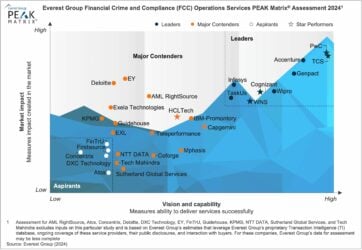

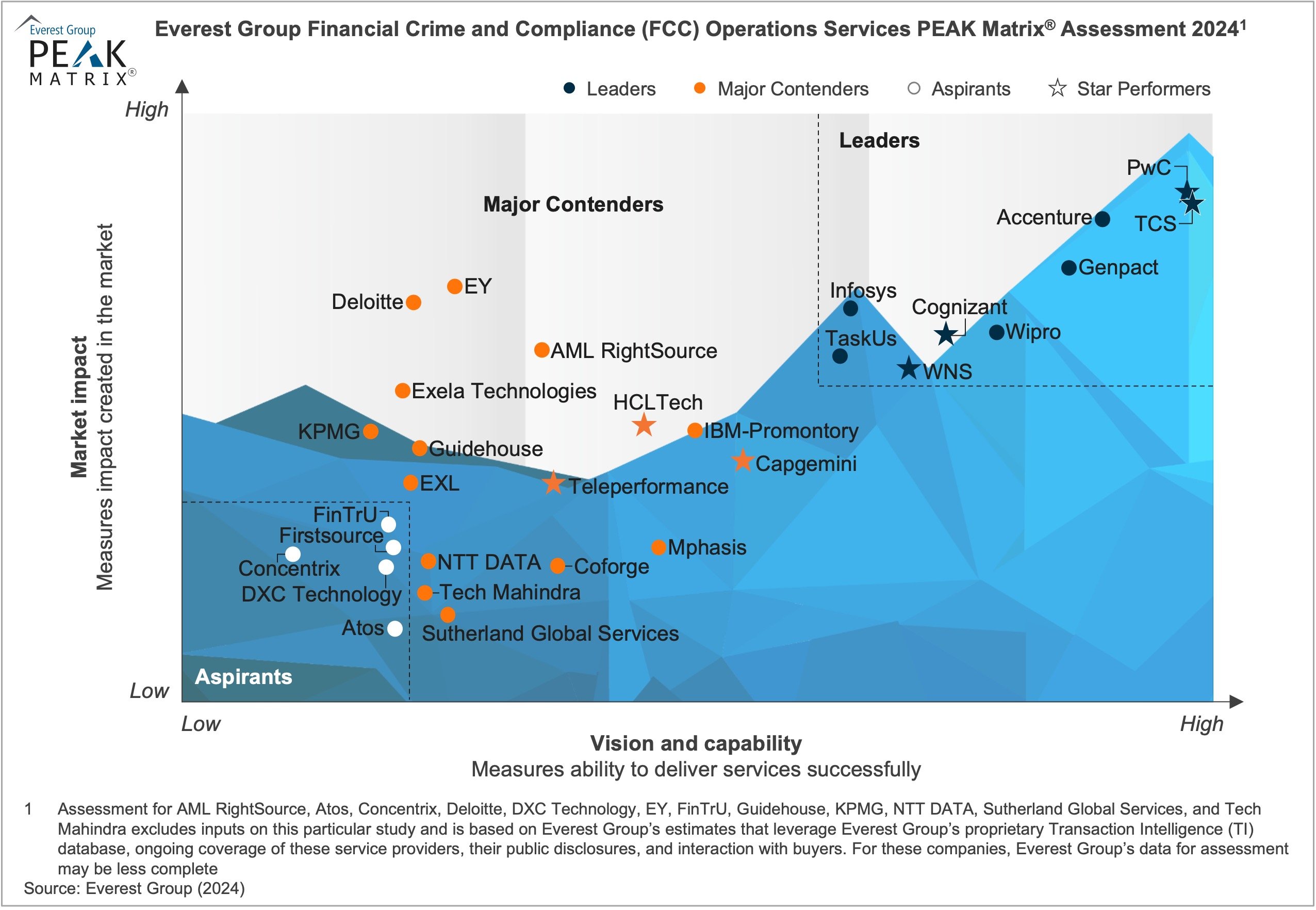

Financial Crime and Compliance (FCC) Operations Services PEAK Matrix® Assessment 2024

Financial Crime and Compliance (FCC) Operations Services

The Financial Crime and Compliance (FCC) operations landscape is rapidly expanding within the Banking and Financial Services (BFS) industry. Amid challenges such as rising fraud, evolving regulatory norms, economic pressures, and unique geopolitical circumstances, financial institutions and next-generation participants are striving to meet compliance standards. They are working to safeguard themselves from financial crimes while managing operational costs and enhancing delivery capabilities. The introduction of new regulations in the financial sector necessitates a dynamic regulatory compliance framework, posing a global management challenge for these institutions.

