Nine Tactics that Can Improve Salesforce Contract Negotiation | Blog

Getting the best deal on Salesforce CRM software can be tricky. Most enterprises find contract benchmarking challenging because market data and custom discounting on modules are unclear. Learn nine key approaches and valuable market insights from our Salesforce contract negotiation playbook that can be used in purchasing or renewal discussions.

When negotiating, understand that software and services are quite different businesses. Over our 25-plus years of services experience, we have observed large pricing variations for services due to client-specific factors such as lead time to renewal, industry, enterprise business size, etc. The software business also has the additional complexity of product stickiness compared to services.

Enterprises should be mindful that, like any software provider, Salesforce also wants to increase its overall revenue per customer each year and is always actively looking for opportunities to increase user volume, expand product adoption rates, and upsell higher versions by offering value adds and new modules at discounted rates.

To get optimal pricing, especially with a looming recession, enterprises should be aware of the various Salesforce contract negotiation tactics that they can leverage for new contracts as well as renewals.

Based on our experience assessing Salesforce contracts for customers of varying revenues and domains, we have found the following nine steps that can give enterprises an edge:

- Assess current and future demand: Enterprises should thoroughly assess their current Salesforce usage and environment. Having a granular understanding of the utilization of individual modules and add-on needs can prevent the enterprise from buying more expensive and premium editions. While customers have seen better Salesforce discounts for more expensive editions, enterprises should always purchase the most suitable versions for their end users (super or light users) to alleviate concerns about software usage

- Examine new products or potential alternatives: When performing demand management, enterprises also should look at cost-effective, viable alternatives from competing vendors. Even if similar options do not exist for each module, demonstrating awareness of alternatives can initiate effective discussions during Salesforce contract negotiations

- Perform an enterprise-level portfolio assessment: Different business units often get varied pricing (even if marginal) for individual modules since they have either different sales reps or the products were added to the Salesforce portfolio through acquisitions. We recommend enterprises build an extensive roadmap of future requirements that consolidates and forecasts volumes across business Larger deals with greater volume are more likely to get higher discounts versus multiple smaller deals with low volume. Also, signing longer contract terms can be an effective measure to get better discounts in Salesforce contract negotiations

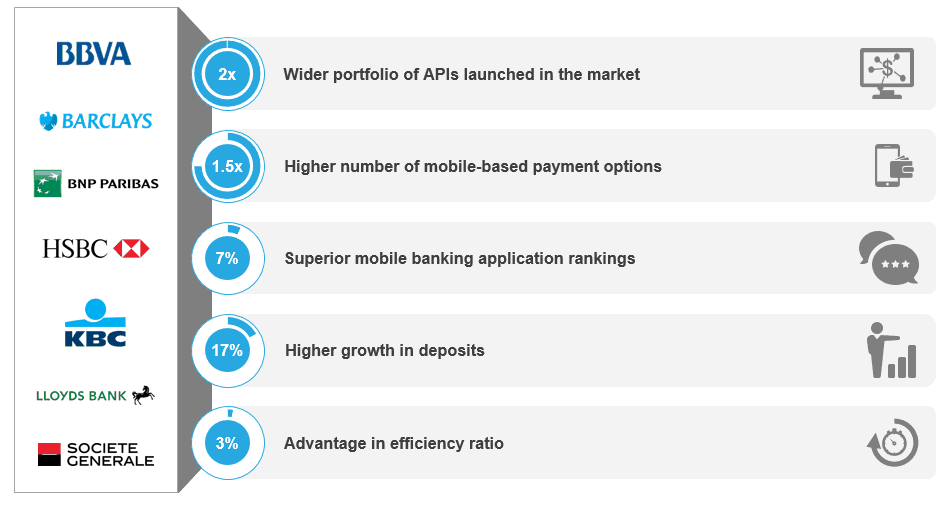

- Evaluate the contract’s market competitiveness: We have observed that Salesforce product pricing varies significantly across enterprises based on deal size, industry, strategic relationship, client logo, contract tenure, etc. We highly recommend enterprises perform external contract benchmarking of their existing agreement before entering the negotiation process. This provides more transparency on the deal’s competitiveness and also makes Salesforce more open to discussions about the overall commercial structure, including unified price protection, upfront and volume-based discounting, etc. We see enterprises receive competitive pricing and higher discounts for additional modules or for products where Salesforce is expanding into new areas. For example, organizations that previously used Sales and Service Cloud may get better discounting for the marketing modules as Salesforce views this as an investment to get entrenched into the enterprise’s overall value chain

- Align negotiations with Salesforce’s fiscal end of quarter/year: Many enterprises already know that Salesforce’s fiscal year concludes later or earlier than the typical calendar/fiscal year of its clients. To ensure predictable revenues, Salesforce account executives may want to quickly close negotiations by offering a few additional single-digit percentage point discounts during this period

- Understand the account executive’s role in discounting: Salesforce has a multi-tiered discounting structure. This implies that each management level has the authority to approve specific incremental discounts. While the deal desk decides the discounts, enterprises must clearly communicate expectations (including asking for cash preservation for future years) with the account executive, who can further send the correct messages to the next approval level

- Take advantage of service credits: Much like other software providers, Salesforce or its resellers may offer customers certain resources as an investment to support them during the platform implementation. Service credit provides an effective way to have hand-holding during the actual implementation

- Secure upfront price protection: At the start of the relationship, an enterprise has the most leverage. With new contracts, enterprises should sign upfront price protection clauses to prevent price increases for at least two to three years. When renewing, longer-term contracts instead of yearly renewals can help protect prices

- Sign global contracts: Enterprises also should ask Salesforce for global contracts that not only consolidate the business units or geographies but also acquire products such as Tableau, Mulesoft, Slack, etc. Discounts are often lower for these products because each unit has its own sales representatives and enterprises spend less on these platforms. Enterprises should request one single point of contact for negotiating the entire portfolio

While each relationship with Salesforce is unique, we firmly believe these recommendations can put your enterprise in a better negotiating position. To discuss Salesforce contract negotiation and for a detailed analysis, please reach out to [email protected]. Explore more about Everest Group’s contract benchmarking offerings.

Don’t miss our session, Nordea’s Story: IT Vendor Management Transformation, to hear from Mihaela Tapu, Head of Supplier Performance Management at Nordea, and how Nordea transformed its IT vendor management function to overcome key obstacles related to compliance, service level management, financial planning, and control.