Appian’s Jidoka Acquisition Sets the Scene for the RPA Market in 2020 | Blog

Appian announced its intent to acquire the Spanish vendor Novayre Solutions SL and its Jidoka RPA platform on January 7. With this acquisition, Appian, best known for its low-code process management and orchestration software, will be able to offer extensive automation capabilities natively, while it did so previously with partners’ software such as Blue Prism and UIPath.

So, what does the acquisition mean for the market?

Why the acquisition?

Our estimates show that the RPA third-party software market is expected to grow by 80 percent to reach $2.5 billion this year. With this phenomenal growth rate, it’s not surprising that non-RPA companies want a slice of the pie.

Appian has been active in this market for a while and has benefitted from many new clients thanks to its partnerships with RPA vendors. It is also a reseller for Blue Prism and has experienced growing demand for RPA first-hand through that channel.

In addition, technology giants are increasing their activities in this market. SAP acquired Contextor back in 2018. And most recently, Microsoft announced UI flows to add RPA capabilities to Microsoft Power Automate (previously Microsoft Flow). It combines digital process automation (DPA) via APIs with UI-based automation. Pega is another competitor that has also invested in this market; it took over OpenSpan back in 2016.

Why Jidoka, and what about the partners?

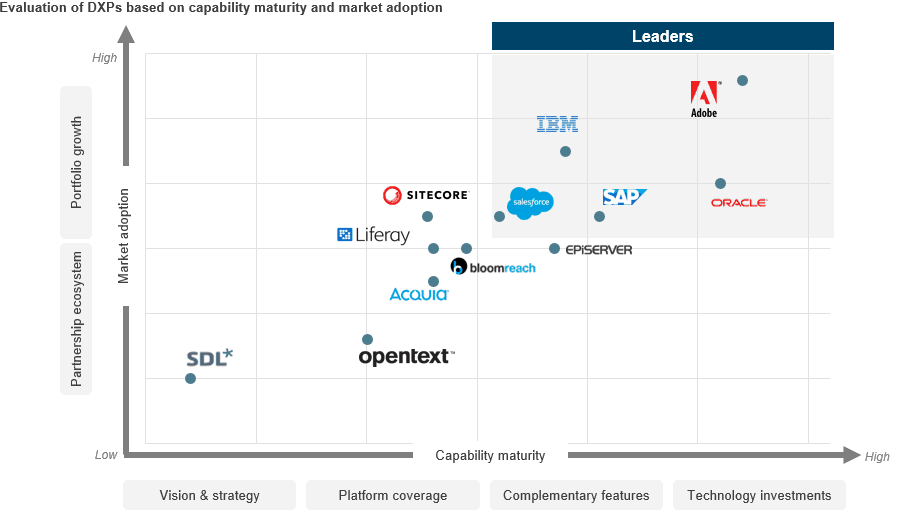

We have assessed Jidoka as part of our RPA Technologies PEAK Matrix for a number of years and most recently positioned it as a major contender in our 2019 assessment. Jidoka is a Java-based platform where robots are designed and managed by a web-based console. There is a design studio for workflow and orchestration of robot operations. A console centralizes monitoring, audit, and exception handling features along with secure user permission and authorization capabilities. It has proprietary image recognition technology, Hawk Eye, to support Citrix automation. The platform offers capabilities such as auto-scaling of robots, a secure credentials vault, roles-based access controls, execution logs, audit trail, robot performance analytics, and ROI calculator. It also offers a chatbot capability that is available from the console. Real-time human-robot collaboration is provided via chat interface from the console (and Google Home,) the Jidoka mobile app (voice and chat,) and via IoT devices.

Appian intends to rebrand the product as Appian RPA. It will turn it into a low-code environment and integrate it with its own solutions to be offered on the cloud on a competitively priced subscription basis. While growing in Spain and Latin America, Jidoka has limited presence in other geographies. This is something that Appian can address with its presence in major tech markets.

As for its partnerships, Appian is keen to keep them going and offer clients choices. It remains to be seen how partners such as Blue Prism and UiPath will react to this news. It is not unusual for partners to go for co-opetition. For example, last year Blue Prism announced an Intelligent Document Processing (IDP) solution called Decipher, but has maintained its partnerships in the IDP segment, e.g., with Abbyy.

What does it mean for the market?

We have been expecting M&A activity in this sector to increase with market maturity and as RPA becomes a key tool for process efficiency and productivity. RPA is also commoditizing, and the fact that Appian is acquiring a very small vendor shows that entry into the market is not expensive. The news of this acquisition could encourage other tech companies, particularly those in the process management and orchestration space, to act too. There are many small RPA vendors with good offerings. The big RPA players with their current large valuations could suffer if a wave of acquisitions materialized and bypassed them; but at the same time, they have an awful lot of customers and a huge global footprint among them. Furthermore, private equity investors continue to invest in the market, as evidenced by Automation Anywhere’s last round of funding. This market remains buoyant and dynamic.

With Microsoft getting into the RPA business, all vendors have to up their game to remain competitive. As for the RPA scale challenge that many enterprises are facing, vendors are working on this with new, improved offerings in the areas of robot management and controls, ease of use, and increased robot resiliency. With its existing and new capabilities, Appian will be well placed to address the scale challenge to make RPA adoption and operations smoother and, in so doing, edge ahead of the competition.