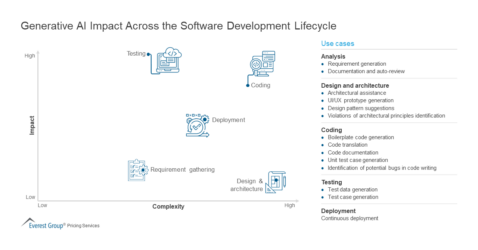

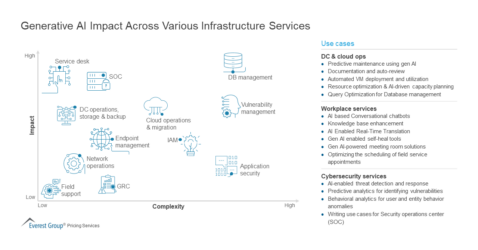

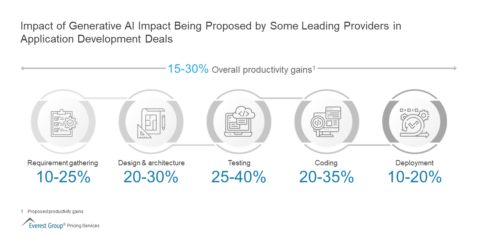

In response to these challenges, the demand for digital-led FCC offerings is rising. Providers are seizing opportunities to leverage technology in their capabilities, provide platform-led solutions, and co-innovative advisory services to meet the industry’s growing demands. Stakeholders prioritize efficiency and productivity, aiming to reduce false positives and mitigate potential losses from regulatory fines.

Financial Crime and Compliance (FCC) Operations Services PEAK Matrix® Assessment 2024

What is in this PEAK Matrix® Report

This report features 30 FCC operations service provider profiles and includes:

