Four Reasons Enterprises Aren’t Getting Full Value from their Automation CoEs | Blog

As we mentioned in our Enterprise RPA Pinnacle report, there are multiple benefits of having an automation CoE:

- Facilitates best practices and skill development, which eventually help in faster scaling-up

- Provides structure and governance to the automation program, e.g., clarifies roles and responsibilities of various teams involved

- Enables optimization of software and license costs

- Fosters sharing and pooling of resources

- Develops strong cross-functional collaboration among stakeholders.

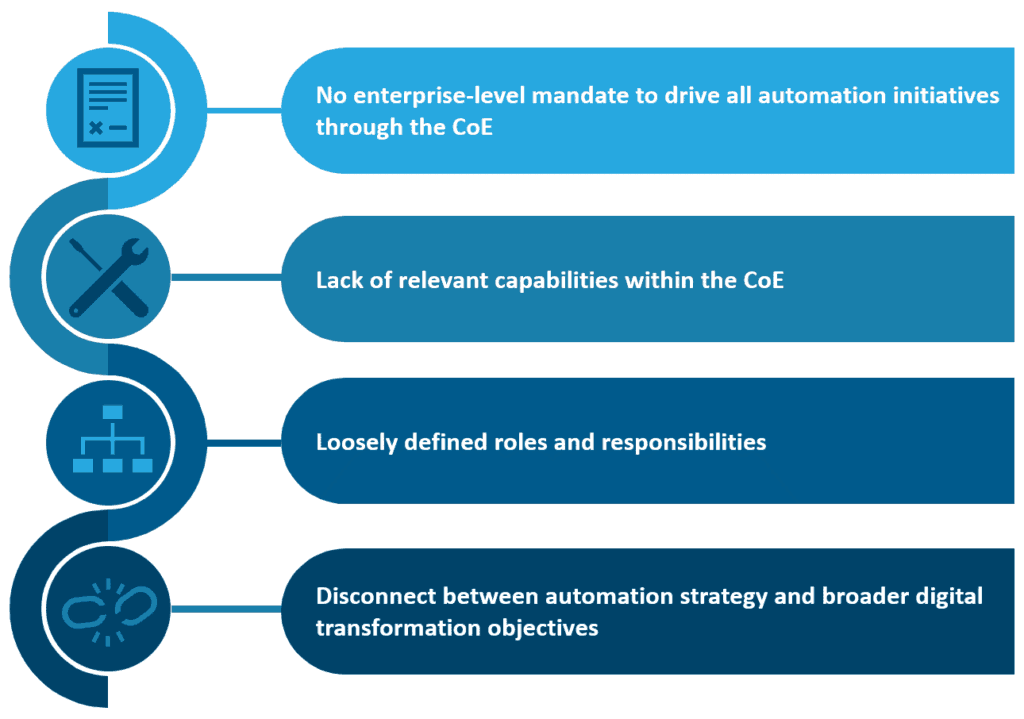

While many enterprises have established CoEs to overcome challenges and accelerate their automation journeys, not all have been able to extract value from them. Here are some common pitfalls that limit the true potential of an automation CoE.

No Enterprise-level Mandate to Drive all Automation Initiatives through the CoE

Automation CoEs work when there is a clear mandate from enterprise leadership. This directive helps ensure that the operating procedures and governance mechanisms are standard across the enterprise. Lack of it could result in the enterprise driving automation initiatives in pockets, leading to potential cost increases, lower license utilization, lower reusability of automation assets, and increased governance challenges.

Lack of Relevant Capabilities within the CoE

In its true sense, a CoE represents an entity with the capability to drive automation initiatives across the enterprise independently, with minimum oversight from outside. In many enterprises, however, automation CoEs lack the relevant skill sets – such as developers, project managers, solution architects, and infrastructure support staff – that are critical to driving these initiatives. Successful CoEs typically have three focus areas: day-to-day delivery, operational/tactical decision making, and strategic decision making/providing direction. Each layer, or focus area, has a unique set of roles and responsibilities that are critical to a smooth functioning CoE. Successful CoEs have an intentional focus on developing and nurturing in-house talent to strengthen the capabilities across the three layers. Many CoEs also bring in third-party specialists to accelerate learning. Our blog titled Driving Success in Your Automation Center of Excellence provides more details.

Loosely Defined CoE Roles and Responsibilities

The role of an automation CoE goes beyond just deploying bots into production. CoEs in best-in-class adopters of automation have evolved from executing solutions to empowering businesses across locations to drive initiatives on their own. For instance, the automation CoE in a financial services firm has established standard operating procedures (SOPs) for driving automation initiatives which include a well-defined approach for process selection, evaluation of ROI, talent impact, access to a library of reusable assets, etc. The CoE has created a platform through which business leaders can access these SOPs to evaluate opportunities on their own, and provides necessary governance and execution support, including talent and infrastructure.

As highlighted in Everest Group’s Smart RPA Playbook, the typical roles and responsibilities of automation CoEs include:

- Providing training and education to develop talent

- Approving all automation procedures before they are put into production

- Assessing suitability of Smart RPA versus other Smart IT tools for use cases

- Ensuring quality and compliance through well-defined standards, procedures, and guidelines owned and developed by the CoE

- Driving the roll-out and implementation of Smart RPA projects, and ensuring coordinated communication with relevant stakeholders

- Defining the roles, responsibilities, and skills sets required for driving automation across the enterprise, and regularly reviewing and optimizing them

- Tracking success/outcomes in collaboration with operational teams so they can build, review, and refine the business case for scaling up.

Disconnect between Automation Strategy and Broader Digital Transformation Objectives

Outcomes achieved through automation initiatives are best realized when these investments are in line with the enterprise’s broader digital transformation objectives. Factors such as investments in other digital technologies (e.g., ERP transformation), changes in leverage of Global In-house Centers (GICs) or shared service centers, changes in vendor roles, etc., can have an impact on automation strategy. Automation CoEs need to closely align with enterprise strategy to realize maximum value.

Pinnacle EnterprisesTM – which we define as companies that are achieving superior business outcomes because of their advanced capabilities – have mastered each of these four requirements for successful automation CoEs. To learn more about how they’re maximizing value from their automation CoEs, please see our Enterprise RPA Pinnacle report.

Feel free to share your opinions and stories on how your automation CoE is evolving in its journey directly with me at [email protected].