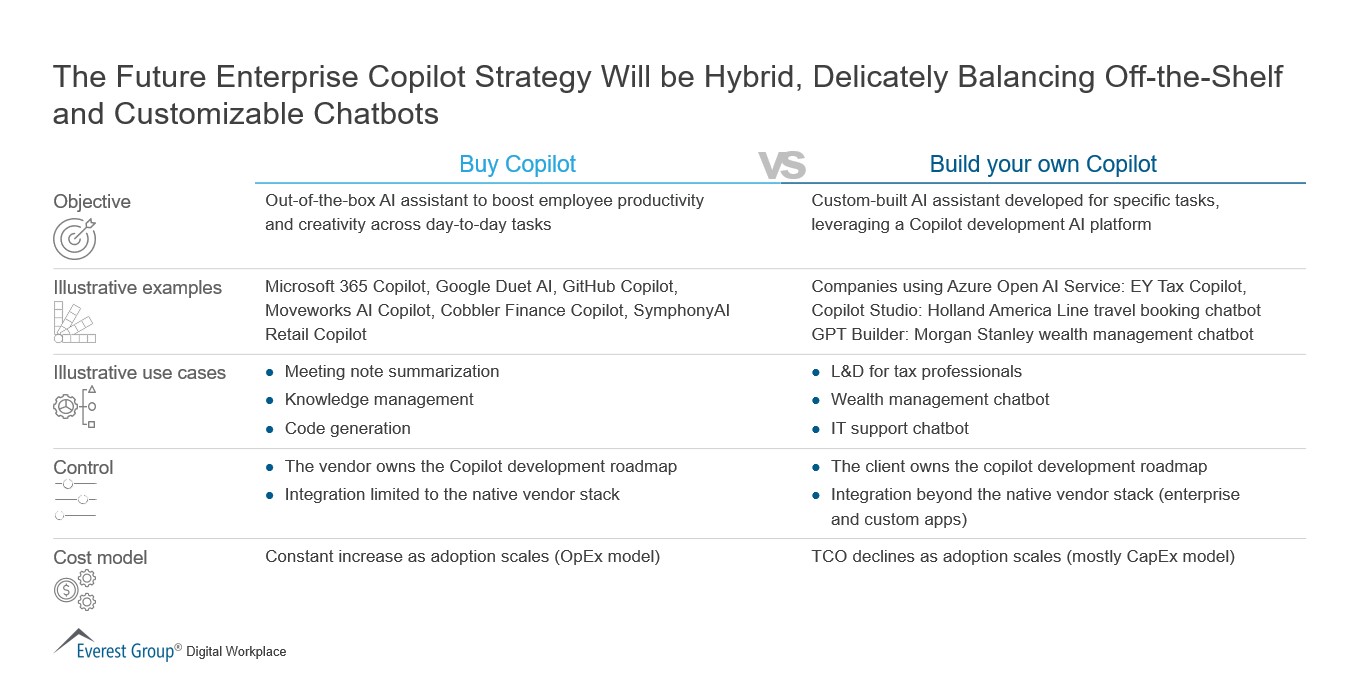

Contrasting Buy versus Build Copilot

The exhibit below captures the differences between the two approaches:

In navigating the Copilot landscape, enterprises find themselves at a critical juncture where the choice between buying and building carries profound implications. Let’s look at the pros of each:

- Buy Copilot: Offers the allure of rapid deployment, lower upfront investment, and access to a vast array of pre-packaged functionalities. Additionally, it requires minimal IT support, streamlining implementation processes, and reducing overhead costs

- Build Copilot: Provides unparalleled customization capabilities. By developing Copilots internally, enterprises gain complete control over the development roadmap, enabling tailored solutions fine-tuned to address unique business requirements. Furthermore, building provides integration flexibility, allowing seamless alignment with existing business applications and workflows

Economies of scale also come into play. While the upfront investment might be higher, the total cost of ownership (TCO) decreases as the adoption of custom solutions scales. Conversely, pursuing a Buy Copilot strategy may lead to constant TCO increases due to ongoing licensing fees and dependencies on external vendors.