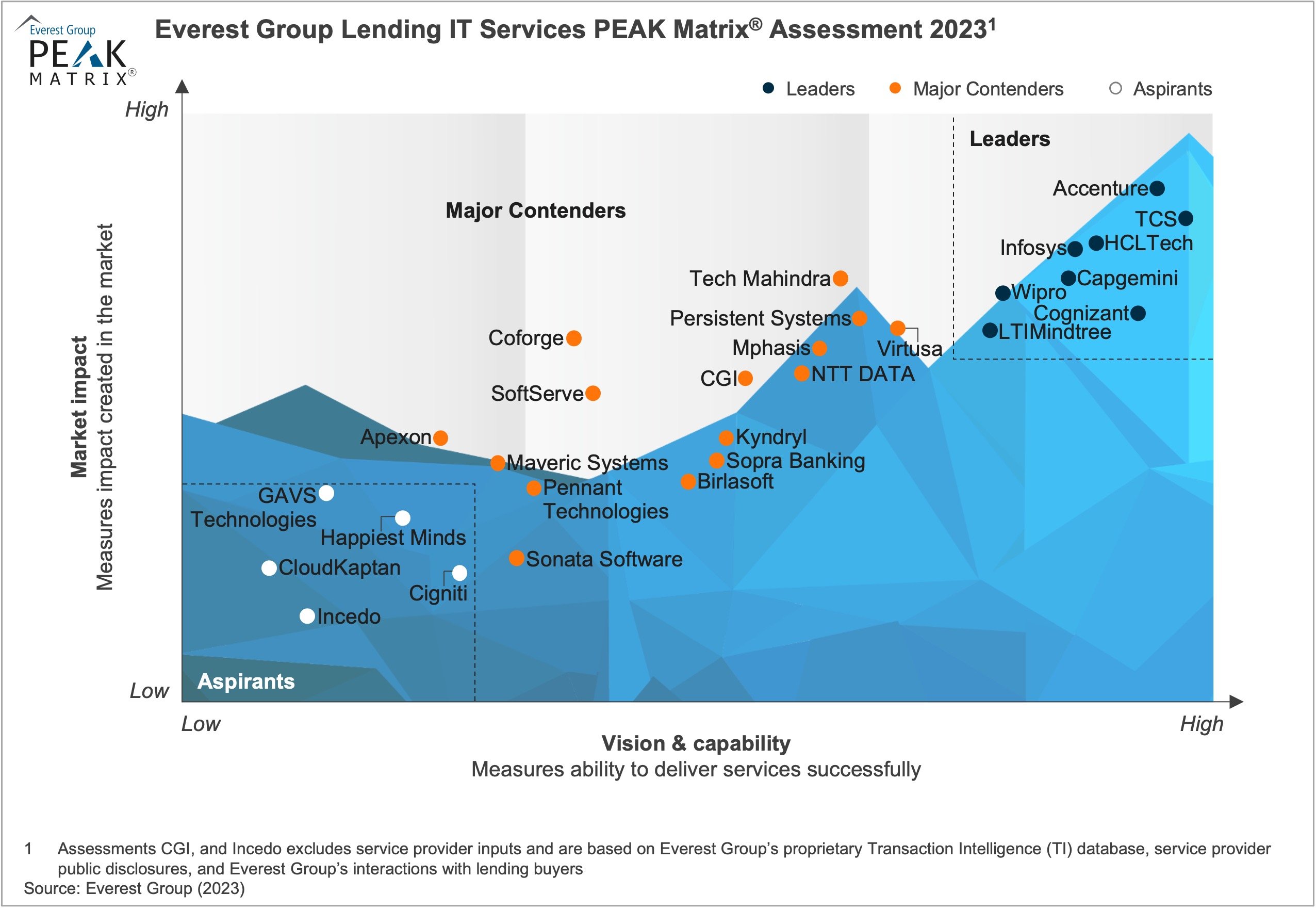

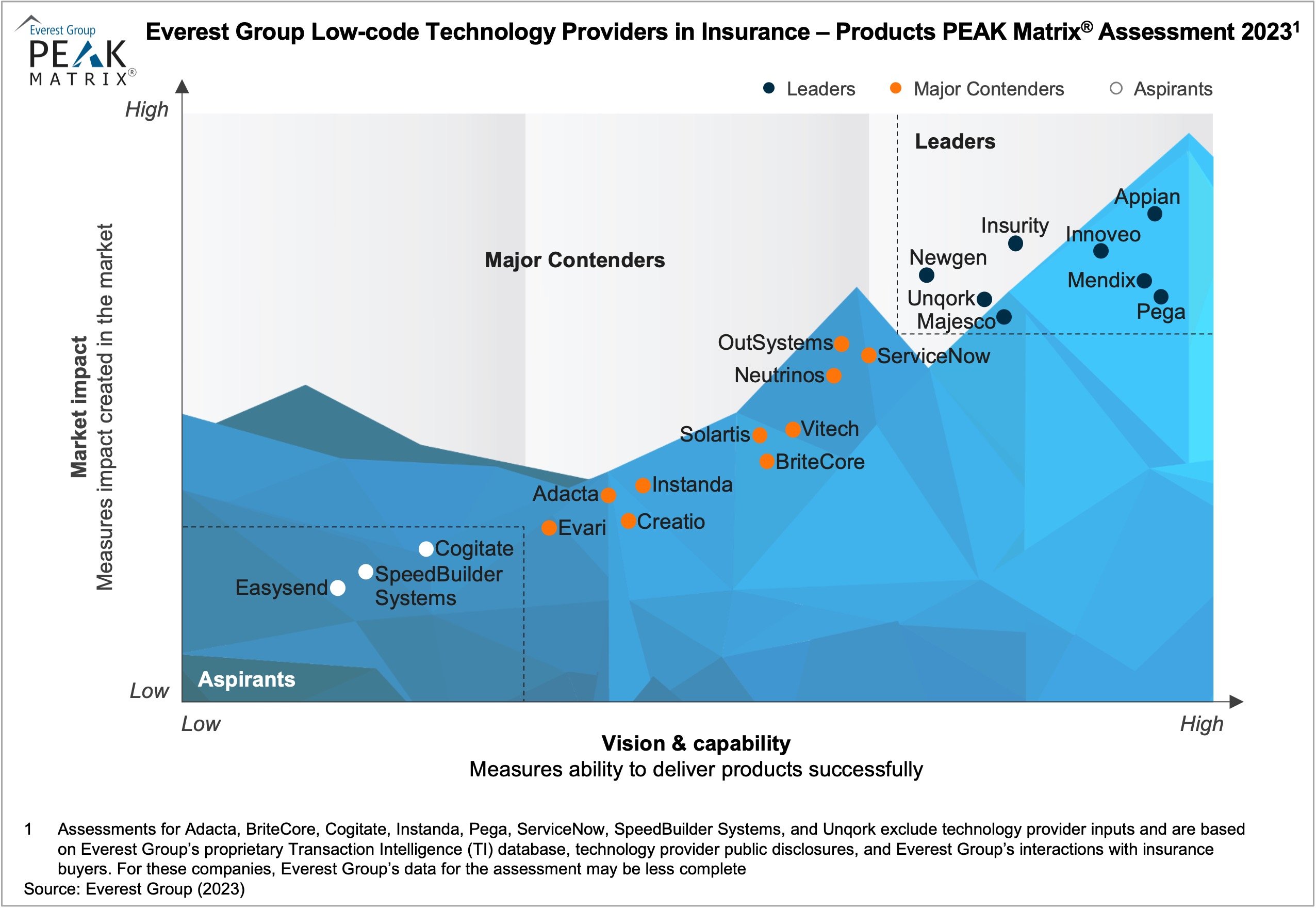

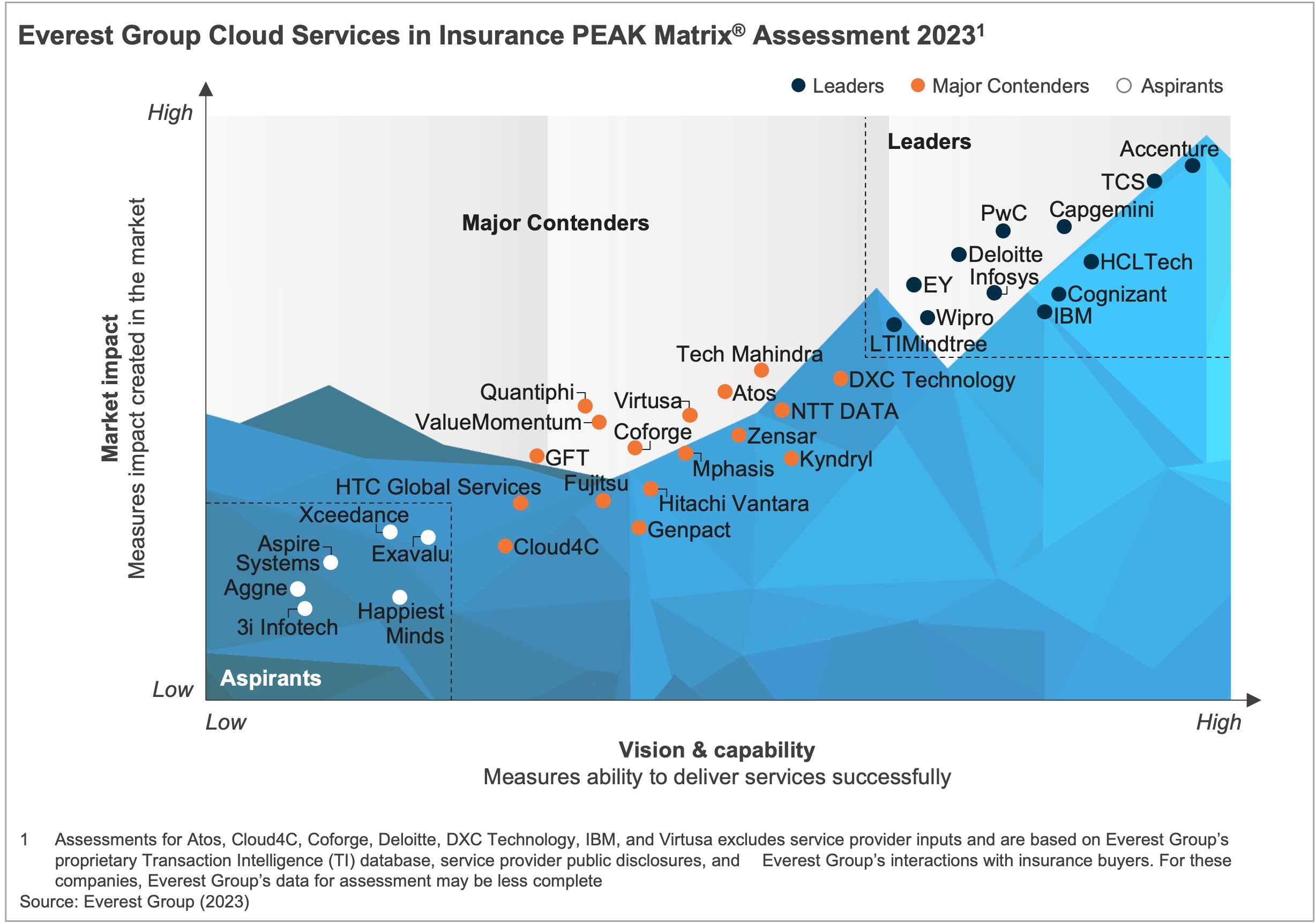

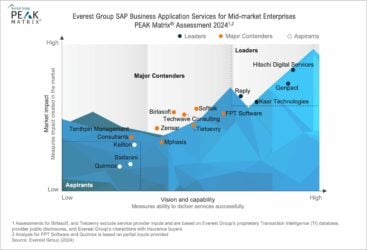

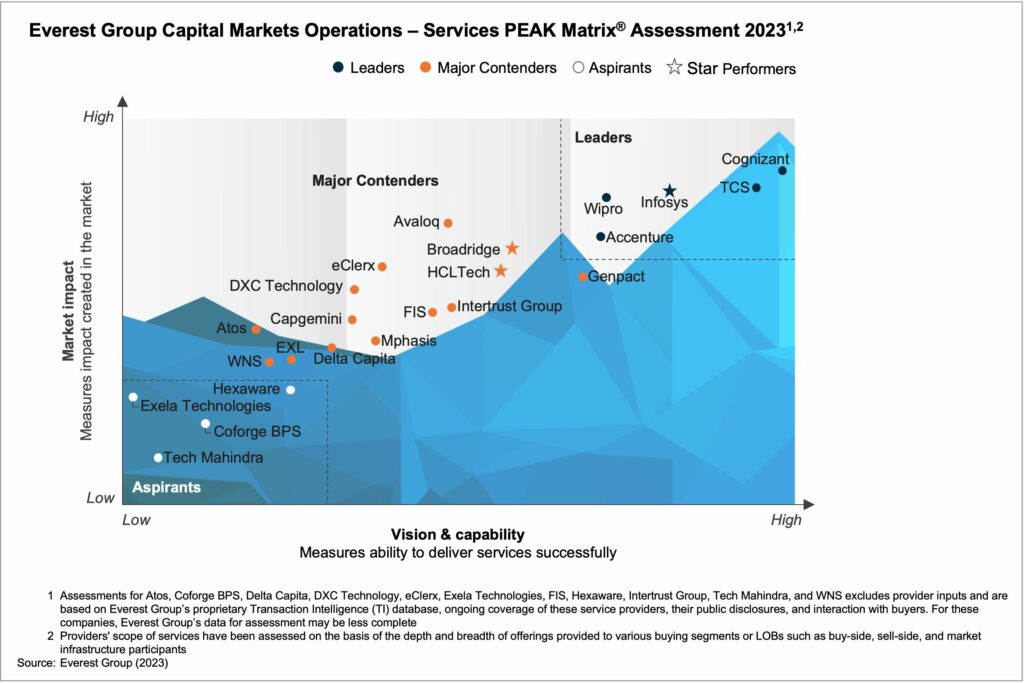

- Each provider’s relative positioning on Everest Group’s PEAK Matrix® for FCC operations

- Providers’ market impact

- Providers’ vision and capability assessment across key dimensions

- Enterprise sourcing considerations

Scope

- Industry: BFS

- Geography: global

- The assessment is based on Everest Group’s annual RFI process and an ongoing analysis of the FCC operations market

Related PEAK Matrix® Assessments

Financial Crime and Compliance (FCC) Operations Services PEAK Matrix® Assessment 2024

Our Latest Thinking

What is the PEAK Matrix®?

