Navigating the Landscape: The Cost and Benefits of Generative AI Implementation | Blog

Generative AI (gen AI) can significantly benefit the BFSI industry. However, it can be an expensive investment, making it critical for enterprises to conduct a cost-benefit analysis before implementation. Explore the various costs and advantages associated with this technology in this blog, or get in touch to find out more.

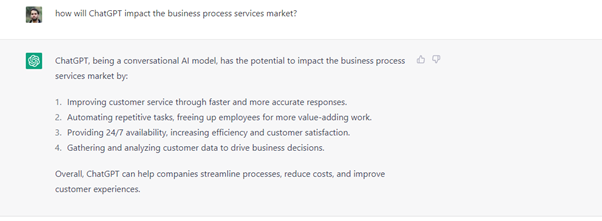

Gen AI has recently gained considerable attention in the banking, financial services, and insurance (BFSI) industry. Many use cases that go beyond creating or summarizing content are being explored throughout the value chain.

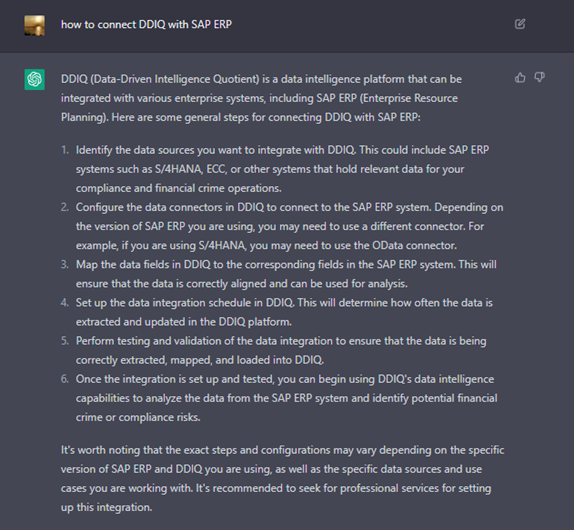

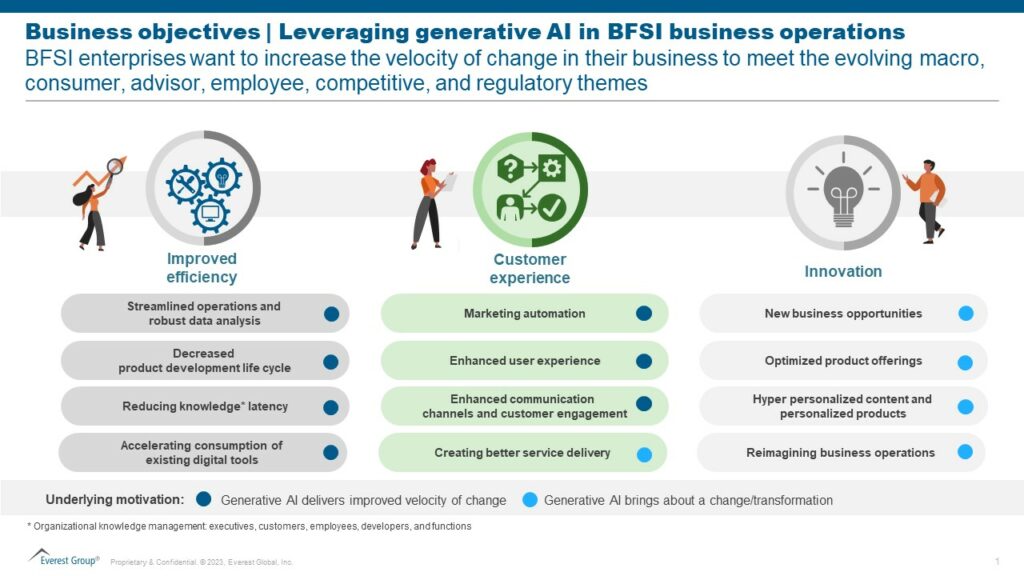

Implementing gen AI can improve the velocity of change, increasing the overall efficiency of existing tasks. This technology can streamline operational processes, automate tasks, and enhance customer experience by fostering engagement through tailored experiences. Moreover, it can potentially drive innovation to create change or transformation by generating unexplored ideas, optimizing products, and identifying new market opportunities. Ultimately, this positions enterprises for continuous evolution and success.