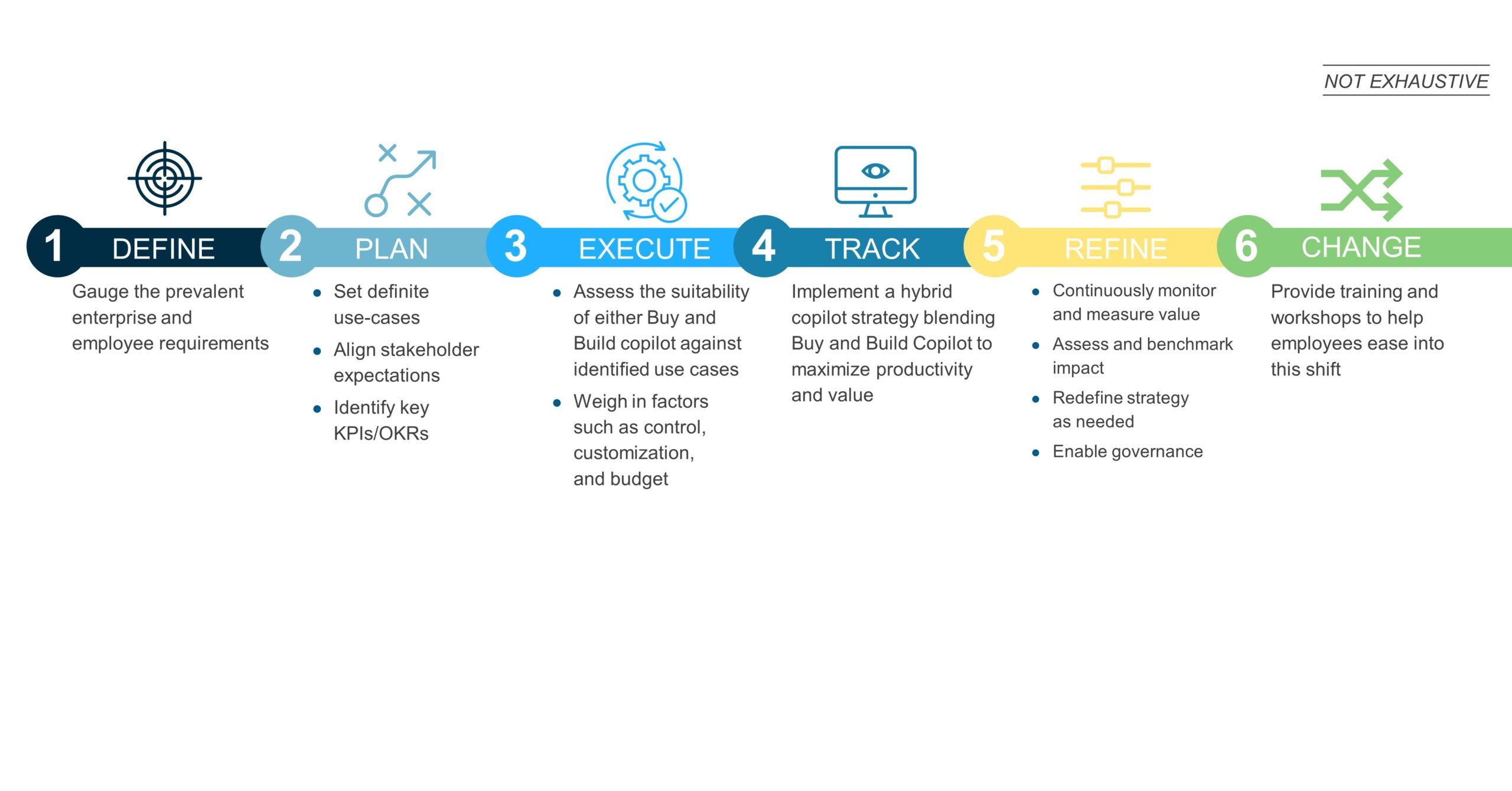

Roadmap for a hybrid Copilot strategy

In charting the course forward, enterprises must strike a delicate balance between buying and building Copilots.

The following six-step roadmap outlines a path to craft a successful Copilot strategy:

- Assess enterprise needs: Begin by comprehensively evaluating enterprise requirements, including workforce dynamics, operational workflows, and strategic objectives

- Identify use cases: Determine specific use cases and essential functions to maximize productivity and efficiency in the enterprise environment

- Evaluate Copilot categories: Weigh factors such as the number of use cases needed, customization and integration requirements, and budget constraints to determine what option is better

- Design and implement the hybrid strategy: Formulate a hybrid Copilot strategy that blends the strengths of buying and building by providing employees with either Buy or Build Copilots as required

- Monitor and optimize: Continuously monitor Copilot performance, gather user feedback, and optimize the strategy iteratively to drive ongoing improvements and maximize value

- Establish change management: Provide employees with training and adoption workshops to ease them into working with Copilots, helping boost productivity

The roadmap for a hybrid Copilot strategy empowers enterprises to leverage the best of both worlds, harnessing the rapid deployment and diverse functionalities of Buy Copilots while capitalizing on the customization and integration flexibility Build Copilots offer.

By strategically aligning with organizational needs and continuously optimizing, enterprises can confidently navigate the Copilot landscape, driving innovation, efficiency, and success.

Everest Group will continue to follow development in this space. To discuss, contact [email protected] and [email protected], or share your views at [email protected].

Watch the webinar, Global Services Lessons Learned in 2023 and Top Trends to Know for 2024, to learn the latest on delivery locations, sourcing strategies, deal trends, talent strategy, and cost optimization strategy.