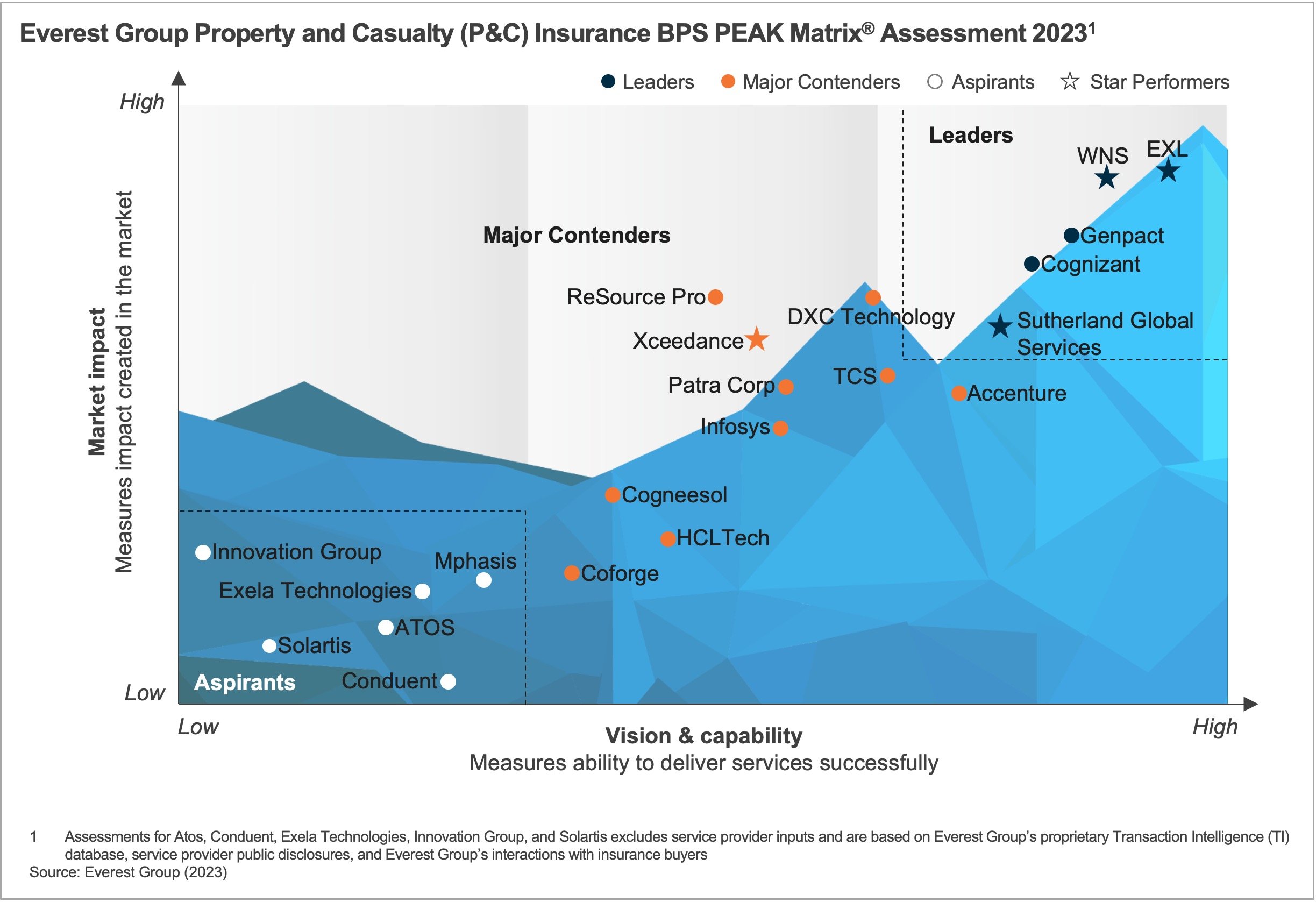

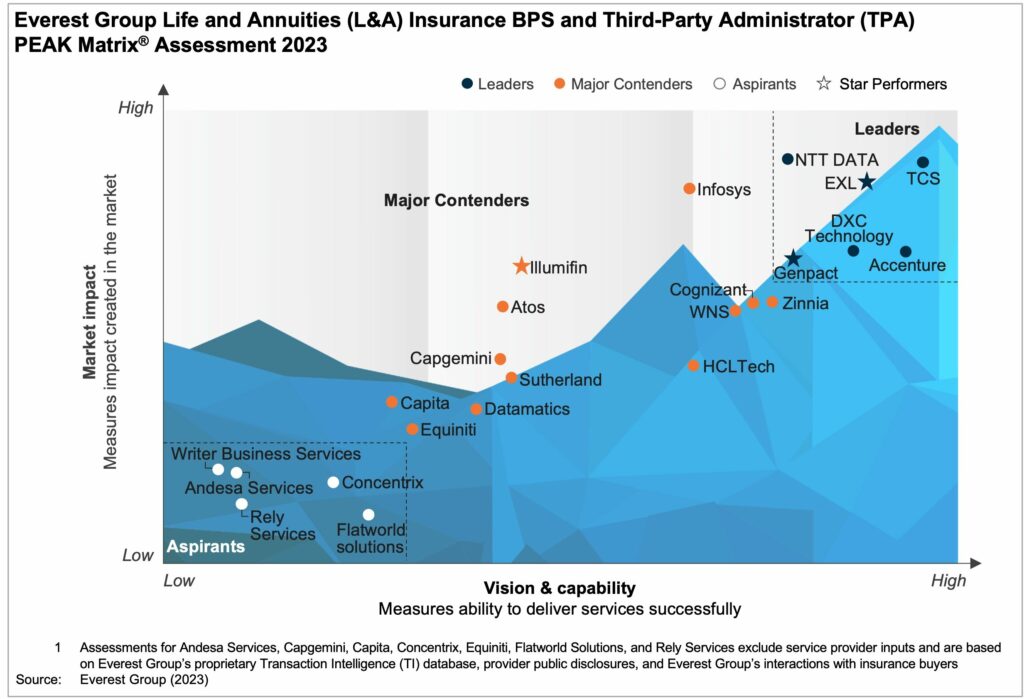