BFSI enterprises have recognized the transformative potential of adopting gen AI, which undoubtedly can disrupt existing enterprise models. In the race to get the early advantage, enterprises face challenges as they reallocate funds from other projects and seek to secure new investments to finance new AI and gen AI initiatives.

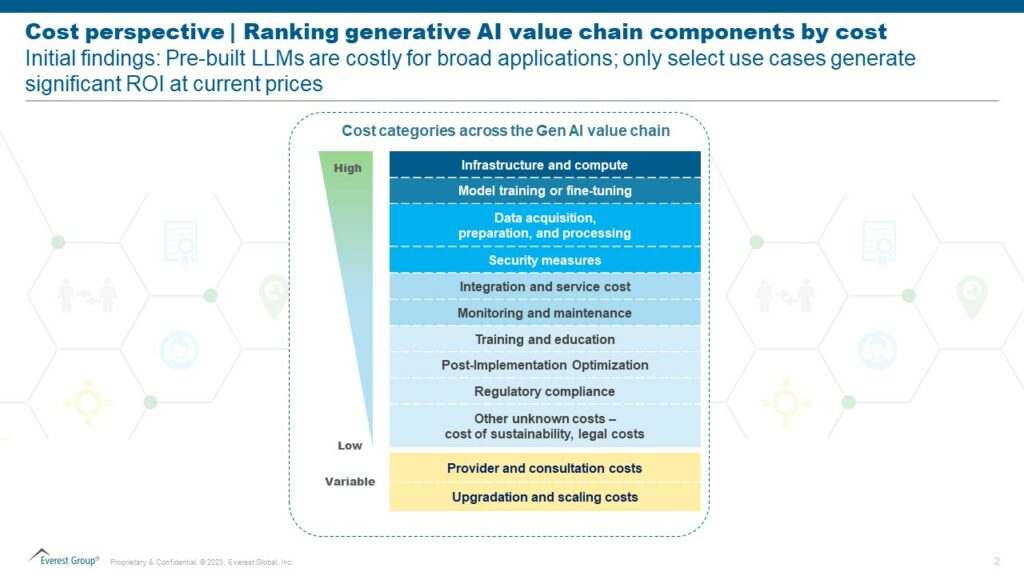

Concurrently, cloud costs emerge as a significant concern that can potentially escalate when training AI models. However, the overall cloud cost impact from gen AI hinges on specific use cases and model architecture.

A cost-benefit analysis becomes imperative as gen AI-driven use cases are limited, and most can be explored through other AI technologies. This is particularly important because other relatively less expensive technologies can achieve comparable outcomes with similar efficiency.

While gen AI has generated a lot of hype and rapid investment, it’s not currently viable to implement the technology almost everywhere without understanding the cost implications for achieving the potential gen AI benefits. Let’s explore this further.

Exploring Cost and Generative AI Benefits

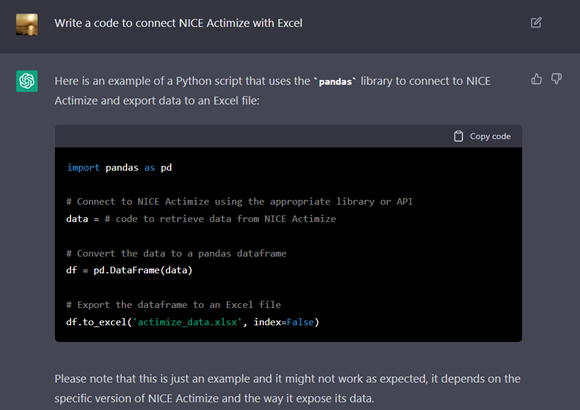

Below are some of the high-cost categories across the value chain to consider:

Infrastructure and compute

The computational backbone, encompassing graphic processing units (GPUs), tensor processing units (TPUs), and energy consumption, constitutes a substantial investment. Building and maintaining a powerful infrastructure is pivotal for running complex algorithms and training sophisticated models.

Model training or fine-tuning

Gen AI implementation comes with many fixed and variable costs. Training or fine-tuning gen AI models to meet specific requirements is intricate, involving significant computational resources, expert oversight, and time. These costs are substantial but also the foundation for the gen AI model’s efficacy and adaptability.