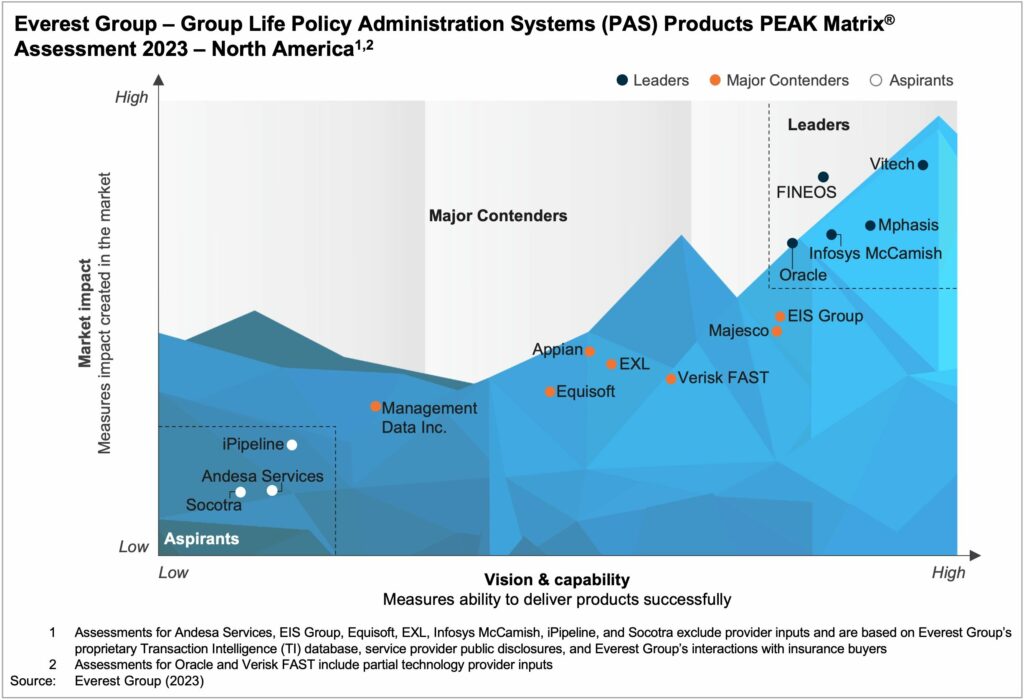

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.