Data acquisition, preparation, and processing

Performance is heavily influenced by the data quality on which these models are trained. Collecting, cleaning, and storing data can come with high costs to acquire, prepare, and process diverse and high-quality datasets. Ensuring diverse and representative datasets while maintaining data quality standards can be challenging, ultimately impacting the accuracy and reliability of gen AI outputs. At the same time, acquiring high-quality data for training gen AI models and holistic data readiness initiatives can be expensive and require significant capital investments, especially if specialized or proprietary datasets are required.

Security measures

In a highly regulated industry like BFSI, where data and security are imperative, meticulous attention to security and regulatory compliance is critical. Implementing robust security measures cannot be compromised.

However, this adds costs for deploying cybersecurity measures, encryption protocols, and access controls to protect sensitive financial data, notwithstanding increased investments in security technologies, routine audits, and adherence to industry standards.

Considering that gen AI often relies on large datasets, managing personally identifiable information (PII) necessitates strict adherence to data privacy regulations.

Privacy-preserving techniques, anonymization processes, and implementing consent management systems to meet compliance requirements can be costly. On top of that, continuous monitoring and regular audits are essential to maintain compliance and security standards, contributing to ongoing operational expenses.

Integration and service

Not all models run independently and often require integration with existing systems. Seamlessly integrating gen AI into existing workflows and providing continuous support have financial implications. The processes of customization, compatibility checks, and uninterrupted service provision collectively contribute to the overall expenditure.

Regulatory compliance

Operating within a highly regulated BFSI industry with standards such as the General Data Protection Regulation (GDPR), the Health Insurance Portability and Accountability Act (HIPAA), and industry-specific regulations necessitates additional investments in compliance monitoring, data governance, and legal counsel.

Non-compliance with these regulations may lead to fines and legal consequences. As the regulatory laws for gen AI are still evolving, enterprises must be vigilant.

In light of the dynamic regulatory landscape, remaining flexible to accommodate incoming regulations is crucial.

Post-implementation

Following deployment, continuous monitoring and proactive maintenance of the systems are demanded to ensure gen AI’s sustained performance. Although this is an ongoing expense, these measures are pivotal for adaptability and longevity.

Talent related costs

Enterprises may incur expenses related to recruitment efforts, training programs, certification courses, and retention strategies to attract and retain top talent in the competitive gen AI landscape. As gen AI continues to evolve and play a pivotal role in digital transformation initiatives, businesses must carefully consider and budget for talent costs to ensure successful implementation and utilization of advanced AI technologies.

While investments in gen AI and related technologies are crucial, enterprises must also invest in their human capital by empowering employees with the skills and knowledge needed to thrive in today’s digital age. Effective leadership and a commitment to upskilling and reskilling will drive successful technology adoption and foster an organizational culture of innovation and agility.

The outlook for cost reduction efforts

While gen AI comes with a high cost, the landscape is evolving daily. Technology companies are substantially investing in developing proprietary AI chips and more efficient architectures, a strategic shift that aims to diminish reliance on expensive alternatives.

Enterprises can also explore a micro use case-led approach to implementing gen AI, deploying small, focused areas where gen AI can deliver clear and measurable benefits. Targeting smaller tasks allows for quicker development and deployment of gen AI solutions, leading to faster ROI (Return on Investment). Micro use cases provide opportunities to test and learn from gen AI implementations, enabling continuous improvement and informing future deployments. Smaller projects require less time and resources compared to developing a large, complex gen AI system.

Moreover, the gen AI domain is experiencing a notable training cost reduction, with some solutions claiming a remarkable 50% reduction. These advancements signal a significant stride toward enhancing AI’s capability and affordability, marking a pivotal turning point in the technology’s ongoing evolution.

While the costs associated with gen AI implementation are evident, the benefits in specific uses can significantly outweigh the expenses. Balancing financial considerations and the innovation potential is key. Enterprises must align their AI strategy with business objectives to position themselves at the forefront of innovation and competitiveness.

To discuss gen AI in BFSI, please reach out to [email protected], [email protected], and [email protected].

Looking for use cases for gen AI? Check out our LinkedIn Live on Distinguishing Gen AI Hype from Real Application, or read our latest research on generative AI and its adoption potential.